Abstract

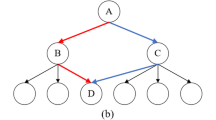

Nowadays, due to some social, legal, and economic reasons, dealing with supply chain risk is an unavoidable issue in many industries. Besides, regarding real-world various emergencies, the research of supply chain risk is extremely difficult. This paper chose industrial index data from 2009 to 2016, utilizing the ternary VAR-GARCH (1,1)–BEKK model to analyze the risk of contagion in Supply Chain Networks which was comprised of the three levels of energy, transportation and industrial enterprises. Through data analysis, we found that the supply chain risk from upstream to downstream enterprises is not only one-way contagion, but also jumping contagion. This one-way or cross-contagion direction can lead to multiple rounds of mixed contagion, which will seriously exacerbate the consequences of supply chain risks. In addition, the type of industry appears to show that supply chains are the most likely to spread the risk from upstream to downstream. So the upstream and downstream enterprises in the supply chain need to jointly control and cope with this risk of contagion effect.

Similar content being viewed by others

References

Gang, L. I. (2011). Research on supply chain risk conduction mechanism. China Business & Market, 25(1), 41–44.

Zhang, J. G. (2011). Research on the elements and process of supply chain risk conduction. Logistics Engineering & Management, 33(11), 139–141.

Mcfarland, R. G., Bloodgood, J. M., & Payan, J. M. (2008). Supply chain contagion. Journal of Marketing, 72(2), 63–79.

Acuna-Agost, R., Michelon, P., Feillet, D., et al. (2011). SAPI: Statistical analysis of propagation of incidents. A new approach for rescheduling trains after disruptions. European Journal of Operational Research, 215(1), 227–243.

Świerczek, A. (2014). The impact of supply chain integration on the “snowball effect” in the transmission of disruptions: An empirical evaluation of the model. International Journal of Production Economics, 157, 89–104.

Feng, N., Wang, H. J., et al. (2014). A security risk analysis model for information systems: Causal relationships of risk factors and vulnerability propagation analysis. Information Sciences, 256(1), 57–73.

Cheng, G. P., & Qiu, Y. G. (2009). Research on the mode of the supply chain risk conduction. Journal of Wuhan University of Technology, 22(1), 36–41.

Zhu, X. Q. (2009). On the carriers of conduction of SCR. Journal of Yangtze University, 23(1), 66–68.

Wei, H. (2013). Study on supermarket food safety risk management based on supply chain. Logistics Technology, 32(12), 341–343, 362.

Li, B., & Jiang, Q. (2014). Study on conduction mechanism of CSR risk based on food supply chain. Chinese Agricultural Science Bulletin, 30(3), 315–320.

Yi-Qinga, H. E., Wan, Y. Y., & Dian-Zhib, H. E. (2009). Empirical study on the cross-market risk contagion between China’s capital market and the banking system under the sub-prime mortgage crisis. Journal of Nanchang University, 33(6), 551–556.

Yi, F., & Yishan, Z. (2007). An empirical study on risk contagion in domestic and foreign metal futures markets. Journal of Financial Research, 52(5), 133–146.

Xinjun, W., & Minhui, L. (2011). Shanghai, deep, the US stock market volatility spillover relationship-based on ternary BEKK–GARCH (1,1) model. Shandong Social Sciences, 24(11), 158–162.

Lin, S. X., & Tamvakis, M. N. (2001). Spillover effects in energy futures markets. Energy Economics, 23(1), 43–56.

Hongfei, J., & Luo, K. (2010). The shadow of international oil price on Chinaese stock market-empirical analysis based on industry data. Financial Research, 356(2), 173–187.

Yao, A., & Ling, X. (2011). Total, an empirical study on the impact of oil price on the trend of Chinese stock market. Modern Economic Information, 000(2), 1.

De Soldier, N., Jianchang, F., & Ego, D. (2013). Transmission analysis of demand and exchange rate risks in the supply chain. Journal of Management Engineering, 27(1), 49–55.

Peng, Z., & Jianyun, Z. (2008). Empirical study on the stock market earnings and volatility spillover effects in Hong Kong, Taipei, New York. Industrial Technology Jinan, 27(7), 145–149.

Engle, R. F., & Kroner, K. F. (1995). Multivariate simultaneous generalized arch. Econometric Theory, 11(1), 122–150.

Kavajecz, K. A., & Odders-White, E. R. (2001). Volatility and market structure. Journal of Financial Markets, 4(4), 359–384.

Acknowledgements

This research was carried out under project number 1611407089, 1611407095 in the framework of Research and Innovation Capacity Graduate Development Program Project of Huaqiao University. The author would like to thank the anonymous reviewers for their valuable comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Pan, W., Zhao, H. & Miu, L. An Empirical Study on Supply Chain Risk Contagion Effect Based on VAR-GARCH (1,1)–BEKK Model. Wireless Pers Commun 109, 761–775 (2019). https://doi.org/10.1007/s11277-019-06589-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11277-019-06589-3