Abstract

In recent years, thematic exchange-traded funds (ETF) have increased in economic significance. Investors in thematic ETFs have more than just financial objectives and gain a non-monetary added value from a thematic portion in their portfolios. Therefore, traditional portfolio optimization models which target only financial criteria cannot suit these investors’ needs anymore. Nevertheless, to account for their thematic interests, investors adapt a core satellite strategy in which conventional core portfolios and thematic satellite portfolios are combined. Thus, these portfolios are separately optimized without further considering inter-portfolio correlation effects. Since modern portfolio theory has originally been established to, inter alia, optimize these correlation effects, portfolios can only be efficient by chance. Therefore, this study targets the correlation effects between conventional and thematic portfolios and uses a tri-criterion thematic portfolio optimization model as an overall framework. Throughout a two-part analysis with tradable ETFs and a simulation with 250,000 draws and 1,750,000 portfolio optimizations performed, the status quo is compared to the tri-criterion model. Quantifying the suboptimality, simulation results show a mean portfolio improvement of 6.23% measured as relative yield enhancement. Further, our analysis concludes that the more narrowly a theme is defined and the more particular it is, relative yield enhancements can increase up to 46.88%.

Similar content being viewed by others

Notes

Data obtained from Thomson Reuters Eikon.

Same as (2). Optimization by holding two objective functions as restrictions.

An exemplary surface is presented in Appendix 1.

The complete collection of assets can be found in ESM_1.

DAX, Dow Jones Global Titans 50, Financial Times Stock Exchange 100 Index, The Global Dow, MSCI All Country World Index, MSCI World, Nikkei 225, Russell 1000 Index, Standard & Poor's 500, STOXX Europe 600.

Calculations have been done comparing risk levels, too. Improvement results are qualitatively the same.

Results show that the mean peak of conceived δ is calculated for thematic proportions above t = 50%.

Smallest amount of different draws within a simulation > 3.87e368.

Full histograms can be found in Appendix 2.

References

Anand, P., Cowton, C.J.: The ethical investor: exploring dimensions of investment behaviour. J. Econ. Psychol. 14(2), 377–385 (1993). https://doi.org/10.1016/0167-4870(93)90007-8

Baker, H.K., Haslem, J.A.: Toward the development of client-specified valuation models. J. Finance 29(4), 1255–1263 (1974). https://doi.org/10.1111/j.1540-6261.1974.tb03102.x

Ballestero, E., Bravo, M., Pérez-Gladish, B., Arenas-Parra, M., Plà-Santamaria, D.: Socially responsible investment: a multicriteria approach to portfolio selection combining ethical and financial objectives. Eur. J. Oper. Res. 216(2), 487–494 (2012). https://doi.org/10.1016/j.ejor.2011.07.011

Bana e Costa, C.A., Soares, J.O.: A multicriteria model for portfolio management. Europ. J. Finance 10(3), 198–211 (2004). https://doi.org/10.1080/1351847032000113254

Barberis, N., Thaler, R.: Chapter 18 A survey of behavioral finance. Handb. Econ. Finance 1, 1053–1128 (2003). https://doi.org/10.1016/s1574-0102(03)01027-6

Barracchini, C.: An ethical investments evaluation for portfolio selection. Electron. J. Bus. Ethics Organ. Stud. 9(1), 1–18 (2004)

Bérubé, V., Ghai, S., Tétrault, J.: From indexes to insights: the rise of thematic investing McKinsey on Investing. Winter 15(1), 51–56 (2014)

DeMiguel, V., Garlappi, L., Uppal, R.: Optimal versus naive diversification: How inefficient is the 1/N portfolio strategy? Rev. Financ. Stud. 22(5), 1915–1953 (2007)

Drut, B.: Social responsibility and mean-variance portfolio selection Working papers CEB 10/002. Retrieved from https://s3.amazonaws.com/academia.edu.documents/32207746/Drut_Bastien_Social_Responsibility_and_Mean_Variance_Portfolio_Selection.pdf?AWSAccessKeyId=AKIAIWOWYYGZ2Y53UL3A&Expires=1557737941&Signature=WOc8jzof3Yq2yDQfkaKAYbZnmG8%3D&response-content-disposition=inline%3B%20filename%3DSocial_responsibility_and_mean-variance.pdf (2010). Accessed 13 May 2019

Ehrgott, M., Klamroth, K., Schwehm, C.: An MCDM approach to portfolio optimization Europ. J. Oper. Res. 155(3), 752–770 (2004). https://doi.org/10.1016/S0377-2217(02)00881-0

Forster, G.: On theme Superfunds. Magazine 424, 16 (2017)

Gasser, S.M., Rammerstorfer, M., Weinmayer, K.: Markowitz revisited: social portfolio engineering. Eur. J. Oper. Res. 258(3), 1181–1190 (2017). https://doi.org/10.1016/j.ejor.2016.10.043

Giammattei, G.: Global Megatrends: Capitalizing on Tomorrow’s Trends Today. Retrieved from https://us.rbcgam.com/resources/docs/pdf/whitepapers/Global_Megatrends_Whitepaper_FINAL.pdf (2014). Accessed 13 May 2019

Haimes, Y.Y.: On a bicriterion formulation of the problems of integrated system identification and system optimization. IEEE Trans. Syst. Man Cybern. 1(3), 296–297 (1971). https://doi.org/10.1109/tsmc.1971.4308298

Hirschberger, M., Steuer, R.E., Utz, S., Wimmer, M., Qi, Y.: Computing the nondominated surface in tri-criterion portfolio selection. Oper. Res. 61(1), 169–183 (2013). https://doi.org/10.1287/opre.1120.1140

Kahneman, D., Riepe, M.W.: Aspects of investor psychology. Portfolio Manag. 24(4), 52–65 (1998). https://doi.org/10.3905/jpm.1998.409643

Keeney, R.L., Raiffa, H.: Decisions with Multiple Objectives: Preferences and Value Tradeoffs. Cambridge University Press, Cambridge (1993)

Konno, H., Suzuki, K.-I.: A mean-variance-skewness portfolio optimization model. J. Oper. Res. Soc. Jpn. 38(2), 173–187 (1995). https://doi.org/10.15807/jorsj.38.173

Lewis, A.: A focus group study of the motivation to invest: ‘ethical/green’ and ‘ordinary’ investors compared. J. Soc. Econ. 30(4), 331–341 (2001). https://doi.org/10.1016/s1053-5357(01)00103-2

Magoon, C.: Better than sectors: the case for thematic investing. J. Indexes 12(5), 18–25 (2009)

Marchioni, U., Antropova, S., Thomson, C., McNaught, C., Schwaiger, K.: Megatrends: an index approach to thematic investing. Retrieved from https://www.ishares.com/uk/individual/en/literature/brochure/ishares-megatrends-thematic-investing-en-gb-rc-end-investor.pdf (2016). Accessed 14 Nov 2017

Markowitz, H.: Portfolio selection. J. Finance 7(1), 77 (1952). https://doi.org/10.2307/2975974

Markowitz, H.: Portfolio selection: efficient diversification of investments, 2nd edn. Blackwell, Cambridge (1996)

MSCI: GICS Structure: Effective Sep1, 2016. https://www.msci.com/documents/10199/4547797/GICS+Structure+effective+Sep+1%2C+2016.xls/d8600f87-cc12-4070-912f-08590232441d (2016). Accessed 19 Mar 2019

Sharpe, W.F.: The sharpe ratio. Portfolio Manag. 21(1), 49–58 (1994)

Spronk, J., Hallerbach, W.: Financial modelling: Where to go? With an illustration for portfolio management. Eur. J. Oper. Res. 99(1), 113–125 (1997). https://doi.org/10.1016/S0377-2217(96)00386-4

Steuer, R.E., Qi, Y., Hirschberger, M.: Portfolio optimization: new capabilities and future methods. J. Bus. Econ. 76(2), 199–220 (2006). https://doi.org/10.1007/s11573-006-0006-z

Steuer, R.E., Qi, Y., Hirschberger, M.: Suitable-portfolio investors, nondominated frontier sensitivity, and the effect of multiple objectives on standard portfolio selection. Ann. Oper. Res. 152(1), 297–317 (2007). https://doi.org/10.1007/s10479-006-0137-1

Steuer, R.E., Qi, Y., Hirschberger, M.: Portfolio selection in the presence of multiple criteria. Handb. Financ. Eng. 18, 3–24 (2008). https://doi.org/10.1007/978-0-387-76682-9_1

Stone, B.K.: A linear programming formulation of the general portfolio selection problem. J. Financ. Quant. Anal. 8(4), 621 (1973). https://doi.org/10.2307/2329828

US SIF Foundation: Report on US sustainable, responsible and impact investing trends 2018 (2018)

Utz, S., Wimmer, M., Hirschberger, M., Steuer, R.E.: Tri-criterion inverse portfolio optimization with application to socially responsible mutual funds. Eur. J. Oper. Res. 234(2), 491–498 (2014). https://doi.org/10.1016/j.ejor.2013.07.024

Utz, S., Wimmer, M., Steuer, R.E.: Tri-criterion modeling for constructing more-sustainable mutual funds. Eur. J. Oper. Res. 246(1), 331–338 (2015). https://doi.org/10.1016/j.ejor.2015.04.035

Webley, P., Lewis, A., Mackenzie, C.: Commitment among ethical investors: an experimental approach. J. Econ. Psychol. 22(1), 27–42 (2001). https://doi.org/10.1016/S0167-4870(00)00035-0

Acknowledgements

We would like to thank the editor Markus Schmid and the anonymous referees for their constructive recommendations, which helped to improve the quality of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

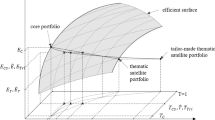

Appendix 1: Three-dimensional surface and compared portfolios

Thematic stocks are defined by a Robotics & A.I. thematic ETF in combination with a S&P 500 ETF. Return and risk are computed by mean and standard deviation of daily stock returns in 2016. The points represent the portfolios that are compared for t ϵ {0.1, 0.2, 0.3, 0.4, 0.5} and the lines connect them to portfolios of the tri-criterion model on the efficient surface and indicate the relative yield enhancement.

Appendix 2: Simulation histograms

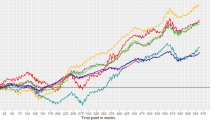

Histograms show the results of the simulation with 3891 stocks and a random evaluation of thematic stocks for different amounts of conventional stocks nC using daily stock returns of the year 2016. Within the histograms, the different lines show each 10,000 results concerning different amounts of thematic stocks. Histogram “nC: All” summarizes the 250,000 results of the five previous histograms.

Rights and permissions

About this article

Cite this article

Methling, F., von Nitzsch, R. Thematic portfolio optimization: challenging the core satellite approach. Financ Mark Portf Manag 33, 133–154 (2019). https://doi.org/10.1007/s11408-019-00329-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-019-00329-0