Abstract

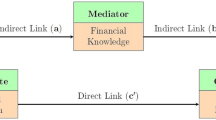

Many individuals learn financial knowledge and skills in school (namely formal financial education) and through friends and family (e.g., family financial socialization). While the two channels have distinctive merits and limitations, little is known about how formal financial education and family financial socialization differ and interact when it comes to helping people gain financial knowledge and skills. Using data from the 2015 National Financial Capability Study, we examined the association between formal financial education, family financial socialization, and financial knowledge. Results from regression estimates with interaction terms included indicated that both channels had positive associations with increased financial knowledge levels with different impact magnitudes, while together they seemed to have negative associations with increased financial knowledge. Our study suggests that each channel likely provides financial knowledge in different domains and has implications for future research and financial education policy.

Similar content being viewed by others

References

Applied Research & Consulting LLC. (2009). Financial capability in the United States: Initial report of research findings from the 2009 National Survey, a component of the National Financial Capability Study. Retrieved 26 Sept, 2018 from https://www.usfinancialcapability.org/downloads/NFCS_2009_Natl_Full_Report.pdf.

Batty, M., Collins, J. M., & Odders-White, E. (2015). Experimental evidence on the effects of financial education on elementary school students’ knowledge, behavior, and attitudes. Journal of Consumer Affairs,49(1), 69–96. https://doi.org/10.1111/joca.12058.

Bernheim, B. D., & Garrett, D. M. (2003). The effects of financial education in the workplace: Evidence from a survey of households. Journal of Public Economics,87(7–8), 1487–1519.

Bernheim, B. D., Garrett, D. M., & Maki, D. M. (2001). Education and saving: The long-term effects of high school financial curriculum mandates. Journal of Public Economics,80(3), 435–465.

Beutler, I., & Dickson, L. (2008). Consumer economic socialization. In J. J. Xiao (Ed.), Handbook of consumer finance research (pp. 83–102). New York, NY: Springer. https://doi.org/10.1007/978-0-387-75734-6_6.

Braunstein, S., & Welch, C. (2002). Financial literacy: An overview of practice, research, and policy. Federal Reserve Bulletin,88, 445–457.

Chen, Z., & Lemieux, C. (2016). Financial knowledge and behaviors of Chinese migrant workers: An international perspective on a financially vulnerable population. Journal of Community Practice,24(4), 462–486.

Clancy, M., Grinstein-Weiss, M., & Schreiner, M. (2001). Financial education and savings outcomes in individual development accounts (CSD working paper no. 01-2). St. Louis, MO: Washington University, Center for Social Development. https://doi.org/10.7936/K7WM1CXJ.

Cole, S., Sampson, T., & Zia, B. (2011). Prices or knowledge? What drives demand for financial services in emerging markets? The Journal of Finance,66(6), 1933–1967. https://doi.org/10.1111/j.1540-6261.2011.01696.x.

Collins, J. M., & O’Rourke, C. (2010). Financial education and counseling—Still holding promise. Journal of Consumer Affairs,44(3), 483–498.

Council for Economic Education. (2016). Survey of the states: Economic and personal finance education in our nation’s schools. Retrieved 26 Sept, 2018 from http://www.councilforeconed.org/wp/wp-content/uploads/2014/02/2014-Survey-of-the-States.pdf.

Danes, S. M., & Haberman, H. (n.d.). 2003–2004 evaluation of the NEFE HSFPP. The National Endowment for Financial Education. Retrieved Jan, 2018 from http://www.nefe.org/hsfppportal/includes/main/home.asp?page=4000#evaluation.

Danes, S. M., & Haberman, H. (2007). Teen financial knowledge, self-efficacy, and behavior: A gendered view. Journal of Financial Counselling and Planning,18(2), 46–48.

Duflo, E., & Saez, E. (2003). The role of information and social interactions in retirement plan decisions: Evidence from a randomized experiment. The Quarterly Journal of Economics,118(3), 815–842.

Fernandes, D., Lynch, J. G., & Netemeyer, G. (2014). Financial literacy, financial education, and downstream financial behaviors. Management Science,60(8), 1861–1883. https://doi.org/10.1287/mnsc.2013.1849.

FINRA Investor Education Foundation. (2015). The national financial capability study. Retrieved Dec, 2017 from http://www.usfinancialcapability.org/about.php.

Gudmunson, C. G., & Danes, S. M. (2011). Family financial socialization: Theory and critical review. Journal of Family and Economic Issues,32(4), 644–667. https://doi.org/10.1007/s10834-011-9275-y.

Harvey, M. (2018). Financial education among financially vulnerable populations in the United States. Doctoral dissertation, Pardee RAND Graduate School, Santa Monica, CA. https://search.proquest.com/docview/2042330469/abstract/6E4CBB1928BD438DPQ/1.

Hastings, J. S., Madrian, B. C., & Skimmyhorn, W. L. (2013). Financial literacy, financial education, and economic outcomes. Annual Review of Economics,5(1), 347–373. https://doi.org/10.1146/annurev-economics-082312-125807.

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin,89, 309–322.

Jorgensen, B. L., & Savla, J. (2010). Financial literacy of young adults: The importance of parental socialization. Family Relations,59(4), 465–478. https://doi.org/10.1111/j.1741-3729.2010.00616.x.

Kasman, M., Heuberger, B., & Hammond, R. A. (2018). Recommendations for improving youth financial literacy education. Washington, DC: The Bookings Institution.

Kim, J., & Chatterjee, S. (2013). Childhood financial socialization and young adults’ financial management. Journal of Financial counseling & Planning.,24(1), 61–79.

Lusardi, A. (2013). Financial literacy and high-cost borrowing in the United States (working paper no. 18969). Cambridge, MA: National Bureau of Economic Research.

Lusardi, A., & Mitchell, O. (2007). Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth. Journal of Monetary Economics,54(1), 205–224.

Lusardi, A., & Mitchell, O. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature,52(1), 5–44.

Mandell, L. (2006). Financial literacy: If it’s so important, why isn’t it improving? Networks Financial Institute, 2006-PB-08. Retrieved Jan, 2018 from http://www.isunetworks.com/pdfs/profiles/2006-PB-08_Mandell.pdf.

Mandell, L., & Klein, L. S. (2009). The impact of financial literacy education on subsequent financial behavior. Journal of Financial Counseling and Planning,20(1), 16.

Marcolin, S., & Abraham, A. (2006). Financial literacy research: Current literature and future opportunities. In Faculty of commerce—Papers (archive). Wollongong: University of Wollongong. Retrieved 26 Sept, 2018 from http://ro.uow.edu.au/commpapers/223.

Miller, M., Reichelstein, J., Salas, C., & Zia, B. (2014). Can you help someone become financially capable? A meta-analysis of the literature. Policy research working papers. World Bank Group. https://doi.org/10.1596/1813-9450-6745.

Organization for Economic Co-operation and Development (OECD). (2005). Improving financial literacy: Analysis of issues and policies. Paris: OECD.

Posey, K. G. (2016). Household income: 2015. Retrieved 26 Sept, 2018 from https://www.census.gov/content/dam/Census/library/publications/2016/acs/acsbr15-02.pdf.

Sebstad, J., & Cohen, M. (2003). Financial education for the poor. Washington, DC: Microfinance Opportunity.

Sherraden, M. (2013). Building blocks of financial capability. In J. Birkenmaier, M. Sherraden, & J. Curley (Eds.), Financial capability and asset development: Research, education, policy, and practice (pp. 3–43). New York, NY: Oxford University Press.

Shim, S., Barber, B. L., Card, N. A., Xiao, J. J., & Serido, J. (2010). Financial socialization of first-year college students: The roles of parents, work, and education. Journal of Youth and Adolescence,39(12), 1457–1470. https://doi.org/10.1007/s10964-009-9432-x.

Shim, S., Xiao, J. J., Barber, B. L., & Lyons, A. C. (2009). Pathways to life success: A conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology,30(6), 708–723. https://doi.org/10.1016/j.appdev.2009.02.003.

Sohn, S., Joo, S., Grable, J. E., Lee, S., & Kim, M. (2012). Adolescents’ financial literacy: The role of financial socialization agents, financial experiences, and money attitudes in shaping financial literacy among South Korean youth. Journal of Adolescence,35(4), 969–980. https://doi.org/10.1016/j.adolescence.2012.02.002.

Tang, N. (2017). Like father like son: How does parents’ financial behavior affect their children’s financial behavior? Journal of Consumer Affairs,51(2), 284–311. https://doi.org/10.1111/joca.12122.

Todd, R. M. (2002). Financial literacy education: A potential tool for reducing predatory lending? The Region,12, 34–36.

Urban, C., Schmeiser, M., Collins, J. M., & Brown, A. (2015). State financial education mandates: It’s all in the implementation. Washington, DC: FINRA Investor Financial Education Foundation.

Van Campenhout, G. (2015). Revaluing the role of parents as financial socialization agents in youth financial literacy programs. Journal of Consumer Affairs,49(1), 186–222. https://doi.org/10.1111/joca.12064.

Von Stumm, S., O’Creevy, M. F., & Furnham, A. (2013). Financial capability, money attitudes and socioeconomic status: Risks for experiencing adverse financial events. Personality and Individual Differences,54(3), 344–349.

Ward, S. (1974). Consumer socialization. Journal of Consumer Research,1(2), 1–14. https://doi.org/10.1086/208584.

Xiao, J. J., Ford, M. F., & Kim, J. (2011). Consumer financial behavior: An interdisciplinary review of selected theories and research. Family and Consumer Sciences Research Journal,39(4), 399–414. https://doi.org/10.1111/j.1552-3934.2011.02078.x.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Jin, M., Chen, Z. Comparing Financial Socialization and Formal Financial Education: Building Financial Capability. Soc Indic Res 149, 641–656 (2020). https://doi.org/10.1007/s11205-019-02248-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-019-02248-z