Abstract

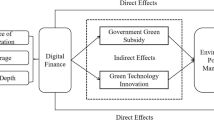

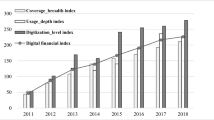

With the continuous advancement of the technological revolution and industrial transformation, environmental governance supported by digital finance has become an important engine for achieving carbon neutrality. Based on panel data from 30 provinces in China, this study discusses the spatial spillover effect and transmission mechanism between digital finance and environmental pollution. Our research results confirm that the inhibitory effect of digital finance on local environmental pollution gradually increases with the improvement of digital finance. Interestingly, digital finance has a significant positive spatial spillover effect on environmental pollution in surrounding areas. The mediating effect shows that digital finance can alleviate environmental pollution by improving technological innovation, industrial upgrading and industrial structure rationalization. A higher degree of marketization and governmental support can increase the positive influences of digital finance on pollution reduction. This research proves the effectiveness of digital finance in improving environmental governance, and it encourages policy-makers around the world to rely on digital finance to promote ecological governance and achieve high-quality economic development.

Similar content being viewed by others

Data availability

Not applicable.

References

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Adams S, Klobodu EKM (2018) Financial development and environmental degradation: does political regime matter? J Clean Prod 197:1472–1479

Al-Mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22(19):14891–14900

Awan U, Shamim S, Khan Z, Zia NU, Shariq SM, Khan MN (2021) Big data analytics capability and decision-making: the role of data-driven insight on circular economy performance. Technol Forecast Soc Chang 168:120766

Butticè V, Vismara S (2021) Inclusive digital finance: the industry of equity crowdfunding. J Technol Transf 47:1–18

Cao S, Nie L, Sun H, Sun W, Taghizadeh-Hesary F (2021) Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327:129458

Chang CP, Wen J, Zheng M (2022) Environmental governance and innovation: an overview. Environ Sci Pollut Res 29:1–2

Chang K, Cheng X, Wang Y, Liu Q, Hu J (2021) The impacts of ESG performance and digital finance on corporate financing efficiency in China. Appl Econ Lett 9:1–8

Chang SC (2015) Effects of financial developments and income on energy consumption. Int Rev Econ Financ 35:28–44

Chen S, Zhang H (2021) Does digital finance promote manufacturing servitization: micro evidence from China. Int Rev Econ Financ 76:856–869

Chen X, Chang CP (2020) Fiscal decentralization, environmental regulation, and pollution: a spatial investigation. Environ Sci Pollut Res 27(25):31946–31968

Demertzis M, Merler S, Wolff GB (2018) Capital Markets Union and the fintech opportunity. J Financ Regul 4(1):157–165

Demirgüç-Kunt A, Klapper LF (2012) Measuring financial inclusion: the global findex database. World Bank Policy Res Work Paper 4:6025–6086

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Dong Q, Wen S, Liu X (2020) Credit allocation, pollution, and sustainable growth: theory and evidence from China. Emerg Mark Financ Trade 56(12):2793–2811

Durai T, Stella G (2019) Digital finance and its impact on financial inclusion. J Emerg Technol Innov Res 6(1):122–127

Feng G, Zhang M (2021) A literature review on digital finance, consumption upgrading and high-quality economic development. J Risk Anal Crisis Response11(4):89–197

Feng Y, Wang X (2020) Effects of urban sprawl on haze pollution in China based on dynamic spatial Durbin model during 2003–2016. J Clean Prod 242:118368

Gomber P, Koch JA, Siering M (2017) Digital finance and FinTech: current research and future research directions. J Bus Econ 87(5):537–580

Han J, Shen Y (2015) Financial development and total factor productivity growth: evidence from China. Emerg Mark Financ Trade 51(sup1):S261–S274

Hao Y, Ba N, Ren S, Wu H (2021) How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain Prod Consum 25:577–590

Isoaho K, Goritz A, Schulz N (2017) Governing clean energy transitions in China and India. Polit Econ Clean Energy Transit 1:231–249

Ketterer JA (2017) Digital Finance. New Times, New Challenges. New Opportunities.-Discussion paper No. IDB-DP-501. Inter-Amer Dev Bank 3:1–45

Khan Z, Hussain M, Shahbaz M, Yang S, Jiao Z (2020) Natural resource abundance, technological innovation, and human capital nexus with financial development: a case study of China. Resour Policy 65:101585

Kusimba S (2018) “It is easy for women to ask!”: gender and digital finance in Kenya. Economic Anthropology 5(2):247–260

Lee CC, Lee CC (2022) How does green finance affect green total factor productivity? Evidence from China. Energy Econ 107:105863

Li J, Wu Y, Xiao JJ (2020) The impact of digital finance on household consumption: evidence from China. Econ Model 86:317–326

Liu J, Jiang Y, Gan S, He L, Zhang Q (2022) Can digital finance promote corporate green innovation? Environ Sci Pollut Res 29(24):35828–35840

Lu Z, Wu J, Li H, Nguyen DK (2022) Local bank, digital financial inclusion and SME financing constraints: empirical evidence from China. Emerg Mark Financ Trade 58(6):1712–1725

Masmoudi K, Abid L, Masmoudi A (2019) Credit risk modeling using Bayesian network with a latent variable. Expert Syst Appl 127:157–166

Moosa I, Ramiah V (2018) Environmental regulation, financial regulation and sustainability. In: Research handbook of finance and sustainability. Edward Elgar Publishing 1:372–385

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ouyang Y, Li P (2018) On the nexus of financial development, economic growth, and energy consumption in China: New perspective from a GMM panel VAR approach. Energy Econ 71:238–252. https://doi.org/10.1016/j.eneco.2018.02.015

Ozili PK (2018) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev 18(4):329–340

Pan X, Ai B, Li C, Pan X, Yan Y (2019) Dynamic relationship among environmental regulation, technological innovation and energy efficiency based on large scale provincial panel data in China. Technol Forecast Soc Chang 144:428–435

Qin L, Raheem S, Murshed M, Miao X, Khan Z, Kirikkaleli D (2021) Does financial inclusion limit carbon dioxide emissions? Analyzing the role of globalization and renewable electricity output. Sustain Dev 29(6):1138–1154

Rehman A, Ma H, Chishti MZ, Ozturk I, Irfan M, Ahmad M (2021) Asymmetric investigation to track the effect of urbanization, energy utilization, fossil fuel energy and CO2 emission on economic efficiency in China: another outlook. Environ Sci Pollut Res 28(14):17319–17330

Ren S, Hao Y, Wu H (2022) How Does Green Investment Affect Environmental Pollution? Evidence from China. Environ Resour Econ 81(1):25–51. https://doi.org/10.1007/s10640-021-00615-4

Ren S, Hao Y, Xu L, Wu H, Ba N (2021) Digitalization and energy: How does internet development affect China’s energy consumption? Energy Econ 98:105220. https://doi.org/10.1016/j.eneco.2021.105220

Shahbaz M, Haouas I, Sohag K, Ozturk I (2020a) The financial development-environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res 27(10):10685–10699

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857

Shahbaz M, Raghutla C, Song M, Zameer H, Jiao Z (2020b) Public-private partnerships investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Energy Econ 86:104664

Shofawati A (2019) The role of digital finance to strengthen financial inclusion and the growth of SME in Indonesia. KnE Soc Sci 3:389–407

Siddik M, Alam N, Kabiraj S (2020) Digital finance for financial inclusion and inclusive growth. In: Digital transformation in business and society, vol 10. Palgrave Macmillan, Cham, pp 155–168

Song Y, Liu D, Wang Q (2021) Identifying characteristic changes in club convergence of China’s urban pollution emission: a spatial-temporal feature analysis. Energy Econ 98:105243

Sorrell S, Dimitropoulos J, Sommerville M (2009) Empirical estimates of the direct rebound effect: a review. Energy Policy 37(4):1356–1371

Sun C (2020) Digital finance, technology innovation, and marine ecological efficiency. J Coast Res 108(SI):109–112

Wan J, Pu Z, Tavera C (2022) The impact of digital finance on pollutants emission: evidence from Chinese cities. Environ Sci Pollut Res 1:1–20

Wang X, Luo Y (2020) Has technological innovation capability addressed environmental pollution from the dual perspective of FDI quantity and quality? Evidence from China. J Clean Prod 258:120941

Winiecki J, Kumar K (2014) Access to energy via digital finance: overview of models and prospects for innovation. Consultative Group to Assist the Poor (CGAP), Washington, DC, USA, pp 1–29

Wu H, Hao Y, Ren S (2020) How do environmental regulation and environmental decentralization affect green total factor energy efficiency: evidence from China. Energy Econ 91:104880

Wu H, Xue Y, Hao Y, Ren S (2021) How does internet development affect energy-saving and emission reduction? Evidence from China. Energy Econ 103:105577

Xu F, Wang Z, Chi G, Zhang Z (2020) The impacts of population and agglomeration development on land use intensity: new evidence behind urbanization in China. Land Use Policy 95:104639

Xu Z, Sun T (2021) The Siphon effects of transportation infrastructure on internal migration: evidence from China’s HSR network. Appl Econ Lett 28(13):1066–1070

Yang D, Wang G, Lu M (2020) Marketization level, government intervention and firm M&As: evidence from the local SOEs in China. Appl Econ Lett 27(5):378–382

Yang X, Wang J, Cao J, Ren S, Ran Q, Wu H (2021a) The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: evidence from 269 cities in China. Empir Econ 11:1–29

Yang X, Wang W, Wu H, Wang J, Ran Q, Ren S (2021c) The impact of the new energy demonstration city policy on the green total factor productivity of resource-based cities: empirical evidence from a quasi-natural experiment in China. J Environ Plann Manag 7:1–34

Yang X, Wu H, Ren S, Ran Q, Zhang J (2021b) Does the development of the internet contribute to air pollution control in China? Mechanism discussion and empirical test. Struct Chang Econ Dyn 56:207–224

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26(8):7926–7937

Zhu B, Zhang M, Zhou Y, Wang P, Sheng J, He K, ... Xie R (2019) Exploring the effect of industrial structure adjustment on interprovincial green development efficiency in China: a novel integrated approach. Energy Policy, 134, 110946

Zhu J, Chen L, Liao H (2022) Multi-pollutant air pollution and associated health risks in China from 2014 to 2020. Atmos Environ 268:118829

Funding

This work was supported by the Major Program of the National Social Science Foundation of China (21&ZD151) and the Beijing Commercial Development Research Center (JD-YB-2022–050).

Author information

Authors and Affiliations

Contributions

Qingjie Zhou: conceptualization, methodology, funding acquisition, and supervision. Mingyue Du: conceptualization, project administration, formal analysis, data curation, and writing-original draft. Yifan Hou: writing-review and editing and validation. Siyu Ren: conceptualization, methodology, and supervision.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Du, M., Hou, Y., Zhou, Q. et al. Going green in China: how does digital finance affect environmental pollution? Mechanism discussion and empirical test. Environ Sci Pollut Res 29, 89996–90010 (2022). https://doi.org/10.1007/s11356-022-21909-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21909-0