Abstract

This paper examines how taxes affect bilateral internal debt financing among foreign entities of multinational firms. Our data allows us to construct precise bilateral tax-rate differentials between borrowers and lenders of internal debt, which are found to be positively related to internal debt financing of borrowing entities. Compared with previous studies, the estimated tax-elasticity of internal debt exceeds earlier findings by far, most probably accruing to the bilateral specification of tax incentives. Additional investigations on whether and to what extent countries effectively impose anti-tax-avoidance measures show that thin-capitalization rules in host countries are particularly effective.

Similar content being viewed by others

Notes

Until now, only a few studies have investigated the effectiveness of anti-tax avoidance rules. Weichenrieder and Windischbauer (2008) as well as Overesch and Wamser (2010) exploit reforms of the German TC rule and find an impact of these reforms on internal debt financing of foreign affiliates. Moreover, Wamser (2008) shows that subsidiaries that were affected by a tightening of the German rule in 2001 avoided the restriction imposed on internal-debt interest deductibility by using more external debt. Buettner et al. (2012) use German outbound FDI data and find a negative impact of the existence as well as the tightness of TC rules on debt financing. Furthermore, the paper by Altshuler and Grubert (2006) illustrates that the US CFC rule is quite ineffective. In contrast, a recent study by Ruf and Weichenrieder (2012) finds that the German CFC rule is generally very effective in restricting tax planning of German multinationals.

This conflict is similar to the free cash flow theory introduced by Jensen (1986).

Besides, in some countries, other preconditions have to be fulfilled. In the US, for example, deduction for interest payments to non-US affiliates or other tax exempt corporations must exceed 50 % of adjusted taxable income (see Sec. 163 (j) IRC). Several countries add requirements related to the ownership share of the creditor.

While the tax penalty depends on the interest rate, it may be possible that firms can avoid the tax penalty by issuing only a small amount of related party debt and instead set a rather high rate of interest. However, high interest rates would generally conflict with the arm’s length principle.

For computing the debt-to-equity ratio, the TC rules of the following countries refer to total debt: Australia, Bulgaria, Denmark, Hungary, Japan, Latvia, Lithuania, Mexico, Netherlands, Poland, Romania, Switzerland, UK, USA. In the following countries only internal debt is considered: Belgium, Canada, Croatia, Czech Republic, France, Germany, Italy, Luxembourg, Portugal, Slovakia, Slovenia, Spain, South Korea, Turkey. It is important to note, though, that, although different definitions of debt are relevant when computing the debt-to-equity thresholds, interest deduction is in all cases only denied for debt provided by related parties.

Note that we are only able to identify bilateral borrowing if we consider a specific group of indirectly-held wholly-owned subsidiaries which are reported in our data (see below). This requires to focus on multinationals that consist of at least two foreign subsidiaries to identify the bilateral tax differential. In this sense, the company structure is held constant.

Lipponer (2008) provides a detailed description of MiDi.

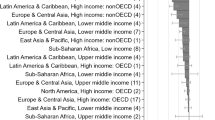

All EU and OECD member states are included, except Romania, because no lending rates were available for this country, and Iceland, because no subsidiaries of German multinationals are reported in our dataset. Additionally, we consider Croatia. Germany is not included as it is the country of the parent companies.

We exclude observations from mining, agriculture, non-profit and membership organizations, because special tax regimes may be available. Furthermore, we exclude observations whose German parent is not an incorporated and legally independent entity, as well as subsidiaries which are not legally independent.

Sec. 26 of Foreign Trade and Payments Act (Aussenwirtschaftsgesetz) in connection with Foreign Trade and Payments Regulation (Aussenwirtschaftsverordnung). Since 2002, FDI has to be reported if the participation is 10 % or more and the balance-sheet total of the respective foreign investment in Germany exceeds 3 million Euros. For details see Lipponer (2008). Though previous years showed lower threshold levels, we apply this threshold level uniformly for all years in the panel.

Note that MiDi allows us to exactly identify bilateral internal debt in this setting. The borrowing affiliate might also use internal parent debt, which is, however, not considered in our analysis. This explains why the average share of internal debt in Table 1 is comparatively low. While one central idea of our empirical analysis is to consider entity j-specific as well as entity i-specific characteristics, parent debt could not be included since relevant information on parent characteristics is not reported in our data. Another reason for focussing on BIDR ijt is that our approach allows us to assign a specific tax-rate differential to the internal loan. This would no longer be possible once parent debt is simply added to our bilateral debt variable.

The tax incentives of debt financing are reduced if an affiliate suffers or carries forward any losses, because the affiliate can offset current profits, thereby reducing the tax base. In some countries a loss carryback is—usually to a very limited degree—possible and additional interest deductions may result in some tax refunding. Owing to the lack of information on the current profitability before interest payments, we can only consider the impact of loss carryforwards on internal debt financing.

More collateral may make a liquidation less costly for shareholders as well as for debt holders, who can resort to liquidation in order to attain a more effective management control. Harris and Raviv (1990) find a positive correlation between companies’ liquidation values (proxied by the fraction of tangible assets) and the optimal debt levels.

References

Aghion P, Bolton P (1992) An incomplete contracts approach to financial contracting. Rev Econ Stud 59:473–494

Akbel B, Schnitzer M (2009) Creditor rights and debt allocation within multinationals. Working paper, University of Munich

Altshuler R, Grubert H (2003) Repatriation taxes, repatriation strategies and multinational financial policy. J Public Econ 87:73–107

Altshuler R, Grubert H (2006) Governments and multinational corporations in the race to the bottom. Nat Tax J 41:459–74

Bernardo AE, Cai H, Luo J (2001) Capital budgeting and compensation with asymmetric information and moral hazard. J Financ Econ 61:311–344

Bianco M, Nicodano G (2006) Pyramidal groups and debt. Eur Econ Rev 50:937–961

Buettner T, Overesch M, Schreiber U, Wamser G (2012) The impact of thin-capitalization rules on the capital structure of multinational firms. J Public Econ 96:930–938

Buettner T, Overesch M, Schreiber U, Wamser G (2009) Taxation and capital structure choice: evidence from a panel of German multinationals. Econ Lett 105:309–311

Buettner T, Wamser G (2012) Internal debt and multinationals’ profit shifting: empirical evidence from firm-level panel data. Nat Tax J forthcoming

Chowdhry B, Coval JD (1998) Internal financing of multinational subsidiaries: debt versus equity. J Corp Financ 4:87–106

De Angelo H, Masulis RW (1980) Optimal capital structure under corporate and personal taxation. J Financ Econ 8:3–29

Desai MA, Foley CF, Hines JR (2004) A multinational perspective on capital structure choice and internal capital markets. J Financ 59:2451–2487

Desai, MA, Foley CF, Hines JR (2008) Capital structure with risky foreign investment. J Financ Econ 88:534–553

Gopalan R, Nanda R, Seru A (2007) Affiliated firms and financial support: evidence from Indian business groups. J Financ Econ 86:759–795

Graham JR, Harvey CR (2001) The theory and practice of corporate finance: evidence from the field. J Financ Econ 60:187–243

Graham JR, Tucker A (2006) Tax shelters and corporate debt policy. J Financ Econ 81:563–594

Harris M, Raviv A (1990) Capital structure and the informational role of debt. J Financ 45:321–349

Healy P, Wahlen J (1999) A review of the earnings management literature and its implications for standard setting. Account Horiz 13:365–374

Hebous S, Weichenrieder A (2010) Debt financing and sharp currency depreciations: wholly versus partially-owned multinational affiliates. Rev World Econ 146:281–306

Huizinga H, Laeven L, Nicodème G (2008) Capital structure and international debt shifting. J Financ Econ 88:80–118

Jensen M (1986) The agency costs of free cash flow: corporate finance and takeovers. Am Econ Rev 76:323–329

Jensen M, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 42:159–185

Kedia S, Mozumdar A (2003) Foreign currency-denominated debt: an empirical examination. J Bus 76:521–546

Kesternich I, Schnitzer M (2010) Who is afraid of political risk? Multinational firms and their choice of capital structure. J Int Econ 82:208–218

Kraus A, Litzenberger RH (1973) A state-preference model of optimal financial leverage. J Financ 28:911–922

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. J Financ 52:1131–1150

Lim Y (2012) Tax avoidance and underleverage puzzle: Korean evidence. Rev Quant Financ Account 39:333–360

Lipponer A (2008) Microdatabase direct investment MiDi: a brief guide. Bundesbank working paper, Frankfurt

Lundstrum L (2003) Firm value, information problems and the internal capital market. Rev Quant Financ Account 21:141–156

MacKie-Mason JK (1990) Do taxes affect corporate financing decisions? J Financ 45:1471–1493

Mills LF, Newberry KJ (2004) Do foreign multinational’s tax incentives influence their U.S. income reporting and debt policy? Nat Tax J 57:89–107

Mintz J, Smart M (2004) Income shifting, investment, and tax competition: theory and evidence from provincial taxation in Canada. J Public Econ 88:1149–1168

Modigliani F, Miller M (1958) The cost of capital, corporation finance, and the theory of investment. Am Econ Rev 48:261–297

Modigliani F, Miller M (1963) Corporate income taxes and the cost of capital: a correction. Am Econ Rev 53:433–443

Myers S (1977) Determinants of corporate borrowing. J Financ Econ 5:147–175

Myers S (2001) Capital structures. J Econ Perspect 15:81–102

Overesch M, Wamser G (2010) Corporate tax planning and thin-capitalization rules: evidence from a quasi-experiment. Appl Econ 42:563–573

Ramb F, Weichenrieder A (2005) Taxes and the financial structure of German inward FDI. Rev World Econ 141:670–692

Ruf M, Weichenrieder A (2012) The taxation of passive foreign investment: lessons from German experience. Can J Econ forthcoming

Ross S (1977) The determination of financial structure: the incentive-signalling approach. Bell J Econ 8:23–40

Stein J (2003) Agency, information and corporate investment. In: Constantinides GM, Harris M, Stulz RM (eds) Handbook of the economics of finance, Volume 1A. Elsevier, North-Holland, pp. 111–165

Wamser G (2008) The impact of thin-capitalization rules on external debt usage: a propensity score matching approach. Ifo working paper 62, Munich

Weichenrieder A, Windischbauer H (2008) Thin-capitalization rules and company responses: experience from German legislation. Working Paper, Geothe University Frankfurt

Acknowledgments

We thank an anonymous referee, participants of the IIPF Conference 2010 in Uppsala, the conference on “Taxation of Foreign Profits” at the Max Planck Institute for Tax Law and Public Finance in Munich, and seminar participants at the University of Dortmund for helpful comments, the Deutsche Bundesbank for granting access to the MiDi database and the German Research Foundation (DFG) for financial support. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Overesch, M., Wamser, G. Bilateral internal debt financing and tax planning of multinational firms. Rev Quant Finan Acc 42, 191–209 (2014). https://doi.org/10.1007/s11156-012-0339-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-012-0339-3