Abstract

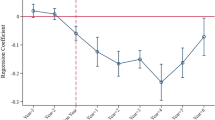

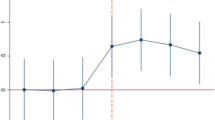

Green bonds, a new green financial instrument, encourage enterprises to achieve high-quality development through green technology innovation. However, a lack of research is currently being conducted into the effect of green bond issuance in China. Can green bonds effectively empower enterprises to green innovation? What is the underlying mechanism? In the context of carbon-neutral strategies, it is significant to answer these questions scientifically. This paper uses a quasi-natural experiment of the launch of the green bond market in China in 2016 to conduct empirical studies based on the panel data of 1 558 non-financial Chinese-listed enterprises from 2015 to 2020 with the multi-period difference-in-difference model. The results show that ① issuing green bonds can significantly empower enterprises’ green technology innovation. The empowering effect is mainly for green utility patents rather than green invention patents. This result remains after dynamic heterogeneity analysis, placebo test, and other tests. In addition, the effect has a lag. ② Heterogeneity tests show that this empowerment effect varies across enterprises with different property rights, industries, and regions. ③ In terms of the mechanism of action, green bonds can enhance enterprises’ ability to innovate green technology by increasing the proportion of long-term loans and improving their debt structure. This paper broadens the relevant literature on the economic consequences of green bonds and the influencing factors of enterprises’ green technology innovation and provides policy suggestions for further improving the analysis of green bonds.

Similar content being viewed by others

Data availability

Data and materials are available from the authors upon request.

Abbreviations

- CSMAR:

-

China Stock Market & Accounting Research Database

- CSRC:

-

China Securities Regulatory Commission

- ST:

-

special treatment

- Gaptatent:

-

green technology Innovation

- Treat:

-

dummy variable for the treatment group and the control group

- Post:

-

policy time dummy variable

- D:

-

the cross-product term of treat and post

- LDR:

-

the ratio of long-term borrowing to the total debt of the enterprise

- Size:

-

total assets at the end (logarithm)

- Debt:

-

total liabilities/total assets

- Tangibility:

-

net fixed assets/total assets

- ROA:

-

net profit/average total assets

- Growth:

-

operating income growth rate

- Cash:

-

net cash flow from operating activities/total assets

- Top1:

-

percentage of shareholding of the largest shareholder

- Board:

-

number of independent directors/number of board of directors

- Age:

-

years of business establishment (logarithm)

- Employee:

-

number of employees (logarithm)

- Tobin’s q:

-

corporate Tobin’s Q

- i:

-

enterprise

- t:

-

year

- α:

-

constant term

- β:

-

coefficient

- X:

-

control variables

- γ:

-

firm fixed effects

- μ:

-

year fixed effects

- ε:

-

residual error term

References

Agliardi E, Agliardi R (2019) Financing environmentally-sustainable projects with green bonds. Environ Dev Econ 24(6):608–623

Bachelet MJ, Becchetti L, Manfredonia S (2019) The green bonds premium puzzle: the role of issuer characteristics and third-party verification. Sustainability 11(4):1098

Bai Y, Song S, Jiao J, Yang R (2019) The impacts of government R&D subsidies on green innovation: evidence from Chinese energy-intensive firms. J Clean Prod 233:819–829

Baldi F, Pandimiglio A (2022) The role of ESG scoring and greenwashing risk in explaining the yields of green bonds: a conceptual framework and an econometric analysis. Glob Financ J 52:100711

Baulkaran V (2019) Stock market reaction to green bond issuance. J Asset Manag 20(5):331–340

Beck T, Levine R, Levkov A (2010) Big bad banks? The winners and losers from bank deregulation in the United States. J Financ 65(5):1637–1667

Boutabba MA, Rannou Y (2022) Investor strategies in the green bond market: the influence of liquidity risks, economic factors and clientele effects. Int Rev Financ Anal 81:102071

Cai X, Zhu B, Zhang H, Li L, Xie M (2020) Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci Total Environ 746:140810

Chen Z, Zhang X, Chen F (2021) Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol Forecast Soc Chang 168:120744

Chukwuma NJ, Famba T, Sun H, Mensah IA, Kurauone O, Li L, Chituku-Dzimiro G (2021) The effect of firm performance on CEO compensation: the moderation role of SOE reform. SN Business Econ 1(11):1–32

Dorfleitner G, Utz S, Zhang R (2022) The pricing of green bonds: external reviews and the shades of green. Rev Manag Sci 16(3):797–834

Fan F, Lian H, Liu X, Wang X (2021) Can environmental regulation promote urban green innovation efficiency? An empirical study based on Chinese cities. J Clean Prod 287:125060

Fang Y, Shao Z (2022) Whether green finance can effectively moderate the green technology innovation effect of heterogeneous environmental regulation. Int J Environ Res Public Health 19(6):3646

Feng S, Chong Y, Li G, Zhang S (2022) Digital finance and innovation inequality: evidence from green technological innovation in China. Environ Sci Pollut Res:1–17

Feng Y, Shen Q (2022) How does green credit policy affect total factor productivity at the corporate level in China: the mediating role of debt financing and the moderating role of financial mismatch. Environ Sci Pollut Res 29(16):23237–23248

Flammer C (2021) Corporate green bonds. J Financ Econ 142(2):499–516

Gao X, Wang S, Ahmad F, Chandio AA, Ahmad M, Xue D (2021) The nexus between misallocation of land resources and green technological innovation: a novel investigation of Chinese cities. Clean Techn Environ Policy 23(7):2101–2115

Hoberg G, Moon SK (2017) Offshore activities and financial vs operational hedging. J Financ Econ 125(2):217–244

Hong M, Li Z, Drakeford B (2021) Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. Int J Environ Res Public Health 18(4):1682

Hu J, Wang Z, Huang Q, Zhang X (2019) Environmental regulation intensity, foreign direct investment, and green technology spillover—an empirical study. Sustainability 11(10):2718

Huang L, Liu S, Han Y, Peng K (2020) The nature of state-owned enterprises and collection of pollutant discharge fees: a study based on Chinese industrial enterprises. J Clean Prod 271:122420

Huang T, Yue Q (2020) How the game changer was generated? An analysis on the legal rules and development of China’s green bond market. Intl Environ Agree Politics Law Econ 20(1):85–102

Jiang M, Feng X, Li L (2021) Market power, intertemporal permits trading, and economic efficiency. Frontiers in Energy Research 328

Jones R, Baker T, Huet K, Murphy L, Lewis N (2020) Treating ecological deficit with debt: the practical and political concerns with green bonds. Geoforum 114:49–58

Kanamura T (2020) Are green bonds environmentally friendly and good performing assets? Energy Econ 88:104767

Karpf A, Mandel A (2018) The changing value of the ‘green’ label on the US municipal bond market. Nat Clim Chang 8(2):161–165

Lai H, Wang F, Guo C (2022) Can environmental awards stimulate corporate green technology innovation? Evidence from Chinese listed companies. Environ Sci Pollut Res 29(10):14856–14870

Lee CC, Tang H, Li D (2022) The roles of oil shocks and geopolitical uncertainties on China’s green bond returns. Econ Anal Policy 74:494–505

Li L, Long X, Laubayeva A, Cai X, Zhu B (2020a) Behavioral intention of environmentally friendly agricultural food: the role of policy, perceived value, subjective norm. Environ Sci Pollut Res 27(15):18949–18961

Li L, Msaad H, Sun H, Tan MX, Lu Y, Lau AK (2020b) Green innovation and business sustainability: new evidence from energy intensive industry in China. Int J Environ Res Public Health 17(21):7826

Li L, Zhu B, Jiang M, Cai X, Lau AK, Shin GC (2020c) The role of service quality and perceived behavioral control in shared electric bicycle in China: does residual effects of past behavior matters? Environ Sci Pollut Res 27(19):24518–24530

Lin B, Su T (2022) Green bond vs conventional bond: outline the rationale behind issuance choices in China. Int Rev Financ Anal 81:102063

Liu C, Xiong M (2022) Green finance reform and corporate innovation: evidence from China. Finance Research Letters: 102993

Liu J, Jiang Y, Gan S, He L, Zhang Q (2022) Can digital finance promote corporate green innovation? Environ Sci Pollut Res 29(24):35828–35840

Liu S, Xu R, Chen X (2021) Does green credit affect the green innovation performance of high-polluting and energy-intensive enterprises? Evidence from a quasi-natural experiment. Environ Sci Pollut Res 28(46):65265–65277

Luo Q, Miao C, Sun L, Meng X, Duan M (2019) Efficiency evaluation of green technology innovation of China’s strategic emerging industries: an empirical analysis based on Malmquist-data envelopment analysis index. J Clean Prod 238:117782

Peng H, Shen N, Ying H, Wang Q (2021) Can environmental regulation directly promote green innovation behavior?——based on situation of industrial agglomeration. J Clean Prod 314:128044

Reboredo JC (2018) Green bond and financial markets: co-movement, diversification and price spillover effects. Energy Econ 74:38–50

Ren XS, Liu YJ, Zhao GH (2020) The impact and transmission mechanism of economic agglomeration on carbon intensity. China Population Resour Environ 30:95–106

Saravade V, Chen X, Weber O, Song X (2022) Impact of regulatory policies on green bond issuances in China: policy lessons from a top-down approach. Climate Policy: 1-12

Sartzetakis ES (2021) Green bonds as an instrument to finance low carbon transition. Econ Chang Restruct 54(3):755–779

Shang L, Tan D, Feng S, Zhou W (2022) Environmental regulation, import trade, and green technology innovation. Environ Sci Pollut Res 29(9):12864–12874

Song M, Wang S, Zhang H (2020) Could environmental regulation and R&D tax incentives affect green product innovation? J Clean Prod 258:120849

Sun H, Zhang Z, Liu Z (2022) Does air pollution collaborative governance promote green technology innovation? Evidence from China. Environ Sci Pollut Res: 1-14

Taghizadeh-Hesary F, Yoshino N (2020) Sustainable solutions for green financing and investment in renewable energy projects. Energies 13(4):788

Tang DY, Zhang Y (2020) Do shareholders benefit from green bonds? J Corp Finan 61:101427

Thio E, Tan M, Li L, Salman M, Long X, Sun H, Zhu B (2022) The estimation of influencing factors for carbon emissions based on EKC hypothesis and STIRPAT model: evidence from top 10 countries. Environ Dev Sustain 24(9):11226–11259

Urbaniec M, Tomala J, Martinez S (2021) Measurements and trends in technological eco-innovation: evidence from environment-related patents. Resources 10(7):68

Wang J, Chen X, Li X, Yu J, Zhong R (2020) The market reaction to green bond issuance: evidence from China. Pac Basin Financ J 60:101294

Wang P, Dong C, Chen N, Qi M, Yang S, Nnenna AB, Li W (2021a) Environmental regulation, government subsidies, and green technology innovation—a provincial panel data analysis from China. Int J Environ Res Public Health 18(22):11991

Wang Q, Zhou Y, Luo L, Ji J (2019) Research on the factors affecting the risk premium of China’s green bond issuance. Sustainability 11(22):6394

Wang X, Wang L, Wang S, Fan F, Ye X (2021b) Marketisation as a channel of international technology diffusion and green total factor productivity: research on the spillover effect from China’s first-tier cities. Tech Anal Strat Manag 33(5):491–504

Xiang X, Liu C, Yang M (2022) Who is financing corporate green innovation? Int Rev Econ Financ 78:321–337

Yang R, Tang W, Zhang J (2021) Technology improvement strategy for green products under competition: the role of government subsidy. Eur J Oper Res 289(2):553–568

Yang Y, Wu D, Xu M, Yang M, Zou W (2022) Capital misallocation, technological innovation, and green development efficiency: empirical analysis based on China provincial panel data. Environmental Science and Pollution Research: 1-14

Yu CH, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255

Zhang D, Jin Y (2021) R&D and environmentally induced innovation: does financial constraint play a facilitating role? Int Rev Financ Anal 78:101918

Zhang Y, Xing C, Wang Y (2020) Does green innovation mitigate financing constraints? Evidence from China’s private enterprises. J Clean Prod 264:121698

Zhang Z, Duan H, Shan S, Liu Q, Geng W (2022) The Impact of green credit on the green innovation level of heavy-polluting enterprises—evidence from China. Int J Environ Res Public Health 19(2):650

Zhao Y, Peng B, Elahi E, Wan A (2021) Does the extended producer responsibility system promote the green technological innovation of enterprises? An empirical study based on the difference-in-differences model. J Clean Prod 319:128631

Zhou XG, Cui YD (2019) Green bonds, corporate performance, and corporate social responsibility. Sustainability 11(23):6881

Funding

This work is supported by the National Natural Science Foundation of China (grant nos. 71673117 and 72004082) and Philosophy and Social Sciences Excellent Innovation Team Construction foundation of Jiangsu province (grant no. SJSZ2020-20).

Author information

Authors and Affiliations

Contributions

Jijian Zhang conceived the topic, combed the relevant literature, and wrote the first draft. Guang Yang chose metrics, built models, and wrote this paper. Xuhui Ding collected and collated the data. Jie Qin collected the data and corrected this paper.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhang, J., Yang, G., Ding, X. et al. Can green bonds empower green technology innovation of enterprises?. Environ Sci Pollut Res 31, 10032–10044 (2024). https://doi.org/10.1007/s11356-022-23192-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-23192-5