Abstract

The promotion of inclusive green growth is one of the most debated topics in international forums and is considered a major concern by all countries in the world. Although the existing literature has examined several determinants of inclusive green growth, the impact of environmental taxation on inclusive green growth is relatively little explored. This study is therefore the first attempt to examine the impact of the environmental tax on inclusive green growth for developing countries from 2000 to 2021. To do this, we apply the system generalised method of moments (GMM) that controls unobserved heterogeneity, heteroskedasticity, simultaneity, reverse causality and endogeneity. The empirical results show that environmental tax promotes inclusive green growth. In addition, our results indicate that the control of corruption, government efficiency, the quality of regulation and the rule of law interact with the environmental tax to promote inclusive green growth. Furthermore, this study reveals interestingly that the environmental tax has a positive impact on the two components of inclusive growth and green growth, but the institutional factors that accentuate the impact of the environmental tax are somewhat nuanced. The results of the study have important policy implications for decision-makers in developing countries in promoting inclusive and environmentally friendly growth.

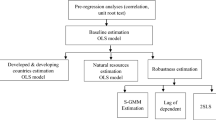

Source: authors’ construction

Source: authors’ construction

Source: authors’ construction

Source: authors’ construction

Similar content being viewed by others

Data availability

The study uses publicly available secondary data sources via the World Bank (WID), https://databank.worldbank.org/source/world-development-indicators?; UNCTAD, https://unctadstat.unctad.org/wds/ReportFolders/reportFolders.aspx?sCS_ChosenLang=fr; GGKP, https://www.greengrowthknowledge.org/data-explorer; PWT, https://www.rug.nl/ggdc/; OECD, https://stats.oecd.org/Index.aspx?DataSetCode=SNA_TABLE3; and IMF/Climate Change Dashboard, https://climatedata.imf.org/.

Notes

The list of countries is provided in the Appendix. The 36 countries included in this study are classified by UNCTAD as developing countries.

References

Abate MA (2022) Le développement moral et l’éthique des contribuables dans un contexte de corruption. Dans Revue Management & Innovation, 70–93. Récupéré sur. https://www.cairn.info/revue-management-et-innovation-2022-2-page

Abdel-Kader K, De Mooij R (2020) Tax policy and inclusive growth. IMF Working Paper No. 2020/271. https://ssrn.com/abstract=3772475.

Abdullah S, Morley B (2014) Environmental taxes and economic growth: evidence from panel causality tests. Energy Econ 42:27–33

Adeleye BN, Osabohien R, Lawal AI, De Alwis T (2021) Energy use and the role of per capita income on carbon emissions in African countries. PLoS ONE 16(11):e0259488. https://doi.org/10.1371/journal.pone.0259488

African Tax Administration Forum (2021) Environmental taxes defined. https://events.ataftax.org/includes/preview.php?file_id=143&language=en_US

Al Shammre AS, Benhamed A, Ben-Salha O, Jaidi Z (2023) Do environmental taxes affect carbon dioxide emissions in OECD countries? Evidence from the Dynamic Panel Threshold Model. Systems 11:307. https://doi.org/10.3390/systems11060307

Alekhina V, Ganelli G (2021) Determinants of inclusive growth in ASEAN. J Asia Pac Econ 28(1):1–33. https://doi.org/10.1080/13547860.2021.1981044

Anand R, Mishra MS, Peiris MSJ (2013) Inclusive growth: measurement and determinants. International Monetary Fund

Archambeau O, Garcier R (2001) Une géographie de l’automobile. PUF, Paris, p 318

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-component models. J Econom 68:29–52. https://doi.org/10.1016/0304-4076(94)01642-D

Asongu SA, Odhiambo NM (2020) Foreign direct investment, information technology and economic growth dynamics in Sub-Saharan Africa. Telecommunications Policy 44(1):101838

Aubert D, Chiroleu-Assouline M (2019) Environmental tax reform and income distribution with imperfect heterogeneous labour markets. Eur Econ Rev 116(C):60–82

Ayanwale AB (2007) FD and economic growth: evidence from Nigeria. African Economic Research Consortium (AERC) research paper 165, airobi

Azam M, Hunjra AI, Bouri E, Tan Y, Al-Faryan MAS (2021) Impact of institutional quality on sustainable development: evidence from developing countries. J Environ Manage 298(15):113465

Baek J (2016) A new look at the FDI–income–energy–environment nexus: dynamic panel data analysis of ASEAN. Energy Policy 91(C):22–27

Bashir MF, Benjiang MA, Shahbaz M, Jiao Z (2020) The nexus between environmental tax and carbon emissions with the roles of environmental technology and financial development. PLoS ONE 15(11):1–20. https://doi.org/10.1371/journal.pone.0242412

Battiau M (2006) Mondialisation et industrie automobile In Wackermann G., dir. - La mondialisation en dissertations corrigées et dossiers, Ellipses: Paris, p 318–322

Baumgärtner S, Drupp MA, Meya JN, Munz JM, Quaas MF (2017) Income inequality and willingness to pay for environmental public goods. J Environ Econ Manag 85:35–61. https://doi.org/10.1016/j.jeem.2017.04.005

Bénassy-Quéré A, Coeuré B, Jacquet P, Pisani-Ferry J (2017) Politique économique. deboeck, Paris

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143

Bond S, Hoeffler A, Temple J (2001) GMM estimation of empirical growth models. economics papers 2001 -W2 1, Economics Group, Nuffield College, University of Oxford

Borel-Saladin JM, Turok IN (2013) The green economy: incremental change or transformation? Environ Policy Gov 23:209–220

Braathen NA, Greene J (2022) Environmental taxation. A guide for policy makers. From Taxation, Innovation and the Environment. www.oecd.org/env/taxes/innovation (Accessed on 15 June 2022)

Brundtland GH (1987) Towards sustainable development. Our Common Future. Oxford University Press, Oxford, UK, pp 43–66

Buehn A, Farzanegan MR (2013) Impact of education on the shadow economy: institutions matter. Econ Bull 33:2052–2063

Cottrell J, Falcão T (2018) Environmental taxation and tax justice in developing countries. https://cadmus.eui.eu/handle/1814/60104

Cottrell J, Ludewig D, Runkel M, Schlegelmilch K, Zerzawy F (2017) Environmental tax reform in Asia and the Pacific. MPDD Working Paper Series WP/17/05, United Nations Economic and Social Commission for Asia and the Pacific (ESCAP)

Degbedji DF, Akpa AF, Chabossou AF, Osabohien R (2023) Institutional quality and green economic growth in West African Economic and Monetary Union. Innovation and Green Development. 100108

Degirmenci T, Aydin M (2023) The effects of environmental taxes on environmental pollution and unemployment: a panel co-integration analysis on the validity of double dividend hypothesis for selected African countries. Int J Financ Econ 28(3):2231–2238

Domguia EN, Pondie TM, Ngounou BA, Nkengfack H (2022) Does environmental tax kill employment? Evidence from OECD and non-OECD countries. J Clean Prod 380:134873

Dronca AT (2016) The influence of fiscal freedom, government effectiveness and human development index on tax evasion in the European Union. Theoretical and Applied Econ 4(609):5–18

Ekins P (1999) European environmental taxes and charges: recent experience, issues, and trends. Ecol Econ 31(1):39–62

Essel RE (2023) Foreign direct investment, technological spillover, and total factor productivity growth in Ghana: SN Business & Economics. Springer 3(8):1–34

Ezenagu A (2016) Carbon taxation as a tool for sustainable development in africa: evaluation of potentials, paradoxes and prospects. Paradoxes and Prospects. 2016. https://www.researchgate.net/profile/Alexander-Ezenagu/publication/318009315_Carbon_Taxation_as_a_Tool_for_Sustainable_Development_in_Africa_Evaluation_of_Potentials_Paradoxes_and_Prospects/links/59f7ff550f7e9b553ebef4a7/.

Ezenagu A (2021) Carbon taxation as a tool for sustainable development in the mena region: potentials and future directions. In Climate change law and policy in the Middle East and North Africa Region; Routledge: London, UK, 2021; pp. 187–203

Fan S, Huang H, Mbanyele W, Guo Z, Zhang C (2022) inclusive green growth for sustainable development of cities in China: spatiotemporal differences and influencing factors. https://ssrn.com/abstract=4025967. https://doi.org/10.2139/ssrn.4025967

Finon D (2020) L’économie politique des politiques carbone dans les pays en développement. https://hal.science/hal-02436646

Fullerton D, Monti H (2013) Can pollution tax rebates protect low-wage earners? J Environ Econ Manag 66(3):539–553

Georgeson L, Maslin M, Poessinouw M (2017) The global green economy: a review of concepts, definitions, measurement methodologies and their interactions. Geo Geogr Environ 4:e00036. https://doi.org/10.1002/geo2.36

GGKP (Green Growth Knowledge Platform) (2013) Moving towards a common approach on green growth indicators.(GGKP Scoping Paper No. 1). Geneva, Switzerland: GGKP

Gujarati DN (2003) Basic Econometrics. Forth Edition. McGraw-Hill.

Gyamfi BA, Onifade ST, Ridzuan AR, Shaari MS, Jena PK (2023) An environmental assessment of the impacts of corruption, foreign investment inflow and trade liberalization in the rapidly emerging Malaysian Economy. Environ Sci Pollut Res 30:93667–93685. https://doi.org/10.1007/s11356-023-28868-0

Halidu OB, Mohammed A, William C (2023) Environmental tax and global income inequality: a method of moments quantile regression analysis. Cogent Business & Management, Taylor & Francis Journals 10(1):1–35

Heine D, Black SJ (2019) Benefits beyond climate: environmental tax reform in developing countries. In Fiscal policies for development and climate action, edited by Miria A. Pigato, 1–56. Washington DC. https://doi.org/10.1596/978-1-4648-1358-0_ch1

Hoechle D (2007) Robust standard errors for panel regressions with cross-sectional dependencE. Stand Genomic Sci 7(3):281–312

FDI Intelligence (2015) The Africa investment report 2015. FDI intelligence. Financial Times. http://forms.fdiintelligence.com/africainvestmentreport/files/The-Africa-InvestmentReport%202015_download.pdf

IRENA (2013) Intellectual property rights: the role of patents in renewable energy technology innovation. https://www.irena.org//media/Files/IRENA/Agency/Publication/

Ivanyna M, Salerno A (2021) Governance for inclusive growth. IMF Working Paper 21/98. International Monetary Fund, Washington, DC.

Jahanger A, Usman M, Balsalobre-Lorente D (2022) Linking institutional quality to environmental sustainability. Sustain Dev 30(6):1749–1765. https://doi.org/10.1002/sd.2345

Jalles JT, Mello LD (2019) Cross-country evidence on the determinants of inclusive growth episodes. Rev Dev Econ 23(4):1818–1839

Jenkins JD (2014) Political economy constraints on carbon pricing policies: what are the implications for economic efficiency, environmental efficacy, and climate policy design? Energy Policy 69:467–477. https://doi.org/10.1016/j.enpol.2014.02.003

Jha S, Sandhu SC, Wachirapunyanont R (2018). Asian Development Bank. https://doi.org/10.22617/TCS189570-2

Jiang C, Qiu Y (2023) Dynamic relationship between green finance, environmental taxes, and CO2 emissions in transition toward circular economy: what causes what?. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-28912-z

Kaufmann D, Kraay A (2018) The worldwide governance indicators. The World Bank. https://info.worldbank.org/governance/wgi/

Kaufmann D, Kraay A, Mastruzzi M (2010) The worldwide governance indicators: methodology and analytical issues. Policy Research Working Paper No. 5430, World Bank, Washington DC.

Keneck-Massil J, Noah A (2019) Shadow economy and educational systems in Africa. Econ Bull 39(2):1467–1478

Li L, Ren S, Gao Z (2023) Green through finance: the impact of monetary policy uncertainty on inclusive green growth. Environ Sci Pollut Res 30:99913–99929. https://doi.org/10.1007/s11356-023-29076-6

Li Y, Fang Y (2023) Effect of digital finance on inclusive green growth through technological innovation Innovation and Development. https://doi.org/10.1080/2157930X.2023.2268914

Lin B, Li X (2011) The effect of carbon tax on per capita CO2 emissions. Energy Policy 39(9):5137–5146

Mason ES (1939) Price and production policies of large-scale enterprise. Am.Ec.Rev 29(1):61–74

Mathieu-Bolh N, Pautrel X (2013) Environmental taxation, health and the life-cycle. Working Papers hal-00930936, HAL

Meadows DH, Meadows DL, Randers J, Behrens WW III, (1972) The limits to growth. Universe Books, New York

Miceikiene A, Ciuleviciene V, Rauluskeviciene J, Streimikiene D (2018) Assessment of the effect of environmental taxes on environmental protection. Ekonomický Časopis 66:286–308

Milne JE (2003) Environmental taxation: why theory matters. In: J Milne et al., eds., Critical Issues in Environmental Taxation, vol. 1, Richmond Law & Tax Ltd., Richmond, UK, 3–26

Morley B, Abdullah S (2010) Environmental taxes and economic growth: evidence from panel causality tests. (Bath Economics Research Working Papers; No. 04/10). Department of Economics, University of Bath

North DC (1990) Institutions, institutional change, and economic performance. Cambridge University Press, Cambridge, UK

North DC, Weingast BR (1989) Constitutions and commitment: the evolution of institutions governing public choice in seventeenth-century England. J Econ Hist 49(1989):803–832

Obeng CK, Mwinlaaru PY, Ofori IK (2022) Global value chain participation and inclusive growth in Sub-Saharan Africa. In The Palgrave handbook of Africa’s economic sectors (pp. 815–840). Palgrave Macmillan, Cham

OCDE (2005) La réforme fiscale écologique axée sur la réduction de la pauvreté. Paris

OCDE (2008) Cadre d'action de l’OCDE pour des politiques de l'environnement efficaces et efficientes [ENV/EPOC(2008)7/FINAL]. https://www.oecd.org/fr/env/41644666.pdf.

OECD (2012) OECD Environmental outlook to 2050 - OECD environmental outlook. OECD Publishing, Paris, France

OECD (2017) Green growth indicators 2017 OECD Green Growth Studies. OECD Publishing: Paris. https://doi.org/10.1787/9789264268586-en

OECD (1972) Guiding principles concerning international economic aspects of environmental policies. C(72)128, adopted 26 May 1972, reprinted in 11 I.L.M. 1172

OECD (1992) The polluter-pays principle: OECD analysis and recommendations. OCDE/DG(92)81

Ofori IK, Figari F (2022) Economic globalisation and inclusive green growth in Africa: contingencies and policy-relevant thresholds of governance. Sustain Dev 31(1):452–482

Ofori IK, Gbolonyo EY, Ojong N (2022) Foreign direct investment and inclusive green growth in Africa: energy efficiency contingencies and thresholds. Energy Econ 117:106414

Ojha VP, Pohit S, Ghosh J (2020) Recycling carbon tax for inclusive green growth: a CGE analysis of India. Energy Policy 144:111708

De Paepe G, Dickinson B (2015) Les recettes fiscales, moteur du développement durable. OCDE.

Pearce D (1991) The role of carbon taxes in adjusting to global warming. Econ J 101:938–948

Pigou AC (1920) The economics of welfare. Macmillan, London

Rivers N, Schaufele B (2015) Salience of carbon taxes in the gasoline market. J Environ Econ Management 74:23–36

Rodríguez M, Robaina M, Teotónio C (2019) Sectoral effects of a green tax reform in portugal. renewable and sustainable energy reviews 104: 408–418. https://doi.org/10.1016/j.rser.2019.01.016

Roodman D (2009) How to do xtabond2: an introduction to difference and system GMM in Stata. Stata J 9(1):86–136. https://doi.org/10.1177/1536867X0900900106

Samad G, Manzoor R (2015) Green growth: important determinants. Singap Econ Rev 60(02):1550014

Sarpong KA, Xu W, Ofori EK, Gyamfi BA (2023) A step towards carbon neutrality in E7 the role of environmental taxes, structural change, and green energy. J Environ Manage 337(39):117556. https://doi.org/10.1016/j.jenvman.2023.117556

Sauvy A (1952) Trois Mondes, Une Planète. L’Observateur 118.

Seo MH, Shin Y (2016) Dynamic panels with threshold effect and endogeneity. J Econom 195:169–186

Söderholm P (2020) The green economy transition: the challenges of technological change for sustainability. Sustain Earth 3:1–11

Soku MG, Amidu M, William C (2023) Environmental tax, carbon emmission and female economic inclusion. Cogent Bus Manag 10(2):2210355. https://doi.org/10.1080/23311975.2023.2210355

Spinesi L (2022) The environmental tax: effects on inequality and growth. Environ Resource Econ 82(3):529–572

Surrey SS (1973) Pathways to tax reform. Harvard University Press, Cambridge, Mass

Tawiah V, Zakari A, Adedoyin FF (2021) Determinants of green growth in developed and developing countries. Environ Sci Pollut Res 28:39227–39242. https://doi.org/10.1007/s11356-021-13429-0

Theil H (1971) Principles of econometrics. John Wiley & Sons

Tu Z, Liu B, Jin D, Wei W, Kong J (2022) The effect of carbon emission taxes on environmental and economic systems. Int J Environ Res Public Health 19(6):1–16. https://doi.org/10.3390/ijerph19063706

Tunyi AA, Ehalaiye D, Gyapong E, Ntim CG (2020) The value of dis-cretion in Africa: evidence from acquired intangible assets under IFRS 3. Int J Account 55(02):2050008

Ugur M (2014) Corruption’s direct effects on per-capita income growth: a meta-analysis. J Econ Surv 28(3):472–490

Villar-Rubio E, Morales MDH (2016) Energy, transport, pollution and natural resources: key elements in ecological taxation. Econ Energy Environ Policy 58:111–122

Wang J, Lin J, Feng K, Liu P, Du M, Ni R, Chen L, Kong H, Weng H, Liu M, Baiocchi G, Zhao Y, Mi Z, Cao J, Hubacek K (2019) Environmental taxation and regional inequality in China. Sci Bull 64(22):1691–1699. https://doi.org/10.1016/j.scib.2019.09.017

Wang D, Hou Y, Li X, Xu Y (2022) Developing a functional index to dynamically examine the spatio-temporal disparities of China’s inclusive green growth. Ecol Ind 139:108861

Weizsäcker EUV, Jesinghaus J (1992) Ecological tax reform. Zed Books, London & New Jersey

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econometrics 126(1):25–51

World Bank (2012) Inclusive green growth: the pathway to sustainable development. World Bank: Washington, DC

Xin C, Mbanyele W, Shahbaz M (2023) Towards inclusive green growth: does digital economy matter? Environ Sci Pollut Res 30:70348–70370. https://doi.org/10.1007/s11356-023-27357-8

Yang X, Tang W (2022) Additional social welfare of environmental regulation: the effect of environmental taxes on income inequality. J Environ Manage 330:117095

Zhao S, Hafeez M, Faisal CMN (2021) Does ICT diffusion lead to energy efficiency and environmental sustainability in emerging Asian economies? Environ Sci Pollut Res 29:12198–12207. https://doi.org/10.1007/s11356-021-16560-0

Zheng Q, Li J, Duan X (2023) The impact of environmental tax and R&D tax incentives on green innovation. Sustainability 15(9):1–18

Author information

Authors and Affiliations

Contributions

IFO gave the subject of the paper, guided the problem statement and wrote the introduction and conclusion. VBDBN wrote the stylised facts, theoretical framework and empirical review, as well as the methodology and interpretation of the results.

Corresponding author

Ethics declarations

Ethical approval

We hereby confirm that the following conditions are met: (1) This paper is the original work of the authors, which has not been previously published elsewhere. (2) The paper is not under consideration for publication elsewhere. (3) The paper accurately and completely reflects the authors’ research and analysis. (4) The article correctly mentions the significant contributions of co-authors and co-investigators. (5) The results are appropriately placed in the context of previous and existing research. (6) All sources used are correctly indicated (correct citation). (7) All authors have been personally and actively involved in the substantive work leading to the article and will take public responsibility for its content.

Consent to participate

All authors agreed with the content, and all gave explicit consent to submit the work.

Consent for publication

All authors agreed for submission in Environmental Science and Pollution Research.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

List of countries: Congo, Congo, Rép. dém. Du, Côte d’Ivoire, Ghana, Maroc, Niger, Nigéria, Sénégal, Togo, Tunisie, Argentine, Bolivie, Brésil, Chili, Colombie, Costa Rica, Équateur, Guatemala, Honduras, Mexique, Nicaragua, Paraguay, Pérou, Bangladesh, Cambodge, Chine, Inde, Kazakhstan, Kirghizistan, Malaisie, Mongolie, Pakistan, Philippines, Singapour, Thaïlande and Türkiye.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Okombi, I.F., Ndoum Babouama, V.BD. Environmental taxation and inclusive green growth in developing countries: does the quality of institutions matter?. Environ Sci Pollut Res (2024). https://doi.org/10.1007/s11356-024-33245-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11356-024-33245-6