Abstract

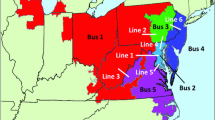

The operation in energy arbitrage markets is an attractive possibility to energy storage systems developers and owners to justify an investment in this sector. The size and the point of connection to the grid can have significant impact on the net revenue in transmission and distribution systems. The decision to install an energy storage system cannot be based only on the cost of the equipment but also in its potential revenue, operation costs, and depreciation through its life cycle. This paper illustrates the potential revenue of a generic energy storage system with 70% round trip efficiency and 1–14 h energy/power ratio, considering a price-taking dispatch. The breakeven overnight installed cost is also calculated to provide the cost below which energy arbitrage would have been profitable for a flow battery. The analysis of the potential revenue was performed for 13 locations within the PJM Real-time market. We considered hourly data of day-ahead and real-time locational marginal prices over 7 years (2008–2014). Breakeven installed cost per MW ranged from $30 (1 MW, 14 MWh, 2009) to $340 (1 MW, 1 MWh, 2008).

Similar content being viewed by others

Change history

01 March 2021

A Correction to this paper has been published: https://doi.org/10.1007/s11356-019-04175-5

References

Akhil AA, Huff G, Currier AB, Kaun BC, Rastler DM, Chen SB, Cotter AL, Bradshaw DT, Gauntlett WD (2013) DOE/EPRI 2013 electricity storage handbook in collaboration with NRECA; SAND2013-5131, technical report. Livermore, Sandia National Laboratories

Bie Z, Lin Y, Li G, Li F (2017) Battling the extreme: a study on the power system resilience. Proc IEEE 105(7):1253–1266

Byrne RH, Silva-Monroy CA (2012) Estimating the maximum potential revenue for grid connected electricity storage: Arbitrage and regulation. Sandia National Laboratories

Choi J, Park WK, Lee IW (2016) Application of vanadium redox flow battery to grid connected microgrid energy management. 2016 IEEE International Conference on Renewable Energy Research and Applications (ICRERA), Birmingham, pp 903–906

Denholm P, Ela E, Kirby B, Milliqan M (2010) The role of energy storage with renewable electricity generation. Technical Report for NREL, Golden

Eyer J, Corey G (2010) Energy storage for the electricity grid: benefits and market potential assessment guide; SAND2010-0815; technical report for Sandia National Laboratories: Livermore, CA, USA

Fan Z, Horger T, Bastian J, Ott A (2008) An overview of PJM energy market design and development. In Proceedings of the 3rd International Conference Electric Utility Deregulation and Restructuring and Power Technologies, NanJing, China, pp. 12–17

Fitzgerald G et al (2015) The economics of battery energy storage: how multi-use, customer-sited batteries deliver the most services and value to customers and the grid. Rocky Mountain Institute

Hesse HC et al (2017) Lithium-ion battery storage for the grid—a review of stationary battery storage system design tailored for applications in modern power grids. Energies 10(12):2107

Internal Revenue Service (2017) How to depreciate property. Available online: http://www.irs.gov/pub/irs-pdf/p946.pdf. Accessed on 1 February 2017

Lazard (2017) Lazard’s Levelized Cost of Storage Analysis —Version 2.0. Available online: https://www.lazard.com/media/438042/lazard-levelized-cost-of-storage-v20.pdf. Accessed on 1 September 2017

Litvinov E (2010) Design and operation of the locational marginal prices-based electricity markets. IET Gener Transm Distrib 4:315–323

Luo X, Wang J, Dooner M, Clarke J (2015) Overview of current development in electrical energy storage technologies and the application potential in power system operation. Appl Energy 137:511–536

Ott AL (2003) Experience with PJM market operation, system design and implementation. IEEE Trans Power Syst 18(2):528–534

Sakti A, Gallagher KG, Sepulveda N, Uckun C, Vergara C, de Sisternes FJ, Dees DW, Botterud A (2017) Enhanced representations of lithium-ion batteries in power systems models and their effect on the valuation of energy arbitrage applications. J Power Sources 342:279–291

Salles MBC, Aziz MJ, Hogan WW (2016) Potential arbitrage revenue of energy storage systems in PJM during 2014. In Proceedings of the IEEE Power & Energy Society General Meeting, Boston, MA, USA, 17–21 July 2016

Salles MB, Huang J, Aziz MJ, Hogan WW (2017a) Potential arbitrage revenue of energy storage systems in PJM. Energies 10(8):1100

Salles MB, Gadotti TN, Aziz MJ, Hogan WW (2017b) Breakeven analysis of energy storage systems in PJM energy markets., In Proceedings of the IEEE 6th International Conference on Renewable Energy Research and Applications (ICRERA), Denver, CA, USA

Schneider KP, Tuffner FK, Elizondo MA, Liu C-C, Xu Y, Ton D (2016) Evaluating the feasibility to use microgrids as a resiliency resource. IEEE Trans Smart Grid 8(2):687–696

Silverstein K (2017) New York City Aims To Cut Greenhouse Gas Emissions By Using Energy Storage, Forbes, Sep 22, 2017. Available online: https://www.forbes.com/sites/kensilverstein/2017/09/22/new-york-city-to-cut-greenhouse-gas-emissions-by-using-energy-storage/#3f7a6f7e9135. Accessed on 28 September 2017

Sioshansi R, Denholm P, Jenkins T, Weiss J (2009) Estimating the value of electricity storage in PJM: arbitrage and some welfare effects. Energy Econ 31(2):269–277

Steel W (2017) Energy storage market outlook 2017: state of play, renewable energy world, February 2, 2017. Available online: http://www.renewableenergyworld.com/articles/print/volume-20/issue-1/features/storage/energy-storage-market-outlook-2017-state-of-play.html3f7a6f7e9135. Accessed on 30 September 2017

Tang A, Bao J, Skyllas-Kazacos M (2011) Dynamic modelling of the effects of ion diffusion and side reactions on the capacity loss for vanadium redox flow battery. J Power Sources 196(24):10737–10747

Tsagkou AS, Doukas EDKDI, Labridis DP, Marinopoulos AG, Tengnér T (2017) Stacking grid services with energy storage techno-economic analysis. In PowerTech, 2017 IEEE Manchester. IEEE, pp. 1–6

Turker B, Klein SA, Hammer EM, Lenz B, Komsiyska L (2013) Modeling a vanadium redox flow battery system for large scale applications. Energy Convers Manag 66:26–32

U.S. Energy Information Administration (EIA)(2014) Spreadsheet AEO2014_financial.xls. Private communication

US Development of Energy (DOE) (2017) Global energy storage database. Available online: http://www.energystorageexchange.org/projects. Accessed on 20 September 2017

Usera I, Rodilla P, Burger S, Herrero I, Batlle C (2017) The regulatory debate about energy storage systems: state of the art and open issues. IEEE Power Energ Mag 15(5):42–50

Wankmüller F, Thimmapuram Prakash R, Gallagher Kevin G, Audun B (2017) Impact of battery degradation on energy arbitrage revenue of grid-level energy storage. J Energy Storage 10:56–66

Zhang Y, Wang XDJ, Wang C, Wang J, Wang J, Wang J (2018) Natural graphene microsheets/sulfur as Li-S battery cathode towards >99% coulombic efficiency of long cycles. J Power Sources 376:131–137

Funding

This work was supported by São Paulo Research Foundation (FAPESP)—grants #2014/05261-0 and #2017/12257-7 and the US Department of Energy Advanced Research Projects Agency—Energy award no. DE-AR0000348.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original article was revised: The original publication of this paper contains a mistake. Correct images for Figures 11, 12 and 13 are shown in this paper.

Rights and permissions

About this article

Cite this article

Salles, M.B.C., Gadotti, T.N., Aziz, M.J. et al. Potential revenue and breakeven of energy storage systems in PJM energy markets. Environ Sci Pollut Res 28, 12357–12368 (2021). https://doi.org/10.1007/s11356-018-3395-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-018-3395-y