Abstract

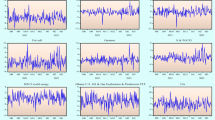

We use an extended joint connectedness technique and the time-varying parameter vector autoregression (ETVP-VAR) method to examine connections between the ARK FinTech Innovation ETF (ARKF), Global X FinTech ETF (FINX), and energy volatility by connectedness as a quality of eight indicators from April 1, 2019, to September 26, 2022. Our results demonstrate that the pattern of ARKF and FINX is picked up as a crucial net shock transmitter that nearly permeates our analyzed sample. Since the COVID-19 epidemic, more people are adopting FinTech partly because of their concern about the disease spreading through social contact and cash handling. Moreover, green bonds are net shock recipients over the long term. Furthermore, during the COVID-19 duration and the Russo-Ukrainian War, shocks transmitted to green bonds soared sharply. By contrast, keeping with the clean energy and crude oil trend, these indicators transmit a network of shocks during the period under study. When considering wind power, it becomes clear that this signal first acts as a net shock transmitter before changing into a net receiver of shocks from mid-2021 onwards. We recognize that the system is a net shock receiver regarding clean power. The dynamics invariably lead the series to change to a net shock transmitter in mid-2021. By mid-2021, the developments always cause the series to transform into a net shock transmitter.

Similar content being viewed by others

Data availability

Data available on request due to privacy/ethical restrictions.

References

Ahram T, Sargolzaei A, Sargolzaei S, Daniels J, Amaba B (2017) Blockchain technology innovations. 2017 IEEE Technology & Engineering Management Conference (TEMSCON) 137–141.https://doi.org/10.1109/TEMSCON.2017.7998367

Akpan IJ, Soopramanien D, Kwak D-H (Austin) (2021) Cutting-edge technologies for small business and innovation in the era of COVID-19 global health pandemic. J Small Bus Entrep 33(6):607–617. https://doi.org/10.1080/08276331.2020.1799294

Ali S, Yan Q, Razzaq A, Khan I, Irfan M (2023) Modeling factors of biogas technology adoption: a roadmap towards environmental sustainability and green revolution. Environ Sci Pollut Res 30(5):11838–11860. https://doi.org/10.1007/s11356-022-22894-0

An YJ, Choi PMS, Huang SH (2021) Blockchain, cryptocurrency, and artificial intelligence in finance. In Choi PMS, Huang SH (Eds.), Fintech with Artificial Intelligence, Big Data, and Blockchain Springer, pp. 1–34. https://doi.org/10.1007/978-981-33-6137-9_1

Andolfatto D (2021) Assessing the impact of central bank digital currency on private banks. Econ J 131(634):525–540. https://doi.org/10.1093/ej/ueaa073

Arner DW, Buckley RP, Zetzsche DA, Veidt R (2020) Sustainability, FinTech and financial inclusion. Eur Bus Organ Law Rev 21(1):7–35. https://doi.org/10.1007/s40804-020-00183-y

Arslan HM, Khan I, Latif MI, Komal B, Chen S (2022) Understanding the dynamics of natural resources rents, environmental sustainability, and sustainable economic growth: new insights from China. Environ Sci Pollut Res 29(39):58746–58761. https://doi.org/10.1007/s11356-022-19952-y

Attarzadeh A, Balcilar M (2022) On the dynamic return and volatility connectedness of cryptocurrency, crude oil, clean energy, and stock markets: a time-varying analysis. Environ Sci Pollut Res 29(43):65185–65196. https://doi.org/10.1007/s11356-022-20115-2

Auer R, Böhme R (2020) The technology of retail central bank digital currency (SSRN Scholarly Paper No. 3561198). https://papers.ssrn.com/abstract=3561198. Accessed 22 Nov 2022

Awan A, Sadiq M, Hassan ST, Khan I, Khan NH (2022) Combined nonlinear effects of urbanization and economic growth on CO2 emissions in Malaysia. An application of QARDL and KRLS. Urban Clim 46:101342. https://doi.org/10.1016/j.uclim.2022.101342

Balcilar M, Gabauer D, Umar Z (2021) Crude oil futures contracts and commodity markets: new evidence from a TVP-VAR extended joint connectedness approach. Resour Policy 73:102219. https://doi.org/10.1016/j.resourpol.2021.102219

Biais B, Bisière C, Bouvard M, Casamatta C (2019) Blockchains, coordination, and forks. AEA Papers Proc 109:88–92. https://doi.org/10.1257/pandp.20191018

Böhme R, Christin N, Edelman B, Moore T (2015) Bitcoin: economics, technology, and governance. J Econ Perspect 29(2):213–238. https://doi.org/10.1257/jep.29.2.213

Bouri E, Gil-Alana LA, Gupta R, Roubaud D (2019) Modelling long memory volatility in the Bitcoin market: evidence of persistence and structural breaks. Int J Financ Econ 24(1):412–426. https://doi.org/10.1002/ijfe.1670

Brunnermeier MK, Niepelt D (2019) On the equivalence of private and public money. J Monet Econ 106:27–41. https://doi.org/10.1016/j.jmoneco.2019.07.004

Caloia FG, Cipollini A, Muzzioli S (2019) How do normalization schemes affect net spillovers? A replication of the Diebold and Yilmaz (2012) study. Energy Econ 84:104536. https://doi.org/10.1016/j.eneco.2019.104536

Chakrabarti P, Jawed MS, Sarkhel M (2021) COVID-19 pandemic and global financial market interlinkages: a dynamic temporal network analysis. Appl Econ 53(25):2930–2945. https://doi.org/10.1080/00036846.2020.1870654

Chen L, Cong LW, Xiao Y (2020) A brief introduction to blockchain economics. In Information for Efficient Decision Making. WORLD SCIENTIFIC, pp. 1–40. https://doi.org/10.1142/9789811220470_0001

Chiu J, Davoodalhosseini SM, Jiang J, Zhu Y (2022) Bank market power and central bank digital currency: theory and quantitative assessment. J Polit Econ. https://doi.org/10.1086/722517

Corea F (2019) Applied artificial intelligence: where AI can be used in business. Springer International Publishing.https://doi.org/10.1007/978-3-319-77252-3

De Reuver M, Sørensen C, Basole RC (2018) The digital platform: a research agenda. J Inf Technol 33(2):124–135. https://doi.org/10.1057/s41265-016-0033-3

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

Diebold FX, Yılmaz K (2014) On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics 182(1):119–134. https://doi.org/10.1016/j.jeconom.2014.04.012

Disli M, Nagayev R, Salim K, Rizkiah SK, Aysan AF (2021) In search of safe haven assets during COVID-19 pandemic: an empirical analysis of different investor types. Res Int Bus Finance 58:101461. https://doi.org/10.1016/j.ribaf.2021.101461

Efanov D, Roschin P (2018) The all-pervasiveness of the blockchain technology. Proc Comput Sci 123:116–121. https://doi.org/10.1016/j.procs.2018.01.019

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient Tests for an Autoregressive Unit Root. Econometrica 64(4):813–836. https://doi.org/10.2307/2171846

Elsayed AH, Nasreen S, Tiwari AK (2020) Time-varying co-movements between energy market and global financial markets: implication for portfolio diversification and hedging strategies. Energy Econ 90:104847. https://doi.org/10.1016/j.eneco.2020.104847

Engert W, Fung BS-C (2017) Central bank digital currency: motivations and implications (Working Paper No. 2017–16). Bank of Canada Staff Discussion Paper. https://doi.org/10.34989/sdp-2017-16

Fernández-Villaverde J, Sanches D, Schilling L, Uhlig H (2021) Central bank digital currency: central banking for all? Rev Econ Dyn 41:225–242. https://doi.org/10.1016/j.red.2020.12.004

Furman J, Seamans R (2019) AI and the economy. Innov Policy Econ 19:161–191. https://doi.org/10.1086/699936

Goodell JW, Goutte S (2021) Co-movement of COVID-19 and Bitcoin: evidence from wavelet coherence analysis. Financ Res Lett 38:101625. https://doi.org/10.1016/j.frl.2020.101625

Gronwald M (2019) Is Bitcoin a commodity? On price jumps, demand shocks, and certainty of supply. J Int Money Financ 97:86–92. https://doi.org/10.1016/j.jimonfin.2019.06.006

Guo X, Lu F, Wei Y (2021) Capture the contagion network of bitcoin – evidence from pre and mid COVID-19. Res Int Bus Financ 58:101484. https://doi.org/10.1016/j.ribaf.2021.101484

Ha LT (2022a) Interlinkages of cryptocurrency and stock markets during COVID-19 pandemic by applying a TVP-VAR extended joint connected approach. J Econ Stud, ahead-of-print(ahead-of-print). https://doi.org/10.1108/JES-01-2022-0055

Ha LT (2022b) Dynamic interlinkages between the crude oil and gold and stock during Russia-Ukraine War: evidence from an extended TVP-VAR analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23456-0

Ha LT, Nham NTH (2022) An application of a TVP-VAR extended joint connected approach to explore connectedness between WTI crude oil, gold, stock and cryptocurrencies during the COVID-19 health crisis. Technol Forecast Soc Chang 183:121909. https://doi.org/10.1016/j.techfore.2022.121909

Habib G, Sharma S, Ibrahim S, Ahmad I, Qureshi S, Ishfaq M (2022) Blockchain technology: benefits, challenges, applications, and integration of blockchain technology with cloud computing. Future Internet 14(11):341. https://doi.org/10.3390/fi14110341

Hornstein A, Krusell P, Violante GL (2005) The effects of technical change on labor market inequalities. In Handbook of Economic Growth 1. Elsevier, pp. 1275–1370. https://doi.org/10.1016/S1574-0684(05)01020-8

Hornstein A, Krusell P (1996) Can technology improvements cause productivity slowdowns? NBER Macroecon Annu 11:209–259. https://doi.org/10.1086/654303

Jackman M, Moore W (2021) Does it pay to be green? An exploratory analysis of wage differentials between green and non-green industries. J Econ Dev 23(3):284–298. https://doi.org/10.1108/JED-08-2020-0099

Jarque CM, Bera AK (1980) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters 6(3):255–259. https://doi.org/10.1016/0165-1765(80)90024-5

Keister T, Monnet C (2022) Central bank digital currency: stability and information. J Econ Dyn Control 142:104501. https://doi.org/10.1016/j.jedc.2022.104501

Kethineni S, Cao Y (2020) The rise in popularity of cryptocurrency and associated criminal activity. Int Crim Justice Rev 30(3):325–344. https://doi.org/10.1177/1057567719827051

Khan I, Hou F (2021) The dynamic links among energy consumption, tourism growth, and the ecological footprint: the role of environmental quality in 38 IEA countries. Environ Sci Pollut Res 28(5):5049–5062. https://doi.org/10.1007/s11356-020-10861-6

Khan I, Hou F, Le HP, Ali SA (2021a) Do natural resources, urbanization, and value-adding manufacturing affect environmental quality? Evidence from the top ten manufacturing countries. Resour Policy 72:102109. https://doi.org/10.1016/j.resourpol.2021.102109

Khan I, Zakari A, Ahmad M, Irfan M, Hou F (2021b) Linking energy transitions, energy consumption, and environmental sustainability in OECD countries. Gondwana Res. https://doi.org/10.1016/j.gr.2021.10.026

Khan I, Hou F, Zakari A, Irfan M, Ahmad M (2022a) Links among energy intensity, non-linear financial development, and environmental sustainability: new evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 330:129747. https://doi.org/10.1016/j.jclepro.2021.129747

Khan I, Tan D, Hassan ST, Bilal (2022b) Role of alternative and nuclear energy in stimulating environmental sustainability: impact of government expenditures. Environ Sci Pollut Res 29(25):37894–37905. https://doi.org/10.1007/s11356-021-18306-4

Lastrapes WD, Wiesen TFP (2021) The joint spillover index. Econ Model 94:681–691. https://doi.org/10.1016/j.econmod.2020.02.010

Le TH, Hoang PD, To TT (2022) Is product proximity a driver for better energy security? Global evidence of nonlinear relationships between product proximity and energy security. International Journal of Sustainable Development & World Ecology 29(4):366–386. https://doi.org/10.1080/13504509.2022.2025500

Le L-T, Yarovaya L, Nasir MA (2021a) Did COVID-19 change spillover patterns between Fintech and other asset classes? Res Int Bus Financ 58:101441. https://doi.org/10.1016/j.ribaf.2021.101441

Le T-L, Abakah EJA, Tiwari AK (2021b) Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technol Forecast Soc Chang 162:120382. https://doi.org/10.1016/j.techfore.2020.120382

Lee J, Choi PMS (2019) Chain of antichains: an efficient and secure distributed ledger technology and its applications (arXiv:1810.11871). arXiv. https://doi.org/10.48550/arXiv.1810.11871

Lizcano D, Lara JA, White B, Aljawarneh S (2020) Blockchain-based approach to create a model of trust in open and ubiquitous higher education. J Comput High Educ 32(1):109–134. https://doi.org/10.1007/s12528-019-09209-y

Lucas RE (1984) Money in a theory of finance. Carn-Roch Conf Ser Public Policy 21:9–46. https://doi.org/10.1016/0167-2231(84)90003-4

Lyu L, Khan I, Zakari A, Bilal (2021) A study of energy investment and environmental sustainability nexus in China: a bootstrap replications analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16254-7

Marty AL (1961) Gurley and Shaw on money in a theory of finance. J Polit Econ 69(1):56–62

Oztemel E, Gursev S (2020) Literature review of Industry 4.0 and related technologies. J Intell Manuf 31(1):127–182. https://doi.org/10.1007/s10845-018-1433-8

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1):17–29. https://doi.org/10.1016/S0165-1765(97)00214-0

Shah J, Parveen S (2021) Understanding the blockchain technology beyond bitcoin. In Phanden RK, Mathiyazhagan K, Kumar R, Paulo Davim J (Eds.), Advances in Industrial and Production Engineering. Springer, pp. 499–516. https://doi.org/10.1007/978-981-33-4320-7_45

Sharma S, Tiwari AK, Nasreen S (2022) Are FinTech, robotics, and blockchain index funds providing diversification opportunities with emerging markets?Lessons from pre and postoutbreak of COVID-19. Electron Commer Res. https://doi.org/10.1007/s10660-022-09611-2

Sugandi EA (2021) The COVID-19 pandemic and Indonesia’s fintech markets (SSRN scholarly paper No. 3916514). https://doi.org/10.2139/ssrn.3916514

Taghizadeh-Hesary F, Zakari A, Yoshino N, Khan I (2022) Leveraging on energy security to alleviate poverty in Asian economies. Singapore Econ Rev 1–28. https://doi.org/10.1142/S0217590822440015

Tawiah VK, Zakari A, Khan I (2021) The environmental footprint of China-Africa engagement: an analysis of the effect of China – Africa partnership on carbon emissions. Sci Total Environ 756:143603. https://doi.org/10.1016/j.scitotenv.2020.143603

Tiwari AK, Abakah EJA, Le T-L, Leyva-de la Hiz DI (2021) Markov-switching dependence between artificial intelligence and carbon price: the role of policy uncertainty in the era of the 4th industrial revolution and the effect of COVID-19 pandemic. Technol Forecast Soc Chang 163:120434. https://doi.org/10.1016/j.techfore.2020.120434

Tobin J (1985) Financial innovation and deregulation in perspective. Monet Econ Stud 3(2)

Webster C, Ivanov S (2020) Robotics, artificial intelligence, and the evolving nature of work. In George B, Paul J (Eds.), Digital Transformation in Business and Society. Springer International Publishing, pp. 127–143. https://doi.org/10.1007/978-3-030-08277-2_8

Williamson S (2022) Central bank digital currency: welfare and policy implications. J Polit Econ 130(11):2829–2861. https://doi.org/10.1086/720457

Yang T, Zhang X (2022) FinTech adoption and financial inclusion: evidence from household consumption in China. Journal of Banking & Finance 145:106668. https://doi.org/10.1016/j.jbankfin.2022.106668

Yang X, Khan I (2021) Dynamics among economic growth, urbanization, and environmental sustainability in IEA countries: the role of industry value-added. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16000-z

Yang Z, Naeem M, Ji H, Liu G, Zhu Y, Xu J (2023) Does China’s stock market react to COVID-19 differently at industry level? Evidence from China. Economic Research-Ekonomska Istraživanja 36(2):2143844. https://doi.org/10.1080/1331677X.2022.2143844

Yermack D (2015) Chapter 2 - is bitcoin a real currency? An economic appraisal. In Lee Kuo Chuen D (Ed.), Handbook of Digital Currency. Academic Press, pp. 31–43. https://doi.org/10.1016/B978-0-12-802117-0.00002-3

Zakari A, Khan I, Tan D, Alvarado R, Dagar V (2022a) Energy efficiency and sustainable development goals (SDGs). Energy 239:122365. https://doi.org/10.1016/j.energy.2021.122365

Zakari A, Khan I, Tawiah V, Alvarado R, Li G (2022b) The production and consumption of oil in Africa: the environmental implications. Resour Policy 78:102795. https://doi.org/10.1016/j.resourpol.2022.102795

Zakari A, Li G, Khan I, Jindal A, Tawiah V, Alvarado R (2022c) Are abundant energy resources and Chinese business a solution to environmental prosperity in Africa? Energy Policy 163:112829. https://doi.org/10.1016/j.enpol.2022.112829

Funding

This paper was supported by the National Economics University.

Author information

Authors and Affiliations

Contributions

Le Thanh Ha equally contributed to all stages of preparing, drafting, writing, and revising this review article. All authors listed have made a substantial, direct, and intellectual contribution to the work during different preparation stages. All authors read, revised, and approved the final version of this manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ha, L.T. Dynamic connectedness between FinTech innovation and energy volatility during the war in time of pandemic. Environ Sci Pollut Res 30, 83530–83544 (2023). https://doi.org/10.1007/s11356-023-28089-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-28089-5