Abstract

Although small and medium-sized enterprises (SMEs) play a vital role in countries’ entrepreneurship and export activities, their lack of financial assets and human resources makes them more vulnerable to difficult-to-control external risks, including financial, legal, and market risks. Since the exposure to these risks might reduce their willingness to export, SMEs’ risk management capabilities included in the dynamic capabilities of Resource-based View (RBV) might enable them to reduce their exporting concerns and stimulate their entrepreneurial spirit. In this regard, this paper purposes to investigate the impacts of financial, legal, and market risk management capabilities on export intentions of SMEs. The effects of risk management capabilities on the export intention of SMEs might differ depending on the countries where SMEs operate because locally specific government bureaucracy, documentation, standards, regulations, and cultural values make companies face various circumstances that might differently affect their management of multiple risk factors and export entrepreneurship. Thus, this paper also aims to determine whether the effects of risk management capabilities on the export intention of SMEs differ depending on their country of origin. In line with the research aims, this paper employs the Binary Logistic Regression Test to analyze 1221 SMEs in various countries. The results indicate that while financial risk management does not have any significant impacts on the export intention of SMEs, the effects of legal and market risk management on export intention differ depending on SMEs’ country of origin. This paper explains the reasons for those results by the institutional factors.

Similar content being viewed by others

References

Akhtar, P., Ullah, S., Amin, S. H., Kabra, G., & Shaw, S. (2020). Dynamic capabilities and environmental sustainability for emerging economies’ multinational enterprises. International Studies of Management & Organization, 50(1), 27–42. https://doi.org/10.1080/00208825.2019.1703376.

Al Nuaimi, F. M. S., Singh, S. K., & Ahmad, S. Z. (2023). Open innovation in SMEs: A dynamic capabilities perspective. Journal of Knowledge Management. https://doi.org/10.1108/JKM-11-2022-0906.

Al-Aali, A., & Teece, D. J. (2014). International entrepreneurship and the theory of the (long-lived) international firm: A capabilities perspective. Entrepreneurship Theory and Practice Special Issue: International Entrepreneurship, 38(1), 95–116. https://doi.org/10.1111/etap.12077.

Arslan, Ö., & Karan, M. B. (2009). Credit risks and internationalization of SMEs. Journal of Business Economics and Management, 10(4), 361–368. https://doi.org/10.3846/1611-1699.2009.10.361-368.

Arthurs, J. D., & Busenitz, L. W. (2006). Dynamic capabilities and venture performance: The effects of venture capitalists. Journal of Business Venturing, 21(2), 195–215. https://doi.org/10.1016/j.jbusvent.2005.04.004.

Ayob, A. H., Ramlee, S., & Abdul Rahman, A. (2015). Financial factors and export behavior of small and medium-sized enterprises in an emerging economy. Journal of International Entrepreneurship, 13(1), 49–66. https://doi.org/10.1007/s10843-014-0141-5.

Baines, P. R., & Viney, H. (2010). The unloved relationship? Dynamic capabilities and political-market strategy: A research agenda. Journal of Public Affairs, 10(4), 258–264. https://doi.org/10.1002/pa.346.

Belás, J., & Cepel, M. (2020). Market Rısk in the Smes Segment in the Vısegrad Group Countrıes. Transformations in Business & Economics, 19, 678–693.

Bogodistov, Y., & Wohlgemuth, V. (2017). Enterprise risk management: A capability-based perspective. The Journal of Risk Finance, 18(3), 234–251. https://doi.org/10.1108/JRF-10-2016-0131.

Boustanifar, H., Zajac, E. J., & Zilja, F. (2022). Taking chances? The effect of CEO risk propensity on firms’ risky internationalization decisions. Journal of International Business Studies, 53(2), 302–325. https://doi.org/10.1057/s41267-021-00480-9.

Bowe, M., Filatotchev, I., & Marshall, A. (2010). Integrating contemporary finance and international business research. International Business Review, 19(5), 435–445. https://doi.org/10.1016/j.ibusrev.2010.01.005.

Calzadilla, G. A. C., Villarreal, S. M., Jerónimo, R. J. M., & López, F. R. (2022). Risk management in the ınternationalization of small and medium-sized Spanish companies. Journal of Risk and Financial Management, 15(8), 361. https://doi.org/10.3390/jrfm15080361.

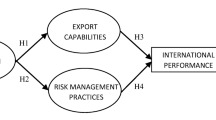

Catanzaro, A., & Teyssier, C. (2021). Export promotion programs, export capabilities, and risk management practices of internationalized SMEs. Small Business Economics, 57(3), 1479–1503.

Chen, W., Dollar, D., & Tang, H. (2018). Why is China investing in Africa? Evidence from the firm level. The World Bank Economic Review, 32(3), 610–632. https://doi.org/10.1093/wber/lhy026.

Ciabuschi, F., Lindahl, O., Barbieri, P., & Fratocchi, L. (2019). Manufacturing reshoring: A strategy to manage risk and commitment in the logic of the internationalization process model. European Business Review, 31(1), 139–159. https://doi.org/10.1108/EBR-02-2018-0046.

Correia, R. J., Teixeira, M. S., & Dias, J. G. (2021). Dynamic capabilities: Antecedents and implications for firms’ performance. International Journal of Productivity and Performance Management, 71(8), 3270–3292. https://doi.org/10.1108/IJPPM-12-2019-0587.

Cuervo-Cazurra, A., Luo, Y., Ramamurti, R., & Ang, S. H. (2018). The impact of the home country on internationalization. Journal of World Business, 53(5), 593–604. https://doi.org/10.1016/j.jwb.2018.06.002.

Dang, V. H., & Lindsay, V. (2022). Determinants of hedging strategy in foreign exchange risk management by exporting small and medium-sized enterprises: The mediating role of resources. Journal of General Management, 48(1), 3–13. https://doi.org/10.1177/03063070211063310.

Del Giudice, M., Scuotto, V., Papa, A., & Singh, S. K. (2023). The ‘bright’side of innovation management for international new ventures. Technovation, 125, 102789. https://doi.org/10.1016/j.technovation.2023.102789.

Denford, J. S. (2013). Building knowledge: Developing a knowledge-based dynamic capabilities typology. Journal of Knowledge Management, 17(2), 175–194. https://doi.org/10.1108/13673271311315150.

Dias, G. C., de Oliveira, U. R., Lima, G. B. A., & Fernandes, V. A. (2021). Risk management in the import/export process of an automobile company: A contribution for supply chain sustainability. Sustainability, 13(11), 6049. https://doi.org/10.3390/su13116049.

Dong, Y., & Men, C. (2014). SME financing in emerging markets: Firm characteristics, banking structure and ınstitutions. Emerging Markets Finance and Trade, 50(1), 120–149. https://doi.org/10.2753/REE1540-496X500107.

Dvorsky, J., Popp, J., Virglerova, Z., Kovács, S., & Oláh, J. (2018). Assessing the importance of market risk and its sources in SMEs of the visegrad group and Serbia. Advances in Decision Sciences, 22, 1–25.

Dvorský, J., Petráková, Z., Ajaz Khan, K., Formánek, I., & Mikoláš, Z. (2020a). Selected aspects of strategic management in service sector. Journal of Tourism and Services, 20(11), 109–123. https://doi.org/10.29036/jots.v11i20.146.

Dvorský, J., Petráková, Z., & Fialová, V. (2020b). Perception of business risks by entrepreneurs according to experience with the business failure. International Journal of Entrepreneurial Knowledge, 8(1), 76–88. https://doi.org/10.37335/ijek.v8i1.104.

European Commission (2023). Country risk profiles. Retrieved August 27, 2023 from https://drmkc.jrc.ec.europa.eu/inform-index/INFORM-Risk/Country-Risk-Profile.

Eurostat (2022). Eurostat Statistics. Retrieved April 1, 2023 from https://ec.europa.eu/eurostat/statistics-explained/images/c/ce/Shares_by_size_class_for_exporting_%28goods%29_enterprises%2C_2020.png.

Farrington, D. P., & Loeber, R. (2000). Some benefits of dichotomization in psychiatric and criminological research. Criminal Behaviour and Mental Health, 10(2), 100–122. https://doi.org/10.1002/cbm.349.

Fatemi, A. M. (1988). The effect of international diversification on corporate financing policy. Journal of Business Research, 16(1), 17–30. https://doi.org/10.1016/0148-2963(88)90078-1.

Ferraris, A., Giachino, C., Ciampi, F., & Couturier, J. (2021). R&D internationalization in medium-sized firms: The moderating role of knowledge management in enhancing innovation performances. Journal of Business Research, 128, 711–718. https://doi.org/10.1016/j.jbusres.2019.11.003.

Field, A. (2009). Discovering statistics using SPSS. Sage.

Gupta, J., Wilson, N., Gregoriou, A., & Healy, J. (2014). The effect of internationalisation on modelling credit risk for SMEs: Evidence from UK market. Journal of International Financial Markets Institutions and Money, 31, 397–413. https://doi.org/10.1016/j.intfin.2014.05.001.

Haapanen, L., Hurmelinna-Laukkanen, P., Nikkilä, S., & Paakkolanvaara, P. (2019). The function-specific microfoundations of dynamic capabilities in cross-border mergers and acquisitions. International Business Review, 28(4), 766–784. https://doi.org/10.1016/j.ibusrev.2019.03.002.

Heritage (2023). Index of Economic Freedom. Retrieved September 5, 2023 fromhttps://www.heritage.org/index/country/slovakia#:~:text=Slovakia?s%20economic%20freedom%20score%20is,the%20world%20and%20regional%20averages.

Hofstede, & Index (2023). Uncertainty avoidance index. Retrieved September 2, 2023 from https://www.hofstede-insights.com/country-comparison-tool?countries=czech+republic%2Chungary*%2Cslovakia.

Hofstede, G., Hofstede, G. J., & Minkov, M. (2010). Cultures and organizations: Software of the mind-intercultural cooperation and its importance for survival. McGraw-Hill.

Hudakova, M., Gabrysova, M., Petrakova, Z., Buganova, K., & Krajcik, V. (2021). The perception of market and economic risks by owners and managers of enterprises in the V4 countries. Journal of Competitiveness, 13(4), 60–77. https://doi.org/10.7441/joc.2021.04.04.

IMD (2022). World Competitiveness Ranking. Retrieved September 1, 2023 from https://www.imd.org/centers/wcc/world-competitiveness-center/rankings/world-competitiveness-ranking/.

IMD’s Competitiveness Index (2022). Government Efficiency Index. Retrieved March 29, 2023 from https://www.imd.org/centers/world-competitiveness-center/rankings/world-competitiveness/.

Ipek, I., & Tanyeri, M. (2020). Home country institutional drivers and performance outcomes of export market orientation: The moderating role of firm resources. International Journal of Emerging Markets, 16(4), 806–836.

Jafari-Sadeghi, V., Dutta, D. K., Ferraris, A., & Del Giudice, M. (2020). Internationalisation business processes in an under-supported policy contexts: Evidence from Italian SMEs. Business Process Management Journal, 26(5), 1055–1074. https://doi.org/10.1108/BPMJ-03-2019-0141.

Javernick-Will, A. (2013). Local embeddedness and knowledge management strategies for project-based multi-national firms. Engineering Management Journal, 25(3), 16–26. https://doi.org/10.1080/10429247.2013.11431979.

Joo, S. H., & Pak, M. S. (2017). Empirical analysis of how risk management by Korea’s exporting companies affects export performance. Journal of Korea Trade, 21(4), 324–348. https://doi.org/10.1108/JKT-01-2017-0017.

Jung, S., Dalbor, M., & Lee, S. (2018). Internationalization as a determinant of systematic risk: the role of restaurant type. International Journal of Contemporary Hospitality Management. 30(8), 2018, 2791–2809. https://doi.org/10.1108/IJCHM-06-2017-0321.

Khan, K. A., Dankiewicz, R., Kliuchnikava, Y., & Oláh, J. (2020). How do entrepreneurs feel bankruptcy? International Journal of Entrepreneurial Knowledge, 8(1), 89–101. https://doi.org/10.37335/ijek.v8i1.103.

Ključnikov, A., Civelek, M., Klimeš, C., & Farana, R. (2022a). Export risk perceptions of SMEs in selected Visegrad countries. Equilibrium. Quarterly Journal of Economics and Economic Policy, 17(1), 173–190. https://doi.org/10.24136/eq.2022.007.

Ključnikov, A., Civelek, M., Krajčík, V., Novák, P., & Červinka, M. (2022b). Financial performance and bankruptcy concerns of SMEs in their export decision. Oeconomia Copernicana, 13(3), 867–890. https://doi.org/10.24136/oc.2022.025.

Ko, C., Lee, P., & Anandarajan, A. (2019). The impact of operational risk incidents and moderating influence of corporate governance on credit risk and firm performance. International Journal of Accounting & Information Management, 27(1), 96–110. https://doi.org/10.1108/IJAIM-05-2017-0070.

Kolková, A., & Ključnikov, A. (2021). Demand forecasting: An alternative approach based on technical indicator Pbands. Oeconomia Copernicana, 12(4), 863–894. https://doi.org/10.24136/oc.2021.028.

Kraus, S., Ambos, T. C., Eggers, F., & Cesinger, B. (2015). Distance and perceptions of risk in internationalization decisions. Journal of Business Research, 68(7), 1501–1505. https://doi.org/10.1016/j.jbusres.2015.01.041.

Krisharyanto, E., Retnowati, E., & Hastuti, N. T. (2019). Regulation and provisions for supervision of halal products in Indonesia. J. Legal Ethical & Regul. Isses, 22, (1),1–10

Lafuente, E., Stoian, M. C., & Rialp, J. (2015). From export entry to de-internationalisation through entrepreneurial attributes. Journal of Small Business and Enterprise Development, 22(1), 21–37. https://doi.org/10.1108/JSBED-09-2012-0101.

Lanfranchi, A., de Resende Melo, P. L., Borini, F. M., & Telles, R. (2020). Institutional environment and internationalization of franchise chains: A regional and global analysis. International Journal of Emerging Markets, 16(4), 726–744. https://doi.org/10.1108/IJOEM-03-2019-0188.

Lee, S. Y. (2019). Exports of SMEs against risk? Theory and evidence from foreign exchange risk insurance schemes in Korea. Journal of Korea Trade, 23(5), 87–101. https://doi.org/10.35611/jkt.2019.23.5.87.

Lee, K., & Wang, L. (2023). Chinese high-tech export performance: Effects of ıntellectual capital mediated by dynamic and risk management capabilities. SAGE Open, 13(1). https://doi.org/10.1177/21582440231153039.

Leonidou, L. C. (2004). An analysis of the barriers hindering small business export development. Journal of Small Business Management, 42(3), 279–302. https://doi.org/10.1111/j.1540-627X.2004.00112.x.

Liu, Y. (2022). Construction of Credit Assessment model for ınternational ımport and export trade based on fuzzy hierarchical analysis. Mathematical Problems in Engineering, 2022(2705068). https://doi.org/10.1155/2022/270506.

Liu, C. H., Horng, J. S., Chou, S. F., Huang, Y. C., & Chang, A. Y. (2018). How to create competitive advantage: The moderate role of organizational learning as a link between shared value, dynamic capability, differential strategy, and social capital. Asia Pacific Journal of Tourism Research, 23(8), 747–764. https://doi.org/10.1080/10941665.2018.1492943.

Mansion, S. E., & Bausch, A. (2020). Intangible assets and SMEs’ export behavior: A meta-analytical perspective. Small Business Economics, 55(3), 727–760. https://doi.org/10.1007/s11187-019-00182-5.

Miller, K. D. (1992). A framework for integrated risk management in international business. Journal of International Business Studies, 23(2), 311–331. https://doi.org/10.1057/palgrave.

Monteiro, A. P., Soares, A. M., & Rua, O. L. (2019). Linking intangible resources and entrepreneurial orientation to export performance: The mediating effect of dynamic capabilities. Journal of Innovation & Knowledge, 4(3), 179–187. https://doi.org/10.1016/j.jik.2019.04.001.

Mudalige, D., Ismail, N. A., & Malek, M. A. (2019). Exploring the role of individual level and firm level dynamic capabilities in SMEs’ internationalization. Journal of International Entrepreneurship, 17, 41–74. https://doi.org/10.1007/s10843-018-0239-2.

Nair, A., Rustambekov, E., McShane, M., & Fainshmidt, S. (2014). Enterprise risk management as a dynamic capability: A test of its effectiveness during a crisis. Managerial and Decision Economics, 35(8), 555–566. https://doi.org/10.1002/mde.2641.

Neupert, K. E., Baughn, C. C., & Dao, T. T. L. (2006). SME exporting challenges in transitional and developed economies. Journal of Small Business and Enterprise Development, 13(4), 535–545. https://doi.org/10.1108/14626000610705732.

Nguyen, Q. T., & Almodóvar, P. (2018). Export intensity of foreign subsidiaries of multinational enterprises: The role of trade finance availability. International Business Review, 27(1), 231–245. https://doi.org/10.1016/j.ibusrev.2017.07.004.

Nummela, N., Vissak, T., & Francioni, B. (2022). The interplay of entrepreneurial and non-entrepreneurial internationalization: An illustrative case of an Italian SME. International Entrepreneurship and Management Journal, 18(1), 295–325. https://doi.org/10.1007/s11365-020-00673-y.

Oberle, C., & Ponterlitschek, L. (2019). Dos and don’ts in export transactions: A practitioner’s guide for SME s? Global Policy, 10(3), 421–423. https://doi.org/10.1111/1758-5899.12731.

OECD (2022). Financing SMEs and Entrepreneurs An OECD Scoreboard. Retrieved September 7, 2023 from https://www.oecd-ilibrary.org/sites/e9073a0f-en/1/3/3/index.html?itemId=/content/publication/e9073a0f-en&_csp_=f3c512744374df0f64f9df449eb7e26c&itemIGO=oecd&itemContentType=book

Oláh, J., Virglerova, Z., Popp, J., Kliestikova, J., & Kovács, S. (2019). The assessment of non-financial risk sources of SMES in the V4 countries and Serbia. Sustainability, 11(17), 4806. https://doi.org/10.3390/su11174806.

Oliva, F. L., Teberga, P. M. F., Testi, L. I. O., Kotabe, M., Giudice, D., Kelle, M., P., & Cunha, M. P. (2022). Risks and critical success factors in the internationalization of born global startups of industry 4.0: A social, environmental, economic, and institutional analysis. Technological Forecasting and Social Change, 175, 121346. https://doi.org/10.1016/j.techfore.2021.121346.

Oliver, C., & Holzinger, I. (2008). The effectiveness of strategic political management: A dynamic capabilities framework. Academy of Management Review, 33(2), 496–520. https://doi.org/10.5465/amr.2008.31193538.

Ozkan, K. S. (2020). International market exit by firms: Misalignment of strategy with the foreign market risk environment. International Business Review, 29(6), 101741. https://doi.org/10.1016/j.ibusrev.2020.101741.

Peng, M. W. (2001). The resource-based view and international business. Journal of Management, 27(6), 803–829. https://doi.org/10.1016/S0149-2063(01)00124-6.

Popa, S., Soto-Acosta, P., & Palacios-Marqués, D. (2022). A discriminant analysis of high and low-innovative firms: The role of IT, human resources, innovation strategy, intellectual capital and environmental dynamism. Journal of Knowledge Management, 26(6), 1615–1632. https://doi.org/10.1108/JKM-04-2021-0272.

Prange, C., & Verdier, S. (2011). Dynamic capabilities, internationalization processes and performance. Journal of World Business, 46(1), 126–133. https://doi.org/10.1016/j.jwb.2010.05.024.

PRS Group (2020). Political Risk Index. Retrieved August 23, 2023 from https://www.prsgroup.com/regional-political-risk-index/.

Rawal, A., Sarpong, D., & Singh, S. K. (2023). Phoenix rising: Rebounding to venture again post firm-failure. Industrial Marketing Management, 112, 71–84. https://doi.org/10.1016/j.indmarman.2023.05.007.

Rialp-Criado, A., Zolfaghari Ejlal Manesh, S. M., & Moen, Ø. (2020). Home (not so) sweet home: Domestic political uncertainty driving early internationalisation in the Spanish renewable energy context. Critical Perspectives on International Business, 16(4), 379–406. https://doi.org/10.1108/cpoib-03-2018-0031.

Rodriguez, V., Barcos, L., & Álvarez, M. J. (2010). Managing risk and knowledge in the internationalisation process. Intangible Capital, 6(2), 202–235. https://doi.org/10.3926/ic.2010.v6n2.p202-235.

Santoro, G., Ferraris, A., & Winteler, D. J. (2019). Open innovation practices and related internal dynamics: Case studies of Italian ICT SMEs. EuroMed Journal of Business, 14(1), 47–61. https://doi.org/10.1108/EMJB-05-2018-0031.

Saura, J. R., Palacios-Marqués, D., Correia, M. B., & Barbosa, B. (2023). Innovative behavior in entrepreneurship: Analyzing new perspectives and challenges. Frontiers in Psychology, 14, 1123236. https://doi.org/10.3389/fpsyg.2023.1123236.

Stefko, R., Džuka, J., & Lačný, M. (2022c). Factors influencing intention to go on a summer holiday during the peak and remission of the Covid-19 pandemic. Ekonomický časopis. (Journal of Economics), 70(2), 144–170. https://doi.org/10.31577/ekoncas.2022.02.03.

Stoian, C. (2013). Extending Dunning’s Investment Development path: The role of home country institutional determinants in explaining outward foreign direct investment. International Business Review, 22(3), 615–637. https://doi.org/10.1016/j.ibusrev.2012.09.003.

Stoian, M. C., & Rialp-Criado, A. (2010). Analyzing export behavior through managerial characteristics and perceptions: A multiple case-based research. Journal of Global Marketing, 23(4), 333–348. https://doi.org/10.1080/08911762.2010.504522.

Stremtan, F., Mıhalanche, S-S., & Pıoras, V. (2009). On the internationalization of the firms– from theory to practice. Amales Univerzitatis Apulensis Series Oeconomica, 11(2), 1025–1033.

Teece, D. J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13), 1319–1350. https://doi.org/10.1002/smj.640.

Teece, D. J. (2012). Dynamic capabilities: Routines versus entrepreneurial action. Journal of Management Studies, 49(8), 1395–1401. https://doi.org/10.1111/j.1467-6486.2012.01080.x.

The World Bank (2023). Depth of credit information index. Retrieved August 28, 2023 from https://data.worldbank.org/indicator/IC.CRD.INFO.XQ.

Trading Economics (2022). Export by country. Retrieved April 7, 2023 from https://tradingeconomics.com/new-zealand/exports-by-country.

Transparency International (2022). Corruption Perception Index. Retrieved April 5, 2023 from https://www.transparency.org/en/cpi/2022.

Ullah, S., Wang, Z., Stokes, P., & Xiao, W. (2019). Risk perceptions and risk management approaches of Chinese overseas investors: An empirical investigation. Research in International Business and Finance, 47, 470–486. https://doi.org/10.1016/j.ribaf.2018.09.008.

Vardarsuyu, M., Spyropoulou, S., Menguc, B., & Katsikeas, C. S. (2023). Managers’ process thinking skills, dynamic capabilities and performance in export ventures. International Marketing Review. https://doi.org/10.1108/IMR-10-2022-0224.

Villar, C., Alegre, J., & Pla-Barber, J. (2014). Exploring the role of knowledge management practices on exports: A dynamic capabilities view. International Business Review, 23(1), 38–44. https://doi.org/10.1016/j.ibusrev.2013.08.008.

Virglerova, Z., Conte, F., Amoah, J., & Massaro, M. R. (2020a). The perception of legal risk and its impact on the business of SMEs. International Journal of Entrepreneurial Knowledge, 8(2), 1–13. https://doi.org/10.37335/ijek.v8i2.115.

Virglerova, Z., Kliestik, T., Rowland, Z., & Rozsa, Z. (2020b). Barriers to internationalization of smes in visegrad countries. Transformations in Business & Economics, 19(3), 58–73.

Virglerova, Z., Ivanova, E., Dvorsky, J., Belas, J., & Krulický, T. (2021). Selected factors of internationalisation and their impact on the SME perception of the market risk. Oeconomia Copernicana, 12(4), 1011–1032. https://doi.org/10.24136/oc.2021.033.

Wang, Y., & Larimo, J. (2020). Survival of full versus partial acquisitions: The moderating role of firm’s internationalization experience, cultural distance, and host country context characteristics. International Business Review, 29(1), 101605. https://doi.org/10.1016/j.ibusrev.2019.101605.

Yakob, S., BAM, H. S., Yakob, R., & Raziff, N. A. M. (2020). The effect of enterprise risk management practice on SME performance. The South East Asian Journal of Management, 13(2). https://doi.org/10.21002/seam.v13i2.11785.

Yayla, S., Yeniyurt, S., Uslay, C., & Cavusgil, E. (2018). The role of market orientation, relational capital, and internationalization speed in foreign market exit & re-entry decisions under turbulent conditions. International Business Review, 27(6), 1105–1115. https://doi.org/10.1016/j.ibusrev.2018.04.002.

Zhao, H., & Zou, S. (2002). The impact of industry concentration and firm location on export propensity and intensity: An empirical analysis of Chinese manufacturing firms. Journal of International Marketing, 10(1), 52–71. https://doi.org/10.1509/jimk.10.1.52.19527.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Civelek, M., Erben, M., Kuděj, M. et al. Exploring the influence of risk management capabilities on SMEs’ export intentions: a cross-country analysis. Int Entrep Manag J (2024). https://doi.org/10.1007/s11365-024-00978-2

Accepted:

Published:

DOI: https://doi.org/10.1007/s11365-024-00978-2