Abstract

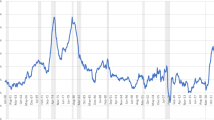

This paper contributes to nonparametric forecasting techniques by developing three local nonparametric forecasting methods for the nonparametric exclusion-from-core inflation persistence model that are capable of utilizing revised real-time personal consumption expenditure and core personal consumption expenditure for 62 vintages. Local nonparametric forecasting provides forecasters with a way of parsing the data by permitting a low inflation measure to be included in other low inflationary time periods and vice versa. Furthermore, when examining real-time data, policy-makers can use the nonparametric models to help identify outliers and potential abnormal economic events and problems with the data such as an underlying change in volatility. The most efficient nonparametric forecasting method is the third model, which uses the flexibility of nonparametrics by making forecasts conditional on the forecasted value, which can be used for counterfactual analysis.

Similar content being viewed by others

Notes

This paper establishes the local nonparametric techniques used in Tierney (2018), which went on to explore in depth the effect of vintage when it comes to forecasting inflation persistence.

The vintages for PCE and Core PCE begin in V_1965:Q4 and V_1996:Q1. It should be noted that benchmark revisions have become more frequent since 2011, which makes it more difficult to conduct within-benchmark analysis.

The average residual squares criterion (ARSC) is used to approximate the IRSC for this paper.

The global nonparametric method is not the preferred method of using nonparametrics because the error terms are not obtained by minimizing the mean squared error.

For more on the forecasting of the OLS exclusion-from-core inflation persistence model, please see Rich and Steindel (2005).

Recall fz stands for the three nonparametric forecasting methods: f1, f2 and f3, and the length of the forecast horizon is g with g = {1, …, 12}.

The last newly released observation corresponding to 1995:Q4 for V_1996:Q1 is not given, so this value is interpolated from the last two values.

A complete table of window widths is in Online Supplemental Appendix Table 1.

Dean Croushore has graciously provided the following information: (i.) there are two different data sources for V_2000:Q1; (ii.) there is no data problem for vintages V_2007:Q2 to V_2008:Q2; and (iii.) he also provided the interpolation method used to obtain the last observation of V_1996:Q1.

In order to test for structural breaks, the Bai-Quant Structural Break Test, the Quandt-Andrews Test, and the Andrews-Ploberger Test are applied to PCE and core PCE of V_2011:Q2 through the use of Bruce Hansen’s (2001) program for testing for structural changes.

More information on the ability of the local nonparametric model to detect changes to the regression parameters due to data revisions can be found in Tierney (2011).

Detailed tables of the parametric, global nonparametric and local nonparametric forecast standard deviations for all 62 vintages and for all 5 in-sample forecast horizons are available upon request. The forecast standard deviations for V_1999:Q4 and V_2000:Q1 are not presented due to a sparsity of data for V_1999:Q4 and the data for V_2000:Q1 being from two different sources.

References

Altman, D. G., & Bland, J. M. (2005). Standard deviations and standard errors. BMJ [British Medical Journal], 331, 903.

Atkeson, C. G., Moore, A. W., & Schaal, S. (1997). Locally weighted learning. Artificial Intelligence Review, 11(1), 11–73.

Barkoulas, J. T., Baum, C. F., & Onochie, J. (1997). Nonparametric investigation of the 90-day T-bill rate. Review of Financial Economics, 6(2), 187–198.

Bryan, M. F., & Cecchetti, S. G. (1994). Measuring core inflation. In N. Gregory Mankiw (Ed.), Monetary policy (pp. 195–215). Chicago: University of Chicago Press.

Cai, Z. (2007). Trending time-varying coefficient time series models with serially correlated errors. Journal of Econometrics, 136(1), 163–188.

Cai, Z., & Chen, R. (2006). Flexible seasonal time series models. In B. T. Fomby & D. Terrell (Eds.), Advances in econometrics volume honoring Engle and Granger (pp. 63–87). Orlando: Elsevier.

Cai, Z., Fan, J., & Yao, Q. (2000). Functional-coefficient regression models for nonlinear time series. Journal of the American Statistical Association, 95(451), 941–956.

Chauvet, M., & Tierney, H.L.R. (2009). Real-time changes in monetary policy. Working Paper, Available at: www.faculty.ucr.edu/~chauvet/rtchanges.pdf.

Clark, T. E. (2001). Comparing measures of Core inflation. Federal Reserve Bank of Kansas City Economic Review, 86(2), 5–31.

Coogley, T. (2002). A simple adaptive measure of core inflation. Journal of Money, Credit, and Banking, 43(1), 94–113.

Croushore, D. (2008). Revisions to PCE inflation measures: Implications for monetary policy. Federal Reserve Bank of Philadelphia Working Paper, available at: https://www.philadelphiafed.org/research-and-data/real-time-center/research.

Croushore, D., & Stark, T. (2001). A real-time data set for macroeconomists. Journal of Econometrics, 105(1), 111–130.

Croushore, D., & Stark, T. (2003). A real-time data set for macroeconomists: does the data vintage matter? The Review of Economics and Statistics, 8(3), 605–617.

De Brabanter, K., De Brabanter, J., Gijbels, I., & De Moor, B. (2013). Derivative estimation with local polynomial fitting. Journal of Machine Learning Research, 14(1), 281–301.

Diebold, F. X., & Mariano, R. S. (1995). Comparing predictive accuracy. Journal of Business & Economic Statistics, 13(3), 253–263.

Diebold, F. X., & Nason, J. A. (1990). Nonparametric exchange rate prediction. Journal of International Economics, 28(3–4), 315–332.

Elliott, G. (2002). Comments on 'forecasting with a real-time data set for macroeconomists'. Journal of Macroeconomics, 24(4), 533–539.

Elliott, G., Rothenberg, T., & Stock, J. (1996). Efficient tests for an autoregressive unit root. Econometrica, 64(4), 813–836.

Fan, J., & Gijbels, I. (1995). Data-driven selection in polynomial fitting: variable bandwidth and spatial adaptation. Journal of the Royal Statistical Society: Series B, 57(2), 371–394.

Fan, J., & Yao, Q. (1998). Efficient estimation of conditional variance functions in stochastic regressions. Biometrika, 85(3), 645–660.

Federal Reserve of Philadelphia Real-Time Data Research Center. (2018a). Core Price Index for Personal Consumption Expenditure (PCONX). https://www.philadelphiafed.org/research-and-data/real-time-center/real-time-data/data-files/pconx. Accessed 5 Aug 2011.

Federal Reserve of Philadelphia Real-Time Data Research Center. (2018b). Price Index for Personal Consumption Expenditures, Constructed (PCON). https://www.philadelphiafed.org/research-and-data/real-time-center/real-time-data/data-files/pcon. Accessed 5 Aug 2011.

Fujiwara, I., & Koga, M. (2004). A statistical forecasting method for inflation forecasting: Hitting every vector autoregression and forecasting under model uncertainty. Monetary and Economic Studies, Institute for Monetary and Economic Studies, Bank of Japan, 22(1), 123–142.

Gooijer, J. G. D., & Gannoun, A. (1999). Nonparametric conditional predictive regions for time series. Computational Statistics & Data Analysis, 33(3), 259–275.

Gooijer, J. G. D., & Zerom, D. (2000). Kernel-based multistep-ahead predictions of the US short-term interest rate. Journal of Forecasting, 19(4), 335–353.

Hansen, B. E. (2001). GAUSS program for testing for structural change. Available at http://www.ssc.wisc.edu/_bhansen/progs/jep_01.htm. Accessed 18 Oct 2011.

Härdle, W., & Tsybakov, A. (1997). Local polynomial estimator of the volatility function in nonparametric autoregression. Journal of Econometrics, 81(1), 223–242.

Harvey, D. I., Leybourne, S. J., & Newbold, P. (1997). Testing the equality of prediction mean squared errors. International Journal of Forecasting, 13(2), 281–291.

Harvey, D. I., Leybourne, S. J., & Newbold, P. (1998). Tests for forecast encompassing. Journal of Business & Economic Statistics, 16(2), 254–259.

Johnson, M. (1999). Core inflation: A measure of inflation for policy purposes. Proceedings from Measures of Underlying Inflation and their Role in Conduct of Monetary Policy-Workshop of Central Model Builders at Bank for International Settlements, February.

Lafléche, T., & Armour, J. (2006). Evaluating measures of core inflation. Bank of Canada Review, (Summer) 19–29.

Marron, J. S. (1988). Automatic smoothing parameter selection: A survey. Empirical Economics, 13(3–4), 187–208.

Matzner-Løfber, E., Gannoun, A., & Gooijer, J. G. D. (1998). Nonparametric forecasting: a comparison of three kernel-based methods. Communications in Statistics-Theory and Methods, 27(7), 1532–1617.

Nordhaus, W. D. (2011). The economics of tail events with an application to climate change. Review of Environmental Economics and Policy, 5(2), 240–257.

Pagan, A., & Ullah, A. (1999). Nonparametric econometrics (pp. 118–122). Cambridge: Cambridge University Press.

Pindyck, S. R., & Rubinfeld, L. D. (1998). Econometric models and economic forecasts. Irwin/McGraw-Hill, New York.

Rich, R., & Steindel, C. (2005). A review of core inflation and an evaluation of its measures. Federal Reserve Bank of New York Staff Report No. 236. https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr236.pdf.

Ruppert, D., & Wand, M. P. (1994). Multivariate locally weighted least squares regression. The Annals of Statistics, 22(3), 1346–1370.

Tierney, H. L. R. (2011). Real-time data revisions and the PCE measure of inflation. Economic Modelling, 28(4), 1763–1773.

Tierney, H. L. R. (2012). Examining the ability of core inflation to capture the overall trend of Total inflation. Applied Economics, 44(4), 493–514.

Tierney, H. L. R. (2018). Tracking real-time data revisions in inflation persistence. Applied Economics, 1–23. https://doi.org/10.1080/00036846.2018.1540849.

Vilar-Fernández, J. M., & Cao, R. (2007). Nonparametric forecasting in time series: a comparative study. Communications in Statistics: Simulation and Computation, 36(2), 311–334.

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica, 48(4), 817–838.

Acknowledgements

I would like to thank in alphabetical order the following people for their gracious comments: Marcelle Chauvet, Graham Elliott, James Hamilton, Hedayeh Samavati, Andres Santos, Zeynep Senyuz, Jack Strauss, Allan Timmermann, and Emre Yoldas, and last but not least, the participants of the 19th Annual Symposium of the Society for Nonlinear Dynamics and Econometrics (2011), the Southern Economic Association (SEA) Meeting 2011, Lafayette College Economics Seminar Series, and the University of California San Diego (UCSD) Econometrics Seminar Series (2013). I also give a very special thanks to Dean Croushore for graciously sharing his knowledge of real-time data with me.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic Supplementary Material

ESM 1

(DOCX 123 kb)

Rights and permissions

About this article

Cite this article

Tierney, H.L.R. Forecasting with the Nonparametric Exclusion-from-Core Inflation Persistence Model Using Real-Time Data. Int Adv Econ Res 25, 39–63 (2019). https://doi.org/10.1007/s11294-019-09726-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-019-09726-7