Abstract

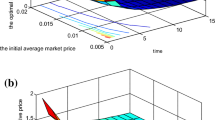

This paper considers the optimal investment problem for an insurer in the sense of maximizing the adjustment coefficient of the risk process. The authors propose a modified periodic risk model in which the periodic risk process is perturbed by a standard Brownian motion. The insurer caninvest in multiple risky assets and one risk-free asset and the correlations between the risky assets and the risk process are considered. Optimal strategy is obtained explicitly, which is a function of time and related to the risk process. The effects of market parameters on the optimal strategy are discussed and a numerical example is also given.

Similar content being viewed by others

References

Browne S, Optimal investment policies for a firm with a random risk process: Exponential utility and minimizing the probability of ruin, Mathematics Operations Research, 1995, 20(4): 937–958.

Hipp C and Plum M, Optimal investment for insurers, Insurance: Mathematics and Economics, 2000, 27(2): 215–228.

Gaier J, Grandits P, and Schachermayer W, Asymptotic ruin probabilities and optimal investment, Annals of Applied Probability, 2003, 13(3): 1054–1076.

Azcue P and Muler N, Optimal investment strategy to minimize the ruin probability of an insurance company under borrowing constraints, Insurance: Mathematics and Economics, 2009, 44(1): 26–34.

Wang Z, Xia J, and Zhang L, Optimal investment for an insurer: The martingale approach, Insurance: Mathematics and Economics, 2007, 40(2): 322–334.

Hipp C, Stochastic control with application in insurance, in Stochastic Methods in Finance (ed. by Morel J M, Takens F, and Teissier B), Springer-Verlag, Berlin, 2004, 127–164.

Schmidli H, Stochastic Control in Insurance, Springer-Verlag, London, 2007.

Wang N, Optimal investment for an insurer with exponential utility preference, Insurance: Mathematics and Economics, 2007, 40(1): 77–84.

Asmussen S, Ruin Probabilities, World Scientific, Singapore, 2000.

Rolski T, Schmidli H, Schmidt V, and Teugels J, Stochastic Processes for Insurance and Finance, John Wiley & Sons Ltd., Chichester, 1999.

Beard R E, Pentikäinen T, and Pesonen E, Risk Theory: The Stochastic Basis of Insurance (3rd ed.), Chapman and Hall, London, 1984.

Asmussen S and Rolski T, Risk theory in a periodic enviroment: The Cram’er-Lundberg approximation and Lundberg’s inequality, Mathematics of Operations Research, 1994, 19(2): 410–433.

KÖtter M and Bäuerle N, The periodic risk model with investment, Insurance: Mathematics and Economics, 2008, 42(3): 962–967.

KÖtter M and Bäuerle N, The Markov-modulated risk model with investment, in Operations Research Proceedings 2006 (ed. by Waldmann K H and Stocker D U M), Springer-Verlag, Berlin, 2007, 575–580.

Yang H and Zhang L, Optimal investment for insurer with jump-diffusion risk process, Insurance: Mathematics and Economics, 2005, 37(3): 615–634.

Karatzas I and Shreve S E, Brownian Motion and Stochastic Calculus (2nd ed.), Springer-Verlag, Berlin, 1991.

Xie S, Li Z, and Wang S, Continuous-time portfolio selection with liability: Mean-variance model and stochastic LQ approach, Insurance: Mathematics and Economics, 2008, 42(3): 943–953.

Protter P E, Stochastic Integration and Differential Equations(2nd ed.), Springer-Verlag, Berlin, 2004.

Author information

Authors and Affiliations

Additional information

This research is supported by the Natural Science Foundation of Tianjin under Grant No. 09JCYBJC01800.

This paper was recommended for publication by Editor SUN Liuquan.

Rights and permissions

About this article

Cite this article

Zhao, H., Rong, X. Optimal investment with multiple risky assets for an insurer with modified periodic risk process. J Syst Sci Complex 28, 997–1014 (2015). https://doi.org/10.1007/s11424-014-2176-z

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-014-2176-z