Abstract

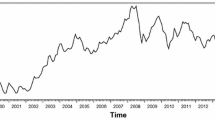

This paper, by following vector error correction modeling, empirically investigates some of the popular monetary models of the NOK/USD rate. The empirical results suggest that there is some scope for the monetary approach to explain the development of the NOK/USD during the period from 1997 to 2008. The coefficients in the co-integration equation of both money and output differentials are statistically significant and consistent with any of the forms of the monetary models. Moreover, empirical evidence for the proportionality between the exchange rate and relative money is provided. Our findings are robust across different measures of inflation expectations. Although there is no clear evidence regarding the exact version of the monetary model, the estimated unrestricted error correction models can fit the actual NOK/USD exchange rate. Finally, the short-term dynamics of the exchange rate are significantly affected by changes in crude oil prices.

Similar content being viewed by others

Notes

The oil prices are depicted through an index, which has 2005 as base year and it is the arithmetic mean of the spot prices for three kinds of oil, Brent, West Texas Intermediate and Dubai Fateh www.indexmundi.com/commodities). In our study the oil prices are calculated in Norwegian Kroner and in real time dividing by the consumer price index in Norway.

We would like to thank anonymous referee for his comment to include different inflation expectation proxies in our model.

The former Global Petroleum Fund, which is managed by the Norges Bank and included as a separate item in the Bank’s balance sheet. As of 2006, the foreign assets of the Global Pension Fund amounted to USD 285 billion or 79 percent of GDP and were matched by krone deposits at the Norges Bank.

References

Akram, Q. F. (2004). Oil prices and exchange rates: Norwegian evidence. The Econometrics Journal, 7(2), 476–504.

Alvarez, F., Atkeson, A., & Kehoe, P. (2007). If exchange rates are random walks, then almost everything we say about monetary policy is wrong. American Economic Review, 97(2), 339–345.

Bilson, J. (1978). The monetary approach to the exchange rate-some empirical evidence. imf Staff Papers, 25(1), 48–75.

Bjørnland, H. C., & Hungnes, H. (2008). The commodity currency puzzle. The IUP Journal of Monetary Economics, VI(2), 7–30.

Chin, L., Azali, M., & Matthews, G. (2007a). The monetary approach to exchange rate determination for Malaysia. Applied Financial Economic Letters, 3(2), 91–94.

Chin, L., Azali, M., Yusop, Z. B., & Yusoff, M. B. (2007b). The monetary model of exchange rate: evidence from the Philippines. Applied Economic Letters, 14(13), 993–997.

Cushman, D. (2007). A portfolio balance approach to the Canadian–U.S. exchange rate. Review of Financial Economics, 16(3), 305–320.

De Grauwe, P. (1996). International money: Postwar-trends and theories (pp. 146–147). New York: Oxford: Oxford University Press.

Diamandis, P. F., Georgoutsos, D. A., & Kouretas, G. P. (1998). The monetary approach to the exchange rate: long-run relationships, identification and temporal stability. Journal of Macroeconomics, 20(4), 741–766.

Dornbusch, R. (1976). Expectations and exchange rate dynamics. Journal of Political Economy, 84(6), 1161–1176.

Faust, J. R., Rogers, J. H., & Wright, J. H. (2001). Exchange rate forecasting: the errors we’ve really made. Journal of International Economics, 60(1), 35–39.

Frankel, J. A. (1979). On the mark: a theory of floating exchange rates based on real interest differentials. American Economic Review, 69(4), 610–622.

Frenkel, J. A. (1976). A monetary approach to the exchange rate: doctrinal aspects and empirical evidence. The Scandinavian Journal of Economics, 78(2), 200–224.

Frenkel, M., & Koske, I. (2004). How well can monetary factors explain the exchange rate of the euro? Atlantic Economic Journal, 32(3), 232–243.

Habib, M. M. & Manolova Kalamova, M. (2007). Are there oil currencies? The real exchange rate of oil exporting countries. No. 839 Working Paper Series, European Central Bank.

Hwang, J. K. (2001). Dynamic forecasting of monetary exchange rate models: evidence from cointegration. International Advances in Economic Research, 7(1), 51–64.

Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica, 59(6), 1551–1580.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inferences on cointegration—with applications to the demand for money. Oxford Bulletin of Economics and Statistics, 52(2), 169–210.

Kloster, A. (2000). Estimating and interpreting interest rate expectations. Norges Economic Bulletin, LXXI(3), 85–94.

Kouretas, G. P. (1997). Identifying linear restrictions on the monetary exchange rate model and the uncovered interest parity: cointegration evidence from the Canadian U.S. dollar. Canadian Journal of Economics, 30(4a), 875–890.

Loria, E., Sanchez, A., & Salgado, U. (2009). New evidence on the monetary approach of exchange rate determination in Mexico 1994–2007: a cointegrated SVAR model. Journal of International Money and Finance, 29(3), 540–554.

MacDonald, R., & Taylor, M. P. (1991). The monetary approach to the exchange rate: long-run relationships and coefficient restrictions. Economics Letters, 37(2), 179–185.

MacDonald, R., & Taylor, M. P. (1993). The monetary approach to the exchange rate: rational expectations, long-run equilibrium, and forecasting. IMF Staff Papers, 40(1), 89–107.

MacDonald, R., & Taylor, M. P. (1994a). The monetary model of the exchange rate: long-run relationships, short-run dynamics and how to beat a random walk. Journal of International Money and Finance, 13(3), 276–290.

MacDonald, R., & Taylor, M. P. (1994b). Re-examining the monetary approach to the exchange rate: the Dollar-Franc, 1976–90. Applied Financial Economics, 4(6), 423–429.

Mark, N. C., & Sul, D. (2001). Nominal exchange rates and monetary fundamentals: evidence from a small post-bretton woods panel. Journal of International Economics, 53(1), 29–52.

Meese, R., & Rogoff, K. (1984). Empirical exchange rate models of the seventies. Journal of International Economics, 14(1–2), 3–24.

Miyakoshi, T. (2000). The monetary approach to the exchange rate: empirical observations from Korea. Applied Economics Letters, 7(12), 791–794.

Neely, C. & Sarno, L. (2002). How well do monetary fundamentals forecast exchange rates? No. 2002-007A Working Paper Series, Federal Reserve of St. Louis.

Rapach, D. E., & Wohar, M. E. (2002). Testing the monetary model of exchange rate determination: new evidence from a century of data. Journal of International Economics, 58(3), 359–385.

Reinton, H., & Ongena, S. (1999). Out-of-sample forecasting performance of single equation monetaryexchange rate models in Norwegian currency markets. Applied Financial Economics, 9(6), 545–550.

Svensson, L. E. O. (1994). Estimating and interpreting forward rates: Sweden 1992-1994. No. 94/114 Working Paper Series, International Monetary Fund.

Tawadros, G. (2001). The predictive power of the monetary model of exchange rate determination. Applied Financial Economics, 11(3), 279–286.

Tawadros, G. (2008). A structural time series test of the monetary model of exchange rates under four big inflations. Economic Modeling, 25(6), 1216–1224.

Acknowledgments

We would like to thank the two anonymous referees, and participants of the 71st International Atlantic Economic conference held in Athens, Greece, in March 2011, for their helpful comments.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Papadamou, S., Markopoulos, T. The Monetary Approach to the Exchange Rate Determination for a “Petrocurrency”: The Case of Norwegian Krone. Int Adv Econ Res 18, 299–314 (2012). https://doi.org/10.1007/s11294-012-9360-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-012-9360-5