Abstract

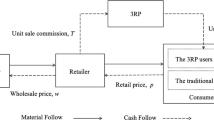

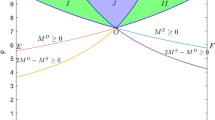

Speculative behaviors have burgeoned in various business settings whereby it is costly for consumers to purchase directly from sellers. This paper examines the values of two typical speculative behaviors, scalping and line-sitting, against a backdrop of markets with resale. We establish a two-stage model in which a monopolist seller sells an item (product or service) to consumers in the first stage, and the item can be traded on a resale platform in the second stage. Speculators have no interests in consumption but incur lower costs in purchasing and reselling processes than consumers. In the scalping model, they buy the item first and resell it later to make profits. In the line-sitting model, they earn incomes by serving as surrogates of consumers in purchasing. We first find whether the two phenomena emerge critically depends on the value of consumers’ entry cost. Our main results indicate that both speculative behaviors can bring benefits to the seller and resale platform by a demand expansion effect, although through different mechanisms. Under scalping, the entry of speculators as additional buyers always boosts demand in both stages, and achieves a win-win outcome for the seller and platform, although less consumers remain in the market and the resale price decreases. Under line-sitting, demand is enlarged and profits rise in both stages, only when consumers find purchasing directly more time- and money-consuming, because they need to pay an extra service fee to speculators. Moreover, the consumer population gets better off from the two speculative behaviors when their entry cost is relatively high. When both models emerge, scalping may be preferable to line-sitting for the seller, resale platform and consumers, if the cost advantage of speculators in resale transactions is more evident.

Similar content being viewed by others

References

Afeche P, Mendelson H (2004). Pricing and priority auctions in queueing systems with a generalized delay cost structure. Management Science 50(7):869–882.

Aviv Y, Wei MM, Zhang F (2019). Responsive pricing of fashion products: The effects of demand learning and strategic consumer behavior. Management Science 65(7):2982–3000.

Cachon G P, Swinney R (2009). Purchasing, pricing, and quick response in the presence of strategic consumers. Management Science 55(3):497–511.

Cui S, Wang Z, Yang L (2020). The economics of line-sitting. Management Science 66(1):227–242.

Cui Y, Duenyas I, Şahin Ö (2014). Should event organizers prevent resale of tickets? Management Science 60(9):2160–2179.

Cui Y, Duenyas I, Sahin O (2018). Pricing of conditional upgrades in the presence of strategic consumers. Management Science 64(7):3208–3226.

Gavirneni S, Kulkarni VG (2016). Self-selecting priority queues with burr distributed waiting costs. Production and Operations Management 25(6): 979–992.

Glazer A, Hassin R (1986). Stable priority purchasing in queues. Operations Research Letters 4(6):285–288.

Hu M, Zhou Y (2020). Price, wage, and fixed commission in on-demand matching. Working paper, University of Toronto.

Jiang L, Dimitrov S, Mantin B (2017). P2P marketplaces and retailing in the presence of consumers’ valuation uncertainty. Production and Operations Management 26(3):509–524.

Kleinrock L (1967). Optimum bribing for queue position. Operations Research 15(2):304–318.

Krishnan V, Ramachandran K (2011). Integrated product architecture and pricing for managing sequential innovation. Management Science 57(11):2040–2053.

Lai G, Debo L G, Sycara K (2010). Buy now and match later: Impact of posterior price matching on profit with strategic consumers. Manufacturing & Service Operations Management 12(1):33–55.

Lei Y, Liu Q, Shum S (2021). Managing return policies with consumer resale. Naval Research Logistics. DOI: https://doi.org/10.1002/nav.22004.

Lim W S, Tang C (2013). Advance selling in the presence of speculators and forward-looking consumers. Production and Operations Management 22(3):571–587.

Lin M, Pan X A, Zheng Q (2020). Platform pricing with strategic buyers: The impact of future production cost. Production and Operations Management 29(5):1122–1144.

Liu Q, Zhang D (2013). Dynamic pricing competition with strategic customers under vertical product differentiation. Management Science 59(1):84–101.

Liu F T (1985). An equilibrium queuing model of bribery. Journal of Political Economy 93(4):760–781.

Su X (2010). Optimal pricing with speculators and strategic consumers. Management Science 56(1):25–40.

Su X, Zhang F (2009). On the value of commitment and availability guarantees when selling to strategic consumers. Management Science 55(5):713–726.

Wang Z, Wang J (2019). Pre-commitment or post-payment: which worsens a line-sitting firm’s revenue? Operations Research Letters 47(5):447–451.

Yang L, Debo L, Gupta V (2017). Trading time in a congested environment. Management Science 63(7):2377–2395.

Yang L, Wang Z, Cui S (2021). A model of queue scalping. Management Science. DOI: https://doi.org/10.1287/mnsc.2020.3865.

Yu M, Ahn H S, Kapuscinski R (2015). Rationing capacity in advance selling to signal quality. Management Science 61(3):560–577.

Zhang F, Zhang R (2018) Trade-in remanufacturing, customer purchasing behavior, and government policy. Manufacturing amp; Service Operations Management 20(4):601–616.

Zou T, Jiang B (2020). Integration of primary and resale platforms. Journal of Marketing Research 57(4):659–676.

Acknowledgments

The authors thank the editor(s) and referees for their guidance and suggestions that help improve the quality of the paper. This work was partly supported by the National Natural Science Foundation of China under Grant Nos. 71871198, 71821002, 71931009 and 72125004, and the China Postdoctoral Science Foundation under Grant No. 2020M681905.

Author information

Authors and Affiliations

Corresponding author

Additional information

Qianqian Chen is a PhD candidate in the School of Management at Zhejiang University. Her research interests include platform economics, revenue management and consumer behavior economics.

Zhenyang Shi is a postdoctoral researcher in the School of Management at Zhejiang University. He received his PhD degree from Antai College of Management and Economics, Shanghai Jiao Tong University. His research interests include inventory management, omnichannel retail operations and sustainable operations management.

Yi Yang is a tenured full professor in the School of Management at Zhejiang University. He obtained his PhD degree from the Department of System Engineering and Engineering Management at The Chinese University of Hong Kong. His main research interests include inventory management, revenue management and operations management. He has published several papers in TOP journals, such as Management Science, Operations Research, Manufacturing & Service Operations Management, and Production and Operations Management, etc. He was named an Distinguished Young Scholars and Excellent Young Scholar by the Natural Science Foundation of China and a Chang Jiang Young Professor by the Ministry of Education in China.

Rights and permissions

About this article

Cite this article

Chen, Q., Shi, Z. & Yang, Y. Scalping or Line-sitting: The Role of Speculators. J. Syst. Sci. Syst. Eng. 31, 1–33 (2022). https://doi.org/10.1007/s11518-021-5517-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11518-021-5517-1