Abstract

The aim of this paper was to analyse distributional implications of the economic development reflected at the macro level in the Baltics. We demonstrated how the concepts of income and its measurement at macro and micro levels can be reconciled using data recorded in the EU Survey on Income and Living Conditions (EU-SILC) and National Accounts. We found that household incomes in the Baltics diverge and lag behind incomes reflected at the macro level. This was especially true for two income categories: property and mixed incomes. Average gaps in social benefits and taxes were small, and these were medium for wages and salaries. Adjusting incomes in EU-SILC to cover the observed gaps resulted in increase in income inequality indicators for all three countries, especially for Latvia and for the period of resumed economic growth following the latest economic crisis in Lithuania. Hence, divergences between macro and micro level accounts on incomes hide potentially higher levels of income inequality than shown in official distributional statistics.

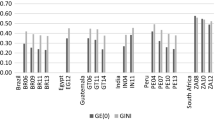

Source: calculations by authors based on Eurostat (2016). Note available counties only. Ireland 1998, Croatia 2000 instead of 1995

Source: calculations by authors based on National Accounts, Eurostat

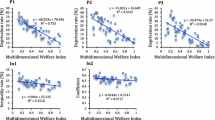

Source: calculations by authors

Source: calculations by authors based on EU-SILC. Note estimates lagged by 1 year to correspond to the income reference period. Income equivalized using modified OECD scale

Source: see previous

Source: see previous

Source: see previous. Note time-period lagged by one year (t − 1) to correspond to the income reference period in EU-SILC

Source: see previous. Note time-period lagged by one year (t − 1) to correspond to the income reference period in EU-SILC

Similar content being viewed by others

Notes

Calculations by the authors based on Eurostat (2016).

In National Accounts the economy is divided into five mutually exclusive institutional sectors: (a) non-financial corporations sector, (b) financial corporations sector, (c) general government sector, (d) household sector and, (e) non-profit institutions serving households (NPISHs) sector.

For further the details see the link: Eurostat.Template:Database http://epp.eurostat.ec.europa.eu/portal/page/portal/income_social_inclusion_living_conditions/introduction.

For detailed list of variables under each income component see Eurostat (2013).

EU-SILC data is available for the three Baltic countries since 2005 (income reference period of 2004). We used the available data since 2007 due to technical limitation and inconsistencies in the income components in the initial waves in Latvia.

For further the details see the link: Eurostat.Template:Database http://epp.eurostat.ec.europa.eu/portal/page/portal/income_social_inclusion_living_conditions/introduction.

See EU-SILC Description Target Variables. Accessed on 05/06/16, source: http://ec.europa.eu/eurostat/documents/1012329/4462345/EU-SILC-sample-size.pdf/1d70e0a7-5761-4adf-8ecb-e464d253b845.

See EU-SILC National quality reports for detail. Accessed on 05/06/16, source: http://ec.europa.eu/eurostat/web/income-and-living-conditions/quality/eu-and-national-quality-reports.

References

Atkinson, A. B. (2009). Factor shares: The principal problem of political economy? Oxford Review of Economic Policy, 25(1), 3–16. doi:10.1093/oxrep/grp007.

Atkinson, A. B. (2015). Inequality: What can be done?. Cambridge: Harvard University Press. ISBN 9780674504769.

Atkinson, A., Piketty, T., & Saez, E. (2011). Top incomes in the long run of history. Journal of Economic Literature, 49(1), 3–71. doi:10.1257/jel.49.1.3.

Bargain, O. (2012). The distributional effects of tax-benefit policies under New Labour: A decomposition approach. Oxford Bulletin of Economics and Statistics, 74(6), 856–874.

Bargain, O., & Callan, T. (2010). Analysing the effects of tax-benefit reforms on income distribution: A decomposition approach. Journal of Economic Inequality, 8(1), 1–21.

Bhalla, S. (2002). Imagine there’s no country: Poverty, inequality and growth in the era of globalization. Washington, DC: Institute for International Economics.

Bivens, J., Gould, E., Mishel, L., & Shierholz, H. (2014). Raising America’s pay: Why it’s our central economic policy challenge. Economic Policy Institute, Briefing Paper 378, http://www.epi.org/files/pdf/65287.pdf

Bourguignon, F., Ferreira, F., & Leite, P. (2008). Beyond Oaxaca–Blinder: Accounting for differences in household income distributions. Journal of Economic Inequality, 6(2), 117–148.

Bourguignon, F., & Morrisson, C. (2002). Inequality among world citizens: 1820–1992. American Economic Review, 92(4), 727–744.

Cingano, F. (2014). Trends in income inequality and its impact on economic growth. OECD social, employment and migration working papers, No. 163. OECD Publishing.

European Commission (2014). Undeclared work in the European Union. Report. Special Eurobarometer 402/Wave EB79.2—TNS opinion & social. doi:10.2767/37041.

Eurostat (2013). European household income by groups of households. Eurostat methodologies and working papers.

Eurostat (2014). Methodological guidelines and descriptions of EU-SILC target variables. 2014 operation. Doc SILC065 (2014 operation). European Commision, p. 390.

Eurostat (2015). Taxation trends in the European Union. Data for the EU Member States, Iceland and Norway. Eurostat Statistical books. doi:10.2785/298426.

Eurostat (2016). Database. Online source [accessed on 15/04/2016]: http://ec.europa.eu/eurostat/data/database.

Fesseau, M., Wolff, F., & Mattonetti M. L. (2013). A cross-country comparison of household income, consumption and wealth between micro sources and national accounts aggregates. OECD.

Fields, G. S. (2003). Accounting for income inequality and its change: A new method, with application to the distribution of earnings in the United States. In: Polachek, S. W. (Ed.), Worker well-being and public policy (Research in Labor Economics) (Vol. 22, pp. 1–38). Emerald Group Publishing Limited.

Fixler, D., Johnson, D., Craig, A., & Furlong, K. (2016). A consistent data series to evaluate growth and inequality in the national accounts. BEA Working Paper, 16-04. http://npc.umich.edu/publications/u/2016-04-npc-working-paper.pdf

Jenkins, S. P., Burkhauser, R. V., Feng, S., & Larrimore, J. (2011). Measuring inequality using censored data: A multiple-imputation approach to estimation and inference. Journal of the Royal Statistical Society, 174(1), 63–81.

Kuznets, S. (1955). Economic growth and income inequality. American Economic Review, 45(1), 1–28.

Lakner, C. & Milanovic, B. (2013). Global income distribution from the fall of the Berlin Wall to the great recession, World Bank Policy Research working paper series #6719.

Lequiller, F. & Blades, D. (2014). Understanding national accounts: second edition. OECD Publishing. doi: 10.1787/978926421463.

Lohman, H. (2011). Comparability of EU-SILC survey and register data: The relationship among employment, earnings and poverty. Journal of European Social Policy, 21(1), 37–54. doi:10.1177/0958928710385734.

Navické, J., & Lazutka, R. (2016). Functional and personal income distribution in the Baltics: Comparison of national and households accounts. 9th International Scientific Conference “Business and Management 2016”. doi:10.3846/bm.2016.38

Neri, L., Gagliardi, F., Ciampalini, G., Verma, V. & Betti, G. (2009). Outliers at upper end of income distribution (EU-SILC 2007), DMQ Working Paper n. 86, November 2009.

OECD (2013). Crisis squeezes income and puts pressure on inequality and poverty—Results from the OECD Income Distribution Database (May 2013). Paris: OECD Publishing. Available from Internet: http://www.oecd.org/els/soc/OECD2013-Inequality-and-Poverty-8p.pdf. Accessed January 11, 2016.

OECD (2015). The distribution of household income consumption and savings, an OECD study. Office for National Statistics. 30 November 2015, [cited 23 January 2016]. Available from Internet: http://www.ons.gov.uk/economy/nationalaccounts/uksectoraccounts/articles/thedistributionofhouseholdincomeconsumptionandsavingsanoecdstudy/2015-11-30.

Ostry, J., Berg, A., & Tsangarides, C. (2014). Redistribution, inequality, and growth. IMF Staff discussion note [cited 13 February 2016]. Available from Internet: https://www.imf.org/external/pubs/ft/sdn/2014/sdn1402.pdf.

Piketty, T. (2014). Capital in the twenty-first century. Cambridge, MA: Harvard University Press.

Piketty, T. (2015). The economics of inequality. London: Harvard University Press.

Piketty, T., Saez, E., & Zucman, G. (2016). Distributional national accounts: Methods and estimates for the United States. NBER Working Paper No. 22945. http://gabriel-zucman.eu/usdina/.

Podkaminer, L. (2013). Development patterns of Central and East European countries (in the course of transition and following EU accession). Vienna Institute for International Economic Studies. Research Reports, N388, July 2013.

Putniņš, T., & Sauka, A. (2011). Size and determinants of shadow economies in the Baltic States. Baltic Journal of Economics, 11(2), 5–25.

Putniņš, T. J., & Sauka, A. (2014). SSE Riga shadow index for the Baltic countries 2009–2013. Riga: SSE Riga.

Pyatt, G., Chen, C., & Fei, J. (1980). The distribution of income by factor components. The Quarterly Journal of Economics, 95(3), 451–473.

Razgūnė, A., & Lazutka, R. (2015). Labor share trends in three Baltic countries: Literature review and empirical evidence. Ekonomika, 94(1), 97–116.

Sala-i-Martin, X. (2002). The world distribution of income (estimated from individual country distributions). NBER Working Paper No. W8933.

Shorrocks, A. F. (1982). Inequality decomposition by factor components. Econometrica, 50(1), 193–211.

Social Situation Monitor (2016). European Commission employment, social affairs and inclusion. Available from Internet: http://ec.europa.eu/social/main.jsp?catId=1049&langId=en. Accessed February 10, 2016.

Sommers, J. & Woolfson, C. (eds). (2014). The Contradictions of austerity: The socio-economic costs of the neoliberal baltic model. Routledge Studies in the European Economy, 1st edition. ISBN-10: 0415820030.

Stiglitz, J. E. (2013). The price of inequality: How today’s divided society endangers our future. New Yord, NY: W. W. Norton & Company.

Stiglitz, J. E., Sen, A., & Fitoussi, J.-P. (2010). Report by the Commission on the measurement of economic performance and social progress. Available from Internet: http://www.stiglitz-sen-fitoussi.fr/. Accessed February 15, 2016.

Therborn, G. (2012). The killing fields of inequality. International Journal of Health Services, 42(4), 579–589. doi:10.2190/HS.42.4.a.

Törmälehto, V. M. & Sauli, H. (2013). The distributional impact of imputed rent in EU-SILC 2007–2010. Eurostat Methodologies and working papers. doi:10.2785/21725.

Wilkinson, R.G., Pickett, K. (2011). The spirit level: Why more equal societies almost always do better. Reprint edition. Bloomsbury Press. ISBN: 1608193411.

Williams, C. C., & Horodnic, I. A. (2015). Explaining and tackling the shadow economy in Estonia, Latvia and Lithuania: A tax morale approach. Baltic Journal of Economics, 15(2), 81–98. doi:10.1080/1406099X.2015.1114714.

Yates, J. (1994). Imputed rent and income distribution. Review of Income and Wealth, 40(1), 43–66. doi:10.1111/j.1475-4991.1994.tb00044.x.

Acknowledgements

This research was funded by a Grant (No. GER - 007/2015) from the Research Council of Lithuania. We are grateful for participants of the 23rd International FISS Conference for valuable comments and suggestions on the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Navickė, J., Lazutka, R. Distributional Implications of the Economic Development in the Baltics: Reconciling Micro and Macro Perspectives. Soc Indic Res 138, 187–206 (2018). https://doi.org/10.1007/s11205-017-1645-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-017-1645-x