Abstract

We propose a theoretical model to explain the usage of time-inconsistent behavior as a strategy to exploit others when reputation and trust have secondary effects on the economic outcome. We consider two agents with time-consistent preferences exploiting common resources. Supposing that an agent is believed to have time-inconsistent preferences with probability p, we analyze whether she uses this misinformation when she has the opportunity to use it. Using the model originally provided by Levhari and Mirman (Bell J Econ 11(1):322–334, 1980), we determine the optimal degree of present bias that the agent would like to have while pretending to have time-inconsistent preferences and we provide the range of present-bias parameter under which deceiving is optimal. Moreover, by allowing the constant relative risk aversion class of utility form, we characterize the distinction between pretending to be naive and sophisticated.

Similar content being viewed by others

Notes

Consider a person with a bad habit of staying up too late. Every morning, he promises to go to bed early, but, at night, he always goes to bed later than he intended. By knowing that he breaks his promises so many times, a rational agent may pre-commit his future behavior. For example, he can say his spouse that he feels tired and sluggish, so that he should go to bed early. If you are married, then you know that your spouse will make you go to bed early either by kindness or by force.

For a comprehensive review on psychological determinants of intertemporal preferences, see Urminsky and Zauberman (2015).

Note that, even if both players know that they have time-consistent preferences, we might have a subgame perfect equilibrium where the consumption path coincides with the one defined in Proposition 1: The agent 1 continues to play \(g_{S}(x)\) and agent 2 continues to play \(g_{A_{S}}(x)\) as long as no agent deviates from this strategy. If at least one player deviates from this strategy, they both play \(h\left( x\right) =x\) and the resources are exhausted. For a set of payoffs to be supportable in discounted dynamic programming, see Fudenberg and Tirole (1991).

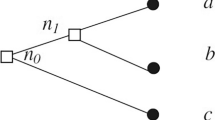

The pooling equilibrium that we define resembles the well-known variant of the chain-store game in which there is a small probability p that the monopolist is “tough” and prefers fight rather than cooperate if there is an entry to the market. In the original chain-store game, a monopolist plays against a succession of K potential competitors. In each period, one of the potential competitors decide whether or not to compete with the monopolist. If it decides to enter, then the monopolist chooses either to cooperate or to fight. Each potential competitor prefers to stay out rather than entering and being fought, but prefers the most when it enters and the monopolist does not fight. If a competitor enters, the monopolist prefers to cooperate rather than fight, but it prefers the most if there is no entry. In the unique subgame perfect equilibrium of the game, each potential competitor chooses to enter and the monopolists always chooses to cooperate (Selten 1978). Kreps and Wilson (1982) shows that the regular monopolist turns the failure of correct common knowledge about its payoff into an advantage by acting like a tough one and preserves its reputation at least until the horizon gets close. Similarly, we show that agent 1 turns the failure of correct common knowledge about its preferences into an advantage and acts as if he might have problems with self-control.

With heterogeneous discount factors, we get \(c=\frac{\left( 1-\delta _{1}\alpha \right) \delta _{2}\alpha }{\delta _{2} +\beta \delta _{1}-\alpha \delta _{1}\delta _{2}},\)\(d=\frac{\left( 1-\delta _{2}\alpha \right) \beta \delta _{1}\alpha }{\delta _{2}+\beta \delta _{1} -\alpha \delta _{1}\delta _{2}}\)and \(1-c-d=\frac{\beta \alpha \delta _{1}\delta _{2} }{\delta _{2}+\beta \delta _{1}-\alpha \delta _{1}\delta _{2}}.\)

We restrict ourselves to linear strategies to obtain definite results. By relaxing the assumption on output elasticity, one can show numerically that the decision to pretend to have time−inconsistent preferences and the preference between naive and sophisticated behavior may depend on the available resource stock.

As we did in Sect. 4, one can solve the model for heterogeneous discount factors. While an MPNE in linear strategies does not exist when agent 1 pretend to be sophisticated, it still exists when both agents act with time-consistent preferences or when agent 1 pretend to be naive. For the naive player, we plot the optimal level of \(\beta \) for multiple cases by freeing modified discount factor of agents one at a time. Our analysis confirms the discussion in Sect. 4 that the optimal level of \(\beta \) depends on the nonlinear interaction of agent 1’s own discount rate and the discount rate of the agent 2.

References

Ainslie, G. (1992). Picoeconomics: The strategic interaction of successive motivational states within the person. Cambridge: Cambridge University Press.

Ainslie, G., & Haslam, N. (1992). Hyperbolic discounting. In G. Loewenstein & J. Elster (Eds.), Choice over time (pp. 57–92). New York: Russell Sage Foundation.

Amir, R., & Nannerup, N. (2006). Information structure and the tragedy of the commons in resource extraction. Journal of Bioeconomics, 8(2), 147–165.

Bryan, G., Karlan, D., & Nelson, S. (2010). Commitment devices. Annual Review of Economics, 2(1), 671–698.

Battaglini, M., Benabou, R., & Tirole, J. (2005). Self-control in peer groups. Journal of Economic Theory, 123, 105–134.

Benabou, R., & Tirole, J. (2004). Willpower and personal rules. Journal of Political Economy, 112(4), 848–886.

Burks, S. V., Carpenter, J. P., Goette, L., & Rustichini, A. (2009). Cognitive skills affect economic preferences, strategic behavior, and job attachment. Proceedings of the National Academy of Sciences, 106, 7745–7750.

Di Corato, L. (2012). Optimal conservation policy under imperfect intergenerational altruism. Journal of Forest Economics, 18(3), 194–206.

Fehr, E., & Leibbrandt, A. (2011). A field study on cooperativeness and impatience in the tragedy of the commons. Journal of Public Economics, 95, 1144–1155.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40(2), 351–401.

Fudenberg, D., & Tirole, J. (1991). Game theory. Cambridge: MIT Press.

Green, L., & Myerson, J. (2004). A discounting framework for choice with delayed and probabilistic rewards. Psychological Bulletin, 130(5), 769–792.

Green, L., & Myerson, J. (2010). Experimental and correlational analyses of delay and probability discounting. In G. J. Madden & W. K. Bickel (Eds.), Impulsivity: The behavioral and neurological science of discounting (pp. 67–92). Washington, DC: American Psychological Association.

Harris, C., & Laibson, D. (2001). Dynamic choices of hyperbolic consumers. Econometrica, 69(4), 935–957.

Haurie, A. (2005). A multigenerational game model to analyze sustainable development. Annals of Operations Research, 137(1), 369–386.

Haurie, A. (2006). A Stochastic multi-generation game with application to global climate change economic impact assessment. Annals of the International Society of Dynamic Games, 8, 309–332.

Haan, M., & Hauck, D. (2014). Games with possibly naive hyperbolic discounters. New York: Mimeo.

Houser, D., Montinari, N., & Piovesan, M. (2012). Private and public decisions in social dilemmas: Evidence from children’s behavior. PLoS ONE, 7(8), e41568.

Jorgensen, S., Martin-Herran, G., & Zaccour, G. (2010). Dynamic games in the economics and management of pollution. Environmental Modeling and Assessment, 15, 433–467.

Karp, L. (2005). Global warming and hyperbolic discounting. Journal of Public Economics, 89(2), 261–282.

Kreps, D. M., & Wilson, R. (1982). Reputation and imperfect information. Journal of Economic Theory, 27(2), 253–279.

Krusell, P., & Smith, A. A. (2003). Consumption-savings decisions with quasi-geometric discounting. Econometrica, 71(1), 365–375.

Krusell, P., Kuruscu, B., & Smith, A. A. (2002). Equilibrium welfare and government policy with quasi-geometric discounting. Journal of Economic Theory, 105(1), 42–72.

Krusell, P., Kuruscu, B., & Smith, A. A. (2000). Tax policy with quasi-geometric discounting. International Economic Journal, 14(3), 1–40.

Laibson, D. (1994). Essays in hyperbolic discounting. Ph.D. dissertation, MIT.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. Quarterly Journal of Economics, 112, 443–77.

Laibson, D. (1998). Life-cycle consumption and hyperbolic discount functions. European Economic Review, 42(3), 861–871.

Levhari, D., & Mirman, L. (1980). The Great Fish war: An example using a dynamic Cournot-Nash solution. The Bell Journal of Economics, 11(1), 322–334.

McClure, S. M., Ericson, K. M., Laibson, D. I., Loewenstein, G., & Cohen, J. D. (2007). Time discounting for primary rewards. The Journal of Neuroscience, 27(21), 5796–5804.

Metcalfe, J., & Mischel, W. (1999). A hot/cool system analysis of delay gratification: Dynamics of willpower. Psychological Review, 106(1), 3–19.

Nowak, A. (2006). A multigenerational dynamic game of resource extraction. Mathematical Social Sciences, 51, 327–336.

O’Donoghue, T., & Rabin, M. (1999). Doing it now or later. American Economic Review, 89(1), 103–124.

Palacios-Huerta, I. (2003). Time-inconsistent preferences in Adam Smith and David Hume. History of Political Economy, 35(2), 241–268.

Phelps, E. S., & Pollak, R. A. (1968). On second-best national saving and game-equilibrium growth. The Review of Economic Studies, 35(2), 185–199.

Pollak, R. A. (1968). Consistent planning. The Review of Economic Studies, 35(2), 201–208.

Rachlin, H. (2000). The science of self-control. Cambridge: Harvard University Press.

Selten, R. (1978). The chain store paradox. Theory and Decision, 9(2), 127–159.

Sigmund, K., Hauert, C., & Nowak, M. A. (2001). Reward and punishment. Proceedings of the National Academy of Sciences, 98(19), 10757–10762.

Soman, D., Ainslie, G., Frederick, S., Li, X., Lynch, J., Moreau, P., et al. (2005). The psychology of intertemporal discounting: Why are distant events valued differently from proximal ones? Marketing Letters, 16, 347–360.

Strotz, R. H. (1955). Myopia and inconsistency in dynamic utility maximization. The Review of Economic Studies, 23(3), 165–180.

Thaler, R. H., & Shefrin, H. (1981). An economic theory of self control. Journal of Political Economy, 89(1), 392–406.

Urminsky, O., & Zauberman, G. (2015). The psychology of intertemporal preferences. In G. Wu., & G. Keren (Eds.), Blackwell Handbook of Judgment and Decision Making (pp. 141–181).

Van Long, N. (2011). Dynamic games in the economics of natural resources: A survey. Dynamic Games and Applications, 1(1), 115–148.

Van Long, N., Shimomura, K., & Takahashi, H. (1999). Comparing open-loop with Markov equilibria in a class of differential games. The Japanese Economic Review, 50, 457–469.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 The proof of proposition 2

(a) Follows from Amir and Nannerup (2006).

(b) From part a, one can compute that:

Under Assumption 2, by 7 and 8, we have

Using the linearity of \(g_{N}\left( {}\right) \) and \(g_{A_{N}}(x),\) we find \(g_{N}\left( x\right) =\frac{1-\delta \alpha }{1+\beta -\alpha \delta }x \) and \(g_{A_{N}}(x)=\frac{\beta \left( 1-\delta \alpha \right) }{1+\beta -\alpha \delta }x.\)

(c) Under Assumption 2, by 11 and 12, we have

Using the linearity of \(g_{S}\left( {}\right) \) and \(g_{A_{S}}(x),\) we find \(g_{S}\left( x\right) =\frac{1-\delta \alpha }{1+\beta -\alpha \delta }x \) and \(g_{A_{S}}(x)=\frac{\beta \left( 1-\delta \alpha \right) }{1+\beta -\alpha \delta }x.\)

1.2 The Proof of Corollary 1

It follows from Proposition 2, as we have

1.3 The Proof of Proposition 3

(a) Under case 2 and 3, agent 1’s utility is given by the following:

By guessing that the value function has the form \(A\log x+B,\) we compute

This implies that utility maximizing \(\beta \) solves the following problem :

From the first-order condition, we get \(\beta =\delta \alpha .\) Note that objective function is increasing when \(\beta <\delta \alpha \) and decreasing when \(\beta >\delta \alpha \), i.e., \(\beta =\delta \alpha \) is the unique maximization point.

(b) If the agent cannot choose \(\beta ,\) she gets \(V^{1}\left( x\right) \) if she acts as if she had time-inconsistent preferences and gets \(V_{tc}\left( x\right) \) if she acts truly. Note that \(V^{1}\left( x\right)>V_{tc}\left( x\right) \Longleftrightarrow \log \frac{1}{1+\beta -\delta \alpha }+\delta \alpha \log \beta >\log \frac{1}{2-\delta \alpha }\) . By part (a), we know that left-hand side of the equation is decreasing in \(\beta \) when \(\beta \) is greater than \(\delta \alpha .\) Since they are equal to each other for \(\beta \) equals to 1, the left-hand side is greater than the right-hand side when \(\beta \in [ \delta \alpha ,1) \). Let us consider the case, such that \(( \frac{1}{2-\delta \alpha }) ^{\frac{1}{\delta \alpha }} <\alpha \delta .\) Our result follows from the fact that, for any \(\beta \in [( \frac{1}{2-\delta \alpha }) ^{\frac{1}{\delta \alpha } },\alpha \delta ) ,\) we have \(\log \frac{1}{1+\beta -\delta \alpha } +\delta \alpha \log \beta >\delta \alpha \log \beta \ge \log \frac{1}{2-\delta \alpha }\).

1.4 The Proof of Proposition 4

(a) Under Assumption 3, by 4, we have

By imposing that \(g_{tc}\left( x\right) =a_{tc}x\), we get \(\left( 1-2a_{tc}\right) ^{\sigma }-\delta A^{1-\sigma }\left( 1-a_{tc}\right) =0.\) Since \(h_{tc}\left( 0\right) >0,h_{tc}\left( \frac{1}{2}\right) <0\) and \(h_{tc}\left( c\right) \) is continuous in c implies that there exist \(a_{tc} \)\(\in \left( 0,\frac{1}{2}\right) \), such that \(h_{tc}\left( a_{tc}\right) =0.\) By 5, we get:

(b) Under Assumption 3, by 7 and 16, we have

By imposing that \(g_{N}\left( x\right) =a_{n}x,\) and \(g_{A_{N}}(x)\) is linear in x, we get \(g_{A_{N}}(x)=\left( 1-a_{n}\left( 1+B^{1/\sigma }\right) \right) x\) and

Consider function \(h_{N}\left( {}\right) \). In equilibrium, we must have \(x-g_{N}\left( x\right) -g_{A_{N}}(x)>0\), i.e., \(a_{n}<\frac{1}{1+B^{1/\sigma }}.\)Since \(h_{N}\left( a_{tc}\right) =Ba_{tc}^{\sigma }-\delta A^{1-\sigma }\left( 1-a_{tc}\right) =\frac{\delta A^{1-\sigma }\left( \beta -1\right) a_{tc}}{1-\delta A^{1-\sigma }\left( 1-2a_{tc}\right) ^{1-\sigma }}<0,\)\(h_{N}^{\prime }\left( c\right) >0,\) and by assumption of the proposition \(h_{N}\left( \frac{1}{1+B^{1/\sigma }}\right) >0,\) there exists unique \(a_{n}\)\(\in \left( a_{tc},\frac{1}{1+B^{1/\sigma }}\right) \), such that \(h_{N}\left( a_{n}\right) =0.\)

(c) Under Assumption 3, by 11, we have

By imposing that \(g_{S}\left( x\right) =a_{s}x,\) and \(g_{A_{S}}(x)\) is linear in x, we get \(g_{A_{S}}(x)=\beta a_{s}x\) and

In equilibrium, we must have \(x-g_{S}\left( x\right) -g_{A_{S}}(x)>0\) i.e. \(a_{s}<\frac{1}{1+\beta }.\)Consider function \(h_{S}\left( {}\right) \). Since \(h_{S}\left( a_{tc}\right) >h_{tc}\left( a_{tc}\right) =0,\)\(h_{S}\left( \frac{1}{1+\beta }\right) <0\) and \(h_{S}\left( c\right) \) is continuous in c, there exists \(a_{s}\)\(\in \left( a_{tc},\frac{1}{1+\beta }\right) \), such that \(h_{S}\left( a_{s}\right) =0.\)

1.5 The proof of corollary 2

Since the equilibrium strategy of a naive and a sophisticated agent does not necessarily coincide, we have two different cases to consider. Let us consider the strategic interaction with a naive agent first. We have

where \(c_{n}x=g_{N}\left( x\right) +g_{A_{N}}(x)=a_{n}x+\left( 1-a_{n}\left( 1+B^{1/\sigma }\right) \right) x\).Since \(\left( 1-2a_{tc}\right) ^{\sigma }-\delta A^{1-\sigma }\left( 1-a_{tc}\right) =0\), we have the relation that:

By Proposition 4b, we conclude \(g_{N}\left( x\right) +g_{A_{N}}(x)>2g_{tc}\left( x\right) .\)Similarly, we have

where \(c_{s}x=g_{S}\left( x\right) +g_{A_{S}}(x).\)This implies that:

By Proposition 4c, we conclude \(g_{S}\left( x\right) +g_{A_{S}}(x)>2g_{tc}\left( x\right) .\)

1.6 The pooling equilibrium and optimal value of discount factor when there is an uncertainty about agent 1’s discount factor

Suppose that agent 1’s true discount factor is \(\delta _{1}\), while agent 2 believes that her discount factor is \(\hat{\delta }_{1}\) with probability p. Consider the games with discount rate pairs \(\left( \hat{\delta }_{1} ,\delta _{2}\right) \) and \(\left( \delta _{1},\delta _{2}\right) .\)Since both agents have time-consistent preferences, MPNE of the games can be found by following the steps that we define in Sect. 2.1. Let us denote MPNE by \(\hat{g}_{tc}^{1}(x),\hat{g}_{tc}^{2}(x)\) and value functions by \(\hat{V}_{tc}^{1}(x),\hat{V}_{tc}^{2}(x)\) for the game with discount rate \((\hat{\delta }_{1},\delta _{2}).\) Similarly, denote MPNE of the game with discount rate \(( \delta _{1},\delta _{2})\) by \(g_{tc}^{1}(x),g_{tc}^{2}(x)\) and the corresponding value functions by \(V_{tc}^{1}(x),V_{tc}^{2}(x).\) We can define the pooling equilibrium as below:

If \(\hat{V}_{tc}^{1}(x)\ge V_{tc}^{1}(x)\) and \(\hat{V}_{tc}^{i}(x)\ge IC (x) \), where \(i\in \left\{ 1,2\right\} ,\) there is a perfect Bayesian equilibrium \(\left( \left( \tilde{s}^{1}(h,\theta ),\tilde{s} ^{2}\left( h\right) \right) ,\left( \mu \left( h\right) \right) \right) \), such that

Under Assumption 2, by Levhari and Mirman (1980), we have:

Agent 1 finds the optimal value of \(\hat{\delta }_{1}\) by solving the trade-off between her consumption rate and combined investment rate governed by the following maximization problem:

where c and d represent the equilibrium consumption rates of the agents, i.e., \(c=\frac{\hat{g}_{tc}^{1}(x)}{x}\) and \(d=\frac{\hat{g}_{tc}^{2}(x)}{x}\). From the first-order condition, we get \(\hat{\delta }_{1}=\frac{\alpha \delta _{1}\delta _{2}}{1-\alpha \delta _{1}+\alpha ^{2}\delta _{1}\delta _{2}}.\)Note that objective function is increasing when \(\hat{\delta }_{1}<\frac{\alpha \delta _{1}\delta _{2}}{1-\alpha \delta _{1}+\alpha ^{2}\delta _{1}\delta _{2}}\) and decreasing when \(\hat{\delta }_{1}>\frac{\alpha \delta _{1}\delta _{2}}{1-\alpha \delta _{1}+\alpha ^{2}\delta _{1}\delta _{2}}\), i.e., \(\hat{\delta } _{1}=\frac{\alpha \delta _{1}\delta _{2}}{1-\alpha \delta _{1}+\alpha ^{2}\delta _{1}\delta _{2}}\) is the unique maximization point.

Rights and permissions

About this article

Cite this article

Turan, A.R. Intentional time inconsistency. Theory Decis 86, 41–64 (2019). https://doi.org/10.1007/s11238-018-9671-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-018-9671-y