Abstract

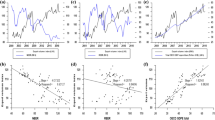

Using data from 1978–2005, this paper estimates RMB equilibrium exchange rate and misalignment respectively, and uses Engle-Granger (E-G) two-step method, error correction model to analyze the influence of RMB exchange rate misalignment on China’s export. Because China is the economic transitional country with the character of dualistic economic structure, this paper introduces a control variant into the model which is the gap between agriculture and industry contribution to GDP. Conclusion shows that this model is more credible and stable. There is an obvious cointegration between China’s export and RMB exchange rate misalignment, real effective exchange rate, domestic GDP and foreign weighted average GDP. RMB exchange rate misalignment has an obvious negative influence on China’s export, but it has self-corrected dynamic mechanism. Then using binary Logit model, this paper concludes that the bigger RMB underestimated misalignment is, the bigger net export probability is, which is good for export. The bigger RMB overestimated misalignment is, the smaller net export probability is, which is bad for export.

Similar content being viewed by others

References

Cho G D, Kim M K, Sun E, Jin H, Koo W W (2003). Nominal exchange rate misalignment: Is it particularly important to agricultural trade? Agribusiness & Applied Economics Report, No. 516

Cottani J A, Cavallo D F, Khan M S (1990). Real exchange rate behavior and economic performance in LDCs. Economic Development and Cultural Change, 39(1): 61–76

Domac I, Shabsigh G (1999). Real exchange rate behavior and economic growth: Evidence from Egypt, Jordan, Morocco and Tunisia. IMF Working Paper, No. 40

Edwards S (1989). Exchange rate misalignment in developing countries. World Bank Research Observer, 4(1): 3–21

Ghura D, Grennes T J (1993). The real exchange rate and macroeconomic performance in Sub-Saharan Africa. Journal of Development Economics, 42(1): 155–174

Guo Qingwang, Jia Junxue (2005) Estimate of China’s total factor efficiency: 1979–2004. Economic Research Journal, (6): 51–60 (in Chinese)

Li Guangzhong. Voon L P (2004). Empirical analysis on the real exchange rate misalignment, exchange rate volatility and impact to manufacture: Panel data from 1978–1998. Management World, (11): 22–28 (in Chinese)

Lin Boqiang (2002). Estimating RMB equilibrium real exchange rate and measuring real exchange rate misalignment. Economic Research Journal, (12): 60–69 (in Chinese)

Pick D H, Vollrath T L (1994). Real exchange rate misalignment and agriculture export performance in developing countries. Economic Development and Cultural Chang, 42(3): 555–571

Razin O, Collins S M (1997). Real exchange rate misalignments and growth. NBER Working Paper, No. 6174

Shi Jianhui, Yu Haifeng (2005). RMB equilibrium exchange rate and exchange rate misalignment: 1991–2004. Economic Research Journal. (4): 34–45 (in Chinese)

Tang Guoxing, Xu Jiangang (2003). Research on Modern Exchange Rate Theory and Model. Beijing: China’s Finance Press (in Chinese)

Wu Lihua, Wang Feng (2006). Empirical study of economic impact of RMB real exchange rate misalignment. Economic Research Journal, (7): 1–28 (in Chinese)

Zhang Zhicaho (2001). Real exchange rate misalignment in China: An empirical investigation. Journal of Comparative Economics, 29(1): 80–94

Zhao Xiaopu (2001). Research on the RMB Equilibrium Exchange Rate. Beijing: China’s Finance Press

Zhao Zhijun, Toshiki Kanamori (2005). Misalignment of Renminbi exchange rate revaluation: Estimation and implications. ADB Institute Research Paper, No. 70

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Lü, J. Empirical study on the influence of RMB exchange rate misalignment on China’s export. Front. Econ. China 2, 224–236 (2007). https://doi.org/10.1007/s11459-007-0012-2

Received:

Issue Date:

DOI: https://doi.org/10.1007/s11459-007-0012-2