Abstract

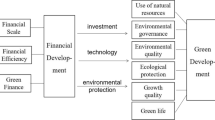

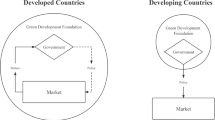

Deeply understanding the driving effect of green finance on green development is of great significance to promote economic transformation and realize the long-term green development. This paper uses the entropy method and undesirable-SE-SBM model to measure provincial green finance and green development efficiency respectively from 2008 to 2018. And based on the above, the panel threshold model is constructed to discuss the nonlinear relationship between green finance and green development efficiency from the first empirical verification. The results show that ① the impact of green finance on green development has a significant single threshold effect, only when R&D investment crosses 2.810 can green finance significantly promote green development efficiency, and before that, it will suppress green development efficiency. ②At present, a few provinces in China have crossed the threshold value of R&D investment, only including Beijing, Tianjin, and Shanghai, while the R&D investment of Jiangsu, Zhejiang, Shandong, and Guangdong gradually approaches the threshold value. Therefore, improving the construction of the green financial system, correctly guiding the direction of green capital investment, and strengthening the supervision of environmental information disclosure are important.

Similar content being viewed by others

Data availability

Data and materials are available from the authors upon request.

References

Andersen P, Petersen NC (1993) A procedure for ranking efficiency units in data envelopment analysis. Manage Sci 39:1261–1265

Carolyn F (2017) Environmental Protection for Sale: Strategic Green Industrial Policy and Climate Finance. Environ Resour Econ 66(3):553–575

Chen LL, Zhang XD, He F, Yuan RS (2019) Regional green development level and its spatial relationship under the constraints of haze in China. J Clean Prod 210:376–387

Chen YF, Ma YB (2021) Does green investment improve energy firm performance? Energy Policy 153(1):112252

Fei RL, Cui AX, Qin KY (2020) Can technology R&D continuously improve green development level in the open economy? Empirical evidence from China’s industrial sector. Environ Sci Pollut Res Int 27(27):34052–34066

Flammer C (2021) Corporate green bonds. J Financ Econ 142(2):499–516

Guo FY, Gao SQ, Tong LJ, Ren JM (2022) Spatio-temporal evolution track and influencing factors of green development efficiency in Yellow River Basin. Geogr Res 41(1):167–180 (Chinese)

Guo YH, Tong LJ, Mei L (2020) The effect of industrial agglomeration on green development efficiency in Northeast China since the revitalization. J Clean Prod 258:120584

Hansen B (1999) Threshold effects in non-dynamic panels estimation, testing, and inference. J Econ 93(2):345–368

He LY, Zhang LH, Zhong ZQ, Wang DQ, Wang F (2019) Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J Clean Prod 208:363–372

Hu G, Wang X, Wang Y (2021) Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ 98(3):105134

Hu QQ, Li X, Feng YH (2022) Do green credit affect green total factor productivity? Empirical Evidence from China. Front Energy Res 9:821242

Hu YQ, Jiang HY, Zhong ZQ (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27(2):10506–10519

Jiang HL, Wang WD, Wang L, Wu JH (2020) The effects of the carbon emission reduction of china’s green finance——an analysis based on green credit and green venture investment. Finance Forum 25(11):39-48+80 (Chinese)

Jiang LL, Wang H, Tong AH, Hu ZF, Duan HJ, Zhang XL, Wang YF (2020b) The measurement of green finance development index and its poverty reduction effect: dynamic panel analysis based on improved entropy method. Discret Dyn Nat Soc 2020:8851684

Jiang MX, Feng XL, Li L (2021) Market power, intertemporal permits trading and economic efficiency. Front Energy Res 9:704556

Jiang NP, Xiang RK (2013) Some problems of green economic development in China. Contemp Econ Res 2:50–54

Jin Y, Gao XY, Wang M (2021) The financing efficiency of listed energy conservation and environmental protection firms: evidence and implications for green finance in China. Energy Policy 153:112254

Kayani GM, Ashfaq S, Siddique A (2020) Assessment of financial development on environmental effect: implications for sustainable development. J Clean Prod 261:120984

Li D, Zeng T (2020) Are China’s intensive pollution industries greening? An analysis based on green innovation efficiency. J Clean Prod 259:120901

Li FR, Shang YZ, Yun Z, Xue ZY (2022) The impact of foreign direct investment on China's green development: evidence from 260 prefecture level cities in china. Econ Problems 4:75–84 (Chinese)

Li G, Zhou Y, Liu F, Wang T (2021) Regional differences of manufacturing green development efficiency considering undesirable outputs in the yangtze river economic belt based on super-SBM and WSR system methodology. Front Environ Sci 8:631911

Li L, Msaad H, Sun HP, Tan MX, Lu YQ, Lau AKW (2020) Green innovation and business sustainability: new evidence from energy intensive industry in China. Int J Environ Res Public Health 17(21):7826

Li LH, Yue YF (2019) Evaluation of green development efficiency in China Based on four-stage DEA model. Sci Technol Manag Res 39(24):247–258 (Chinese)

Li XX, Xia G, Cai N (2015) Green finance and sustainable development. Finance Forum 20(10):30–40 (Chinese)

Liu JY, Xia Y, Fan Y, Lin SM, Wu J (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302

Liu K, Qiao YR, Zhou Q (2021a) Analysis of China’s industrial green development efficiency and driving factors: research based on MGWR. Int J Environ Res Public Health 18(8):3960

Liu NN, Liu CZ, Xia YF, Ren Y, Liang JZ (2020) Examining the coordination between green finance and green economy aiming for sustainable development: a case study of China. Sustainability 12(9):3717

Liu RY, Wang DQ, Zhang L, Zhang LH (2019) Can green financial development promote regional ecological efficiency? A case study of China. Nat Hazards 95(1–2):325–341

Liu Y, Tian LX, Xie ZY, Zhen ZL, Sun HP (2021b) Option to survive or surrender: carbon asset management and optimization in thermal power enterprises from China. J Clean Prod 314:128006

Luo X, Zhang WY (2020) Green innovation efficiency: a threshold effect of research and development. Clean Technol Environ Policy 23(1):285–298

Ma L (2019) Promoting green development with green finance. People’s Tribune 24:72–73 (Chinese)

Mahat TJ, Blaha L, Uprety B, Bittner M (2019) Climate finance and green growth: reconsidering climate-related institutions, investments, and priorities in Nepal. Environ Sci Eur 31:46

Peng BH, Yan WM, Elahi WAX (2021) Does the green credit policy affect the scale of corporate debt financing? Evidence from listed companies in heavy pollution industries in China. Environ Sci Pollut Res Int 29(1):755–767

Qiu FD, Chen Y, Tan JT, Liu JB, Zheng ZY, Zhang XL (2020) Spatial-temporal heterogeneity of green development efficiency and its influencing factors in growing metropolitan area: a case study for the Xuzhou Metropolitan area. Chin Geogra Sci 30(2):352–365

Qu Y, Yu Y, Appolloni A, Li MR, Liu Y (2017) Measuring green growth efficiency for Chinese manufacturing industries. Sustainability 9(4):637

Ramli NA, Munisamy S (2015) Eco-efficiency in greenhouse emissions among manufacturing industries: A range adjusted measure. Econ Model 47:219–227

Ren XD, Shao QL, Zhong RY (2020) Nexus between green finance, non-fossil energy use, and carbon intensity: empirical evidence from China based on a vector error correction model. J Clean Prod 277:122844

Salazar J (1998) Environmental finance: Linking two world. Present Workshop Financ lnnvotions Biodivers BratisIava 1:2–18

Sinha A, Mishra S, Sharif A, Yarovaya L (2021) Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J Environ Manag 292:112751

Song ML, Xie QJ, Shen ZY (2021) Impact of green credit on high-efficiency utilization of energy in China considering environmental constraints. Energy Policy 153:112267

Soundarrajan P, Vivek N (2016) Green finance for sustainable green economic growth in India. Agric Econ 62(1):35–44

Tone K (2001) A Slacks-based Measure of Efficiency in Data Envelopment Analysis. Eur J Oper Res 130:498–509

Wang XY, Zhao HK, Bi KX (2021a) The measurement of green finance index and the development forecast of green finance in China. Environ Ecol Stat 28(2):263–285

Wang YL, Zhao N, Lei XD, Long RY (2021b) Green Finance Innovation and Regional Green Development. Sustainability 13(15):8230

Wen HW, Lee CC, Zhou FX (2021) Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ 94:105099

Xu XK, Li JS (2020) Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J Clean Prod 264:121574

Yang LS, Ni MY (2022) Is financial development beneficial to improve the efficiency of green development? Evidence from the “Belt and Road” countries. Energy Econ 105:105734

Ye TF, Zheng H, Ge XY, Yang KL (2021) Pathway of green development of Yangtze River economics belt from the perspective of green technological innovation and environmental regulation. Int J Environ Res Public Health 18(19):10471

Yu CH, Wu XQ, Zhang DY, Chen S, Zhao JS (2021a) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153(1):112255

Yu DS, Li XP, Yu JJ, Li H (2021b) The impact of the spatial agglomeration of foreign direct investment on green total factor productivity of Chinese cities. J Environ Manag 290:112666

Zhang DY, Mohsin M, Rasheed AK, Chang Y, Taghizadeh-Hesary F (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy 153:112256

Zhang N, Deng JQ, Ahmad F, Draz MU (2020) Local government competition and regional green development in China: the mediating role of environmental regulation. Int J Environ Res Public Health 17(10):3485

Zhang SL, Wang Y, Hao Y, Liu ZW (2021) Shooting two hawks with one arrow: could China’s emission trading scheme promote green development efficiency and regional carbon equality? Energy Econ 101:105412

Zhou YY, Xu YR, Liu CZ, Fang ZQ, Fu XY, He MZ (2019) The threshold effect of China’s financial development on green total factor productivity. Sustainability 11(14):3776

Zhu BZ, Zhang MF, Huang LQ, Wang P, Su B, Wei YM (2020) Exploring the effect of carbon trading mechanism on China’s green development efficiency: a novel integrated approach. Energy Econ 85:104601

Zhu BZ, Zhang MF, Zhou YH, Wang P, Sheng JC, He KJ, Wei YM, Xie R (2019) Exploring the effect of industrial structure adjustment on interprovincial green development efficiency in China: a novel integrated approach. Energy Policy 134:110946

Funding

This work is supported by the National Natural Science Foundation of China (Grant Nos. 71673117 and 72004082).

Author information

Authors and Affiliations

Contributions

Jijian Zhang conceived the idea and wrote the original draft. Fengqin Li constructed the model and wrote this paper. Xuhui Ding collected and collated data.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent to publish

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, J., Li, F. & Ding, X. Will green finance promote green development: based on the threshold effect of R&D investment. Environ Sci Pollut Res 29, 60232–60243 (2022). https://doi.org/10.1007/s11356-022-20161-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-20161-w