Abstract

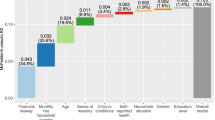

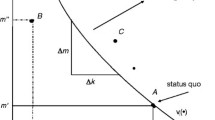

We model family choice among health plans taking account of family, insurer and health care provider (e.g., doctor) characteristics not addressed by earlier models. We use an additively separable utility function permitting an intuitive treatment of how families trade health against consumption, and how income and health risk influence that trade-off. Health care provider quality affects expected health outcomes and the family’s choice set includes health maintenance organization and preferred provider organization (PPO) plans. We model how families value the PPO’s option to use out-of-network providers taking into account uncertainty about future diagnoses and incomplete information about provider quality. The model’s predictions are consistent with enrollment patterns in the National Health Interview Survey. The approach has implications for cost control and income-related disparities in quality of care.

Similar content being viewed by others

Notes

Additional details on the dataset construction using the Person file and the Family file in the NHIS along with STATA code used in the analysis are available upon request from the authors.

In aggregate time series estimations where endogeneity issues are common, one can often lag an endogenous variable to achieve exogeneity. Even though we have cross-sectional data, the chronic condition variable has a similar “pre-existing” time element, as it is defined in terms of duration of a health condition.

See Fernandez (2001) for a model of school funding using an additively separable utility function in consumption and educational quality.

As nothing significant would change with the inclusion of a lump sum discovery cost, we assume here that once health condition is revealed, discovery of relevant provider quality is costless. However, an interesting refinement of the model might include discovery costs that varied with family characteristics. For example, discovery costs might be lower for families with higher education levels or higher for families with limited English language proficiency.

In simulations not reported here but available from the authors, using higher quality OON providers yielded higher utility at the high and low ends of the severity range, while staying in-network yielded higher utility at intermediate severity levels. The range over which staying in-network yielded higher utility was wider the lower the family’s income level.

If we interpret a monetary unit as $1000, these figures are roughly equal to the average employee share of family premium plus deductible for each type of plan in the Kaiser Family Foundation 2010 employer survey.

Additional simulation results available from the authors.

References

Bardey, D., & Rochet, J.-C. (2010). Competition among health plans: a two-sided market approach. Journal of Economics and Management Strategy, 19(2), 435–451. Summer 2010.

Baumgardner, J. R. (1991). The interaction between forms of insurance contract and types of technical change in medical care. RAND Journal of Economics, 22(1), 36–53. Spring 1991.

Beeson Royalty, A., & Solomon, N. (1999). Health plan choice: price elasticities in a managed competition setting. Journal of Human Resources, 34(1), 1–41. Winter 1999.

Bellman, R. (1954). Some problems in the theory of dynamic programming. Econometrica, 22(1), 37–48. Jan., 1954.

Buchmueller, T. (2006). Price and the health plan choices of retirees. Journal of Health Economics, 25(1), 81–101. January 2006.

Capps, C., Dranove, D., & Satterthwaite, M. (2003). Competition and market power in option demand markets. RAND Journal of Economics, 34(4), 737–63. Winter 2003.

Chernew, M. E., & Frick, K. D. (1999). The Impact of managed care on the existence of equilibrium in health insurance markets. Journal of Health Economics, 18(5), 573–92. October 1999.

Enthoven, A. (2008). Health care with a few bucks left over New York times, December 28, 2008: Op-Ed section, online version www.nytimes.com.

Evans, W. N., & Viscusi, W. K. (1991). Estimation of state-dependent utility functions using survey data. Review of Economics and Statistics, v73(n1), 94–104. February 1991.

Finkelstein, A., Luttmer, E. F. P., Notowidigdo, M. J. (2008). What good is wealth without health? The effect of health on the marginal utility of consumption. NBER Working Paper Series: 14089.

Fernandez, R. (2001). Sorting, education, and inequality. NBER Working Paper Series, (8101):173–193, 2001.

Frank, R. G., Glazer, J., & McGuire, T. G. (2000). Measuring adverse selection in managed health care. Journal of Health Economics, 19(6), 829–54. November 2000.

Gruber, J., & Washington, E. (2005). Subsidies to employee health insurance premiums and the health insurance market. Journal of Health Economics, 24(2), 253–76. March 2005.

Hamer, R., Anderson, D. (2000). Inter-study report: PPO operations and markets, February 2000, accessed Feb. 6, 2011 at http://www.kff.org/insurance/upload/PPO-Operations-and-Markets-Report.pdf.

Hurley, R. E., Strunk, B. C., & White, J. S. (2004). The puzzling popularity of the PPO: PPOs have overtaken HMOs as the most popular health benefit option among U.S. workers–to the surprise of many analysts. Health Affairs, 23(2), 56–68. March/April 2004.

Jack, W. (2006). Optimal risk adjustment with adverse selection and spatial competition. Journal of Health Economics, 25(5), 908–26. September 2006.

Kaiser Family Foundation and Health Research and Educational Trust. (2010). Employer health benefits 2010 annual survey, available at http://ehbs.kff.org/pdf/2010/8085.pdf

Kreier, R. (2006). Economic theory and political reality: managed competition and U.S. health policy. Politics & Policy, 34(3), 579–605. September, 2006.

Lillard, L. A., & Weiss, Y. (1997). Uncertain health and survival: effects on end-of-life consumption. Journal of Business and Economic Statistics, v15(n2), 254–68. April 1997.

Merton, R. C. (1997). Applications of option-pricing theory twenty-five years later. Nobel Lecture, 9, 1997.

Miller, N. H. (2006). Insurer-provider integration, credible commitment, and managed-care backlash. Journal of Health Economics, 25(2006), 861–876.

Pauly, M. V., & Herring, B. (2007). The demand for health insurance in the group setting: can you always get what you want? Journal of Risk and Insurance, 74(1), 115–40. March 2007.

Pauly, M. V., & Ramsey, S. D. (1999). Would you like suspenders to go with that belt? an analysis of optimal combinations of cost sharing and managed care. Journal of Health Economics, 18(4), 443–58. August 1999.

Olivella, P., & Vera-Hernandez, M. (2007). Competition among differentiated health plans under adverse selection. Journal of Health Economics, 26(2), 233–50. March 2007.

Peele, P. B., & Lave, J. R. (2000). Employer-sponsored health insurance: are employers good agents for their employees? Milbank Quarterly, 78(1), 5–32.

Sengupta, B., & Kreier, R. (2011). A dynamic model of health plan choice from a real options perspective. Atlantic Economic Journal, 39(3), 401–419. September, 2011.

Sloan, F. A., Viscusi, W. K., Chesson, H. W., Conover, C. J., & Whetten-Goldstein, K. (1998). Alternative approaches to valuing intangible health losses: the evidence for multiple sclerosis. Journal of Health Economics, 17(4), 475–497. August 1998.

Studdert, D. M., Bhattacharya, J., Schoenbaum, M., Warren, B., & Escarce, J. J. (2002). Personal choice of health plans by managed care experts. Medical Care, 40(5), 375–386. May 2002.

Viscusi, W. K., & Evans, W. N. (1990). Utility functions that depend on health status: estimates and economic implications. American Economic Review, 80(3), 353–74. June 1990.

Wedig, G. J. (2010). Consumer Choice and the Decline in HMO Enrollments. doi:10.2139/ssrn.1621710.

Zweifel, P., Telser, H., & Vaterlaus, S. (2006). Consumer resistance against regulation: the case of health care. Journal of Regulatory Economics, 29, 319–332.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kreier, R., Sengupta, B. Income, Health, and the Value of Preserving Options. Atl Econ J 43, 431–448 (2015). https://doi.org/10.1007/s11293-015-9479-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-015-9479-x