Abstract

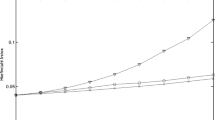

The frequent global financial crises in recent years show that it is necessary to implement macroprudential regulation for the banking system. At present, quantitative research on the macroprudential regulation for the dynamic Chinese banking network system is lacking, while the related studies in other countries have not considered the interbank network structure. Therefore, in the present paper, we construct a dynamic banking network model with a scale-free network and a dynamic macroprudential regulation model under four risk allocation mechanisms (CVaR, Incremental VaR, Shapley value EL, and ΔCoVaR) for the dynamic Chinese banking network system. Then, we conduct empirical research to study the effect of the macroprudential regulation model on the Chinese banking network system. Our results show that the Chinese banking network system was the most unstable in 2010 and that the average default probability decreased every year after the macroprudential regulation, indicating the effectiveness of the macroprudential regulation model. From the perspective of the scale-free network structure, we find that the intrinsic mechanism of macroprudential regulation is to rewire the interbank linkages from small banks to large banks with more interbank lending to prevent contagious risk, thereby improving the stability of the entire banking system. Moreover, the regulation effects of ΔCoVaR and CVaR mechanisms are found to be better than those of the other mechanisms. The regulation effect of ΔCoVaR is the most significant.

Similar content being viewed by others

References

Adrian T, Brunnermeier MK (2008) CoVaR. Federal Reserve Bank of New York Staff Report 348

Allen F, Gale D (1998) Optimal financial crises. J Finance 53(4):1245–1284

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Balogh P (2012) Macro prudential supervision tools in the European banking system. Procedia Econ Finance 3:642–647

Berger AN, Bouwman CH (2013) How does capital affect bank performance during financial crises. J Financ Econ 109(1):146–176

Berry R (2000) Portfolio management with incremental VaR. Seventh in a series of articles exploring risk management at J.P. Morgan

Brusco S, Castiglionesi F (2007) Liquidity coinsurance, moral hazard and financial contagion. J Finance 62(5):2275–2302

Chan-Lau JA (2010) Regulatory capital charges for too-connected-to-fail institutions: a practical proposal. Financ Mar Inst Instr 19(5):355–379

Cihak M, Demirguckunt A, Peria MS et al (2013) Bank regulation and supervision in the context of the global crisis. J Financ Stab 9(4):733–746

Cont R, Moussa A, Santos EBE (2010) Network structure and systemic risk in banking systems. Available at SSRN 1733528

Cruz JP, Lind PG (2012) The dynamics of financial stability in complex networks. Eur Phys J B 85(8):256

Degryse H, Nguyen G (2004) Interbank exposures: an empirical examination of contagion risk in the belgian banking system. J Cent Bank 3(2):123–172

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econ 91(3):401–419

Eisenberg L, Noe TH (2001) Systemic risk in financial systems. Manag Sci 47(2):236–249

Elsinger H, Lehar A, Summer M et al (2006) Risk assessment for banking systems. Manag Sci 52(9):1301–1314

Gai P, Kapadia S (2010) Contagion in financial networks. Proc R Soc A 466(2120):2401–2423

Gauthier C, Lehar A, Souissi M (2010) Macroprudential capital requirements and systemic risk. J Financ Stab 21(4):594–618

Georg C (2013) The effect of the interbank network structure on contagion and common shocks. J Bank Finance 37(7):2216–2228

Grilli R, Tedeschi G, Gallegati M et al (2014) Bank interlinkages and macroeconomic stability. Int Rev Econ 34:72–88

Grilli R, Tedeschi G, Gallegati M (2015) Markets connectivity and financial contagion. J Econ Interact Coord 10(2):287–304

Huang X, Zhou H, Zhu H (2010) Systemic risk contributions. FEDS 2011–08. Board of Governors of the Federal Reserve, Washington

Inaoka H, Takayasu H, Shimizu T et al (2004) Self-similarity of banking network. Phys A 339(3):621–634

Iori G, Jafarey S, Padilla FG (2006) Systemic risk on the interbank market. J Econ Behav Organ 61(4):525–542

Jorion P (2001) Value at risk: the new benchmark for managing financial risk. McGraw-Hill, New York

Kobayashi T (2013) Network versus portfolio structure in financial systems. Eur Phys J B 86(10):434

Lehar A (2005) Measuring systemic risk: a risk management approach. J Bank Finance 29(10):2577–2603

Leitner Y (2005) Financial networks: contagion, commitment, and private sector bailouts. J Finance 60(6):2925–2953

Leon C, Berndsen R (2014) Rethinking financial stability: challenges arising from financial networks’ modular scale-free architecture. J Financ Stab 15:241–256

Liao S, Sojli E, Tham WW et al (2015) Managing systemic risk in The Netherlands. Int Rev Econ Finance 40:231–245

Liu C, Wu MW, Ma YJ (2014) A study on features of interbank market based on complex network theory—for data around financial crisis (2007–2009). Theory Pract Finance Econ 35(188):9–15 (in Chinese)

Shapley LS (1953) A value for n-person games. Ann Math Study 28:307

Steinbacher M, Steinbacher M, Steinbacher M (2016) Robustness of banking networks to idiosyncratic and systemic shocks: a network-based approach. J Econ Interact Coord 11(1):95–117

Sui C, Wang ZR (2015) Interbank network scale-free characteristics. J Manag Sci China 18(12):18–26 (in Chinese)

Tarashev N, Tsatsaronis K, Borio C (2016) Risk attribution using the Shapley value. Rev Finance 20(3):1189–1213

Zhou C (2013) The impact of imposing capital requirements on systemic risk. J Financ Stab 9:320–329

Acknowledgements

We acknowledge the support from the National Natural Science Foundation of China under Grant No. 71371046 and the Fundamental Research Funds for the Central Universities (19D110803).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Gao, Q., Fan, H. Macroprudential regulation for a dynamic Chinese banking system with a scale-free network. J Econ Interact Coord 15, 579–611 (2020). https://doi.org/10.1007/s11403-019-00246-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-019-00246-5

Keywords

- Risk allocation mechanism

- Macroprudential regulation

- Chinese banking network system

- Systemic risk

- Scale-free network