Abstract

This paper uses GLOBE’s performance orientation (PO) dimension to investigate the relationship between national culture and private equity (PE) performance. We argue that high PO has negative performance implications as it provides the lowest potential for portfolio firms to benefit from a spillover of the distinct PE performance focus, and vice versa. To test this hypothesis, we analyze operating performance metrics of 946 deals from 26 European countries and exit channels of 5093 global deals from 67 countries. Consistent with the “spillover hypothesis”, we find that higher levels of PO are detrimental to efficiency improvements and increase the probability for unsuccessful exits. These findings hold after addressing endogeneity concerns, confounding and measurement error.

Similar content being viewed by others

Notes

Firms in our sample grow on average 18.9% in low PO and 20.1% in high PO countries pre-PE. These firms have an average pre-PE EBIT margin of 5.1% in low PO countries and of 5.3% in high PO countries. All differences are economically small and statistically insignificant.

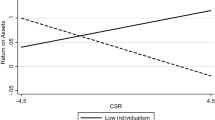

Take asset turnover as an example (Table 5, Panel D, third column) and PO = 5.0 and pre-PE growth = 0.0 as the starting point. Our reference point calculates as − 0.339 × 5 − 3.872 × 0 + 0.599 × 0 × 5 = − 1.695. This number is not equal to our linear prediction because we disregard all other variables in this easy example (Fig. 1 considers the impact of all other control variables). It is, however, sufficient as a reference point to understand the impact of changes in PO and pre-PE growth on asset turnover because we keep all other variables constant. We first consider changes in pre-PE growth. For pre-PE growth = 0.2, we calculate − 0.339 × 5 − 3.872 × 0.2 + 0.599 × 0.2 × 5 = − 1.870, i.e. our linear prediction for asset turnover growth has a delta of − 1.870 − (− 1.695) = − 0.175. Higher pre-PE growth is, ceteris paribus, associated with a lower asset turnover growth (in this case 17.5 percentage points lower). Likewise, for pre-PE growth = − 0.2, we calculate a value of − 1.520, i.e. a delta of 0.175. Lower pre-PE growth is thus associated with higher asset turnover growth. We now consider changes in PO. For PO = 6 and pre-PE growth = 0, we calculate a value of − 0.339 × 6 + 0 + 0 = − 2.034, i.e. the delta to our initial reference point is − 2.034 − (− 1.695) = − 0.339. Higher PO is, c. p., associated with lower asset turnover growth. For PO = 6 and pre-PE growth = 0.2, we calculate − 0.339 × 6 − 3.872 × 0.2 + 0.599 × 0.2 × 6 = − 2.090, i.e. the delta to PO = 5 and pre-PE growth = 0.2 is − 2.090 − (− 1.870) = − 0.220. The impact of the increase in PO on asset turnover is less negative if pre-PE growth is large. For PO = 6 and pre-PE growth = − 0.2, we calculate − 0.339 × 6 − 3.872 × (− 0.2) + 0.599 × (− 0.2) × 6 = − 1.978, i.e. the delta to PO = 5 and pre-PE growth = − 0.2 is − 1.978 − (− 1.520) = − 0.458. The impact of the increase in PO on asset turnover is more negative if pre-PE growth is small. To summarize, for an increase from PO = 5 to PO = 6, we yield a delta of − 0.339 for pre-PE growth = 0, i.e. higher PO has a negative impact on performance. We yield a more negative value (− 0.458) for lower pre-PE growth (− 0.2) and a less negative value (− 0.220) for higher pre-PE growth (0.2). We observe these patterns and deltas in Fig. 1, which illustrates the link of Fig. 1 to Table 5.

The following example of Andreß et al. (2013) illustrates the underlying idea of the fixed effects estimation technique. Imagine we want to estimate the effect of education on a person’s income with the simple model \(income_{it} = \beta_{0} + \beta_{1} \times education_{it} + u_{i} + \epsilon_{it}\), whereas u i is something typical for unit i, which is unobservable for us, such as a person’s ability. To control for u i , we could include a dummy variable for each unit of analysis. This approach is called Least Square Dummy Variables (LSDV) regression. However, including a dummy variable for each unit of analysis is not efficient. The alternative, which yields the same results as LSDV estimation, is the so called fixed effects transformation of the data. Instead of controlling for u i , we eliminate it from the regression function. This fixed effects transformation is effectively a time-demeaning of the panel data, i.e. we subtract the unit-specific mean of each variable from each observation. This transformation yields the new model \((income_{it} - \overline{{income_{i} }} ) = (\beta_{0} - \beta_{0} ) + \beta_{1} \times (education_{it} - \overline{{education_{i} }} ) + (u_{i} - u_{i} ) + (\epsilon_{it} - \overline{{\epsilon_{i} }} )\). Note that ui drops out of the model and that our estimates are now solely based on within-unit variation in the data.

The coefficients of multinomial logit estimates can be interpreted as the change in multinomial log-odds. If we take the PO estimate of column (2) for receivership exits and increase PO by one unit, the multinomial log-odds for a receivership exit relative to a trade sale exit are expected to increase by 0.401 units. We can compute relative risk ratios by exponating the multinomial logit coefficient, i.e. eβ. For a one unit PO change, the relative risk ratio of receivership relative to a trade sale is expected to change by e0.401 = 1.493. The effect is even larger when referring to the PO coefficient estimates of model (1). Note that increasing PO by one unit is a big, yet possible, step, considering that we observe PO values between 5.095–6.564.

References

Acharya VV, Kehoe C, Reyner M (2009) Private equity vs. PLC boards in the U.K.: a comparison of practices and effectiveness. J Appl Corp Finance 21(1):45–56

Acharya VV, Gottschalg OF, Hahn M, Kehoe C (2013) Corporate governance and value creation: evidence from private equity. Rev Financial Stud 26(2):368–402

Achleitner AK, Figge C (2014) Private equity lemons? Evidence on value creation in secondary buyouts. Eur Financial Manag 20(2):406–433

Achleitner AK, Braun R, Engel N, Figge C, Tappeiner F (2010) Value creation drivers in private equity buyouts: empirical evidence from Europe. J Private Equity 13(2):17–27

Achleitner AK, Braun R, Engel N (2011) Value creation and pricing in buyouts: empirical evidence from Europe and North America. Rev Financial Econ 20(4):146–161

Aggarwal R, Faccio M, Guedhami O, Kwok CCY (2016) Culture and finance: an introduction. J Corp Finance 41:466–474

Ahern KR, Daminelli D, Fracassi C (2015) Lost in translation? The effect of cultural values on mergers around the world. J Financial Econ 117(1):165–189

Aizenman J, Kendall J (2008) The internationalization of venture capital and private equity. NBER Working Paper No. 14344

Alperovych Y, Amess K, Wright M (2013) Private equity firm experience and buyout vendor source: what is their impact on efficiency? Eur J Oper Res 228(3):601–611

Andreß HJ, Golsch K, Schmidt AW (2013) Applied panel data analysis for economic and social surveys. Springer Science and Business Media, Berlin

Arcot S, Fluck Z, Gaspar JM, Hege U (2015) Fund managers under pressure: rationale and determinants of secondary buyouts. J Financial Econ 115(1):102–135

Axelson U, Jenkinson T, Strömberg P, Weisbach MS (2013) Borrow cheap, buy high? The determinants of leverage and pricing in buyouts. J Finance 68(6):2223–2267

Baltagi B (2008) Econometric analysis of panel data. Wiley, New York

Batt R (2002) Managing customer services: human resource practices, quit rates, and sales growth. Acad Manag J 45(3):587–597

Bekaert G, Harvey CR, Lundblad C, Siegel S (2007) Global growth opportunities and market integration. J Finance 62(3):1081–1137

Bernstein S, Giroud X, Townsend RR (2016) The impact of venture capital monitoring. J Finance 71:1591–1622

Bertoni F, Groh AP (2014) Cross-border investments and venture capital exits in Europe. Corp Gov 22(2):84–99

Bienz C, Leite TE (2008) A pecking order of venture capital exits. Working Paper. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=916742

Bonini S (2015) Secondary buyouts: operating performance and investment determinants. Financial Manag 44(2):431–470

Bottazzi L, Da Rin M, Hellmann T (2008) Who are the active investors? Evidence from venture capital. J Financial Econ 89(3):488–512

Boucly Q, Sraer D, Thesmar D (2011) Growth LBOs. J Financial Econ 102(2):432–453

Braguinsky S, Mityakov S (2015) Foreign corporations and the culture of transparency: evidence from Russian administrative data. J Financial Econ 117(1):139–164

Breuer W, Nadler C (2015) Cultural finance as a research field—an evaluative survey. Working Paper. https://ssrn.com/abstract=2658146

Brigl M, Nowotnik P, Pelisari K, Rose J, Zwillenberg P (2012) The 2012 private equity report: engaging for growth. bcg.perspectives

Brigl M, Jansen A, Schwetzler B, Hammer B, Hinrichs H (2016) The power of buy and build: how private equity firms fuel next-level value creation. bcg.perspectives

Buono AF, Bowditch JL, Lewis JW (1985) When cultures collide: the anatomy of a merger. Hum Relat 38(5):477–500

Cao JX (2011) IPO timing, buyout sponsors’ exit strategies, and firm performance of RLBOs. J Financial Quant Anal 46(4):1001–1024

Cao JX, Cumming D, Qian M, Wang X (2015) Cross-border LBOs. J Bank Finance 50(1):69–80

Chakrabarti R, Gupta-Mukherjee S, Jayaraman N (2009) Mars-Venus marriages: culture and cross-border M&A. J Int Bus Stud 40(2):216–236

Chatterjee S, Lubatkin MH, Schweiger DM, Weber Y (1992) Cultural differences and shareholder value in related mergers: linking equity and human capital. Strateg Manag J 13(5):319–334

Cho HJ, Pucik V (2005) Relationship between innovativeness, quality, growth, profitability, and market value. Strateg Manag J 26(6):555–575

Chui AC, Kwok CC (2009) Cultural practices and life insurance consumption: an international analysis using GLOBE scores. J Multinatl Financial Manag 19(4):273–290

Chung JW, Sensoy BA, Stern L, Weisbach MS (2012) Pay for performance from future fund flows: the case of private equity. Rev Financial Stud 25(11):3259–3304

Cohn JB, Mills LF, Towery EM (2014) The evolution of capital structure and operating performance after leveraged buyouts: evidence from US corporate tax returns. J Financial Econ 111(2):469–494

Cressy R, Munari F, Malipiero A (2007) Playing to their strengths? Evidence that specialization in the private equity industry confers competitive advantage. J Corp Finance 13(4):647–669

Cumming D, Walz U (2010) Private equity returns and disclosure around the world. J Int Bus Stud 41(4):727–754

Degeorge F, Martin J, Phalippou L (2016) On secondary buyouts. J Financial Econ 120(1):124–145

Desbrières P, Schatt A (2002) The impacts of LBOs on the performance of acquired firms: the French case. J Bus Finance Account 29(5–6):695–729

Dikova D, Sahib PR (2013) Is cultural distance a bane or a boon for cross-border acquisition performance? J World Bus 48(1):77–86

Easterwood JC, Singer RF, Seth A, Lang DF (1994) Controlling the conflict of interest in management buyouts. Rev Econ Stat 76(3):512–522

Erel I, Liao RC, Weisbach MS (2012) Determinants of cross-border mergers and acquisitions. J Finance 67(3):1045–1082

Espenlaub S, Khurshed A, Mohamed A (2015) Venture capital exits in domestic and cross-border investments. J Bank Finance 53:215–232

Eun CS, Kolodny R, Scheraga C (1996) Cross-border acquisitions and shareholder wealth: tests of the synergy and internalization hypotheses. J Bank Finance 20(9):1559–1582

Ewelt-Knauer C, Knauer T, Thielemann M (2014) Exit behaviour of investment companies: the choice of exit channel. J Bus Econ 84(4):571–607

Frésard L, Hege U, Phillips G (2017) Extending industry specialization through cross-border acquisitions. Rev Financial Stud 30(5):1539–1582

Giot P, Schwienbacher A (2007) IPOs, trade sales and liquidations: modelling venture capital exits using survival analysis. J Bank Finance 31(3):679–702

Gompers P (1996) Grandstanding in the venture capital industry. J Financial Econ 42(1):133–156

Gompers P, Kaplan SN, Mukharlyamov V (2016) What do private equity firms say they do? J Financial Econ 121(3):449–476

Gordon GG, DiTomaso N (1992) Predicting corporate performance from organizational culture. J Manag Stud 29:783–799

Groh AP, von Liechtenstein H, Lieser K (2010) The European venture capital and private equity country attractiveness indices. J Corp Finance 16(2):205–224

Grove CN (2005) Worldwide differences in business values and practices: overview of GLOBE research findings. Working Paper. http://www.grovewell.com/wp-content/uploads/pub-GLOBE-dimensions.pdf

Guiso L, Sapienza P, Zingales L (2006) Does culture affect economic outcomes? J Econ Perspec 20(2):23–48

Guo S, Hotchkiss ES, Song W (2011) Do buyouts (still) create value? J Finance 66(2):479–517

Hambrick DC, Cannella AA (1993) Relative standing: a framework for understanding departures of acquired executives. Acad Manag J 36(4):733–762

Hammer B, Knauer A, Pflücke M, Schwetzler B (2017) Inorganic growth strategies and the evolution of the private equity business model. J Corp Finance 45:31–63

Hofstede G (1980) Culture’s consequences: international differences in work-related values. Sage Publications, Newbury Park

Hofstede G (2001) Culture’s consequences: comparing values, behaviors, institutions and organizations across nations. Sage Publications, Newbury Park

Holloway I, Lee HS, Shen T (2016) Private equity firm heterogeneity and cross-border acquisitions. Int Rev Econ Finance 44:118–141

House RJ, Hanges PJ, Javidan M, Dorfman PW, Gupta V (eds) (2004) Culture, leadership, and organizations: the GLOBE study of 62 societies. Sage Publications, Newbury Park

Huber C (2017) In the spotlight: visualizing continuous-by-continuous interactions with margins and twoway contour. Stata News 32(1). https://www.stata.com/stata-news/news32-1/spotlight/

Jenkinson T, Sousa M (2015) What determines the exit decision for leveraged buyouts? J Bank Finance 59:399–408

Kaplan S (1989) The effects of management buyouts on operating performance and value. J Financial Econ 24(2):217–254

Kaplan S, Schoar A (2005) Private equity performance: returns, persistence, and capital flows. J Finance 60(4):1791–1823

Karolyi GA (2016) The gravity of culture for finance. J Corp Finance 41:610–625

Leeds R, Sunderland J (2003) Private equity investing in emerging markets. J Appl Corp Finance 15(4):111–119

Lichtenberg FR, Siegel D (1990) The effects of leveraged buyouts on productivity and related aspects of firm behavior. J Financial Econ 27(1):165–194

Lim J, Makhija AK, Shenkar O (2016) The asymmetric relationship between national cultural distance and target premiums in cross-border M&A. J Corp Finance 41:542–571

Lubatkin M, Schweiger D, Weber Y (1999) Top management turnover in related M&A’s: an additional test of the theory of relative standing. J Manag 25(1):55–73

MacArthur H, Elton G, Haas D, Varma S, Evander C (2016) Four tactics for creating value in private equity. Forbes. https://www.forbes.com/sites/baininsights/2016/04/08/four-tactics-for-creating-value-in-private-equity/#1068cb41a92b

Malul M, Shoham A (2008) A global analysis of culture and imperfect competition in banking systems. Int J Financial Serv Manag 3(2):124–135

Manigart S, Lockett A, Meuleman M, Wright M, Landström H, Bruining H, Desbrières P, Hommel U (2006) The syndication decision of venture capital investments. Entrepreneurship Theory Pract 30(2):131–153

Matthews M, Bye M, Howland J (2009) Operational improvement: the key to value creation in private equity. J Appl Corp Finance 21(3):21–27

Meier D, Hiddemann T, Brettel M (2006) Wertsteigerung bei Buyouts in der Post Investment-Phase—der Beitrag von Private Equity-Firmen zum operativen Erfolg ihrer Portfoliounternehmen im europäischen Vergleich. Zeitschrift für Betriebswirtschaft 76(10):1035–1066

Meuleman M, Amess K, Wright M, Scholes L (2009a) Agency, strategic entrepreneurship, and the performance of private equity-backed buyouts. Entrepreneurship Theory Pract 33(1):213–239

Meuleman M, Wright M, Manigart S, Lockett A (2009b) Private equity syndication: agency costs, reputation and collaboration. J Bus Finance Account 36(5–6):616–644

Morosini P, Shane S, Singh H (1998) National cultural distance and cross-border acquisition performance. J Int Bus Stud 29(1):137–158

Muscarella CJ, Vetsuypens MR (1990) Efficiency and organizational structure: a study of reverse LBOs. J Finance 45(5):1389–1413

Nahata R (2008) Venture capital reputation and investment performance. J Financial Econ 90(2):127–151

Nahata R, Hazarika S, Tandon K (2014) Success in global venture capital investing: do institutional and cultural differences matter? J Financial Quant Anal 49(4):1039–1070

Nikoskelainen E, Wright M (2007) The impact of corporate governance mechanisms on value increase in leveraged buyouts. J Corp Finance 13(4):511–537

O’brien RM (2007) A caution regarding rules of thumb for variance inflation factors. Qual Quant 41(5):673–690

Opler TC (1992) Operating performance in leveraged buyouts: evidence from 1985–1989. Financial Manag 21(1):27–34

Page SE (2007) Difference: how the power of diversity creates better groups, firms, schools, and societies. Princeton University Press, Princeton

Phalippou L (2008) The hazards of using IRR to measure performance: the case of private equity. J Perform Meas 12(4):55–67

Phalippou L (2009) Beware of venturing into private equity. J Econ Perspect 23(1):147–166

Phalippou L, Gottschalg O (2009) The performance of private equity funds. Rev Financial Stud 22(4):1747–1776

Ramezani CA, Soenen L, Jung A (2002) Growth, corporate profitability, and value creation. Financial Anal J 58(6):56–67

Renneboog L, Simons T, Wright M (2007) Why do public firms go private in the UK? The impact of private equity investors, incentive realignment and undervaluation. J Corp Finance 13(4):591–628

Rigamonti D, Cefis E, Meoli M, Vismara S (2016) The effects of the specialization of private equity firms on their exit strategy. J Bus Finance Account 43(9–10):1420–1443

Rogers P, Cullinan G, Shannon T (2002) “Performance culture” the private equity way. Eur Bus J 14(4):206–211

Rossi S, Volpin PF (2004) Cross-country determinants of mergers and acquisitions. J Financial Econ 74(2):277–304

Sarala RM, Junni P, Cooper CL (2016) A sociocultural perspective on knowledge transfer in mergers and acquisitions. J Manag 42(5):1230–1249

Scellato G, Ughetto E (2013) Real effects of private equity investments: evidence from European buyouts. J Bus Res 66(12):2642–2649

Schmidt DM, Steffen S, Szabo F (2010) Exit strategies of buyout investments: an empirical analysis. J Altern Invest 12(4):58–84

Schwartz SH (1992) Universals in the content and structure of values: theoretical advances and empirical tests in 20 countries. Adv Exp Soc Psychol 25:1–65

Schwartz SH (1994) Beyond individualism/collectivism: new cultural dimensions of values. Sage Publications, Thousand Oaks

Singh H (1990) Management buyouts: distinguishing characteristics and operating changes prior to public offering. Strateg Manag J 11(4):111–129

Smith AJ (1990) Corporate ownership structure and performance: the case of management buyouts. J Financial Econ 27(1):143–164

Staiger DO, Stock JH (1997) Instrumental variables regression with weak instruments. Econometrica 65(3):557–586

Steigner T, Sutton NK (2011) How does national culture impact internalization benefits in cross-border mergers and acquisitions? Financial Rev 46:103–125

Triandis HC, Bontempo R, Betancourt H, Bond M, Leung K, Brenes A, Georgas J, Hui CH, Marin G, Setiadi B, Sinha JB (1986) The measurement of the etic aspects of individualism and collectivism across cultures. Aust J Psychol 38(3):257–267

Tykvová T (2017) Venture capital and private equity financing: an overview of recent literature and an agenda for future research. J Bus Econ. https://doi.org/10.1007/s11573-017-0874-4

Tykvová T, Borell M (2012) Do private equity owners increase risk of financial distress and bankruptcy? J Corp Finance 18(1):138–150

Tykvová T, Schertler A (2014) Does syndication with local venture capitalists moderate the effects of geographical and institutional distance? J Int Manag 20(4):406–420

Upton N, Teal EJ, Felan JT (2001) Strategic and business planning practices of fast growth family firms. J Small Bus Manag 39(1):60–72

Valkama P, Maula M, Nikoskelainen E, Wright M (2013) Drivers of holding period firm-level returns in private equity-backed buyouts. J Bank Finance 37(7):2378–2391

Very P, Lubatkin M, Calori R, Veiga J (1997) Relative standing and the performance of recently acquired European firms. Strateg Manag J 18(8):593–614

Wang Y (2012) Secondary buyouts: why buy and at what price? J Corp Finance 18(5):1306–1325

Weir C, Jones P, Wright M (2015) Public to private transactions, private equity and financial health in the UK: an empirical analysis of the impact of going private. J Manag Gov 19(1):91–112

Wilson N, Wright M (2013) Private equity, buy-outs and insolvency risk. J Bus Finance Account 40(7–8):949–990

Wilson N, Wright M, Siegel DS, Scholes L (2012) Private equity portfolio company performance during the global recession. J Corp Finance 18(1):193–205

Wright M, Wilson N, Robbie K (1996) The longer-term effects of management-led buy-outs. J Entrepreneurial Finance 5(3):213

Wright M, Robbie K, Albrighton M (2000) Secondary management buy-outs and buy-ins. Int J Entrepreneurial Behav Res 6(1):21–40

Zhou D, Jelic R, Wright M (2014) SMBOs: buying time or improving performance? Manag Decis Econ 35(2):88–102

Zingales L (2015) The “cultural revolution” in finance. J Financial Econ 117(1):1–4

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank two anonymous referees, Hue Hwa Au Yong (discussant), Aurélie Sannajust (discussant), and conference participants at the INFINITI Conference on International Finance 2017 (Valencia) and FMA European Conference 2017 (Lisbon). We further thank Robin Jung and Fabian Sommer who provided valuable research assistance.

Rights and permissions

About this article

Cite this article

Hammer, B., Hinrichs, H. & Schwetzler, B. Does culture affect the performance of private equity buyouts?. J Bus Econ 88, 393–469 (2018). https://doi.org/10.1007/s11573-017-0886-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11573-017-0886-0