Abstract

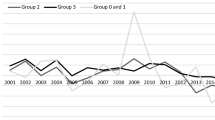

Prior evidence on whether institutions are informed about dividend changes is mixed. We contribute to this debate by examining institutional trade around dividend changes by industrial firms and REITs. The unique features of REITs, which make them more transparent than industrial firms, present an opportunity to compare institutional trade around dividend changes by the two groups of firms and discern whether institutions are informed about dividend changes by the industrial firms. Using both univariate and multivariate difference-in-differences mean tests, we find that abnormal institutional volume is higher when industrial firms change dividends than when REITs do so. This is consistent with the higher information asymmetry associated with dividend changes by industrial firms, suggesting institutions trade more upon arrival of the more informative dividend changes by the industrial firms. Further, the observed higher abnormal institutional volume is non-directional, and institutional buys offset institutional sales after both dividend increases and reductions by the industrial firms. The higher abnormal institutional volume and the non-directional nature of the abnormal volume suggest that institutions, on average, are not as informed about dividend changes by the industrial firms as they are about the same events by REITs due to their transparent nature. Thus, we uncover new evidence that institutions are not informed about dividend changes by industrial firms.

Similar content being viewed by others

Notes

However, the exact information that they convey is actively debated. Dividend signaling theories (e.g., Miller and Modigliani 1961; Bhattacharya 1979 and John and Williams 1985) suggest that a change in dividend conveys managerial information about the firm’s future earnings. More recent studies (e.g., Benartzi et al. 1997 and Koch and Sun 2004) suggest that the dividend events convey managerial information about the permanence of the current earnings change.

According to the Securities and Exchange Commission (SEC), to qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

For example, at least 75% of gross income must be derived from rents, interest on obligations secured by mortgages, gains from sale of certain assets or income attributable to investments in other REITS.

Some models suggest public announcements exacerbate information heterogeneity since private information can lead to information interpretation advantage (e.g., Kim and Verrecchia 1994, 1997), motivating trade after the news. Like prior studies, we do not focus on this type of private information due to the difficulty of separating trade after a public announcement into trade motivated by information interpretation advantage and other trades. Thus, like others, our assessment of institutional private information is based on the behavior of informed traders in models that predict public announcements reduce information heterogeneity (e.g., Kyle 1985).

Hayunga and Stephens (2009) report a muted response to dividend changes by REITs than non-REITs and Blua et al. (2011b) report that REITs see economically significant short-selling activity, but this is statistically lower than that for non-REITs.

Baker et al. (2009) report that mutual fund trades forecast earnings surprise. In comparison, Daske et al. (2005) find no evidence that short sales transactions concentrate around earnings announcements.

They argue that institutions with small stake cannot justify the fixed cost of developing private pre-disclosure information. Similarly, institutions with large stake are dedicated investors or face regulation that make informed trading difficult.

The proprietary institutional trading data are provided by the Ancerno Corporation (formerly, Abel Noser). This database contains extensive information on institutional orders such as order quantity, order price, code number of broker(s) used to fill the order, transaction price, quantity of shares traded, execution date, buy vs. sell order indicator, and commissions charged by the broker. Ancerno provides consulting and advisory services to about 1000 domestic institutional clients which includes pension plan sponsors such as CalPERS, the Commonwealth of Virginia, and the YMCA retirement fund, as well as money managers such as Massachusetts Financial Services (MFS), Putman Investments, and Lazard Asset Management. Institutions included in the Ancerno dataset collectively transacted over $30 trillion during our sample period of 2001–2012. For a detailed description of the data, please see Puckett and Yan (2011).

We use two-digit SIC code to identify an industry in our matching exercise.

When using log of market capitalization instead of the book value of total assets, the results are similar.

While the median test is significant for days 0 and + 1 for all dividend changes and dividend increases, firms that cut dividends see significant medians on days 0, + 1 and + 2.

The regulation stipulates that if a firm discloses any material nonpublic information to a limited group of individuals, the firm must also make public disclosure of that information. Such disclosures must be simultaneously made if it is intentional. A non-intentional disclosure to a limited group of individuals must be promptly followed by a public disclosure.

We thank the referee for this suggestion.

The results are not tabulated and are available upon request.

The results using subsample analysis of investor type should be interpreted with caution as the sample size is dramatically reduced in the sub-sample analysis.

Our original propensity score matching is based on firm size, debt-to-assets, cash-to-assets, dividend yield, share volume, industry and year.

References

Ali A, Klasa S, Li OZ (2008) Institutional stakeholdings and better-informed traders at earnings announcements. J Account Econ 46(1):47–61

Amihud Y, Li K (2006) The declining information content of dividend announcements and the effects of institutional holdings. J Financ Quant Anal 41(3):637–660

Amin AS, Dutta S, Saadi S, Vora PP (2015) Institutional shareholding and information content of dividend surprises: re-examining the dynamics in dividend-reappearance era. J Corp Finan 31:152–170

Anand A, Irvine P, Puckett A, Venkataraman K (2012) Performance of institutional trading desks: an analysis of persistence in trading costs. Rev Financ Stud 25(2):557–598

Andres C, Hofbaur U (2017) Do what you did four quarters ago: trends and implications of quarterly dividends. J Corp Finance 43:139–158

Baker M, Litov L, Wachter JA, Wurgler J (2010) Can mutual fund managers pick stocks? Evidence from their trades prior to earnings announcements. J Financ Quant Anal 45(5):1111–1131

Benartzi S, Michaely R, Thaler R (1997) Do changes in dividends signal the future or the past? J Finance 52(3):1007–1034

Berkman H, McKenzie MD (2012) Earnings announcements: good news for institutional investors and short sellers. Financ Rev 47(1):91–113

Bhattacharya S (1979) Imperfect information, dividend policy, and “the bird in the hand” fallacy. Bell J Econ 10(1):259–270

Blau BM, Fuller KP, Van Ness RA (2011a) Short selling around dividend announcements and ex-dividend days. J Corp Finance 17(3):628–639

Blau BM, Hill MD, Wang H (2011b) REIT short sales and return predictability. J Real Estate Finance Econ 42(4):481–503

Capozza DR, Lee S (1994) The equity REIT universe 1985–1992: the role of property type and size. Working Paper, University of Michigan

Chemmanur TJ, Fedaseyeu V (2017) A theory of corporate boards and forced CEO turnover. Manage Sci 64(10):4798–4817

Chemmanur TJ, Tian X (2014) Communicating private information to the equity market before a dividend cut: an empirical analysis. J Financ Quant Anal 49(5–6):1167–1199

Chemmanur TJ, He S, Hu G (2009) The role of institutional investors in seasoned equity offerings. J Financ Econ 94(3):384–411

Chemmanur TJ, Hu G, Huang J (2010) The role of institutional investors in initial public offerings. Rev Financ Stud 23(12):4496–4540

Chemmanur TJ, Hu G, Huang J (2015) Institutional investors and the information production theory of stock splits. J Financ Quant Anal 50(3):413–445

Chemmanur TJ, Li Y, Xie J, Zhu A (2016) Noisy signaling through open market share repurchase programs and information production by institutions, working paper

Daske H, Richardson SA, Tuna I (2006) Do short sale transactions precede bad news events? New evidence from NYSE daily data. Working paper, University of Pennsylvania

DeAngelo H, DeAngelo L, Skinner DJ (2009) Corporate payout policy. Found Treads Finance 3:95–287

Devos E, Ong SE, Spieler AC, Tsang D (2013) REIT institutional ownership dynamics and the financial crisis. J Real Estate Finance Econ 47(2):266–288

Dey MK, Radhakrishna B (2007) Who trades around earnings announcements? Evidence from TORQ data. J Bus Finance Acc 34(1–2):269–291

Downs DH, Gu ZN, Patterson GA (2000a) Capital distribution policy and information asymmetry: a real estate market perspective. J Real Estate Finance Econ 21(3):235–250

Downs D, Gune Z, Patterson GA (2000b) Capital distribution policy and information asymmetry: a real estate market perspective. J Real Estate Finance Econ 21:235–250

Easley D, Hvidkjaer S, O'hara M (2002) Is information risk a determinant of asset returns? J Fin 57(5):2185–2221

Gentry WM, Kemsley D, Mayer CJ (2003) Dividend taxes and share prices: evidence from real estate investment trusts. J Finance 58(1):261–282

Goodwin K (2013) Discounting & underpricing of REIT seasoned equity offers. J Real Estate Res 35(2):153–172

Graham JR, Koski JL, Loewenstein U (2006) Information flow and liquidity around anticipated and unanticipated dividend announcements. J Bus 79:2301–2336

Hardin W III, Hill MD (2008) REIT dividend determinants: excess dividends and capital markets. Real Estate Econ 36(2):349–369

Hardin WG, Highfield MJ, Hill MD, Kelly GW (2009) The determinants of REIT cash holdings. J Real Estate Finance Econ 39(1):39–57

Hayunga DK, Stephens CP (2009) Dividend behaviour of US equity REITs. J Prop Res 26(2):105–123

Hendershott T, Livdan D, Schürhoff N (2015) Are institutions informed about news? J Financ Econ 117(2):249–287

Henry D, Nguyen L, Pham VH (2017) Institutional trading before dividend reduction announcements. J Financ Mark 36:40–55

Jegadeesh N, Tang Y (2010) Institutional trades around takeover announcements: skill versus inside information, working paper

John K, Williams J (1985) Dividends, dilution, and taxes: a signalling equilibrium. J Finance 40(4):1053–1070

Ke B, K., Petroni, K. R., Yu, Y. (2008) The effect of Regulation FD on transient institutional investors’ trading behavior. J Account Res 46:853–883

Kim O, Verrecchia R (1991) Trading volume and price reactions to public announcements. J Account Res 29:302–309

Kim O, Verrecchia R (1994) Market liquidity and volume around earnings announcements. J Account Econ 17:41–67

Kim O, Verrecchia R (1997) Pre-announcement and event-period private information. J Account Econ 24:395–419

Koch AS, Sun AX (2004) Dividend changes and the persistence of past earnings changes. J Finance 59(5):2093–2116

Kyle AS (1985) Continuous auctions and insider trading. Econometrica 53:1315–1335

Lee C, Zhu C (2021) Active funds and bundled news active funds and bundled news. Account Rev, forthcoming

Miller M, Modigliani F (1961) Dividend policy, growth, and the valuation of shares. J Bus 34(4):411–433

Nissim D, Ziv A (2001) Dividend change and future profitability. J Finance 56(6):2111–2133

Price SM, Gatzlaff DH, Sirmans CF (2012) Information uncertainty and the post-earnings-announcement drift anomaly: insights from REITs. J Real Estate Finance Econ 44(1–2):250–274

Puckett A, Yan X (2011) The interim trading skills of institutional investors. J Finance 66(2):601–633

Funding

None.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Asem, E., Baulkaran, V., Jain, P. et al. Are institutional investors informed? The case of dividend changes for REITS and Industrial Firms. Rev Quant Finan Acc 58, 1685–1707 (2022). https://doi.org/10.1007/s11156-021-01035-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-021-01035-7