Abstract

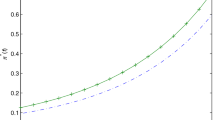

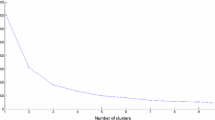

This paper investigates a multi-period portfolio optimization problem for a defined contribution pension plan with Telser’s safety-first criterion. The plan members aim to maximize the expected terminal wealth subject to a constraint that the probability of the terminal wealth falling below a disaster level is less than a pre-determined number called risk control level. By Tchebycheff inequality, Lagrange multiplier technique, the embedding method and Bellman’s principle of optimality, the authors obtain the conditions under which the optimal strategy exists and derive the closed-form optimal strategy and value function. Special cases show that the obtained results in this paper can be reduced to those in the classical mean-variance model. Finally, numerical analysis is provided to analyze the effects of the risk control level, the disaster level and the contribution proportion on the disaster probability and the value function. The numerical analysis indicates that the disaster probability in this paper is less than that in the classical mean-variance model on the premise that the value functions are the same in two models.

Similar content being viewed by others

References

Di Giacinto M, Federico S, and Gozzi F, Pension funds with a minimum guarantee: A stochastic control approach, Finance Stochastics, 2011, 15: 297–342.

Blake D, Wright D, and Zhang Y, Target-driven investing: Optimal investment strategies in defined contribution pension plans under loss aversion, Journal of Economic Dynamics and Control, 2013, 37(1): 195–209.

Yao H X, Yang Z, and Chen P, Markowitzs mean-variance defined contribution pension fund management under inflation: A continuous-time model, Insurance: Mathematics and Economics, 2013, 53: 851–863.

Nkeki C I, Mean-variance portfolio selection problem with time-dependent salary for defined contribution pension scheme, Financial Mathematics and Applications, 2013, 2(1): 1–26.

He L and Liang Z X, Optimal investment strategy for the DC plan with the return of premiums clauses in a mean-variance framework, Insurance: Mathematics and Economics, 2013, 53: 643–649.

Vigna E, On efficiency of mean-variance based portfolio selection in defined contribution pension schemes, Quantitative Finance, 2014, 14: 237–258.

Menoncin F and Vigna E, Mean-variance target-based optimisation for defined contribution pension schemes in a stochastic framework, Insurance: Mathematics and Economics, 2017, 76: 172–184.

Chen Z P, Wang L Y, Chen P, et al., Continuous-time mean-variance optimization for defined contribution pension funds with regime-switching, International Journal of Theoretical and Applied Finance, 2019, 22(5): 1950029.

Yao H X, Lai Y Z, Ma Q H, et al., Asset allocation for a DC pension fund with stochastic income and mortality risk: A multi-period mean-variance framework, Insurance: Mathematics and Economics, 2014, 54: 84–92.

Yao H X, Chen P, and Li X, Multi-period defined contribution pension funds investment management with regime-switching and mortality risk, Insurance: Mathematics and Economics, 2016, 71: 103–113.

Wu H L, Zhang L, and Chen H, Nash equilibrium strategies for a defined contribution pension management, Insurance: Mathematics and Economics, 2015, 62: 202–214.

Wu H L and Zeng Y, Equilibrium investment strategy for defined-contribution pension schemes with generalized mean-variance criterion and mortality risk, Insurance: Mathematics and Economics, 2015, 64: 396–408.

Sun J Y, Li Z F, and Zeng Y, Precommitment and equilibrium investment strategies for defined contribution pension plans under a jump-diffusion model, Insurance: Mathematics and Economics, 2016, 67: 158–172.

Bian L H, Li Z F, and Yao H X, Pre-commitment and equilibrium investment strategies for the DC pension plan with regime switching and a return of premiums clause, Insurance: Mathematics and Economics, 2018, 81: 78–94.

Guan G H and Liang Z X, Mean-variance efficiency of DC pension plan under stochastic interest rate and mean-reverting returns, Insurance: Mathematics and Economics, 2015, 61: 99–109.

Temocin B Z, Korn R, and Selcuk-Kestel A S, Constant proportion portfolio insurance in defined contribution pension plan management under discrete-time trading, Annals of Operations Research, 2018, 266: 329–348.

Roy A D, Safety first and the holding of assets, Econometrica, 1952, 20(3): 431–449.

Kataoka S, A stochastic programming model, Econometrica, 1963, 31: 181–196.

Telser L G, Safety first and hedging, Review of Economic Studies, 1955, 23(1): 1–16.

Li D, Chan T F, and Ng W L, Safety-first dynamic portfolio selection, Dynamics of Continuous, Discrete and Impulsive Systems, 1998, 4(4): 585–600.

Li Z F and Yao J, Optimal dynamic portfolio selection under safety-first criterion, Systems Engineering — Theory & Practice, 2004, 24(1): 41–45.

Chiu M C and Li D, Asset-liability management under the safety-first principle, Journal of Optimization Theory and Applications, 2009, 143(3): 455–478.

Chiu M C, Wong H Y, and Li D, Roy’s safety-first portfolio principle in financial risk management of disastrous events, Risk Analysis, 2012, 32(11): 1856–1872.

Yan W, Continuous-time safety-first portfolio selection with jump-diffusion processes, International Journal of Systems Science, 2012, 43(4): 622–628.

Ding Y and Zhang B, Optimal portfolio of safety-first models, Journal of Statistical Planning and Inference, 2009, 139(9): 2952–2962.

Ding Y and Zhang B, Risky asset pricing based on safety first fund management, Quantitative Finance, 2009, 9(3): 353–361.

Arzac E R and Bawa V S, Portfolio choice and equilibrium in capital markets with safety-first investors, Journal of Financial Economics, 1977, 4(3): 277–288.

Lin C W and Wu H L, Multiperiod Telser’s safety-first portfolio selection with regime switching, Discrete Dynamics in Nature and Society, 2018, 2018, Article ID 1832926, 18 pages.

Haley M R and Whiteman C H, Generalized safety first and a new twist on portfolio performance, Econometric Reviews, 2008, 27: 457–483.

Hagigi M and Kluger B, Assessing risk and return of pension funds’ portfolios by the Telser safety-first approach, Journal of Business Finance and Accounting, 1987, 14(2): 241–253.

Lopes L L, Between hope and fear: The psychology of risk, Advances in Experimental Social Psychology, 1987, 20: 255–295.

De Bondt W F M, A portrait of the individual investor, European Economic Review, 1998, 42: 831–844.

Neugebauer T, Individual choice from a convex lottery set: Experimental evidence, Advances in Decision Making Under Risk and Uncertainty, 2008, 42: 121–135.

Wang X G and Zhou R X, Dynamic portfolio selection under safety-first criterion, Management Review, 2010, 22(12): 20–27 (in Chinese).

Luenberger D G, Optimization by Vector Space Methods, Wiley, New York, 1969.

Hsiaw A, Goal-setting and self-control, Journal of Economic Theory, 2013, 148(2): 601–626.

Fu C P, Lari-Lavassani A, and Li X, Dynamic mean-variance portfolio selection with borrowing constraint, European Journal of Operational Research, 2010, 200: 312–319.

Wu H L and Li Z F, Multi-period mean-variance portfolio selection with Markov regime switching and uncertain time-horizon, Journal of Systems Science & Complexity, 2011, 24(1): 140–155.

Cui X, Li X, and Li D, Unified framework of mean — Field formulations for optimal multi-Period mean-variance portfolio selection, IEEE Transactions on Automatic Control, 2014, 59(7): 1833–1844.

Cui X Y, Li X, Li D, et al., Time consistent behavioral portfolio policy for dynamic mean-variance formulation, Journal of the Operational Research Society, 2017, 68: 1647–1660.

Li D and Ng W L, Optimal dynamic portfolio selection: Multiperiod mean-variance formulation, Mathematical Finance, 2000, 10: 387–406.

Zhu S S, Li D, and Wang S Y, Risk control over bankruptcy in dynamic portfolio selection: A generalized mean-variance formulation, IEEE Transactions on Automatic Control, 2004, 49(3): 447–457.

Korn R, Siu T K, and Zhang A H, Asset allocation for a DC pension fund under regime switching environment, European Actuarial Journal, 2011, 1: 361–377.

Han N W and Hung M W, Optimal asset allocation for DC pension plans under inflation, Insurance: Mathematics and Economics, 2012, 51: 172–181.

Wu H L and Dong H B, Multi-period mean-variance defined contribution pension management with inflation and stochastic income, Systems Engineering — Theory & Practice, 2016, 36(3): 545–558 (in Chinese).

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by grants from Innovation Research in Central University of Finance and Economics, National Natural Science Foundation of China under Grant Nos. 11671411, 71871071, 72071051, Guangdong Basic and Applied Basic Research Foundation under Grant No. 2018B030311004, the Key Program of the National Social Science Foundation of China under Grant No. 21AZD071 and the 111 Project under Grant No. B17050.

Rights and permissions

About this article

Cite this article

Li, F., Wu, H. & Yao, H. Multi-Period Telser’s Safety-First Portfolio Selection Problem in a Defined Contribution Pension Plan. J Syst Sci Complex 36, 1189–1227 (2023). https://doi.org/10.1007/s11424-023-1142-z

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-023-1142-z