Abstract

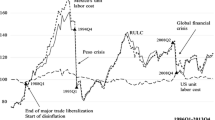

Previous “oil curse” studies primarily estimate a single, linear effect of oil rents on income using time-invariant parameters over entire sample periods. This means the true effects of oil dependence cannot be captured if structural changes are taking place, or effects are non-linear. We introduce a two regime Markov-switching model into the resource effects literature to assess the time-varying effects of oil rent dependence on the Malaysian manufacturing sector. We also allow for non-linear threshold effects. We find the impact of oil rents is regime-dependent. Under a rarer “first regime” structure, there is no significant effect. Under a predominant “second regime,” there is an inverted U-shaped effect, with oil rents’ share of GDP up to 8% positively associated with manufacturing, and negatively associated beyond this. We find connections between regime changes and the 1997 Asian financial crisis and 2008 global financial crisis. Implications for effective diversification policies are discussed.

Similar content being viewed by others

Notes

It checks the validity of the existence of a second regime via the statistical significance of the estimated transition matrix parameters between the regimes.

We do not reproduce the results of the unit root tests to conserve space; however, the results are available upon request.

The global recession in 1986 led to weakened international demand for electronics and commodities, which severely affected related production in Malaysia, particularly the semiconductor industry, and thus Malaysia’s GDP growth (Okposin and Ming, 2000).

The RCM for a Markov Switching model is given by \(RCM=400\times \frac{1}{T}\sum_{t=1}^T{P}_t\left(1-{P}_t\right)\)

Under the Markov-switching model, the expected durations of regime 1 (D1) and regime 2 (D2) are calculated as D1=1/(1-p11) and D2= 1/(1-p22).

This option in Eviews creates a polynomial by taking sets of three adjacent points from a variable’s annual series and fitting a quadratic such that the average or sum of quarterly points matches the annual points actually observed. It thus generates a smoothed or averaged interpolation of quarterly data.

References

Abdulahi ME, Shu Y, Khan MA (2019) Resource rents, economic growth, and the role of institutional quality: a panel threshold analysis. Resources Policy 61:293–303

Adams D, Adams K, Ullah S, Ullah F (2019a) Globalisation, governance, accountability and the natural resource ‘curse’: implications for socio-economic growth of oil-rich developing countries. Resources Policy 61:128–140

Adams D, Ullah S, Akhtar P, Adams K, Saidi S (2019b) The role of country-level institutional factors in escaping the natural resource curse: insights from Ghana. Resources Policy 61:433–440

Alexeev M, Conrad R (2009) The elusive curse of oil. The Review of Economics and Statistics 91(3):586–598

Amiri H, Samadian F, Yahoo M, Jamali SJ (2019) Natural resource abundance, institutional quality and manufacturing development: evidence from resource-rich countries. Resources Policy 62:550–560

Ampofo GKM, Cheng J, Asante DA, Bosah P et al (2020) Total natural resource rents, trade openness and economic growth in the top mineral-rich countries: new evidence from nonlinear and asymmetric analysis. Resources Policy 68(C)

Ang JB, McKibbin WJ (2007) Financial liberalization, financial sector development and growth: evidence from Malaysia. Journal of Development Economics. https://doi.org/10.1016/j.jdeveco.2006.11.006

Apergis N, Cooray A, Khraief N, Apergis I (2019) Do gold prices respond to real interest rates? Evidence from the Bayesian Markov Switching VECM model. Journal of International Financial Markets, Institutions and Money 60:134–148

Arezki R, der Ploeg F (2010) Trade policies, institutions and the natural resource curse. Applied Economics Letters 17(15):1443–1451

Athukorala PC (2005) Trade policy in Malaysia: liberalization process, structure of protection, and reform agenda. ASEAN Economic Bulletin 22(1):19–34

Auty RM (1993) Sustaining development in mineral economies: The resource curse thesis. Routledge, London

Badeeb RA, Lean HH (2017) Natural resources, financial development and sectoral value added in a resource based economy. In: Robustness in econometrics. Springer, Cham, pp 401–417

Badeeb RA, Lean HH, Clark J (2017) The evolution of the natural resource curse thesis: A critical literature survey. Resources Policy 51. https://doi.org/10.1016/j.resourpol.2016.10.015

Badeeb RA, Lean HH, Smyth R (2016) Oil curse and finance-growth nexus in Malaysia: the role of investment. Energy Economics 57. https://doi.org/10.1016/j.eneco.2016.04.020

Badeeb RA, Szulczyk KR, Lean HH (2021) Asymmetries in the effect of oil rent shocks on economic growth: a sectoral analysis from the perspective of the oil curse. Resources Policy 74:102326

Banerjee P (2011) Microeconomic policy environment—An analytical guide for managers. Tata McGraw-Hill

Banerjee A, Dolado JJ, Mestre R (1998) Error-correction mechanism tests for cointegration in a single-equation framework. Journal of Time Series Analysis. https://doi.org/10.1111/1467-9892.00091

Bayer C, Hanck C (2013) Combining non-cointegration tests. Journal of Time Series Analysis 34(1):83–95

Berg A, Ostry JD, Zettelmeyer J (2012) What makes growth sustained? Journal of Development Economics 98:149–166

Bhar R, Hammoudeh S (2011) Commodities and financial variables: analyzing relationships in a changing regime environment. International Review of Economics and Finance 20(4):469–484

Bhattacharyya S, Hodler R (2010) Natural resources, democracy and corruption. European Economic Review 54(4):608–621

Bhattacharyya S, Hodler R (2014) Do natural resource revenues hinder financial development? The role of political institutions. World Development 57:101–113

BP (2020) Statistical review of world energy, 69th edn. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf. Accessed 16 Aug 2021

Brahmbhatt, M., Otaviano, C. and Vostroknutova, E. (2010) Dealing with Dutch Disease. Economic Premise 16. Washington, D.C.: World Bank.

Brunnschweiler CN, Bulte EH (2008) The resource curse revisited and revised: a tale of paradoxes and red herrings. Journal of Environmental Economics and Management 55(3):248–264

Bulte EH, Damania R, Deacon RT (2005) Resource intensity, institutions, and development. World Development 33:1029–1044. https://doi.org/10.1016/j.worlddev.2005.04.004

Charfeddine L (2017) The impact of energy consumption and economic development on Ecological Footprint and CO2 emissions: evidence from a Markov Switching Equilibrium Correction Model. Energy Economics 65:355–374. https://doi.org/10.1016/j.eneco.2017.05.009

Chica-Olmo J, Sari-Hassoun S, Moya-Fernández P (2020) Spatial relationship between economic growth and renewable energy consumption in 26 European countries. Energy Economics 92:104962

Chkili W, Nguyen DK (2014) Exchange rate movements and stock market returns in a regime-switching environment: evidence for BRICS countries. Research in International Business and Finance 31:46–56

Clemente J, Montañés A, Reyes M (1998) Testing for a unit root in variables with a double change in the mean. Economics Letters 59(2):175–182

Corden WM, Neary JP (1982) Booming sector and de-industrialisation in a small open economy. The Economic Journal 92(368):825–848

Corden WM (1984) Booming sector and Dutch disease economics: survey and consolidation. Oxford Economic Papers 36(3):359–380

Damette O, Seghir M (2018) Natural resource curse in oil exporting countries: a nonlinear approach. International Economics 156:231–246

Davies RB (1977) Hypothesis testing when a nuisance parameter is present only under the alternative. Biometrika 64(2):247–254

Der Ploeg F, Poelhekke S (2009) Volatility and the natural resource curse. Oxford Economic Papers 61(4):727–760

Doğan İ, Bilgili F (2014) The non-linear impact of high and growing government external debt on economic growth: a Markov Regime-switching approach. Economic Modelling 39:213–220

Dong B, Zhang Y, Song H (2019) Corruption as a natural resource curse: evidence from the Chinese coal mining. China Economic Review 57:101314

Doraisami A (2015) Has Malaysia really escaped the resource curse? A closer look at the political economy of oil revenue management and expenditures. Resources Policy 45:98–108

Dou S, Yue C, Xu D, Wei Y, Li H (2022) Rethinking the “resource curse”: new evidence from nighttime light data. Resources Policy 76:102617

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica: Journal of the Econometric Society:251–276

Estrades C, Llambi C, Perera M, Rovira F (2016) Large-scale mining in a small developing country: Macroeconomic impacts of revenue allocation policies. Resources Policy 49:433–443. https://doi.org/10.1016/j.resourpol.2016.07.004

Farhadi M, Islam MR, Moslehi S (2015) Economic freedom and productivity growth in resource-rich economies. World Development. https://doi.org/10.1016/j.worlddev.2015.02.014

Fisher RA (1932) Statistical methods for research workers. Oliver and Boyd, Edinburgh and London

Francis N, Owyang MT (2005) Monetary policy in a markov-switching vector error-correction model: implications for the cost of disinflation and the price puzzle. Journal of Business and Economic Statistics 23(3):305–313

Frankel, J. A. (2010). The natural resource curse: a survey.

Gregory AW, Hansen BE (1996) Practitioners corner: tests for cointegration in models with regime and trend shifts. Oxford Bulletin of Economics and Statistics 58(3):555–560

Gylfason T (2001) Natural resources, education, and economic development. European Economic Review 45(4–6):847–859

Gylfason T, Zoega G (2006) Natural resources and economic growth: the role of investment. World Economy 29(8):1091–1115

Haseeb M, Kot S, Hussain HI, Kamarudin F (2020) The natural resources curse-economic growth hypotheses: quantile--on--quantile evidence from top Asian economies. Journal of Cleaner Production 279:123596

Hausmann R, Rigobon R (2003) An alternative interpretation of the ‘resource curse’: theory and policy implications

Hausmann R, Hwang J, Rodrik D (2007) What you export matters. Journal of Economic Growth 12:1–25

Henry A (2019) Transmission channels of the resource curse in Africa: a time perspective. Economic Modelling 82:13–20

Hilmawan R, Clark J (2021) Resource dependence and the causes of local economic growth: an empirical investigation. Australian Journal of Agricultural and Resource Economics 65:596–626

Humphreys M, Sachs JD, Stiglitz JE, Soros G, Humphreys M (2007) Escaping the resource curse. Columbia University Press

Ibrahim MH (2000) Public and private capital formation and economic growth in Malaysia, 1961-1995. International Journal of Economics, Management and Accounting 8(1)

Iimi A (2007) Escaping from the resource curse: evidence from Botswana and the rest of the world. IMF Staff Papers 54(4):663–699

Inglesi-Lotz R (2016) The impact of renewable energy consumption to economic growth: a panel data application. Energy Economics. https://doi.org/10.1016/j.eneco.2015.01.003

Ito K (2017) Dutch disease and Russia. International. Economics 151:66–70

James A (2015) The resource curse: a statistical mirage? Journal of Development Economics 114:55–63

Jarreau J, Poncet S (2012) Export sophistication and economic growth: evidence from China. Journal of Development Economics 97:281–292

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica. https://doi.org/10.2307/2938278

Khan Z, Badeeb RA, Nawaz K (2022) Natural resources and economic performance: evaluating the role of political risk and renewable energy consumption. Resources Policy 78:102890

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y et al (1992) Testing the null hypothesis of stationarity against the alternative of a unit root. Journal of Econometrics 54(1–3):159–178

Lederman D, Maloney WF (2008) In search of the missing resource curse. The World Bank

Majumder MK, Raghavan M, Vespignani J (2020) Oil curse, economic growth and trade openness. Energy Economics 91:104896

Mallick H, Mahalik MK, Sahoo M (2018) Is crude oil price detrimental to domestic private investment for an emerging economy? The role of public sector investment and financial sector development in an era of globalization. Energy Economics. https://doi.org/10.1016/j.eneco.2017.12.008

Mehlum H, Moene K, Torvik R (2006) Institutions and the resource curse. The Economic Journal 116(508):1–20

Mehrara M (2009) Reconsidering the resource curse in oil-exporting countries. Energy Policy 37(3):1165–1169

Menon, J. (2012). Malaysia's investment malaise: what happened and can it be fixed? Asian Development Bank Working Paper Series No. 312, April.

Nabli MMK, Arezki MR (2012) Natural resources, volatility, and inclusive growth: perspectives from the Middle East and North Africa (Issues 12–111). International Monetary Fund

Okamoto Y (1994) The impact of trade and FDI liberalization policies on the Malaysian economy. The Developing Economies 32(4):460–478

Okposin SB, Ming YC (2000) Economic crises in Malaysia: causes, implications and policy prescriptions. Asean Academic Press

Pan X, Uddin MK, Saima U, Guo S, Guo R (2019) Regime switching effect of financial development on energy intensity: evidence from Markov-switching vector error correction model. Energy Policy 135:110995

Papyrakis E, Gerlagh R (2006) Resource windfalls, investment, and long-term income. Resources Policy 31(2):117–128

Papyrakis E, Raveh O (2014) An empirical analysis of a regional Dutch disease: the case of Canada. Environmental and Resource Economics 58:179–198. https://doi.org/10.1007/s10640-013-9698-z

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica: Journal of the Econometric Society:1361–1401

Peter Boswijk H (1994) Testing for an unstable root in conditional and structural error correction models. Journal of Econometrics. https://doi.org/10.1016/0304-4076(93)01560-9

Rahman A, Khan MA, Charfeddine L (2021) Regime-specific impact of financial reforms on economic growth in Pakistan. Journal of Policy Modeling 43(1):161–182

Rasiah R (2011) Is Malaysia facing negative deindustrialization? Pacific Affairs 84(4):714–735

Rodrik D (2001) The global governance of trade: as if development really mattered, vol 58. UNDP, New York

Rosser, A. (2006). The political economy of the resource curse: a literature survey.

Sachs, J. D., Warner, A. M. (1995). Natural resource abundance and economic growth.

Sachs JD, Warner AM (1997) Fundamental sources of long-run growth. The American Economic Review 87(2):184–188

Sachs JD, Warner AM (2001) The curse of natural resources. European Economic Review 45(4–6):827–838

Sala-i-Martin X, Subramanian A (2008) Addressing the natural resource curse: an illustration from Nigeria. Palgrave Macmillan UK, pp 61–92

Sala-i-Martin X, Subramanian A (2013) Addressing the natural resource curse: an illustration from Nigeria. Journal of African Economies 22:570–615. https://doi.org/10.1093/jae/ejs033

Shahbaz M, Ahmed K, Tiwari AK, Jiao Z (2019a) Resource curse hypothesis and role of oil prices in USA. Resources Policy. https://doi.org/10.1016/j.resourpol.2019.101514

Shahbaz M, Destek MA, Okumus I, Sinha A (2019b) An empirical note on comparison between resource abundance and resource dependence in resource abundant countries. Resources Policy 60:47–55

Shahbaz M, Zakaria M, Shahzad SJH, Mahalik MK (2018) The energy consumption and economic growth nexus in top ten energy-consuming countries: fresh evidence from using the quantile-on-quantile approach. Energy Economics 71:282–301

Sharma C, Mishra RK (2022) On the good and bad of natural resource, corruption, and economic growth nexus. Environmental and Resource Economics 82(4):889–922

Sini S, Abdul-Rahim AS, Sulaiman C (2021) Does natural resource influence conflict in Africa? Evidence from panel nonlinear relationship. Resources Policy 74:102268

Stijns JP (2005) Natural resource abundance and economic growth revisited. Resources Policy 30:1–40. https://doi.org/10.1016/j.resourpol.2005.05.001

Tiba S, Frikha M (2019) The controversy of the resource curse and the environment in the SDGs background: the African context. Resources Policy 62:437–452

Tsani S (2013) Natural resources, governance and institutional quality: the role of resource funds. Resources Policy 38(2):181–195

Tvaronavičius V, Tvaronavičiene M (2008) Role of fixed investments in economic growth of country: Lithuania in European context. J Bus Econ Manag 9(1):57–64

Van der Ploeg F (2011) Natural resources: curse or blessing? Journal of Economic Literature 49:366–420. https://doi.org/10.1257/jel.49.2.366

Walid C, Chaker A, Masood O, Fry J (2011) Stock market volatility and exchange rates in emerging countries: a Markov-state switching approach. Emerging Markets Review 12(3):272–292

World Bank (2020) World Bank in Malaysia, Overview. https://www.worldbank.org/en/country/malaysia/overview. Accessed 13 Feb 2021

Yang J, Rizvi SKA, Tan Z, Umar M, Koondhar MA (2021) The competing role of natural gas and oil as fossil fuel and the non-linear dynamics of resource curse in Russia. Resources Policy 72:102100

Availability of data and materials

The datasets used and/or analyzed during the current study are available from the corresponding author upon reasonable request.

Funding

This research was supported by Ministry of Higher Education Malaysia (MOHE), Fundamental Research Grant Scheme, (FRGS/1/2019/SS08/CURTIN/02/1).

Author information

Authors and Affiliations

Contributions

Ramez Abubakr Badeeb: conceptualization; methodology; formal analysis; investigation; writing—review and editing; funding acquisition. Jeremy Clark: writing—review, editing; and supervision. Abey Philip: writing—original draft preparation

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

I am free to contact any of the people involved in the research to seek further clarification and information.

Consent to publish

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Badeeb, R.A., Clark, J. & Philip, A.P. Modeling the time-varying effects of oil rent on manufacturing: implications from structural changes using Markov-switching model. Environ Sci Pollut Res 30, 39012–39028 (2023). https://doi.org/10.1007/s11356-022-25045-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-25045-7