Abstract

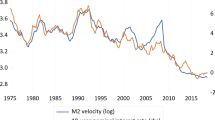

The demand for real M1 in Slovakia is positively influenced by real output and the stock price and negatively associated with the deposit rate, depreciation of the koruna, the euro interest rate, and the expected inflation rate. Considering the goods and the money market simultaneously, these results suggest that a higher stock price may or may not cause real output to rise and that a depreciation of the koruna or a higher euro interest rate would help raise Slovakia's real output. The coefficients of the deposit rate and the stock price in real M2 demand are insignificant at the 10% level. The likelihood ratio test in the extended Box–Cox model shows that the double-log form cannot be rejected at the 5% level while the linear form can be rejected at the 5% level. The CUSUM and CUSUMSQ tests show that the money demand function was relatively stable.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Hsing, Y. Roles of Stock Price and Exchange Rate in Slovakia's Money Demand Function and Policy Implications. Transition Stud Rev 14, 274–282 (2007). https://doi.org/10.1007/s11300-007-0146-z

Issue Date:

DOI: https://doi.org/10.1007/s11300-007-0146-z

Keywords

- Box–Cox transformation

- substitution effect

- wealth effect

- capital mobility effect

- cost of borrowing effect

- stability tests