Abstract

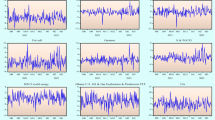

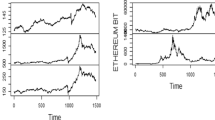

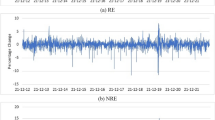

Renewable energy tokens allow investors to diversify their portfolios while supporting renewable energy projects. While renewable energy tokens and renewable energy stocks are different investment instruments with different characteristics, there can be important links between them, as both offer the opportunity to invest in renewable energy sources. The aim of the study is to investigate the return connectedness between renewable energy tokens and renewable energy stock indices. EWT, PWR, SNC, and WPR are used to represent renewable energy tokens, and WilderHill Clean Energy Index, S&P Global Clean Energy Index, and European Renewable Energy Index indices are used to represent renewable energy stock markets. In the study, return connectedness between assets is investigated with the QVAR model. The return spillovers between renewable energy tokens and renewable energy stock indices show that they vary under different market conditions. Under normal market conditions, renewable energy tokens and renewable energy indices are significantly unconnected. During extreme market downturns and upturns, the return interconnectedness among these assets significantly increases. Moreover, the return spillovers between renewable energy tokens and renewable energy stock indices are asymmetric and time-varying. The return connectedness between these assets is affected by extreme events such as COVID-19, the Russia-Ukraine war, and the collapse of the cryptocurrency market. Since the net return spillover relationships between assets are time-varying and under different market conditions, investors and portfolio managers should constantly review the net return spillovers between assets and adjust their positions accordingly.

Similar content being viewed by others

Data availability

The author will make the data available on request.

Notes

The most popular of these are Energy Web Token, Powerledger, SunContract, and WePower.

March 3, 2020, is the first trading date of EWT, which has the highest market cap.

References

Ali, S, Ijaz, MS, Yousaf, I (2023) Dynamic spillovers and portfolio risk management between defi and metals: empirical evidence from the Covid-19. Resources Policy, 83. https://doi.org/10.1016/j.resourpol.2023.103672

Ando T, Greenwood-Nimmo M, Shin Y (2022) Quantile connectedness: modeling tail behavior in the topology of financial networks. Manage Sci 68(4):2401–2431. https://doi.org/10.1287/mnsc.2021.3984

Ang A, Bekaert G (2002) International asset allocation with regime shifts. The Rev Financial Stud 15(4):1137–1187. https://doi.org/10.1093/rfs/15.4.1137

Attarzadeh A, Balcilar M (2022) On the dynamic return and volatility connectedness of cryptocurrency, crude oil, clean energy, and stock markets: a time-varying analysis. Environ Sci Pollut Res Int 29(43):65185–65196. https://doi.org/10.1007/s11356-022-20115-2

Bouri, E, Lucey, B, Saeed, T, Vo, XV (2020) Extreme spillovers across Asian-Pacific currencies: a quantile-based analysis. Int Rev Financial Anal, 72. https://doi.org/10.1016/j.irfa.2020.101605

Bouri, E, Saeed, T, Vo, XV, Roubaud, D (2021) Quantile connectedness in the cryptocurrency market. J Int Financial Markets, Inst Money, 71. https://doi.org/10.1016/j.intfin.2021.101302

Corbet, S, Lucey, B, Yarovaya, L (2021) Bitcoin-energy markets interrelationships - new evidence. Resources Policy, 70. https://doi.org/10.1016/j.resourpol.2020.101916

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

Diebold FX, Yılmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econometrics 182(1):119–134. https://doi.org/10.1016/j.jeconom.2014.04.012

Feng W, Wang Y, Zhang Z (2018) Can cryptocurrencies be a safe haven: a tail risk perspective analysis. Appl Econ 50(44):4745–4762. https://doi.org/10.1080/00036846.2018.1466993

Gupta M (2018) Blockchain for dummies. John Wiley & Sons Inc

Ha LT (2023a) Dynamic connectedness between FinTech innovation and energy volatility during the war in time of pandemic. Environ Sci Pollut Res 30(35):83530–83544. https://doi.org/10.1007/s11356-023-28089-5

Ha LT (2023b) Dynamic interlinkages between the crude oil and gold and stock during Russia-Ukraine War: evidence from an extended TVP-VAR analysis. Environ Sci Pollut Res 30(9):23110–23123. https://doi.org/10.1007/s11356-022-23456-0

Huynh TLD, Nasir MA, Nguyen DK (2023) Spillovers and connectedness in foreign exchange markets: the role of trade policy uncertainty. Q Rev Econ Finance 87:191–199. https://doi.org/10.1016/j.qref.2020.09.001

Jena SK, Tiwari AK, Aikins Abakah EJ, Hammoudeh S (2022) The connectedness in the world petroleum futures markets using a quantile VAR approach. J Commod Mark 27:100222. https://doi.org/10.1016/j.jcomm.2021.100222

Koenker R, Bassett G (1978) Regression quantiles. Econometrica 46(1):33–50. https://doi.org/10.2307/1913643

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Econometrics 74(1):119–147. https://doi.org/10.1016/0304-4076(95)01753-4

Le TH (2023) Quantile time-frequency connectedness between cryptocurrency volatility and renewable energy volatility during the COVID-19 pandemic and Ukraine-Russia conflicts. Renew Energy 202:613–625. https://doi.org/10.1016/j.renene.2022.11.062

Madaleno, M, Dogan, E, Taskin, D (2022) A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ, 109. https://doi.org/10.1016/j.eneco.2022.105945

Naeem, MA, Karim, S (2021) Tail dependence between bitcoin and green financial assets. Econ Lett, 208. https://doi.org/10.1016/j.econlet.2021.110068

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1):17–29. https://doi.org/10.1016/S0165-1765(97)00214-0

Rehman MU, Naeem MA, Ahmad N, Vo XV (2023) Global energy markets connectedness: evidence from time-frequency domain. Environ Sci Pollut Res 30(12):34319–34337. https://doi.org/10.1007/s11356-022-24612-2

Ren, B, Lucey, B (2022) A clean, green haven?—Examining the relationship between clean energy, clean and dirty cryptocurrencies. Energy Econ, 109. https://doi.org/10.1016/j.eneco.2022.105951

Rizvi, SKA, Naqvi, B, Mirza, N, Umar, M (2022) Safe haven properties of green, Islamic, and crypto assets and investor’s proclivity towards treasury and gold. Energy Econ, 115. https://doi.org/10.1016/j.eneco.2022.106396

Saeed T, Bouri E, Alsulami H (2021) Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Economics 96:105017. https://doi.org/10.1016/j.eneco.2020.105017

Sharif, A, Brahim, M, Dogan, E, Tzeremes, P (2023) Analysis of the spillover effects between green economy, clean and dirty cryptocurrencies. Energy Econ, 120. https://doi.org/10.1016/j.eneco.2023.106594

Su X (2020) Measuring extreme risk spillovers across international stock markets: a quantile variance decomposition analysis. The North Am J Econ Finance 51:101098. https://doi.org/10.1016/j.najef.2019.101098

Symitsi E, Chalvatzis KJ (2018) Return, volatility and shock spillovers of Bitcoin with energy and technology companies. Econ Lett 170:127–130. https://doi.org/10.1016/j.econlet.2018.06.012

Umar Z, Bossman A (2023) Quantile connectedness between oil price shocks and exchange rates. Resour Policy 83:103658. https://doi.org/10.1016/j.resourpol.2023.103658

Umar, Z, Polat, O, Choi, S-Y, Teplova, T (2022) Dynamic connectedness between non-fungible tokens, decentralized finance, and conventional financial assets in a time-frequency framework. Pacific-Basin Finance J, 76. https://doi.org/10.1016/j.pacfin.2022.101876

Ustaoglu E (2022) Safe-haven properties and portfolio applications of cryptocurrencies: evidence from the emerging markets. Financ Res Lett 47:102716. https://doi.org/10.1016/j.frl.2022.102716

Ustaoglu, E (2023) Diversification, hedge, and safe-haven properties of gold and bitcoin with portfolio implications during the Russia–Ukraine war. Resources Policy, 84. https://doi.org/10.1016/j.resourpol.2023.103791

Yousaf I, Jareno F, Tolentino M (2023b) Connectedness between Defi assets and equity markets during COVID-19: a sector analysis. Technol Forecast Soc Chang 187:122174. https://doi.org/10.1016/j.techfore.2022.122174

Yousaf I, Pham L, Goodell JW (2023c) Interconnectedness between healthcare tokens and healthcare stocks: evidence from a quantile VAR approach. Int Rev Econ Financ 86:271–283. https://doi.org/10.1016/j.iref.2023.03.013

Yousaf, I, Yarovaya, L (2022) Static and dynamic connectedness between NFTs, Defi and other assets: portfolio implication. Global Finance J, 53. https://doi.org/10.1016/j.gfj.2022.100719

Yousaf, I, Jareño, F, Esparcia, C (2022a) Tail connectedness between lending/borrowing tokens and commercial bank stocks. Int Rev Financial Anal, 84. https://doi.org/10.1016/j.irfa.2022.102417

Yousaf, I, Nekhili, R, Umar, M (2022b) Extreme connectedness between renewable energy tokens and fossil fuel markets. Energy Econ, 114. https://doi.org/10.1016/j.eneco.2022.106305

Yousaf, I, Jareño, F, Martínez-Serna, M-I (2023a) Extreme spillovers between insurance tokens and insurance stocks: evidence from the quantile connectedness approach. J Behav Exp Finance, 39. https://doi.org/10.1016/j.jbef.2023.100823

Author information

Authors and Affiliations

Contributions

Erkan Ustaoglu: carried out all process (conceptualization, methodology, data curation, analysis, writing—original draft).

Corresponding author

Ethics declarations

Ethical approval

We declare that current research fully abides by both local and international guidelines of ethical research regulations.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ustaoglu, E. Extreme return connectedness between renewable energy tokens and renewable energy stock markets: evidence from a quantile-based analysis. Environ Sci Pollut Res 31, 5086–5099 (2024). https://doi.org/10.1007/s11356-023-31563-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-31563-9