Abstract

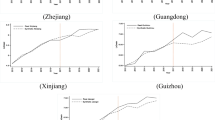

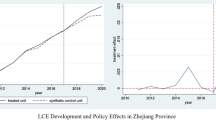

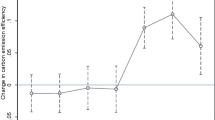

As a new financial model that balances economic and ecological benefits, green finance (GF) plays an important role in promoting green economic development and ecological environmental protection. Based on the panel data set of 30 provinces in China from 2010 to 2020, this paper uses the synthetic control method (SCM) to explore the impact of the green financial reform pilot policy (GFRP) on the green technology innovation (GTI) capabilities of pilot areas and evaluate the policy effects. The specific research conclusions are as follows: (1) On the whole, the GFRP has a positive role in promoting the GTI capability of the pilot areas, but this role is different due to the different resources, environment, and economic development levels of each region. The areas with economic development levels in the middle and head are obviously affected by the policy, and the less developed areas are less affected by the policy or even have a restraining effect. (2) Although the pilot policy has improved the GTI capability of the pilot area, the promotion effect is unstable, that is, the implementation effect of the policy is unstable. In the early stage of policy implementation, the promotion effect of the policy on the regional GTI capacity is the most obvious, and this promotion effect begins to show a downward or stable trend in the 2–3 years after the policy is implemented. Based on the above conclusions, it can provide some reference for the revision and improvement of GFRP.

Similar content being viewed by others

Data availability

The dataset used in this research is available from the corresponding author on reasonable request.

References

Abadie A, Gardeazabal J (2003) The economic costs of conflict: a case study of the Basque Country. Am Econ Rev 93:113–132

Abadie A, Diamond A, Hainmueller J (2010) Synthetic control methods for comparative case studies: estimating the effect of California’s Tobacco Control Program. J Am Stat Assoc 105:493–505

Abadie A, Diamond A, Hainmueller J (2015) Comparative politics and the synthetic control method. Am J Polit Sci 59:495–510

Athey S, Imbens GW (2017) The state of applied econometrics: causality and policy evaluation. J Econ Perspect 31:3–32

Awawdeh AE, Ananzeh M, El-khateeb AI, Aljumah A (2022) Role of green financing and corporate social responsibility (CSR) in technological innovation and corporate environmental performance: a COVID-19 perspective. China Finance Rev Int 12(2):297–316. https://doi.org/10.1108/cfri-03-2021-0048

Bai JC, Chen ZL, Yan X, Zhang YY (n.d.) Research on the impact of green finance on carbon emissions: evidence from China. Ekon. Istraz., 20

Cao SP, Nie L, Sun HP, Sun WF, Taghizadeh-Hesary F (2021) Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327:13

Chen X, Chen ZG (2021) Can green finance development reduce carbon emissions? Empirical evidence from 30 Chinese provinces. Sustainability 13:18

Ding WN, Han BT, Zhao X, Mazzanti M (2015) How does green technology influence CO2 emission in China? - An empirical research based on provincial data of China. J.Environ.Biol. 36:745–753

Du G, Yu M, Sun CW, Han Z (2021) Green innovation effect of emission trading policy on pilot areas and neighboring areas: an analysis based on the spatial econometric model. Energy Policy 156:10

Du KR, Li JL (2019) Towards a green world: how do green technology innovations affect total-factor carbon productivity. Energy Policy 131:240–250

Du KR, Li PZ, Yan ZM (2019) Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol Forecast Soc Chang 146:297–303

Fang Z, Gao X, Sun CW (2020) Do financial development, urbanization and trade affect environmental quality? Evidence from China. J Clean Prod 259:11

Guo YY, Xia XN, Zhang S, Zhang DP (2018) Environmental regulation, government R&D funding and green technology innovation: evidence from China provincial data. Sustainability 10:21

Hafner S, Jones A, Anger-Kraavi A, Pohl J (2020) Closing the green finance gap - a systems perspective. Environ Innov Soc Trans 34:26–60

Hao FJ, Xie YT, Liu XJ (2020) The Impact of Green Credit Guidelines on the Technological Innovation of Heavily Polluting Enterprises: A Quasi-Natural Experiment from China. Math Probl Eng 2020:13

He LY, Liu RY, Zhong ZQ, Wang DQ, Xia YF (2019a) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984

He LY, Zhang LH, Zhong ZQ, Wang DQ, Wang F (2019b) Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J Clean Prod 208:363–372

Hsu CC, Quang-Thanh N, Chien FS, Li L, Mohsin M (2021) Evaluating green innovation and performance of financial development: mediating concerns of environmental regulation. Environ Sci Pollut Res 28:57386–57397

Hu J, Li JC, Li XY, Liu YY, Wang WW, Zheng LS (2021) Will Green Finance Contribute to a Green Recovery? Evidence From Green Financial Pilot Zone in China. Front Public Health 9:14

Huang HF, Zhang J (2021) Research on the Environmental Effect of Green Finance Policy Based on the Analysis of Pilot Zones for Green Finance Reform and Innovations. Sustainability 13:14

Lee CC, Lee CC (2022) How does green finance affect green total factor productivity?. Evidence from China. Energy Economics 107:15

Li S, Zhang W, Zhao J (2022): Does green credit policy promote the green innovation efficiency of heavy polluting industries?-empirical evidence from China’s industries. Environ. Sci. Pollut. Res., 16

Ling SX, Han GS, An D, Hunter WC, Li H (2020) The impact of green credit policy on technological innovation of firms in pollution-intensive industries: evidence from China. Sustainability 12:16

Liu Q, Wang W, Chen H (2020) A study of the impact of Green Credit Guidelines implementation on innovation performance in heavy polluting enterprises. Sci Res Manag 41:100–112

Liu RY, Wang DQ, Zhang L, Zhang LH (2019) Can green financial development promote regional ecological efficiency? A case study of China. Nat Hazards 95:325–341

Liu Y, Liu M, Wang GG, Zhao LL, An P (2021) Effect of environmental regulation on high-quality economic development in china-an empirical analysis based on dynamic spatial Durbin model. Environ Sci Pollut Res 28:54661–54678

Luo YS, Salman M, Lu ZN (2021) Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci Total Environ 759:11

Mngumi F, Shaorong SR, Shair F, Waqas M (2022): Does green finance mitigate the effects of climate variability: role of renewable energy investment and infrastructure. Environ. Sci. Pollut. Res., 13

Ning YY, Cherian J, Sial MS, Alvarez-Otero S, Comite U, Zia-Ud-Din M (2022): Green bond as a new determinant of sustainable green financing, energy efficiency investment, and economic growth: a global perspective. Environ. Sci. Pollut. Res., 16

Peng WB, Yin Y, Kuang CG, Wen ZZ, Kuang JS (2021) Spatial spillover effect of green innovation on economic development quality in China: evidence from a panel data of 270 prefecture-level and above cities. Sustain Cities Soc 69:9

Petruzzelli AM, Dangelico RM, Rotolo D, Albino V (2011) Organizational factors and technological features in the development of green innovations: evidence from patent analysis. Innov Organ Manag 13:291–310

Ren Z, Huang C, Shi N (2020): Study on the contribution of financial innovation and opening to economic growth in Shanghai FTZ: from the perspective of policy effect of financial industry China Soft Sci, 184-192

Shang LN, Tan DQ, Feng SL, Zhou WT (2022) Environmental regulation, import trade, and green technology innovation. Environ Sci Pollut Res 29:12864–12874

Sheng PF, Li J, Zhai MX, Huang SJ (2020) Coupling of economic growth and reduction in carbon emissions at the efficiency level: evidence from China. Energy 213:12

Sinha A, Mishra S, Sharif A, Yarovaya L (2021) Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J Environ Manage 292:13. https://doi.org/10.1016/j.jenvman.2021.112751

Soundarrajan P, Vivek N (2016) Green finance for sustainable green economic growth in India. Agric Econ 62:35–44

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett 31:98–103

Taghizadeh-Hesary F, Yoshino N (2020) Sustainable solutions for green financing and investment in renewable energy projects. Energies 13:18

Tan Z, Cheng B (2018) Analysis of the net policy effect of the western development. China Population Resour Environ 28:169–176

Wang MX, Li YL, Liao GK (2021a) Research on the impact of green technology innovation on energy total factor productivity, based on provincial data of China. Front Environ Sci 9:11

Wang MY, Li YM, Li JQ, Wang ZT (2021b) Green process innovation, green product innovation and its economic performance improvement paths: a survey and structural model. J Environ Manag 297:12

Wang XY, Wang Q (2021) Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Res Policy 74:10

Wang XY, Zhao DS, Zhang LL, Hu HQ, Ma YD, Ma JY (2021c) Relations between upgrading of industrial structure, innovation of green technology and water environmental pollution: estimation based on dynamic simultaneous equation. Desalin Water Treat 218:80–86

Wang XY, Zhao HK, Bi KX (2021d) The measurement of green finance index and the development forecast of green finance in China. Environ Ecol Stat 28:263–285

Wang XY (2022) Research on the impact mechanism of green finance on the green innovation performance of China’s manufacturing industry. Manag. Decis. Econ., 26

Wang XY, Sun XM, Zhang HT, Xue CK (2022a) Digital economy development and urban green innovation CA-pability: based on panel data of 274 prefecture-level cities in China. Sustainability 14:21

Wang Y, Chen H, Long R, Sun Q, Jiang S, Liu B (2022b) Has the sustainable development planning policy promoted the green transformation in China’s resource-based cities? Resources, Conservation and Recycling 180

Xiong Q, Sun D (2022) Influence analysis of green finance development impact on carbon emissions: an exploratory study based on fsQCA. Environ. Sci. Pollut. Res., 12

Yang YX, Su X, Yao SL (2021) Nexus between green finance, fintech, and high-quality economic development: empirical evidence from China. Res Policy 74:8

Zeng YT, Wang F, Wu J (2022) The impact of green finance on urban haze pollution in China: a technological innovation perspective. Energies 15(3):20. https://doi.org/10.3390/en15030801

Zhao PJ, Zeng LE, Lu HY, Zhou Y, Hu HY, Wei XY (2020) Green economic efficiency and its influencing factors in China from 2008 to 2017: based on the super-SBM model with undesirable outputs and spatial Dubin model. Sci Total Environ 741:17

Zhou XG, Tang XM, Zhang R (2020) Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ Sci Pollut Res 27:19915–19932

Zhou XX, Du JT (2021) Does environmental regulation induce improved financial development for green technological innovation in China? J Environ Manag 300:12

Funding

Funding This work was supported by the project supported by the National Social Science Fund of China (19BGL276). The authors are grateful for the receipt of these funds.

Author information

Authors and Affiliations

Contributions

XW: Conceptualization, Data collection, Statistical analysis, Writing-original draft. XS: Conceptualization, Supervision, Funding acquisition and writing, Review and editing. HZ: Writing, Review and editing, Supervision. CX: Data curation, Project administration, Writing-original draft

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This article does not contain any studies with human participants or animals performed by any of the authors.

Consent for publication

All authors have consent for the publication of the manuscript.

Consent to participate

All authors contributed voluntarily to this study.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, X., Sun, X., Zhang, H. et al. Does green financial reform pilot policy promote green technology innovation? Empirical evidence from China. Environ Sci Pollut Res 29, 77283–77299 (2022). https://doi.org/10.1007/s11356-022-21291-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21291-x