Abstract

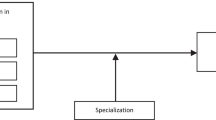

Organizational size is an important factor contributing to the heterogeneous nature of corporate entrepreneurship (CE). We focus on explicating size-based differences in CE and integrating them into new theoretical development. Through a search of the contemporary CE literature, we argue that there has been a tendency toward examining CE dimensions within the context of large public firms, even though they represent a relatively small proportion of the firms that engage in CE activities. Drawing on resource-based theorizing, we identify how size confers CE competitive advantages via slack resources and resource structuring processes, but disadvantages via bureaucratic structures and resource bundling. Aware of these weaknesses, we suggest that small firms are more likely to utilize CE for growth to overcome liabilities of smallness, while large firms are more likely to utilize CE for learning to overcome liabilities of inertia. We thereby provide greater specificity to CE research and stimulate new theoretical development with a forward-looking CE research agenda that incorporates the role of organizational size.

Similar content being viewed by others

Notes

In general, we use the terms size, firm size, and organizational size interchangeably.

The EU definition technically defines size categories based on employees and assets. However, as most studies did not report both assets and employees, we base our categorization on either indicator available.

References

Due to space limitations not all articles included in the review are included in the references cited. Only the articles we specifically cite in the text are included in the references list.

Acs, Z. J., & Audretsch, D. B. (2003). Innovation and technological change. Handbook of entrepreneurship research international handbook series on entrepreneurship (Vol. 1, pp. 55–79). USA: Springer.

Amit, R., & Schoemaker, P. J. H. (1993). Strategic assets and organizational rent. Strategic Management Journal, 14(1), 33–46.

Atinc, G., Simmering, M. J., & Kroll, M. J. (2012). Control variable use and reporting in micro and macro management research. Organizational Research Methods, 15, 57–74.

Autio, E., Sapienza, H. J., & Almeida, J. G. (2000). Effects of age at entry, knowledge intensity and imitability of international growth. Academy of Management Journal, 43, 909–924.

Baker, D., & Cullen, J. (1993). Administrative reorganization and configurational context: The contingent effects of age, size and change in size. Academy of Management Journal, 36, 1251–1277.

Barney, J. (1986). Strategic factor markets: Expectations, luck, and business strategy. Management Science, 32(10), 1231–1241.

Barney, J., Wright, M., & Ketchen, D. J. (2001). The resource-based view of the firm: Ten years after 1991. Journal of Management, 27(6), 625–641.

Benson, D., & Ziedonis, R. H. (2009). Corporate venture capital as a window on new technologies: Implications for the performance of corporate investors when acquiring startups. Organization Science, 20, 329–351.

Bhardwaj, G., Camillus, J. C., & Hounshell, D. A. (2006). Continual corporate entrepreneurial search for long-term growth. Management Science, 52, 248–261.

Birkinshaw, J. M. (1997). Entrepreneurship in multinational corporations: The characteristics of subsidiary initiatives. Strategic Management Journal, 18, 207–230.

Blau, P. M. (1970). A format theory of differentiation in organizations. American Sociological Review, 35, 201–218.

Bluedorn, A. C. (1993). Pilgrim’s Progress: Trends and convergence in research on organizational size and environments. Journal of Management, 19, 163–191.

Borch, O. J., Huse, M., & Senneseth, K. (1999). Resource configuration, competitive strategies, and corporate entrepreneurship: An empirical examination of small firms. Entrepreneurship Theory & Practice, 24(1), 49–70.

Brinckmann, J., & Hoegl, M. (2011). Effects of initial teamwork capability and initial relational capability on the development of new technology based firms. Strategic Entrepreneurship Journal, 5, 37–57.

Bromiley, P., Miller, K.D., & Rau, D. (2001). Risk in strategic management research. In M. A. Hitt, R. E. Freeman, & J. S. Harrison (Eds.), The Blackwell Handbook of Strategic Management (pp. 259–288). Malden, MA: Blackwell.

Brush, C. G., & Vanderwerf, P. A. (1992). A comparison of methods and sources for obtaining estimates of new venture performance. Journal of Business Venturing, 7, 157–170.

Burgelman, R. A. (1983). Corporate entrepreneurship and strategic management: Insights from a process study. Management Science, 29(12), 1349–1364.

Camisón-Zornoza, C., Lapiedra-Alcami, R., Segarra-Ciprés, M., & Boronat-Navarro, M. (2004). A meta-analysis of innovation and organizational size. Organization Studies, 25, 331–361.

Carrier, C. (1994). Intrapreneurship in large firms and SMEs: A comparative study. International Small Business Journal, 12, 54–61.

Carrier, C. (1996). Intrapreneurship in small businesses: An exploratory study. Entrepreneurship Theory & Practice, 21(1), 5–20.

Chandler, A. (1962). Strategy and structure. Cambridge, MA: M.I.T. Press.

Chandler, G. N., McKelvie, A., & Davidsson, P. (2009). Asset specificity and behavioral uncertainty as moderators of the sales growth—Employment growth relationship in emerging ventures. Journal of Business Venturing, 24(4), 373–387.

Chen, M. J., & Hambrick, D. C. (1995). Speed, stealth, and selective attack: How small firms differ from large firms in competitive behavior. Academy of Management Journal, 38, 453–482.

Chesbrough, H. W. (2002). Making sense of corporate venture capital. Harvard Business Review, 80(3), 90–99.

Child, J., & Kieser, A. (1981). Development of organizations over time. In P. C. Nystrom & W. H. Starbuck (Eds.), Handbook of organizational design (pp. 28–64). Oxford: Oxford University Press.

Cohen, W. M., & Klepper, S. (1996). A reprise of size and R&D. The Economic Journal, 106(437), 925–951.

Corbett, A., Covin, J. G., O’Connor, G. C., & Tucci, C. L. (2013). Corporate Entrepreneurship: State-of-the-art research and a future research agenda. Journal of Product Innovation Management, 30(5), 812–820.

Courtney, H. (2001). 20/20 Foresight: Crafting strategy in an uncertain world. Boston, MA: Harvard Business School Press.

Crockett, D. R., McGee, J. E., & Payne, G. T. (2013). Employing new business divisions to exploit disruptive innovations: The interplay between characteristics of the corporation and those of the venture management team. Journal of Product Innovation Management, 30(5), 856–879.

de Jong, J., & Marsili, O. (2006). The fruit flies of innovations: A taxonomy of innovative small firms. Research Policy, 35, 213–229.

Delmar, F., Davidsson, P., & Gartner, W. B. (2003). Arriving at the high-growth firm. Journal of Business Venturing, 18(2), 189–216.

Dess, G. G., Ireland, R. D., Zahra, S. A., Floyd, S. W., Janney, J. J., & Lane, P. J. (2003). Emerging issues in corporate entrepreneurship. Journal of Management, 29, 351–378.

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35(12), 1504–1511.

Dobrev, S., & Carroll, G. (2003). Size (and competition) among organizations: Modeling scale-based selection among automobile producers in four major countries, 1885–1981. Strategic Management Journal, 24, 541–558.

Dushnitsky, G., & Lavie, D. (2010). How alliance formation shapes corporate venture capital investment in the software industry: A resource-based perspective. Strategic Entrepreneurship Journal, 4, 22–48.

Dushnitsky, G., & Shaver, J. M. (2009). Limitations to interorganizational knowledge acquisition: The paradox of corporate venture capital. Strategic Management Journal, 30, 1045–1064.

Fama, E., & Jensen, M. C. (1983). Agency problems and residual claims. Journal of Law and Economics, 26, 325–344.

Fini, R., Grimaldi, R., Marzocchi, G. L., & Sobrero, M. (2012). The determinants of corporate entrepreneurial intention within small and newly established firms. Entrepreneurship Theory & Practice, 36(2), 387–414.

Ford, J. D. (1980). The occurrence of structural hysteresis in declining organizations. Academy of Management Review, 5, 589–598.

Freeman, J., Carroll, G., & Hannan, M. (1983). The liability of newness: Age dependence in organizational death rates. American Sociological Review, 48, 692–710.

Gersick, C. J. G. (1994). Pacing strategic change: The case of a new venture. Academy of Management Journal, 37, 9–45.

Gooding, R., & Wagner, J, III (1985). A meta-analytic review of the relationship between size and performance: The productivity and efficiency or organizations and their subunits. Administrative Science Quarterly, 30, 462–481.

Greve, H. R. (2003). A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Academy of Management Journal, 46(6), 685–702.

Greve, H. R. (2007). Exploration and exploitation in product innovation. Industrial and Corporate Change, 16(5), 945–975.

Greve, H. R. (2008). A behavioral theory of firm growth: Sequential attention to size and performance goals. Academy of Management Journal, 51(3), 476–494.

Guth, W. D., & Ginsberg, A. (1990). Guest editors’ introduction: Corporate entrepreneurship. Strategic Management Journal, 11, 5–15.

Hannan, M. T., & Freeman, J. (1977). The population ecology of organizations. American Journal of Sociology, 82, 929–964.

Haveman, H. (1993). Organizational size and change: Diversification in the savings and loan industry after deregulation. Administrative Science Quarterly, 38, 20–50.

Hayton, J. C. (2005). Promoting corporate entrepreneurship through human resource management practices: A review of empirical research. Human Resource Management Review, 15, 21–41.

Henrekson, M., & Johansson, D. (2010). Gazelles as job creators: A survey and interpretation of the evidence. Small Business Economics, 35, 227–244.

Hoang, H., & Rothaermel, F. T. (2005). The effect of general and partner-specific alliance experience on joint R&D project performance. Academy of Management Journal, 48, 332–345.

Hockerts, K., & Wüstenhagen, R. (2010). Greening Goliaths versus emerging Davids: Theorizing about the role of incumbents and new entrants in sustainable entrepreneurship. Journal of Business Venturing, 25, 481–492.

Hornsby, J. S., Kuratko, D. F., Shepherd, D. A., & Bott, J. P. (2009). Managers’ corporate entrepreneurial actions: Examining perception and position. Journal of Business Venturing, 24, 236–247.

Hult, G. T. M., Snow, C. C., & Kandemir, D. (2003). The role of entrepreneurship in building cultural competitiveness in different organizational types. Journal of Management, 29(3), 401–426.

Ireland, R. D., Hitt, M. A., & Sirmon, D. G. (2003). A model of strategic entrepreneurship: The construct and its dimensions. Journal of Management, 29(6), 963–989.

Ireland, D., Reutzel, C., & Webb, J. (2005). Editor’s note: Entrepreneurship research in AMJ: What has been published, and what might the future hold? Academy of Management Journal, 48, 556–564.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3, 305–360.

Keil, T. (2004). Building external corporate venturing capability. Journal of Management Studies, 41(5), 799–825.

Kellermanns, F. W., & Eddleston, K. A. (2006). Corporate Entrepreneurship in family firms: A family perspective. Entrepreneurship: Theory & Practice, 30, 809–830.

Ketchen, D. J., Ireland, R. D., & Snow, C. C. (2007). Strategic entrepreneurship, collaborative innovation, and wealth creation. Strategic Entrepreneurship Journal, 1(3–4), 371–385.

Kimberly, J. (1976). Organizational size and the structuralist perspective: A review, critique, and proposal. Administrative Science Quarterly, 21, 571–597.

König, A., Kammerlander, N., & Enders, A. (2013). The family innovator’s dilemma: How family influence affects the adoption of discontinuous technologies by incumbent firms. Academy of Management Review, 38(3), 418–441.

Kuratko, D. (2007). Corporate entrepreneurship. Cambridge, MA: Foundations and Trends in Entrepreneurship.

Lawless, M. (2014). Age or size? Contributions to job creation. Small Business Economics, 42, 815–830.

Lee, C., Lee, K., & Pennings, J. M. (2001). Internal capabilities, external networks, and performance: A study on technology-based ventures. Strategic Management Journal, 22, 615–640.

Levie, J., & Lichtenstein, B. (2010). A terminal assessment of stages theory: Introducing dynamic states approach to entrepreneurship. Entrepreneurship Theory & Practice, 34, 317–350.

Levinthal, D. A. (1991). Random walks and organizational mortality. Administrative Science Quarterly, 36, 397–420.

Ling, Y. A., Simsek, D., Lubatkin, M., & Viega, D. (2008). Transformational leadership’s role in promoting corporate entrepreneurship: Examining the CEO-TMT interface. Academy of Management Journal, 51, 557–576.

Low, M. B., & MacMillan, I. C. (1988). Entrepreneurship: Past research and future challenge. Journal of Management, 14, 139–151.

Lubatkin, M. H., Simsek, Z., Ling, Y., & Veiga, J. F. (2006). Ambidexterity and performance in small-to medium-sized firms: The pivotal role of top management team behavioral integration. Journal of Management, 32(5), 646–672.

Lumpkin, G. T., & Lichtenstein, B. B. (2005). The role of organizational learning in the opportunity-recognition process. Entrepreneurship: Theory & Practice, 29, 451–472.

Markides, C. C., & Williamson, P. J. (1996). Corporate diversification and organizational structure: A resource-based view. Academy of Management Journal, 39(2), 340–367.

Mauri, A. J., & Michaels, M. P. (1998). Firm and industry effects within strategic management: An empirical examination. Strategic Management Journal, 19(3), 211–219.

McKelvie, A., McKenney, A. F., Lumpkin, G. T., & Short, J. C. (2014). Corporate entrepreneurship in family businesses: Past contributions and future opportunities. In L. Melin, M. Nordqvist, & P. Sharma (Eds.), SAGE handbook of family business (pp. 340–363). Thousand Oaks, CA: SAGE.

McKelvie, A., & Wiklund, J. (2010). Advancing firm growth research: A focus on growth mode instead of growth rate. Entrepreneurship Theory & Practice, 34, 261–288.

Meyer, G. D. (2009). Commentary: On the integration of strategic management and entrepreneurship: Views of a contrarian. Entrepreneurship Theory & Practice, 33(1), 341–351.

Michael, S. C. (2007). Transaction cost entrepreneurship. Journal of Business Venturing, 22(3), 412–426.

Miles, R. E., & Snow, C. C. (1978). Organizational strategy, structure and process. New York: McGraw-Hill.

Miller, D., & Toulouse, J. M. (1986). Chief executive personality and corporate strategy and structure in small firms. Management Science, 32, 1389–1409.

Mishina, Y., Pollock, T. G., & Porac, J. F. (2004). Are more resources always better for growth? Resource stickiness in market and product expansion. Strategic Management Journal, 25(12), 1179–1197.

Monsen, E., & Boss, R. W. (2009). The impact of strategic entrepreneurship within the organization: Examining job stress and employee retention. Entrepreneurship Theory & Practice, 33, 71–104.

Morris, M. H., Kuratko, D. F., & Covin, J. G. (2011). Corporate entrepreneurship and innovation (3rd ed.). Mason, OH: Cengage/Thomson South-Western.

Morse, C. W. (1986). The delusion of intrapreneurship. Long Range Planning, 19, 92–95.

Narayanan, V., Yang, Y., & Zahra, S. (2009). Corporate venturing and value creation: A review and proposed framework. Research Policy, 38, 58–76.

Neergaard, H., & Ulhøi, J. P. (2006). Government agency and trust in the formation and transformation of interorganizational entrepreneurial networks. Entrepreneurship Theory & Practice, 30, 519–539.

Nelson, R., & Winter, S. (1984). An evolutionary theory of economic change. Cambridge: Belknap.

Nohria, N., & Gulati, R. (1996). Is slack good or bad for innovation? Academy of Management Journal, 39(5), 1245–1264.

Ozcan, P., & Eisenhardt, K. M. (2009). Origin of alliance portfolios: Entrepreneurs, network strategies, and firm performance. Academy of Management Journal, 52, 246–279.

Patzelt, H., Shepherd, D. A., Deeds, D., & Bradley, S. (2008). Financial slack and venture managers’ decisions to seek a new alliance. Journal of Business Venturing, 23, 465–481.

Penrose, E. T. (1959). The theory of the growth of the firm. New York: John Wiley.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. Stanford, CA: Stanford University Press.

Phan, P., Wright, M., Ucbasaran, D., & Tan, W. (2009). Corporate entrepreneurship: Current research and future directions. Journal of Business Venturing, 24, 197–205.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. New York: Simon and Schuster.

Rauch, A., Wiklund, J., Lumpkin, G. T., & Frese, M. (2009). Entrepreneurial Orientation and business performance: An assessment of past research and suggestions for the future. Entrepreneurship: Theory & Practice, 3, 761–787.

Richard, O. C., Barnett, T., Dwyer, S., & Chadwick, K. (2004). Cultural diversity in management, firm performance, and the moderating role of entrepreneurial orientation dimensions. Academy of Management Journal, 47, 255–266.

Rosenbusch, N., Brinckmann, J., & Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing, 26, 441–457.

Sarasvathy, S. D. (2001). Causation and effectuation: Toward a theoretical shift from economic inevitability to entrepreneurial contingency. Academy of Management Review, 26, 243–263.

Scherer, F. (1991). Changing perspectives on the firm size problem. In Zoltan J. Acs & David B. Audretsch (Eds.), Innovation and technological change: An international comparison (pp. 24–38). Ann Arbor: University of Michigan Press.

Schildt, H. A., Maula, M. V. J., & Keil, T. (2005). Explorative and exploitative learning from external corporate ventures. Entrepreneurship Theory & Practice, 29, 493–515.

Schulze, W. S., Lubatkin, M. H., Dino, R. N., & Buchholtz, A. K. (2001). Agency relationships in family firms: Theory and evidence. Organization Science, 12(2), 99–116.

Sharma, P., & Chrisman, J. J. (1999). Toward a reconciliation of the definitional issues in the field of corporate entrepreneurship. Entrepreneurship Theory & Practice, 23, 11–27.

Sharma, P., & Manikutty, S. (2005). Strategic divestments in family firms: Role of family structure and community culture. Entrepreneurship Theory & Practice, 29(3), 293–311.

Shepherd, D. A., & Wiklund, J. (2009). Are we comparing apples with apples or apples with oranges? Appropriateness of knowledge accumulation across growth studies. Entrepreneurship Theory & Practice, 33, 105–123.

Short, J. C. (2009). The art of writing a review article. Journal of Management, 35, 1312–1317.

Shrader, R. C., & Simon, M. (1997). Corporate versus independent new ventures: Resource, strategy and performance differences. Journal of Business Venturing, 12, 47–66.

Sieger, P., Zellweger, T., Nason, R. S., & Clinton, E. (2011). Portfolio entrepreneurship in family firms: A resource-based perspective. Strategic Entrepreneurship Journal, 5(4), 327–351.

Simonin, B. L. (1999). Ambiguity and the process of knowledge transfer in strategic alliances. Strategic Management Journal, 20(7), 595–623.

Sirmon, D. G., Hitt, M. A., & Ireland, R. D. (2007). Managing firm resources in dynamic environments to create value: Looking inside the black box. Academy of Management Review, 32, 273–292.

Sirmon, D. G., Hitt, M. A., Ireland, R. D., & Gilbert, B. A. (2011). Resource orchestration to create competitive advantage breadth, depth, and life cycle effects. Journal of Management, 37(5), 1390–1412.

Souitaris, V., Zerbinati, S., & Liu, G. (2012). Which iron cage? Endo-and exoisomorphism in corporate venture capital programs. Academy of Management Journal, 55(2), 477–505.

Stinchcombe, A. L. (1965). Social structure and organizations. In J. G. March (Ed.), Handbook of organizations. Chicago: Rand McNally.

Teng, B.-S. (2007). Corporate entrepreneurship activities through strategic alliances: A resource-based approach toward competitive advantage. Journal of Management Studies, 44(1), 119–142.

van Burg, E., Romme, A. G. L., Gilsing, V. A., & Reymen, I. M. J. (2008). Creating university spin-offs: A science-based design perspective. Journal of Product Innovation Management, 25, 114–128.

Venkataraman, N. (1989). The concept of fit in strategy research: Toward verbal and statistical correspondence. Academy of Management Review, 14(3), 423–444.

Voss, G. B., Sirdeshmukh, D., & Voss, Z. G. (2008). The effects of slack resources and environmental threats on product exploration and exploitation. Academy of Management Journal, 51(1), 147–164.

Wadhwa, A., & Kotha, S. (2006). Knowledge creation through external venturing: Evidence from the telecommunications equipment manufacturing industry. Academy of Management Journal, 49, 819–835.

Wales, W. J., Monsen, E., & McKelvie, A. (2011). The organizational pervasiveness of entrepreneurial orientation. Entrepreneurship Theory & Practice, 35, 895–923.

Wiklund, J., & Shepherd, D. A. (2008). Portfolio entrepreneurship: Habitual and novice founders, new entry, and mode of organizing. Entrepreneurship Theory & Practice, 32, 701–725.

Williamson, O. E. (1979). Transaction-cost economics: The governance of contractual relations. Journal of Law and Economics, 22(2), 233–261.

Wolcott, R. C., & Lippitz, M. J. (2007). The four models of corporate entrepreneurship. MIT Sloan Management Review, 49(1), 75–82.

Yiu, D. W., & Lau, C.-M. (2008). Corporate entrepreneurship as resource capital configuration in emerging market firms. Entrepreneurship Theory and Practice, 32(1), 37–57.

Zahra, S. A. (1993). Environment, corporate entrepreneurship, and financial performance: A taxonomic approach. Journal of Business Venturing, 8, 319–341.

Zahra, S. A. (2005). Entrepreneurial risk taking in family firms. Family Business Review, 18(1), 23–40.

Zahra, S. A. (2007). Contextualizing theory building in entrepreneurship research. Journal of Business Venturing, 22(3), 443–452.

Zahra, S. A., & Filatotchev, I. (2004). Governance of the entrepreneurial threshold firm: A knowledge-based perspective. Journal of Management Studies, 41, 883–895.

Zahra, S. A., Filatotchev, I., & Wright, M. (2009). How do threshold firms sustain corporate entrepreneurship? The role of boards and absorptive capacity. Journal of Business Venturing, 24, 248–260.

Zahra, S. A., & Hayton, J. C. (2008). The effect of international venturing on firm performance: The moderating influence of absorptive capacity. Journal of Business Venturing, 23, 195–220.

Zahra, S. A., Neubaum, D. O., & Huse, M. (2000). Entrepreneurship in medium-size companies: Exploring the effects of ownership and governance systems. Journal of Management, 26, 947–976.

Zellweger, T. (2007). Time horizon, costs of equity capital, and generic investment strategies of firms. Family Business Review, 20, 1–15.

Zenger, T. R., Felin, T., & Bigelow, L. (2011). Theories of the firm-market boundary. The Academy of Management Annals, 5(1), 89–133.

Acknowledgments

The authors would like to thank action editor Donald F. Kuratko and two anonymous reviewers for their insightful comments on this manuscript throughout the review process. The authors also benefited from feedback at the special issue conference held at the University of Warwick, including the special issue editors and Erik Monsen, and on an earlier version of this paper presented at the 2012 Academy of Management Conference.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nason, R.S., McKelvie, A. & Lumpkin, G.T. The role of organizational size in the heterogeneous nature of corporate entrepreneurship. Small Bus Econ 45, 279–304 (2015). https://doi.org/10.1007/s11187-015-9632-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-015-9632-6

Keywords

- Corporate entrepreneurship

- Organizational size

- Contingency approach

- Resource-based theory

- Resource management