Abstract

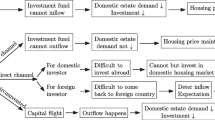

Taking the inflation into consideration and making use of the quarter data of the actual foreign investment, housing and land prices in China from 1998 to 2006, this paper examines the relationship between housing prices and international capital flows using Error Correction Model (ECM) and Granger causality test. Results show that in the short run, the increase of housing prices attracts the inflow of foreign capitals; in the long run, foreign capitals help to boost the rise of housing prices. Therefore, at present, Chinese government must impose effective restrictions on the flow of foreign capital into the real estate market.

摘要

在考虑通货膨胀的前提下, 利用我国1998–2006年的实际利用外资和房地产价格的季度数据建立误差纠正模型(ECM), 使用 Granger 因果检验方法对我国的房地产价格和国际资本流动的关系进行实证检验。 短期而言, 房地产价格上涨吸引了外资的流入; 长期来说, 外资的流入对我国的住房价格上6DA8产生了影响。 在现阶段控制外资过度流入房地产市场, 有利于保持我国房地产价格的稳定。

Similar content being viewed by others

References

Engle R F, Granger C W J (1987). Cointegration and error correction: Representation, estimation and testing. Econometrica, 55: 251–276

Fisher S (1997). Capital Account Liberalization and the Role of the IMF. Washington, D. C.: International Monetary Fund

Frenkel J, Assaf R (1996). Fiscal Policies and Growth in the World Economy. Cambridge: Mass MIT Press

Granger C W J (1988). Some recent development in a concept of causality. Journal of Econometrics, 39: 199–211

Granger C W J, Newbold P (1974). Spurious regressions in econometrics. Journal of Econometrics, (2): 111–120

Hymer S (1976). The International Operation of National Firms: A Study of Foreign Direct Investment. Cambridge: Massachusetts Institute of Technology Press

Kemp M C (1969). The Pure Theory of International Trade and Investment. New Jersey: Englewood Cliffc

Macdougall G D (1957). The World Dollar Problem: A Study in International Economy. New York: St. Martin’s Press

Peter J B, Mark C (1992). Multinational Enterprises in the Word Economy: Essays in Honor of John Dunning. Aldershot: Brookfield Elgar Pub

Phillips P C (1986). Understanding spurious regressions in econometrics. Journal of Econometrics, 33: 311–340

Shiskin J (1965). The X-11 variant of the census method II. Seasonal Adjustment Program, 11: 23–33

Stock J H, Waston M W (1989). A simple MLE of cointegrating vectors in higher order integrated systems, NBER working paper /t0083.pdf

Xiao D Q (1987). The Theory of Foreign Trade (in Chinese, trans. Zhou Baolian). Tianjin: Nankai University Press

Zhong W (2005). Scale and channel foreign investment into Chinese real estate Market. Real Estate World, 12: 32–34

Author information

Authors and Affiliations

Corresponding author

Additional information

__________

Translated from Caijing Wenti Yanjiu 财经问题研究 (Research on Financial and Economic Issues), 2007, (3): 55–61

About this article

Cite this article

Song, B., Gao, B. Impact of international capital flows on real estate market: The empirical test in China from 1998 to 2006. Front. Econ. China 2, 520–531 (2007). https://doi.org/10.1007/s11459-007-0027-8

Issue Date:

DOI: https://doi.org/10.1007/s11459-007-0027-8