Abstract

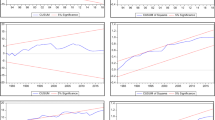

The purpose of this study is to observe the effects of stock markets and exchange rate volatility on environmental pollution in Pakistan during the period 1985–2018. A nonlinear autoregressive distributed lag (ARDL) model is applied to get this objective. In general, the short-term results revealed that the positive and negative shocks in stock markets reducing the carbon emissions. In adverse, positive shocks in exchange rate volatility reduces the carbon emissions while negative shocks in exchange rate volatility have a positive significant effect on carbon emissions in Pakistan. Moreover, the positive and negative shocks in the stock market have a positive significant effect on Pakistan’s carbon emissions but positive and negative shocks in exchange rate volatility negative influence on carbon emissions in the long run. The findings further show that positive and negative shocks of the stock markets and exchange rate volatility have the same effects in sign but different in magnitude in the long run. Based on these findings, some policy recommendations proposed in the context of Pakistan as well as for other developing countries.

Similar content being viewed by others

References

Abbasi F, Riaz K (2016) Co 2 emissions and financial development in an emerging economy: an augmented var approach. Energy Policy 90:102–114

Adjasi CK, Biekpe NB (2006) Stock market development and economic growth: the case of selected African countries. Afr Dev Rev 18(1):144–161

Al-mulali U, Solarin SA, Ozturk I (2019) Examining the asymmetric effects of stock markets on Malaysia’s air pollution: a nonlinear ARDL approach. Environ Sci Pollut Res 26(34):34977–34982

Atje R, Jovanovic B (1993) Stock markets and development. Eur Econ Rev 37(2):632–640

Bahmani-Oskooee M, Gelan A (2019) Asymmetric effects of exchange rate changes on the demand for money in Africa. App Econ 51(31):3365–3375

Bahmani-Oskooee M, Harvey H (2019) Who is hurt by dollar-euro volatility in the euro zone? Int.Econ 159:36–47

Bahmani-Oskooee M, Mohammadian A (2018) Asymmetry effects of exchange rate changes on domestic production in emerging countries. J Emerg Mark Finance 54(6):1442–1459

Bahmani-Oskooee M, Xi D, Bahmani S (2019) More evidence on the asymmetric effects of exchange rate changes on the demand for money: evidence from Asian. App Econ Lett 26(6):485–495

Beck T, Levine R (2004) Stock markets, banks, and growth: Panel evidence. J Bank Financ 28(3):423–442

Bloch H, Rafiq S, Salim R (2015) Economic growth with coal, oil and renewable energy consumption in China: prospects for fuel substitution. Econ Model 44:104–115

Carp L (2012) Can stock market development boost economic growth? Empirical evidence from emerging markets in central and eastern europe. Procedia Economics and Finance 3:438–444

Cooray A (2010) Do stock markets lead to economic growth? J Policy Model 32(4):448–460

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42(3):310–335

Devereux MB, Smith GW (1994) International risk sharing and economic growth. Int Econ Rev 35(3):535–550

He X, Liu Y (2018) The public environmental awareness and the air pollution effect in Chinese stock market. J Clean Prod 185:446–454

Gupta S, Goldar B (2005) Do stock markets penalize environment-unfriendly behaviour? Evidence from India. Ecol Econ 52(1):81–95

Kutan, A. M., Paramati, S. R., Ummalla, M., & Zakari, A (2017) Financing renewable energy projects in major emerging market economies: evidence in the perspective of sustainable economic development. Emerg Mark Financ Trade, (available online)

Lanoie P, Laplante B, Roy M (1997) Can capital markets create incentives for pollution control? World Bank Policy Research Working Paper 1753

Lanoie P, Laplante Bt, Roy M (1998) Can capital markets create incentives fo pollution control? Ecol Econ 26(1):31–41

Li Q, Peng CH (2016) The stock market effect of air pollution: evidence from China. App Econ 48(36):3442–3461

Mankiw, N. G., & Scarth, W (2008) Macroeconomics. 3rd Canadian Edition

Narayan PK, Saboori B, Soleymani A (2016) Economic growth and carbon emissions. Econ Model 53:388–397

Ngare E, Nyamongo EM, Misati RN (2014) Stock market development and economic growth in Africa. J Econ Bus 74:24–39

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ 56:29–41

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371

Paramati SR, Alam MS, Apergis N (2018) The role of stock markets on environmental degradation: a comparative study of developed and emerging market economies across the globe. Emerg Mark Rev 35:19–30

Pardy, R., & Mundial, B (1992) Institutional reform in emerging securities markets (Vol. 907): Country Economics epartment, World Bank

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Rafiq S, Salim R, Nielsen I (2016) Urbanization, openness, emissions, and energy intensity: a study of increasingly urbanized emerging economies. Energy Econ 56:20–28

Ramiah V, Martin B, Moosa I (2013) How does the stock market react to the announcement of green policies? J Bank Financ 37(5):1747–1758

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Sadorsky P (2011) Financial development and energy consumption in central and eastern european frontier economies. Energy Policy 39(2):999–1006

Sbia R, Shahbaz M, Hamdi H (2014) A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ Model 36:191–197

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Festschrift in honor of Peter Schmidt. Springer, New York, pp 281–314

Singh A (1997) Financial liberalisation, stockmarkets and economic development. Econ J 107(442):771–782

Spears A (1991) Financial development and economic growth—causality tests. Atl Econ J 19(3):66–66

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from bric countries. Energy Policy 37(1):246–253

Ullah S, Ozturk I, Usman A, Majeed MT, Akhtar P (2020) On the asymmetric effects of premature deindustrialization on CO2 emissions: evidence from Pakistan. Environ Sci Pollut Res:1–11

Usman A, Ullah S, Ozturk I, Chishti MZ (2020) Analysis of asymmetries in the nexus among clean energy and environmental quality in Pakistan. Environ Sci Pollut Res:1–12

World Bank (2019) World development indicators 2019. World Bank Publications

Wu X, Chen S, Guo J, Gao G (2018) Effect of air pollution on the stock yield of heavy pollution enterprises in China’s key control cities. J Clean Prod 170:399–406

Zhang YJ, Fan JL, Chang HR (2011) Impact of China’s stock market development on energy consumption: an empirical analysis. Energy Procedia 5:1927–1931

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ullah, S., Ozturk, I. Examining the asymmetric effects of stock markets and exchange rate volatility on Pakistan’s environmental pollution. Environ Sci Pollut Res 27, 31211–31220 (2020). https://doi.org/10.1007/s11356-020-09240-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09240-y