Abstract

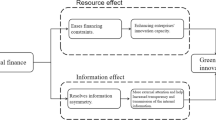

Recently, the rapid development of digital finance in China has exerted a subtle influence on many aspects of social and economic development. However, the research on the impact of digital finance on corporate green innovation is rather lacking. In order to fill this gap, this paper uses the “Peking University Digital Finance Index” to evaluate the micro impact of financial innovation development on environmental governance from the firm level. The results show that digital finance can significantly improve the quantity and quality of corporate green innovation, and this effect still exists after considering endogeneity and a series of robustness tests. The promotion effect of digital finance on the quantity and quality of corporate green innovation is more obvious in state-owned, eastern, and mature enterprises. In addition, we find the mechanism behind the positive relationship between digital finance and corporate green innovation: digital finance makes firms more transparent and funds flow more convenient. Overall, this paper provides a micro explanation of environmental governance for the accelerated popularization of digital finance in emerging markets, which is urgently needed for most emerging economies seeking high-quality development.

Similar content being viewed by others

Data availability

Not applicable.

Code availability

Source codes are available on request.

Notes

By the end of 2018, the number of patent applications processed in China had topped the world for eight consecutive years, almost equal to the total number of applications from the second to the 11th place. However, according to the “2018 Global Innovation Index Report” released by the World Intellectual Property Organization (WIPO) and Cornell University in the United States, China ranked only 17th in innovation The gap also reflects the low quality of Innovation in China.

Eastern provinces include Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian,

Shandong, Guangdong, Guangxi, and Hainan; The central & western provinces include Shanxi, Inner Mongolia, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan, Sichuan, Chongqing, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Ningxia, Qinghai, and Xinjiang.

References

Abdullah M, Zailani S, Iranmanesh M, Jayaraman K (2016) Barriers to green innovation initiatives among manufacturers: the malaysian case. RMS 10(4):1–27

Aghion P, Akcigit U, Bergeaud A et al (2019) Innovation and top income inequality. Rev Econ Stud 86(1):1–45

Aivazian V, Gu X, Qiu J et al (2015) Loan collateral, corporate investment, and business cycle. J Bank Finance 55:380–392

Akcigit U, Baslandze S, Stantcheva S (2016) Taxation and the international mobility of inventors. American Economic Review 106(10):2930–2981

Amore MD, Bennedsen M (2016) Corporate governance and green innovation. J Environ Econ Manag 75(1):54–72

Arena C, Michelon G, Trojanowski G (2018) Big egos can be green: a study of CEO hubris and environmental innovation. Br J Manag 29(2):316–336

Arranz N, Arroyabe M, Li J et al (2020) Innovation as a driver of eco-innovation in the firm: an approach from the dynamic capabilities theory. Bus Strateg Environ 29(3):1494–1503

Awan U, Arnold MG, Gölgeci I (2021) Enhancing green product and process innovation: towards an integrative framework of knowledge acquisition and environmental investment. Bus Strateg Environ 30(2):1283–1295

Ayyagari M, Demirgüç-Kunt A, Maksimovic V (2010) Formal versus informal finance: evidence from China. Rev Financ Stud 23(8):3048–3097

Barbieri, N., Marzucchi, A., Rizzo, U. 2020. Knowledge sources and impacts on subsequent inventions: do green technologies differ from non-green ones? Res Policy, 2020, 49(2), 103901.

Barron DN, West E, Hannan MT (1994) A time to grow and a time to die: growth and mortality of credit unions in New York City, 1914–1990. Am J Sociol 100(2):381–421

Beck T, Pamuk H, Ramrattan R, Uras BR (2018) Payment instruments, finance and development. J Dev Econ 133(7):162–186

Bendell BL (2017) I don’t want to be green: prosocial motivation effects on firm environmental innovation rejection decisions. J Bus Ethics 143(2):277–288

Bollaert. H., de Silanes F. L., Schwienbacher. A. 2021. Fintech and access to finance. J Corp Financ 68, 101941.

Buchak G, Matvos G, Piskorski T, Seru A (2018) Fintech, regulatory arbitrage, and the rise of shadow banks. J Financ Econ 130(3):453–483

Cai X, Lu Y, Wu M et al (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85

Cai, X., Zhu, B. Z., Zhang, H. J., Li, L., Xie, M. Y. 2020. Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci Total Environ 746(12), 140810.

Cao, S., Nie, L., Sun, H., et al. Digital finance, green technological innovation and energy-environmental performance: Evidence from China's regional economies[J]. J Clean Prod 2021, 327: 129458.

Carrión-Flores CE, Innes R (2010) Environmental innovation and environmental performance. J Environ Econ Manag 59(1):27–42

Chang YK, Oh WY, Park JH et al (2017) Exploring the relationship between board characteristics and CSR: empirical evidence from Korea. J Bus Ethics 140(2):225–242

Chava S, Oettl A, Subramanian A et al (2013) Banking deregulation and innovation. J Financ Econ 109(3):759–774

Chen L, Zhao X (2006) On the relation between the market-to-book ratio, growth opportunity, and leverage ratio. Financ Res Lett 3(4):253–266

Z Chen Z Liu Suárez. Serrato. J. C., et al 2021 Notching R&D investment with corporate income tax cuts in China Am Econ Rev 111 7 2065 2100

Chong TTL, Lu L, Ongena S (2013) Does banking competition alleviate or worsen credit constraints faced by small-and medium-sized enterprises? Evidence from China. J Bank Finance 37(9):3412–3424

Coles JL, Daniel ND, Naveen L (2008) Boards: does one size fit all? J Financ Econ 87(2):329–356

David-West O, Iheanachor N, Kelikume I (2018) A resource-based view of digital financial services (DFS): an exploratory study of Nigerian providers. J Bus Res 88:513–526

Elmagrhi MH, Ntim CG, Elamer AA, Zhang Q (2018) A study of environmental policies and regulations, governance structures, and environmental performance: the role of female directors. Bus Strateg Environ 28(1):206–220

EIA. 2019. International Energy Outlook 2019 With Projections to 2050. Retrieved from: <https://www.eia.gov/outlooks/ieo/pdf/ieo2019.pdf>.

Gabor D, Brooks S (2017) The digital revolution in financial inclusion: international development in the fintech era. New Political Econ 22(4):1–14

Gomber P, Koch JA, Siering M (2017) Digital finance and fintech: current research and future research directions. J Bus Econ 87(5):537–580

Gomber P, Kauffman RJ, Parker C, Weber BW (2018) On the fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J Manag Inf Syst 35(1):220–265

González-Benito J, González-Benito Ó (2010) A study of determinant factors of stakeholder environmental pressure perceived by industrial companies. Bus Strateg Environ 19(3):164–181

Guo F, Wang JY, Wang F, Kong T, Zhang X, Cheng ZY (2020) Measuring China’s digital financial inclusion: index compilation and spatial characteristics. China Econ Q (In Chinese) 19(4):1401–1418

He JJ, Tian X (2013) The dark side of analyst coverage: The case of innovation. J Financ Econ 109(3):856–878

Hottenrott H, Peters B (2012) Innovative capability and financing constraints for innovation: more money, more innovation? Rev Econ Stat 94(4):1126–1142

Hu AGZ, Zhang P, Zhao L (2017) China as number one? Evidence from China’s most recent patenting surge. J Dev Econ 124:107–119

Hu, C., Mao, J., Tian, M., et al. 2021. Distance matters: investigating how geographic proximity to ENGOs triggers green innovation of heavy-polluting firms in China. J Environ Manage 2021, 279: 111542.

Huang YP, Huang Z (2018) The development of digital finance in China: present and future. China Econ Q (In Chinese) 17(4):1489–1502

Huang ZH, Liao GK, Li ZH (2019) Loaning scale and government subsidy for promoting green innovation. Technol Forecast Soc Chang 144(7):148–156

Hvide HK, Jones BF (2018) University innovation and the professor’s privilege. Am Econ Rev 108(7):1860–1898

Jain S, Gabor D (2020) The rise of digital financialisation: the case of india. New Political Econ 25(5):813–828

Jin. Y., Gao. X., Wang. M. 2021. The financing efficiency of listed energy conservation and environmental protection firms: Evidence and implications for green finance in China. Energy Policy, 153: 112254.

Kim. I., Pantzalis. C., Zhang. Z. 2021. Multinationality and the value of green innovation. J Corp Financ 69: 101996.

Knaack P, Gruin J (2020) From shadow banking to digital financial inclusion: china’s rise and the politics of epistemic contestation within the financial stability board. Rev Int Political Econ 2:1–25

Kshetri N (2016) Big data’s role in expanding access to financial services in china. Int J Inf Manage 36(3):297–308

Laeven L, Levine R, Michalopoulos S (2015) Financial innovation and endogenous growth. J Financ Intermed 24(1):1–24

Li D, Zhao Y, Zhang L, Chen X, Cao C (2018) Impact of quality management on green innovation. J Clean Prod 170(1):462–470

Li J, Wu Y, Xiao JJ (2020) The impact of digital finance on household consumption: evidence from china. Econ Model 86(3):317–326

Li, W.A., Zhang, Y.W., Zheng, M.N., Li X.L., Cui, G.Y., Li, H. 2019. Research on green governance of Chinese listed companies and its evaluation. J Manage World (In Chinese), 35(5), 126–133+160.

Li WJ, Zheng MN (2016) Is it substantive innovation or strategic innovation? - Impact of macroeconomic policies on micro – enterprises’ innovation. Econ Res J (In Chinese) 51(4):60–73

Liang XQ (2020) An empirical study on the effects of digital financial inclusion on local tax. J Audit Econ (In Chinese) 35(5):96–104

Lin M, Prabhala NR, Viswanathan S (2013a) Judging borrowers by the company they keep: friendship networks and information asymmetry in online peer-to-peer lending. Manage Sci 59(1):17–35

Lin RJ, Tan KH, Geng Y (2013b) Market demand, green product innovation, and firm performance: evidence from Vietnam motorcycle industry. J Clean Prod 40:101–107

Liu Q, Qiu LD (2016) Intermediate input imports and innovations: evidence from Chinese firms’ patent filings. J Int Econ 103:166–183

Lu J, Wang W (2018) Managerial conservatism, board independence and corporate innovation. J Corp Finan 48:1–16

Lyandres E, Palazzo B (2016) Cash holdings, competition, and innovation. J Financ Quantitat Anal 51(6):1823–1861

Miao C, Fang D, Sun L, Luo Q (2017) Natural resources utilization efficiency under the influence of green technological innovation. Resour Conserv Recycl 126:153–161

Michalopoulos S, Levine R, Laeven LA (2015) Financial innovation and endogenous growth. J Financ Intermed 24:1–24

Mollick E (2014) The dynamics of crowdfunding: an exploratory study. J Bus Ventur 29(1):1–16

Norden L, Buston CS, Wagner W (2014) Financial innovation and bank behavior: evidence from credit markets. J Econ Dyn Control 43(6):130–145

Peng, W., Yin, Y., Kuang, C., Wen, Z., Kuang, J. 2021. Spatial spillover effect of green innovation on economic development quality in china: evidence from a panel data of 270 prefecture-level and above cities. Sustain Cities Soc 69(2), 102863.

Phelps CC (2010) A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Acad Manag J 53(4):890–913

Polzin F, Flotow PV, Klerkx L (2016) Addressing barriers to eco-innovation: Exploring the finance mobilisation functions of institutional innovation intermediaries. Technol Forecast Soc Chang 103:34–46

Qi SZ, Lin C, Cui JB (2018) Do environmental rights trading schemes induce green innovation? Evidence fron listed firms in China. Econ Res J (In Chinese) 53(12):129–143

Qiu L, Hu D, Wang Y (2020) How do firms achieve sustainability through green innovation under external pressures of environmental regulation and market turbulence? Bus Strateg Environ 29(6):2695–2714

Ren S, Wang Y, Hu Y et al (2020) CEO hometown identity and firm green innovation. Bus Strateg Environ 30(2):756–774

Ren, S., Cheng, Y., Hu, Y., et al. 2021. Feeling right at home: Hometown CEOs and firm innovation. J Corp Financ, 66: 101815.

Rennings K (2000) Redefining innovation – eco-innovation research and the contribution from ecological economics. Ecol Econ 32(2):319–332

Shrader, L., Duflos, E. 2014. p. 1. China: a new paradigm in branchless Banking, pp. 1–64. The Consultative Group to Assist the Poor (CGAP).

Song M, Yang MX, Zeng KJ et al (2020) Green knowledge sharing, stakeholder pressure, absorptive capacity, and green innovation: Evidence from Chinese manufacturing firms. Bus Strateg Environ 29(3):1517–1531

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Tang, K., Qiu, Y., Zhou, D. 2020a. Does command-and-control regulation promote green innovation performance? evidence from china's industrial enterprises. Science of The Total Environment, 712(4), 136362.

Tang, S, Wu, X.C., Zhu, J. 2020b. Digital finance and enterprise technology innovation: structural feature, mechanism identification and effect difference under financial. Journal of Management World (In Chinese), 36(5), 52–66+9.

Wang CH (2020) An environmental perspective extends market orientation: green innovation sustainability. Bus Strateg Environ 29(8):3123–3134

Wang, M., Li, X., Wang, S. 2021. Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis. Energy Policy, 2021, 154: 112295.

Xie X, Huo J, Zou H (2019) Green process innovation, green product innovation, and corporate financial performance: a content analysis method. J Bus Res 101(8):697–706

Xu T (2018) Investigating environmental kuznets curve in china–aggregation bias and policy implications. Energy Policy 114(3):315–322

Yang L, Zhang Y (2020) Digital financial inclusion and sustainable growth of small and micro enterprises—evidence based on China’s new third board market listed companies. Sustainability 12(9):3733

Yu, C. H., Wu, X., Zhang, D., Chen, S., Zhao, J. 2021. Demand for green finance: resolving financing constraints on green innovation in china. Energy Policy, 153(1), 112255.

Yuan, G., Ye, Q., Sun, Y. 2021. Financial innovation, information screening and industries’ green innovation—Industry-level evidence from the OECD. Technol Forecast Soc Chang 171: 120998.

Zhang J, Liang G, Feng T, Yuan C, Jiang W (2020) Green innovation to respond to environmental regulation: how external knowledge adoption and green absorptive capacity matter? Bus Strateg Environ 29(1):39–53

Zhang X, Wan GH, Zhang JJ, He ZY (2019) Digital economy, inclusive finance and inclusive growth. Econ Res J (In Chinese) 54(8):71–86

Zhao XG, Zhong SH, Guo XX (2021) Digital inclusive finance development, financial mismatch mitigation and enterprise innovations. Sci Res Manage (In Chinese) 42(4):158

Zhong T, Wang CY (2018) Financial development and firm—level innovation output: a perspective of comparing different financing patterns. J Financ Res (In Chinese) 12:127–142

Funding

This study was supported by the National Natural Science Foundation of China (71803171); by the Science and Technology Planning Project of Henan Province (192400410063); by the Social Science Planning Project of Henan Province (2017BJJ052).

Author information

Authors and Affiliations

Contributions

S.R.: conceptualization, data curation, writing original draft. Y.P.: theoretical and empirical analysis, writing original draft. J.H: literature review, formal analysis. X.S.: conceptualization, methodology, funding acquisition, and supervision.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no conflict of interest.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Rao, S., Pan, Y., He, J. et al. Digital finance and corporate green innovation: quantity or quality?. Environ Sci Pollut Res 29, 56772–56791 (2022). https://doi.org/10.1007/s11356-022-19785-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19785-9