Abstract

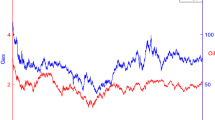

Value at Risk and Expected Shortfall are two traditional tools used to measure extreme risk in financial markets. However, there is little research on measuring extreme risk in emerging markets such as green bonds and clean energy. This paper uses both semi-parametric models with simultaneous excitation functions and traditional models to estimate extreme risk in SP500 Green Bond (GB) and Global Clean Energy (GCE), selecting Expected Shortfall (ES) and Value at Risk (VaR) as the indices of extreme risk. Then, the paper uses a breakpoint scan of the predictions of the different types of models. The results find that the green bond market was relatively stable while the global clean energy market experienced sharp fluctuations after the COVID-19 pandemic outbreak. Representative models in GCE have at least two breakpoints, but those for GB have no breakpoints. The GARCH model with normal innovations performs the best among all target models, and the GARCH-FZ model fits the best among all semi-parametric candidates. Our research could help governments, companies, and investors with risk management and improve model accuracy and mechanisms for measuring extreme risks.

Similar content being viewed by others

Availability of data and materials

Most of the basic data are publicly available, mainly from the Wind and IFind financial databases.

References

Alkathery MA, Chaudhuri K, Nasir MA (2022) Implications of clean energy, oil and emissions pricing for the gcc energy sector stock. Energy Economics 112:106119

Artzner P, Delbaen F, Eber JM, Heath D (1999) Coherent measures of risk. Mathematical finance 9(3):203–228

Asl MG, Canarella G, Miller SM (2021) Dynamic asymmetric optimal portfolio allocation between energy stocks and energy commodities: Evidence from clean energy and oil and gas companies. Resources Policy 71:101982

Association WM, et al (2022) State of the global climate 2021

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. Journal of applied econometrics 18(1):1–22

Chatziantoniou I, Abakah EJA, Gabauer D, Tiwari AK (2022) Quantile time-frequency price connectedness between green bond, green equity, sustainable investments and clean energy markets. Journal of Cleaner Production 132088

Chen R, Xu J (2019) Forecasting volatility and correlation between oil and gold prices using a novel multivariate gas model. Energy Economics 78:379–391

Contractor D, Balli F, Hoxha I (2022) Market reaction to macroeconomic anouncements: green vs conventional bonds. Applied Economics 1–26

Dawar I, Dutta A, Bouri E, Saeed T (2021) Crude oil prices and clean energy stock indices: Lagged and asymmetric effects with quantile regression. Renewable Energy 163:288–299

Duan K, Ren X, Wen F, Chen J (2023) Evolution of the information transmission between chinese and international oil markets: A quantile-based framework. Journal of Commodity Markets 29:100304

Ejaz R, Ashraf S, Hassan A, Gupta A (2022) An empirical investigation of market risk, dependence structure, and portfolio management between green bonds and international financial markets. Journal of Cleaner Production 365:132666

Espoir DK, Sunge R (2021) Co2 emissions and economic development in africa: Evidence from a dynamic spatial panel model. Journal of Environmental Management 300:113617

Febi W, Schäfer D, Stephan A, Sun C (2018) The impact of liquidity risk on the yield spread of green bonds. Finance Research Letters 27:53–59

Fissler T, Ziegel JF (2016) Higher order elicitability and osband’s principle. The Annals of Statistics 44(4):1680–1707

Fu Z, Chen Z, Sharif A, Razi U (20220 The role of financial stress, oil, gold and natural gas prices on clean energy stocks: Global evidence from extreme quantile approach. Resources Policy 78:102860

Griffiths S (2017) A review and assessment of energy policy in the middle east and north africa region. Energy Policy 102:249–269

Han Y, Li J (2022) Should investors include green bonds in their portfolios? evidence for the usa and europe. International Review of Financial Analysis 80:101998

Hansen BE (1994) Autoregressive conditional density estimation. International Economic Review 705–730

He Y, Jiao Z, Yang J (2018) Comprehensive evaluation of global clean energy development index based on the improved entropy method. Ecological Indicators 88:305–321

Hyun S, Park D, Tian S (2020) The price of going green: the role of greenness in green bond markets. Accounting & Finance 60(1):73–95

Hyun S, Park D, Tian S (2022) The price of frequent issuance: the value of information in the green bond market. Economic Change and Restructuring 1–23

Junior PO, Tiwari AK, Tweneboah G, Asafo-Adjei E (2022) Gas and garch based value-at-risk modeling of precious metals. Resources Policy 75:102456

Kanamura T (2022) A model of price correlations between clean energy indices and energy commodities. Journal of Sustainable Finance & Investment 12(2):319–359

Karim S, Khan S, Mirza N, Alawi SM, Taghizadeh-Hesary F (2022) Climate finance in the wake of covid-19: connectedness of clean energy with conventional energy and regional stock markets. Climate Change Economics 2240008

Lee C-C, Lee C-C, Li Y-Y (2021) Oil price shocks, geopolitical risks, and green bond market dynamics. The North American Journal of Economics and Finance 55:101309

Li H, Zhou D, Hu J, Guo L (2022) Dynamic linkages among oil price, green bond, carbon market and low-carbon footprint company stock price: Evidence from the tvp-var model. Energy Reports 8:11249–11258

Manganelli S, Engle RF (2004) A comparison of value-at-risk models in finance. Risk measures for the 21st century 123–143

Marín-Rodríguez NJ, González-Ruiz JD, Botero S (2022a) Dynamic relationships among green bonds, co2 emissions, and oil prices. Frontiers in Environmental Science 10:992726

Marín-Rodríguez NJ, González-Ruiz JD, Botero-Botero S (2022b) Dynamic co-movements among oil prices and financial assets: A scientometric analysis. Sustainability 14(19):12796

Marín-Rodríguez NJ, González-Ruiz JD, Botero S (2023) A wavelet analysis of the dynamic connectedness among oil prices, green bonds, and co2 emissions. Risks 11(1):15

McNeil A, Frey R, Embrechts P (2015) Quantitative risk management (revised ed.). Princeton Series in Finance

Nolde N, Ziegel JF (2017) Elicitability and backtesting: Perspectives for banking regulation. The annals of applied statistics 11(4):1833–1874

Patton AJ, Ziegel JF, Chen R (2019) Dynamic semiparametric models for expected shortfall (and value-at-risk). Journal of econometrics 211(2):388–413

Pham L (2021) Frequency connectedness and cross-quantile dependence between green bond and green equity markets. Energy Economics 98:105257

Reboredo JC (2018) Green bond and financial markets: Co-movement, diversification and price spillover effects. Energy Economics 74:38–50

Reboredo JC, Ugolini A (2020) Price connectedness between green bond and financial markets. Economic Modelling 88:25–38

Ren X, Li Y, Shahbaz M, Dong K, Lu Z (2022a) Climate risk and corporate environmental performance: Empirical evidence from china. Sustainable Production and Consumption 30:467–477

Ren X, Li Y, Wen F, Lu Z et al (2022b) The interrelationship between the carbon market and the green bonds market: Evidence from wavelet quantile-on-quantile method. Technological Forecasting and Social Change 179:121611

Ren X, Zhang X, Yan C, Gozgor G (2022c) Climate policy uncertainty and firm-level total factor productivity: Evidence from china. Energy Economics 113:106209

Ren X, Li J, He F, Lucey B (2023a) Impact of climate policy uncertainty on traditional energy and green markets: Evidence from time-varying granger tests. Renewable and Sustainable Energy Reviews 173:113058

Ren X, Zeng G, Gozgor G (2023b) How does digital finance affect industrial structure upgrading? evidence from chinese prefecture-level cities. Journal of Environmental Management 330:117125

Sun X, Xiao S, Ren X, Xu B (2023) Time-varying impact of information and communication technology on carbon emissions. Energy Economics 106492

Tang DY, Zhang Y (2020) Do shareholders benefit from green bonds? Journal of Corporate Finance 61:101427

Tsoukala AK, Tsiotas G (2021) Assessing green bond risk: an empirical investigation. Green Finance 3(2):222–252

Wang J, Chen X, Li X, Yu J, Zhong R (2020) The market reaction to green bond issuance: Evidence from china. Pacific-Basin Finance Journal 60:101294

Wang J, Ma F, Bouri E, Zhong J (2022a) Volatility of clean energy and natural gas, uncertainty indices, and global economic conditions. Energy Economics 108:105904

Wang X, Li J, Ren X (2022b) Asymmetric causality of economic policy uncertainty and oil volatility index on time-varying nexus of the clean energy, carbon and green bond. International Review of Financial Analysis 83:102306

Wang Z-R, Fu H-Q, Ren X-H (2022c) The impact of political connections on firm pollution: New evidence based on heterogeneous environmental regulation. Petroleum Science

Wang X, Li J, Ren X, Bu R, Jawadi F (2023a) Economic policy uncertainty and dynamic correlations in energy markets: Assessment and solutions. Energy Economics 117:106475

Wang Z, Fu H, Ren X (2023b) Political connections and corporate carbon emission: New evidence from chinese industrial firms. Technological Forecasting and Social Change 188:122326

Wei P, Qi Y, Ren X, Duan K (2022) Does economic policy uncertainty affect green bond markets? evidence from wavelet-based quantile analysis. Emerging Markets Finance and Trade 58(15):4375–4388

Xu X, Wenhong Xie MD (2022) Global green taxonomy development, alignment, and implementation

Yahya M, Kanjilal K, Dutta A, Uddin GS, Ghosh S (2021) Can clean energy stock price rule oil price? new evidences from a regime-switching model at first and second moments. Energy Economics 95:105116

Yeow KE, Ng S-H (2021) The impact of green bonds on corporate environmental and financial performance. Managerial Finance

Yuan X, Su C-W, Umar M, Shao X, LobonŢ O-R (2022) The race to zero emissions: Can renewable energy be the path to carbon neutrality? Journal of Environmental Management 308:114648

Zhou X, Cui Y (2019) Green bonds, corporate performance, and corporate social responsibility. Sustainability 11(23):6881

Zhou W, Chen Y, Chen J (2022) Risk spread in multiple energy markets: Extreme volatility spillover network analysis before and during the covid-19 pandemic. Energy 256:124580

Funding

Research Project Supported by the Natural Science Fund of Hunan Province (2022JJ40647)

Author information

Authors and Affiliations

Contributions

Jinghua Zhuo: data preparation, software, writing–original draft. Xiaohang Ren: conceptualization, methodology, supervision, analysis and writing–reviewing and editing. Kun Duan: writing–editing

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Ethics approval and consent to participate

Not applicable

Consent for publication

Not applicable

Additional information

Responsible editor: Nicholas Apergis.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhuo, J., Ren, X. & Duan, K. Modelling extreme risks for green bond and clean energy. Environ Sci Pollut Res 30, 83702–83716 (2023). https://doi.org/10.1007/s11356-023-27071-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-27071-5