Abstract

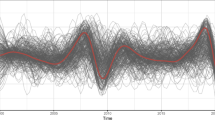

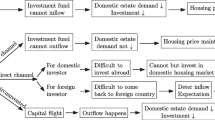

This paper examines the dynamic short-run and long-run co-movement between the real estate and stock markets in China by employing a continuous wavelet method. We use gross domestic product and M2 (broad money supply) as control variables to eliminate the common factors of the two markets and to identify the real nexus between them. The empirical results show that the co-movement between real estate and stock prices is weak in the short run, except during the financial crisis period. Since the stock market is highly volatile, while real estate prices are relatively stable, the two markets are less correlated in the short run. The results also show that real estate prices affect stock prices in the long run, which supports the existence of a credit-price effect in China. Real estate prices remained very high in most time periods. Enterprises and individuals can obtain funds from bank loans to invest in the stock market, thus raising stock prices. These findings indicate that the two markets are generally segmented in the short run but are integrated in the long run. The stabilization of the real estate market is critical for stability in the stock market, but not vice versa. Additionally, investments in the two markets may not provide a high level of risk dispersion in the long run in China.

Similar content being viewed by others

References

Adcock C, Hua X, Huang Y (2016) Are Chinese stock and property markets integrated or segmented? Eur J Finance 22(4–6):345

Aguiar-Conraria L, Soares MJ (2011) Business cycle synchronization and the Euro: a wavelet analysis. J Macroecon 33(3):477

Apergis N, Lambrinidis L (2007) More evidence on the relationship between the stock and the real estate market. J Soc Sci Res Netw 17:24

Aye G, Balcilar M, Gupta R (2013) Long-and short-run relationships between house and stock prices in South Africa: a nonparametric approach. J Hous Res 22(2):203

Ba SS, Tan CT, Zhu YQ (2009) Interaction between China real estate and stockmarket. Syst Eng 27(9):16

Chan KC, Chang CH (2014) Analysis of bond, real estate, and stock market returns in China. Chin Econ 47(2):27

Chan HL, Woo KY (2013) Studying the dynamic relationships between residential property prices, stock prices, and GDP: lessons from Hong Kong. J Hous Res 22(1):75

Chan KF, Treepongkaruna S, Brooks R, Gray S (2011) Asset market linkages: evidence from financial, commodity and real estate assets. J Bank Finance 35(6):1415

Chang Q (2016) The characteristics of stock price fluctuation and government macro regulation in China. Price Theor Prac 5:21

Chen J (2007) Rapid urbanization in China: a real challenge to soil protection and food security. CATENA 69(1):1

Chen J (2016) Housing system and urbanization in the People’s Republic of China. Asian Development Bank Institute working paper

Chen X, Ji X (2017) The effect of house price on stock market participation in China: evidence from the CHFS micro-Data. Emerg Mark Finance Tr (forthcoming)

Cheng Z, Zheng S (2015) The change of relationship between real estate and stock markets in China-An application of VaR mothod. http://lup.lub.lu.se/luur/download?func=downloadFile&recordOId=7866584&fileOId=7866587

Deng Y, Girardin E, Joyeux R, Shi S (2017) Did bubbles migrate from the stock to the housing market in China between 2005 and 2010? Institute of Real Estate studies working paper series

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057

Ding H, Chong TTL, Park SY (2014) Nonlinear dependence between stock and real estate markets in China. Econ Lett 124(3):526

Dornbusch R, Fischer S, Startz R (2011) Macroeconomics. McGraw-Hill, New York

Eichholtz PM, Hartzell DJ (1996) Property shares, appraisals and the stock market: an international perspective. J Real Estate Financ Econ 12(2):163

Fu Y, Ng LK (2001) Market efficiency and return statistics: evidence from real estate and stock markets using a present-value approach. Real Estate Econ 29(2):227

Gao X, Gu AY (2012) The relationship between Chinese real estate market and stock market. J Int Bus Res 11(1):73

Granger CW, Terasvirta T (1993) Modelling non-linear economic relationships. Oxford University Press, Oxford

Grinsted A, Moore JC, Jevrejeva S (2004) Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Proc Geophys 11:561

He Q, Liu F, Qian Z, Chong TTL (2017) Housing prices and business cycle in China: a DSGE analysis. Int Rev Econ Finance (forthcoming)

Hong ZH, Yin ZL (2007) Interaction between stock and housing prices conceals financial crisis. Western Forum 12:26

Huang B, Zhang Y, Lai RN (2014) Seemingly unrelated stock market and housing market in China—a myth or truth. http://sfm.finance.nsysu.edu.tw/pdf/2013pdf/091-102662961.pdf

Hui EC, Ng IM (2012) Wealth effect, credit price effect, and the inter-relationships between Hong Kong’s property market and stock market. Prop Manag 30(3):255

Ibrahim MH (2010) House price-stock price relations in Thailand: an empirical analysis. Int J Hous Mark Anal 3(1):69

Jin T, Chu M (2013) The mystery on housing price volatility, stock price volatility associated with macroeconomic volatility in China?—Based on the perspective of generalized virtual economy. Res Gen Virt Econ 3:68

Jin T, Chu M (2015) China price fluctuations of house, fluctuations in the stock price impact on resident’s consumer. Res Gen Virt Econ 6(2):71

Kwiatowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationary against the alternative of a unit root. J Econ 54:159

Lean HH, Smyth R (2012) REITs, interest rates and stock prices in Malaysia. Int J Bus Soc 13(1):49

Lean HH, Smyth R (2014) Dynamic interaction between house prices and stock prices in Malaysia. Int J Strat Prop Manag 18(2):163

Lee CC, Liang CM, Wu WH, You SM (2013) Interactions between house prices, stock prices and monetary policy-Using recursive VAR. Am J Iin Bus Manag 3(8):645

Lee CC, Lee CC, Chiang SH (2016) Ripple effect and regional house prices dynamics in China. Int J Strat Prop Manag 20(4):397

Li J, Zang XH (2015) Housing price fluctuation and consumption behavior of urban residents in China: an analysis based on dynamic panel data at provincial level. Nankai Econ Stud 1:89

Li XL, Chang T, Miller SM, Balcilar M, Gupta R (2015) The co-movement and causality between the US housing and stock markets in the time and frequency domains. Int Rev Econ Financ 38:220

Li JP, Fan JJ, Su CW, Lobonţ OR (2017) Investment coordinates in the context of housing and stock markets nexus. Appl Econ Lett (forthcoming)

Liang LJ (2016) Macro control tools and the effectiveness on housing price in China (Unpublished doctoral dissertation). University of Hong Kong, Hong Kong

Lin PT, Fuerst F (2014) The integration of direct real estate and stock markets in Asia. Appl Econ 46(12):1323

Lin TC, Lin ZH (2011) Are stock and real estate markets integrated? An empirical study of six Asian economies. Pac-Basin Finance J 19(5):571

Lin Z, Lin XS (2013) An empirical study on the correlation between real estate market and stock market in China. Stat Decis 12:133

Lin B, Liu C (2016) Why is electricity consumption inconsistent with economic growth in China? Energy Policy 88:310

Liu YS, Su CW (2010) The relationship between the real estate and stock markets of China: evidence from a nonlinear model. Appl Finance Econ 20(22):1741

Liu CH, Hartzell DJ, Greig W, Grissom TV (1990) The integration of the real estate market and the stock market: some preliminary evidence. J Real Estate Finance Econ 3(3):261

Lou T (2017) Nonlinear causality relationship between stock and real-estate returns in PIGS countries: wealth effect or credit-price effect. Appl Econ Lett 24(11):736

Mao G (2016) Do regional house prices converge or diverge in China? China Econ J 9(2):154

Markowitz H (1952) Portfolio selection. J Finance 7(1):77

Mihanović H, Orlić M, Pasarić Z (2009) Diurnal thermocline oscillations driven by tidal flow around an island in the Middle Adriatic. J Marine Syst 78:157

Newey W, West K (1987) A simple, positive semidefinite, heteroscedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703

Ng EK, Chan JC (2012) Geophysical applications of partial wavelet coherence and multiple wavelet coherence. J Atmos Ocean Technol 29(12):1845

Oikarinen E (2009) Interaction between housing prices and household borrowing: the Finnish case. J Bank Finance 33(4):747

Okunev J, Wilson P, Zurbruegg R (2000) The causal relationship between real estate and stock markets. J Real Estate Finance Econ 21(3):251

Peng XT (2011) Study on the correlation between the real estate market and the stock market of China. J Beijing Inst Tech (Soc Sci Ed) 13(5):39

Perron P (1989) The great crash, the oil price shock and the unit root hypothesis. Econometrica 57(6):1361

Phillips PBC, Perron P (1988) Testing for unit roots in time series regression. Biometrika 75:335

Quan DC, Titman S (1999) Do real estate prices and stock prices move together? An international analysis. Real Estate Econ 27(2):183

Shao F, Zhu DZ (2016) Under the new normal a relevant empirical analysis on real estate and stock market. J Shijiazhuang U Econ 39(3):11

Shiller RJ (2014) Speculative asset prices. Am Econ Rev 104(6):1486

Sim S, Chang B (2006) Stock and real estate markets in Korea: wealth or credit price effect. J Econ Res 11:99

Su CW (2011) Non-linear causality between the stock and real estate markets of Western European countries: evidence from rank tests. Econ Model 28(3):845

Torrence C, Compo GP (1998) A practical guide to wavelet analysis. Bull Am Meteorol Soc 79(1):61

Tsai IC, Lee CF, Chiang MC (2012) The asymmetric wealth effect in the US housing and stock markets: evidence from the threshold cointegration model. J Real Estate Finance Econ 45(4):1005

Wu WX, Qi TX (2007) Liquidity, life cycle and portfolio choice heterogeneity. Econ Res J 2(3):97

Wu J, Gyourko J, Deng Y (2012) Evaluating conditions in major Chinese housing markets. Reg Sci Urban Econ 42(3):531

Xu XE, Chen T (2012) The effect of monetary policy on real estate price growth in China. Pac-Basin Finance J 20(1):62

Yao S, Luo D, Wang J (2014) Housing development and urbanization in China. World Econ 37(3):481

Yilmaz A, Unal G, Karatasoglu C (2017) Wavelet based analysis of major real estate markets. J Adv Stud Finance 7(2):107

Yuksel A (2016) The relationship between stock and real estate prices in Turkey: evidence around the global financial crisis. Cent Bank Rev 16(1):33

Zhang G, Fung HG (2006) On the imbalance between the real estate market and the stock markets in China. Chin Econ 39(2):26

Zhou X, Chang MS, Gibler K (2016) The asymmetric wealth effects of housing market and stock market on consumption in China. J Asia Pac Econ 21(2):196

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Augmented Dickey-Fuller (1981, ADF), Phillips and Perron (1988, PP) and Kwiatowski et al. (1992, KPSS) tests are employed to examine the stationarity of real estate prices (RP) and stock prices (SP). The corresponding results are shown in Table 2, and we find that the level series is not stationary under the ADF, PP and KPSS tests. However, their first differences (DSP, DRP) are stationary, which means that they are integrated of order 1.

To investigate the long-run relationship between the real estate and stock markets in China, we use Johansen cointegration tests in which the optimal lag length is chosen based on the Schwarz information criterion. The results are presented in Table 3. The cointegration test includes both the trace and maximum eigenvalue statistics tests. The results of both tests reported in Table 3 indicate no evidence of a long-run relationship between RP and SP. However, when we control for GDP and M2, we find a co-integration relationship, which is consistent with our empirical results in Figs. 3 and 4. This result means that RP and SP are cointegrated in a long-run relationship.

Furthermore, we use the vector error correction (VEC) model to obtain the long-run and short-run relationships between RP and SP when GDP and M2 are controlled, respectively. The cointegration and error correction equations are shown in Tables 4 and 5. From the cointegration equations, we find that when M2 is controlled, the cointegration coefficient is larger than the coefficient when GDP is controlled, and this also supports the results of the previous analysis. With regard to the series in logarithmic form, the estimated coefficients represent long-run elasticities. Therefore, when M2 is controlled, the influence of RP on SP is stronger than in the case when GDP is controlled. In addition, RP is nonsignificant in Table 4, which may be because it clearly affects SP only after 2005, as we observe in Fig. 3. Finally, based on the error correction equations, we find that the estimated coefficients of the lagged DRP and DSP are nonsignificant in both Tables 4 and 5, which indicates that there is no obvious nexus in the short run between the two series.

Rights and permissions

About this article

Cite this article

Su, CW., Yin, XC., Chang, HL. et al. Are the stock and real estate markets integrated in China?. J Econ Interact Coord 14, 741–760 (2019). https://doi.org/10.1007/s11403-018-0215-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-018-0215-x