Abstract

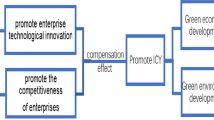

Enhancing green total factor productivity (GTFP) is essential for achieving the objective of green development, and the effect of environmental protection tax (EPT), a crucial instrument for addressing environmental challenges, on green TFP is crucial. Based on provincial panel data from 2004 to 2020 in China, this study uses inter-provincial differences in environmental protection tax rates as a quasi-natural experiment and utilizes a synthetic control method to assess the impact of the “changing sewage charge to tax” on regional GTFP. The empirical results suggest that EPT can help enhance GTFP, a finding that still holds after regional placebo tests, time placebo tests, and difference-in-differences robustness tests. The mechanism test demonstrates that EPT influences GTFP via the industrial structure impact and the green technological innovation effect. According to heterogeneity research, regions with a high level of marketization and financial growth are more significantly affected by environmental protection tax policy. This paper offers crucial empirical data for assessing the efficacy of environmental protection tax policy and enhancing the environmental tax system.

Similar content being viewed by others

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Abadie A, Gardeazabal J (2003) The economic costs of conflict: a case study of the Basque country. Am Econ Rev 93(1):113–132. https://doi.org/10.1257/000282803321455188

Abadie A, Diamond A, Hainmueller J (2010) Synthetic control methods for comparative case studies: estimating the effect of California’s Tobacco Control Program. J Am Stat Assoc 105(490):493–505

Abdullah S, Morley B (2014) Environmental taxes and economic growth: evidence from panel causality tests. Energy Econ 42:27–33. https://doi.org/10.1016/j.eneco.2013.11.013

Albrizio S, Kozluk T, Zipperer V (2017) Environmental policies and productivity growth: evidence across industries and firms. J Environ Econ Manage 81:209–226. https://doi.org/10.1016/j.jeem.2016.06.002

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173–1182

Chen SY, Wu YT (2018) Environmental tax reform and the synergistic management of haze - a perspective based on the marginal cost of treatment. Acad Mon 50(10):39–57+117. https://doi.org/10.19862/j.cnki.xsyk.2018.10.004.

Cheng Z, Kong S (2022) The effect of environmental regulation on green total-factor productivity in China’s industry. Environ Impact Assess Rev 94:106757. https://doi.org/10.1016/j.eiar.2022.106757

Cheng Z, Li X (2022) Do raising environmental costs promote industrial green growth? A quasi-natural experiment based on the policy of raising standard sewage charges. J Clean Prod 343:131004. https://doi.org/10.1016/j.jclepro.2022.131004

Doğan B, Chu LK, Ghosh S (2022) How environmental taxes and carbon emissions are related in the G7 economies? Renew Energy 187:645–656. https://doi.org/10.1016/j.renene.2022.01.077

Esen Ö, Yıldırım DÇ, Yıldırım S (2021) Pollute less or tax more? asymmetries in the eu environmental taxes – ecological balance nexus. Environ Impact Assess Rev 91:106662. https://doi.org/10.1016/j.eiar.2021.106662

Falcone PM (2020) Environmental regulation and green investments: the role of green finance. Int J Green Econ 14:159–173. https://doi.org/10.1504/IJGE.2020.109735

Fan G, Wang XL, Ma GR (2011) The contribution of China’s marketisation process to economic growth. Econ Res 46(09):4–16

Fan QQ, Zhou XH, Zhang TB (2016) Dynamic environmental tax externalities, pollution accumulation paths and long-term economic growth - a discussion on the timing of environmental taxation. Econ Res 51(08):116–128

Feng Q, Yang JQ (2023) China’s environmental protection tax promotes innovation of economic green transformation model. Environ Protect Sci (03):1–7 (in Chinese). https://doi.org/10.16803/j.cnki.issn.1004-6216.202303060

Guo B, Wang Y, Feng Y (2022) The effects of environmental tax reform on urban air pollution: a quasi-natural experiment based on the environmental protection tax law. Front Public Health 10:967524. https://doi.org/10.3389/fpubh.2022.967524

Guo B, Feng Y, Hu F (2023) Have carbon emission trading pilot policy improved urban innovation capacity? Evidence from a quasi-natural experiment in China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-25699-x

Han F, Li J (2020) Assessing impacts and determinants of China’s environmental protection tax on improving air quality at provincial level based on Bayesian statistics. J Environ Manage 271:111017. https://doi.org/10.1016/j.jenvman.2020.111017

Han F, Yan SQ (2023) Can environmental protection tax promote regional green total factor productivity growth? An empirical study based on Bayesian spatio-temporal statistics. Econ Iss (7):103–112 (in Chinese). https://doi.org/10.16011/j.cnki.jjwt.2023.07.014

He LY, Qi XF (2022) Environmental regulation and green total factor productivity - evidence from Chinese industrial firms. Econ News 06:97–114

He Y, Zhu X, Zheng H (2022) The influence of environmental protection tax law on total factor productivity: evidence from listed firms in China. Energy Econ 113:106248. https://doi.org/10.1016/j.eneco.2022.106248

Hille E, Möbius P (2019) Environmental policy, innovation, and productivity growth: controlling the effects of regulation and endogeneity. Environ Resour Econ 73(4):1315–1355. https://doi.org/10.1007/s10640-018-0300-6

Huang JQ, Qi Y (2022) Can environmental taxes force industrial structure optimization and upgrading? A quasi-natural experiment based on environmental “Fee to Tax”. Indust Econ Res (02):1–13 (in Chinese). https://doi.org/10.13269/j.cnki.ier.2022.02.001

Huang JQ, Qi Y, Gan XQ (2023) The road to green taxation: can environmental protection taxes reduce pollutant emissions? Econ Reform 3:145–154

Hung NT (2023) Green investment, financial development, digitalization and economic sustainability in Vietnam: evidence from a quantile-on-quantile regression and wavelet coherence. Technol Forecast Soc Chang 186:122185. https://doi.org/10.1016/j.techfore.2022.122185

Jin YL, Gu JR, Zeng HX (2020) Will the “environmental fee to tax” change affect business performance? Account Res 05:117–133

Julio B, Yook Y (2012) Political uncertainty and corporate investment cycles. J Financ 67(1):45–83. https://doi.org/10.1111/j.1540-6261.2011.01707.x

Karmaker SC, Hosan S, Chapman AJ (2021) The role of environmental taxes on technological innovation. Energy 232:121052. https://doi.org/10.1016/j.energy.2021.121052

Kesidou E, Wu L (2020) Stringency of environmental regulation and eco-innovation: evidence from the eleventh five-year plan and green patents. Econ Lett 190:109090. https://doi.org/10.1016/j.econlet.2020.109090

Khan SAR, Ponce P, Yu Z (2021) Technological innovation and environmental taxes toward a carbon-free economy: an empirical study in the context of cop-2. J Environ Manage 298:113418. https://doi.org/10.1016/j.jenvman.2021.113418

Li G, Masui T (2018) Assessing the impacts of China’s environmental tax using a dynamic computable general equilibrium model. J Clean Prod 208:316–324. https://doi.org/10.1016/j.jclepro.2018.10.016

Li T, Liao G (2020) The heterogeneous impact of financial development on green total factor productivity. Front Energy Res 8:29. https://doi.org/10.3389/fenrg.2020.00029

Li P, Lu Y, Wang J (2016) Does flattening government improve economic performance? Evidence from China. J Develop Econ 123:18–37. https://doi.org/10.1016/j.jdeveco.2016.07.002

Li H, He F, Deng G (2019) How does environmental regulation promote technological innovation and green development? New evidence from China. Pol J Environ Stud 29(1):689–702

Li P, Lin ZG, Du HB, Feng T, Zuo J (2021a) Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J Environ Manage 295:113112. https://doi.org/10.1016/j.jenvman.2021.113112

Li XF, Xu C, Cheng BD, Duan JY, Li YM (2021b) Does environmental regulation improve the green total factor productivity of Chinese cities? A threshold effect analysis based on the economic development level. Int J Environ Res Public Health 18(9):4828

Liu NQ, Wu Y (2017) Can the enlargement in Yangtze River Delta boost regional economic common growth? China Ind Econ (06):79–97 (in Chinese). https://doi.org/10.19581/j.cnki.ciejournal.2017.06.019

Liu HY, Wang Y (2019) The economic dividend effect of a combination of energy use rights and carbon tradable policies. Chin J Popul Resour Environ 29(05):1–10

Liu JK, Xiao YY (2022) Environmental protection tax and green innovation in China: leverage or crowding-out effect? Econ Res 57(01):72–88

Liu GQ, Yang ZQ, Zhang F, Zhang N (2022) Environmental tax reform and environmental investment: a quasi-natural experiment based on China’s Environmental Protection Tax Law. Energy Econ 109:106000. https://doi.org/10.1016/j.eneco.2022.106000

Lotz JR, Morss ER (1967) Measuring “tax effort” in developing countries. Staff Pap (International Monetary Fund) 14(3):478–499. https://doi.org/10.2307/3866266

Manello A (2017) Productivity growth, environmental regulation and win–win opportunities: the case of chemical industry in Italy and Germany. Eur J Oper Res 262(2):733–743. https://doi.org/10.1016/j.ejor.2017.03.058

Mardones C, Mena C (2020) Economic, environmental and distributive analysis of the taxes to global and local air pollutants in Chile. J Clean Prod 259:120893. https://doi.org/10.1016/j.jclepro.2020.120893

Maung M, Wilson C, Tang X (2016) Political connections and industrial pollution: evidence based on state ownership and environmental levies in China. J Bus Ethics 138(4):649–659

Nejati M, Taleghani F (2022) Pollution halo or pollution haven? A CGE appraisal for Iran. J Clean Prod 344:131092. https://doi.org/10.1016/j.jclepro.2022.131092

Nesta L, Vona F, Nicolli F (2014) Environmental policies, competition and innovation in renewable energy. J Environ Econ Manage 67(3):396–411. https://doi.org/10.1016/j.jeem.2014.01.001

Qin CB, Wang JN, Ge CZ (2015) Impact of environmental taxes on the economy and pollution emissions. Chin J Popul Resour Environ 25(01):17–23 (in Chinese)

Qiu S, Wang Z, Geng S (2021) How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? an empirical test based on Chinese provincial panel data. J Environ Manage 287:112282

Renström TI, Spataro L, Marsiliani L (2021) Can subsidies rather than pollution taxes break the trade-off between economic output and environmental protection? Energy Econ 95:105084. https://doi.org/10.1016/j.eneco.2020.105084

Sharif A, Kartal MT, Bekun FV, Pata UK, Foon CL, Depren SK (2023) Role of green technology, environmental taxes, and green energy towards sustainable environment: insights from sovereign Nordic countries by CS-ARDL approach. Gondwana Res 117:194–206. https://doi.org/10.1016/j.gr.2023.01.009

She S, Wang Q, Zhang AC (2020) Technological innovation, industrial structure and urban green total factor productivity - an examination of the impact channels based on national low carbon city pilot. Econ Manag Res 41(08):44–61. https://doi.org/10.13502/j.cnki.issn1000-7636.2020.08.004.

Shi H, Qiao YB, Shao XY, Wang PP (2019) The effect of pollutant charges on economic and environmental performances: evidence from Shandong Province in China. J Clean Prod 232:250–256. https://doi.org/10.1016/j.jclepro.2019.05.272

Shi X, Jiang Z, Bai D (2023) Assessing the impact of green tax reforms on corporate environmental performance and economic growth: do green reforms promote the environmental performance in heavily polluted enterprises? Environ Sci Pollut Res 30(19):56054–56072. https://doi.org/10.1007/s11356-023-26254-4

Silva S, Soares I, Afonso O (2021) Assessing the double dividend of a third-generation environmental tax reform with resource substitution. Environ Dev Sustain 23(10):15145–15156. https://doi.org/10.1007/s10668-021-01290-7

Tang M, Ming HR (2018) Analysis of the effectiveness of environmental protection tax in combating pollution with taxes in the perspective of optimal tax rate: a measurement based on the practice of environmental protection tax. Financ Trade Res 29(08):83–93. https://doi.org/10.19337/j.cnki.34-1093/f.2018.08.008.

Tong JZ, Wen X, Qiu RF (2022) Can environmental protection tax be effective in combating air pollution? Tax Res (08): 94–100 (in Chinese). https://doi.org/10.19376/j.cnki.cn11-1011/f.2022.08.021

Wagner M (2007) On the relationship between environmental management, environmental innovation and patenting: evidence from German manufacturing firms. Res Policy 36(10):1587–1602. https://doi.org/10.1016/j.respol.2007.08.004

Wang GJ, Lu XX (2019) “The Belt and Road” initiative and the upgrading of Chinese companies. China Ind Econ (03):43–61 (in Chinese). https://doi.org/10.19581/j.cnki.ciejournal.2019.03.013

Wang XY, Zhao H (2023) Study on the impact of environmental protection tax reform on enterprises’ green development. Res Manage 44(8):139–151. https://doi.org/10.19571/j.cnki.1000-2995.2023.08.015.

Wang Y, Sun X, Guo X (2019) Environmental regulation and green productivity growth: empirical evidence on the Porter hypothesis from OECD industrial sectors. Energy Policy 132:611–619

Xin BG, Gao FF (2021) Does the pilot project of ecological civilization contribute to the improvement of ecological total factor productivity? Chin J Popul Resour Environ 31(05):152–162

Xue G, Ming HR, Cai YX (2021) Study on the optimization path of China’s environmental protection tax system under the double dividend objective. Int Tax 12:29–38. https://doi.org/10.19376/j.cnki.cn10-1142/f.2021.12.005.

Xue J, Zhu D, Zhao LJ, Lei L (2022) Designing tax levy scenarios for environmental taxes in China. J Clean Prod 332:130036. https://doi.org/10.1016/j.jclepro.2021.130036

Yang ZB, Fan MT, Shao S, Yang LL (2017) Does carbon intensity constraint policy improve industrial green production performance in China? A quasi-DID analysis. Energy Econ 68:271–282. https://doi.org/10.1016/j.eneco.2017.10.009

Yin YG, Chang XD (2022) Do Chinese carbon emission trading policies promote the improvement of regional green total factor productivity? Financ Econ (03):60–70 (in Chinese). https://doi.org/10.19622/j.cnki.cn36-1005/f.2022.03.007

Yuan YJ, Xie RH (2014) Research on the effect of environmental regulation to industrial restructuring – empirical test based on provincial panel data of China. China Ind Econ (08):57–69 (in Chinese). https://doi.org/10.19581/j.cnki.ciejournal.2014.08.005

Yuan YJ, Xie RC (2015) FDI, environmental regulation and green total factor productivity growth of China’s industry: an empirical study based on Luenberger index. J Int Trade (08):84–93 (in Chinese). https://doi.org/10.13510/j.cnki.jit.2015.08.009

Yuan B, Ren S, Chen X (2017) Can environmental regulation promote the coordinated development of economy and environment in China’s manufacturing industry? a panel data analysis of 28 sub-sectors. J Clean Prod 149:11–24. https://doi.org/10.1016/j.jclepro.2017.02.065

Yuan JQ, Bu W (2022) How can environmental regulations improve industrial green total factor productivity: based on the perspective of the change of factor allocation ratio among different industries. Econ Iss (06):75–84 (in Chinese). https://doi.org/10.16011/j.cnki.jjwt.2022.06.013

Zameer H, Yasmeen H, Zafar MW (2020) Analyzing the association between innovation, economic growth, and environment: divulging the importance of FDI and trade openness in India. Environ Sci Pollut Res 27(23):29539–29553. https://doi.org/10.1007/s11356-020-09112-5

Zeng YM, Zhang JS (2009) Can tax collection serve a corporate governance function? J Manage World (03):143–151+158 (in Chinese). https://doi.org/10.19744/j.cnki.11-1235/f.2009.03.016

Zeng XF, Zhang C, Zeng Q (2019) Research on the impact of resource tax and environmental protection tax reform on China’s economy. Chin J Popul Resour Environ 29(12):149–157

Zhang H (2021) Trade openness and green total factor productivity in China: the role of ICT-based digital trade. Front Environ Sci 9:809339. https://doi.org/10.3389/fenvs.2021.809339

Zhang J, Wu GY, Zhang JP (2004) Estimation of China’s inter-provincial material capital stock: 1952–2000. Econ Res 10:35–44

Zhang B, Yu L, Sun C (2022) How does urban environmental legislation guide the green transition of enterprises? Based on the perspective of enterprises’ green total factor productivity. Energy Econ 110:106032. https://doi.org/10.1016/j.eneco.2022.106032

Zhao A, Wang J, Sun Z, Guan HJ (2022) Environmental taxes, technology innovation quality and firm performance in China—a test of effects based on the Porter hypothesis. Econ Anal Policy 74:309–325. https://doi.org/10.1016/j.eap.2022.02.009

Funding

This work was financially supported by the General Project of Humanities and Social Science Research in Colleges and Universities in Henan Province (No. 2023ZZJH185) & the Social Science Foundation of Henan Province (No. 2019GGJS090).

Author information

Authors and Affiliations

Contributions

Chaoxia Yao: investigation, conceptualization, formal analysis, and writing original draft. Bin Xi: responsible for the idea of this manuscript, software provision, revision of this manuscript, and language checking.

Corresponding author

Ethics declarations

Ethics approval

I would like to declare on behalf of my co-authors that the work described was original research that has not been published previously and is not under consideration for publication elsewhere, in whole or in part.

Consent to participate

Informed consent was obtained from all individual participants included in the study.

Consent for publication

The participant has consented to the submission of the article research to the journal.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yao, C., Xi, B. Does environmental protection tax improve green total factor productivity? Experimental evidence from China. Environ Sci Pollut Res 30, 105353–105373 (2023). https://doi.org/10.1007/s11356-023-29739-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-29739-4