Abstract

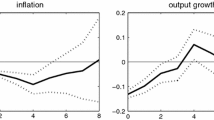

This paper provides empirical assistance in forecasting monetary policy in Switzerland. After the introduction, we provide a descriptive analysis of the four cycles of rising interest rates from 1979 to 2003. It is apparent that the individual cycles diverge to greater or lesser degrees from the average rising interest rate cycle. The third section evaluates the quality of various market forecasts. Regardless of the method of measurement, they show statistically significant and systematic forecast errors. Even simple trend forecasts for money market rates seldom beat the toss of a coin. If we divide the observation periods into regimes of rising and of falling interest rates, then forecasts based on futures contracts on the 3-month LIBOR are superior to other market variables such as forwards or consensus estimates in times when rates are rising. In the fourth section, we assess an empirical response function for the Swiss National Bank’s (SNB) monetary policy. Due to the long, variable time lags with which monetary policy affects the real economy, the central banks must adopt a forward-looking approach and base decisions on expectations. Hence, by employing consensus forecasts, we use expectations for inflation and growth as explanatory variables. The analysis shows that the SNB has a stable interest rate policy, with inflation forecasts weighted four times more heavily than growth expectations. Assuming the SNB will behave similarly in the future as it has in the past, this rule of thumb allows us to assign historically consistent money market rates to a specific macro-economic climate.

Similar content being viewed by others

References

BELSLEY, D. A., E. KUH and R. E. WELSCH (1989): Regression Diagnostics: Identifying Influential Data and Sources of Collinearity, New York, NY: John Wiley and Sons.

BOFINGER, P. and R. SCHMIDT (2003): “Professional Exchange Rate Forecasts—Are They Reliable? An Empirical Analysis of Professional Forecasts for the /US-Q Rate”, Financial Markets and Portfolio Management, 17(4), pp. 437–449.

BROWN, R. L., J. DURBIN and J. M. EVANS (1975): “Techniques for Testing the Constancy of Regression Relationships Over Time,” Journal of the Royal Statistical Society, Series B, Vol. 37, pp. 149– 192.

DIEBOLD, F. X. and J. A. LOPEZ (1996): “Forecast Evaluation and Combination”, in: G. S. Maddala and C. R. Rao (eds.): Handbook of Statistics 14, Amsterdam, pp. 241–268.

ENGLE, R. F. and B. S. YOO (1987): “Forecasting and Testing in Co-Integrated Systems”, Journal of Econometrics, 35, pp. 143–159.

GREENE, W. H. (2003): Econometric Analysis, 5th Edition, Upper Saddle River, NJ: Prentice Hall.

MACKINNON, J. (1991): “Critical values for co-integration tests”, in: R. F. Engle and C. W. J. Granger (eds.): Long-Run Economic Relationships, Oxford University Press, pp. 267–276.

ROTH, J. P. 2003. “Geldpolitische Standortbestimmung”, speech on March 17, 2003 in Berne, (http://www.snb.ch/d/aktuelles/referate/ref_030317_jpr.html).

TAYLOR. J. B. (1993): “Discretion versus Policy Rules in Practice”, Carnegie-Rochester Conference Series on Public Policy, 12/1993, pp. 195–214.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hock, T., Zimmermann, P. Forecasting Monetary Policy in Switzerland: Some Empirical Assistance. Fin Mkts Portfolio Mgmt 19, 201–212 (2005). https://doi.org/10.1007/s11408-005-3386-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-005-3386-0