Abstract

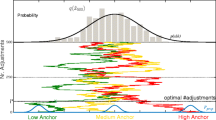

Models in decision theory and game theory assume that preferences are determinate: for any pair of possible outcomes, a and b, an agent either prefers a to b, prefers b to a, or is indifferent as between a and b. Preferences are also assumed to be stable: provided the agent is fully informed, trivial situational influences will not shift the order of her preferences. Research by behavioral economists suggests, however, that economic and hedonic preferences are to some degree indeterminate and unstable, which in turn suggests that other sorts of preferences may suffer the same problem. Even fully informed agents do not always determinately prefer a to b, prefer b to a, or feel indifferent as between a and b. Seemingly trivial situational influences rearrange the order of their preferences. One could respond that decision theory and game theory are not meant to describe actual behavior, and that they instead adumbrate an ideal of rationality from which human action diverges in various ways. When the divergences are small and systematic, they help us identify the heuristics that conspire to help people approximate rationality. One such heuristic, dubbed the Wilde heuristic, is explored. However, the divergences documented by behavioral economists threaten to be too large to handle through idealization. The Rum Tum Tugger Model, in which indifference is intransitive, is spelled out as one promising way for decision and game theory to retrench. Preferences may be locally unstable and indeterminate, but when the differences between options are sufficiently large, they approximate stability and determinacy.

Similar content being viewed by others

References

Ariely D., Loewenstein G., Prelec D. (2006) Tom Sawyer and the construction of value. Journal of Economic Behavior & Organization 60: 1–10

Camerer C., Thaler R. (1995) Anomalies: Ultimatums, dictators and manners. Journal of Economic Perspectives 9: 209–219

Fishkin J. (1982) The limits of obligation. Yale University Press, London

Gaus G. (2008) On philosophy, politics, and economics. Wadsworth, New York

Gigerenzer G., Hoffrage U. (1995) How to improve Bayesian reasoning without instruction. Psychological Review 102: 684–704

Gilovich, T., Griffin, D., Kahneman, D (eds) (2002) Heuristics and Biases: The Psycology of Intuitive Judgment. Cambridge University Press, New York

Green D., Jacowitz K., Kahneman D., McFadden D. (1998) Referendum contingent valuation, anchoring, and willingness to pay for public goods. Resources and Energy Economics 20: 85–116

Hoeffler S., Ariely D., West P. (2006) Path dependent preferences: The role of early experience and biased search in preference development. Organizational Behavior and Human Decision Processes 101: 215–229

Hoffman E., McCabe K., Shachat K., Smith V. (1994) Preferences, property rights, and anonymity in bargaining games. Games and Economic Behavior 7: 346–380

Johnson E., Schkade A. (1989) Bias in utility assessments. Management Science 35: 406–424

Kahneman D., Slovic P., Tversky A. (1982) Judgment under uncertainty: Heuristics and biases. Cambridge University Press, Cambridge

Kahneman D., Tversky A. (1974) Judgment under uncertainty: Heuristics and Biases. Science 185:4157: 1124–1131

Lichtenstein S., Slovic P. (1971) Reversals of preference between bids and choices in gambling decisions. Journal of Experimental Psychology 89: 46–55

Lichtenstein S., Slovic P. (1973) Response-induced reversals of preference in gambling. Journal of Experimental Psychology 101: 16–20

Myerson R. (1991) Game theory: Analysis of conflict. Harvard University Press, London

Roth A., Prasnikar V., Okuno-Fujiwara M., Zamir S. (1991) Bargaining and market behavior in Jerusalem, Ljubljana, Pittsburgh, and Tokyo. American Economic Review 81: 1068–1095

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the Notre Dame Institute for Advanced Study.

Rights and permissions

About this article

Cite this article

Alfano, M. Wilde heuristics and Rum Tum Tuggers: preference indeterminacy and instability. Synthese 189 (Suppl 1), 5–15 (2012). https://doi.org/10.1007/s11229-012-0128-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11229-012-0128-5