Abstract

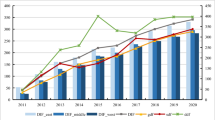

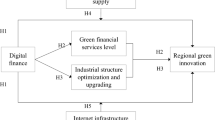

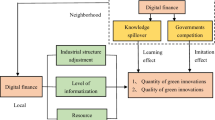

Based on the provincial panel data of China from 2011 to 2020, this paper explores the relationship between two-way FDI and green technology innovation and examines the moderating role of digital finance in the impact of two-way FDI on green technology innovation. The results show that (1) two-way FDI can significantly enhance the level of green technology innovation. (2) Digital finance plays a moderating effect in the process of two-way FDI to enhance the level of green technology innovation. The conclusion is still robust by replacing the dependent variable, eliminating special samples and shrinking the tail. (3) The results of sub-dimensional analysis show that the three sub-dimensions indicators of the digital finance also have a positive moderating effect on the relationship between two-way FDI and green technology innovation. (4) The results of sub-regional regression show that the moderating effect in the central and western regions is greater than that in the eastern region. The results of the study can provide reference for governments to formulate policies about digital finance, which is conducive to achieve high-quality opening-up and realize green development.

Similar content being viewed by others

Data availability

Not applicable.

References

Behera P, Sethi N (2022) Nexus between environment regulation, FDI, and green technology innovation in OECD countries. Environ Sci Pollut Res 29:52940–52953

Cao XX, Zhang YY (2023) Environmental regulation, foreign investment, and green innovation: a case study from China. Environ Sci Pollut Res 30:7218–7235

Cao SP, Nie L, Sun HP, Sun WF, Taghizadeh-Hesary F (2021) Digital fnance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327:129458. https://doi.org/10.1016/j.jclepro.2021.129458

Dai LH, Mu XR, Lee C-C, Liu W (2021) The impact of outward foreign direct investment on green innovation: the threshold effect of environmental regulation. Environ Sci Pollut Res 28:34868–34884

Feng SL, Zhang R, Li GX (2022) Environmental decentralization, digital finance and green technology innovation. Struct Chang Econ Dyn 61:70–83

Guo F, Wang JY, Wang F, Kong T, Zhang X, Cheng ZY (2020) Measuring China’s digital financial inclusion: index compilation and spatial characteristics. China Econ Q (In Chinese) 19:1401–1418

Jiang J-J, Ye B, Zhou N, Zhang X-L (2019) Decoupling analysis and environmental Kuznets curve modelling of provincial-level CO2 emissions and economic growth in China: a case study. J Clean Prod 212:1242–1255. https://doi.org/10.1016/j.jclepro.2018.12.116

Jiang MR, Luo SM, Zhou GY (2020) Financial development, OFDI spillovers and upgrading of industrial structure. Technol Forecast Soc Chang 155:119974

Kang PH, Ru SF (2020) Bilateral effects of environmental regulation on green innovation. China Popul Resour Environ (In Chinese) 30(10):93–104

Li M, Wang J (2023) The productivity effects of two-way FDI in China’s logistics industry based on system GMM and GWR model. J Ambient Intell Humaniz Comput 14:581–595

Li X, Shao XF, Chang T, Albu LL (2022) Does digital finance promote the green innovation of China’s listed companies? Energy Econ 114:106254

Lin BQ, Ma RY (2022) How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J Environ Manag 320:115833

Liu LY, Zhao ZZ, Su B, Ng TS, Zhang MM, Qi L (2021a) Structural breakpoints in the relationship between outward foreign direct investment and green innovation: an empirical study in China. Energy Econ 103:105578

Liu LY, Zhao ZZ, Zhang MM et al (2021b) The effects of environmental regulation on outward foreign direct investment’s reverse green technology spillover: crowding out or facilitation? J Clean Prod 284:124689

Liu JM, Jiang YL, Gan SD et al (2022) Can digital finance promote corporate green innovation? Environ Sci Pollut Res 29:35828–35840

Luo YS, Salman M, Lu ZN (2021) Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci Total Environ 759:143744

Ma KL (2023) Digital inclusive finance and corporate green technology innovation. Financ Res Lett 55:104015

Ma GC, Cao JH, Famanta M (2023a) Does the coordinated development of two-way FDI increase the green energy efficiency of Chinese cities? Evidence from Chinese listed companies. Struct Chang Econ Dyn 65:59–77

Ma GC, Qin JH, Zhang YM (2023b) Does the carbon emissions trading system reduce carbon emissions by promoting two-way FDI in developing countries? Evidence from Chinese listed companies and cities. Energy Econo 120:106581

Qiu SL, Wang ZL, Geng SS (2021) How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J Environ Manag 287:112282

Rao SY, Pan Y, He JN et al (2022) Digital finance and corporate green innovation: quantity or quality. Environ Sci Pollut Res 29:56772–56791

Ren SY, Hao Y, Wu HT (2022) The role of outward foreign direct investment (OFDI) on green total factor energy efficiency: does institutional quality matters? Evidence from China. Resour Policy 76:102587

Shi X,Zeng YJ,Wu YR,Wang S(2023) Outward foreign direct investment and green innovation in Chinese multinational companies. Int Bus Rev 102160. https://doi.org/10.1016/j.ibusrev.2023.102160

Song WF, Han XF (2022) The bilateral effects of foreign direct investment on green innovation efficiency: evidence from 30 Chinese provinces. Energy 261:125332

Wang MR, Zhang X, Hu Y (2021) The green spillover effect of the inward foreign direct investment: market versus innovation. J Clean Prod 328:129501

Wang JT, Chen JW, Li RR (2023) Outward foreign direct investment and urban green productivity: promote or inhibit? Int Rev Econ Financ 88:516–530

Wu HT, Ren SY, Yan GY, Hao Y (2020) Does China’s outward direct investment improve green total factor productivity in the “Belt and Road” countries? Evidence from dynamic threshold panel model analysis. J Environ Manag 275:111295

Xu R, Yao DJ, Zhou M (2023) Does the development of digital inclusive finance improve the enthusiasm and quality of corporate green technology innovation? J Innov Knowl 8:100382

Yan B, Zhang Y, Shen Y et al (2018) Productivity, financial constraints and outward foreign direct investment: firm-level evidence. China Econ Rev 47:47–64

You JL, Xiao H (2022) Can FDI facilitate green total factor productivity in China? Evidence from regional diversity. Environ Sci Pollut Res 29:49309–49321

Yu DS, Li XP, Yu JJ, Li H (2021) The impact of the spatial agglomeration of foreign direct investment on green total factor productivity of Chinese cities. J Environ Manag 290:112666

Zhang WW, Zhang SJ, Chen F, Wang Y, Zhang YC (2023) Does Chinese companies’ OFDI enhance their own green technology innovation? Financ Res Lett 56:104113

Zhou Y, Jiang JJ, Ye B, Hou BJ (2019) Green spillovers of outward foreign direct investment on home countries: evidence from China’s province-level data. J Clean Prod 215:829–844

Zhou X, Yu Y, Yang F, Shi QF (2021) Spatial-temporal heterogeneity of green innovation in China. J Clean Prod 282:124464. https://doi.org/10.1016/j.jclepro.2020.124464

Zhu BZ, Zhang MF, Zhou YH et al (2019) Exploring the effect of industrial structure moderation on interprovincial green development efficiency in China: a novel integrated approach. Energy Policy 134:110946. https://doi.org/10.1016/j.enpol.2019.110946

Funding

This study was supported by the Chongqing Federation of Social Sciences (grant number 2019QNJJ19), by the Chongqing Municipal Education Commission (grant number 20SKGH098), by the Chongqing Technology and Business University (grant number 1955017), and by the Chongqing Technology and Business University (grant number 1951015).

Author information

Authors and Affiliations

Contributions

Q.J.: conceptualization, data curation, and writing original draft. Q.J.: theoretical and empirical analysis and writing original draft. K.W.: literature review and formal analysis. Q.J.: conceptualization, methodology, funding acquisition, and supervision.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

All authors listed agreed to publish this work.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jin, Q., Wang, K. Exploring the moderating role of digital finance in the two-way foreign direct investment and green technology innovation nexus: an empirical evidence from China. Environ Sci Pollut Res 31, 10473–10482 (2024). https://doi.org/10.1007/s11356-024-31896-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-024-31896-z