Abstract

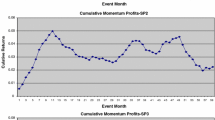

In this paper we study the impact of noise or quality of prices on returns. The noise arises from herding by market participants beyond what is justified by information. We construct a firm-quarter-specific measure of speculative intensity (SPEC) based on autocorrelation in daily trading volume adjusted for the amount of information available, and find that speculative intensity has a significant positive impact on returns. Both cross-sectional and time series variation in SPEC are consistent with conventional wisdom, and with implications of theories of herding as in DeLong et al. (1990, J Political Econ 98(4):703–738). We find that high-SPEC firms drive the returns to momentum trading strategies and that investor over-reaction is significant only in the case of high-SPEC firms.

Similar content being viewed by others

Notes

These information proxies are general proxies and do not distinguish between private and public information.

Hereafter we refer to ‘noise in prices’ and ‘speculative intensity’ interchangeably.

See, e.g., Sharma et al. (2004) for a more detailed analysis.

The 5 days of the week dummies serve as the intercept term, inspired by previous work (e.g., Brusa and Liu 2004).

The primary goal in Ajinkya and Jain (1989) is not to identify the time series properties of individual firms’ daily trading volumes but to refine the market model for volume used in studies of volume reaction to earnings announcements.

We also investigated the autocorrelation properties of daily trading volume in the firm-quarters that had at least 25 observations. In an overwhelming preponderance of cases the first lag was the most important.

Our results are robust to limiting our sample to autocorrelations that are calculated using 50 or more trading days.

The actual implementation used the MIXED procedure in SAS.

Our sample ends with the 3rd quarter of 2004.

We also used total assets, and it made little difference.

We report results using VARRET defined as the variance of the daily returns adjusted for the value weighted market return calculated for each company quarter.

We also ran all of our regressions without VARRET as a control variable, and it turns out the same qualitative conclusions continue to hold. But because a priori it is likely the LHS variance is not constant in a sample spanning 20 years we choose to report the results with VARRET.

For instance the correlation between the ACCs generated by the firm volumes not adjusted for market volume and the market adjusted volume is 0.78 with p-value of less then 0.0001.

References

Ajinkya B, Jain PC (1989) The behavior of daily stock market trading volume. J Account Econ 11(4):331–59

Allen F, Morris S, Shin HS (2002) Beauty contests, bubbles and iterated expectations in asset markets. Mimeo, Yale (April 2002) (http://www.econ.yale.edu/∼sm326/beauty.pdf)

Bamber LS (1987) Unexpected earnings, firm size and trading volume around quarterly earnings announcements. Account Rev 62(3):510–532

Bamber LS (1986) Information content of annual earnings releases: a trading volume approach. J Account Res 24(1):40–56

Beaver W (1986) The information content of annual earnings announcements. J Account Res (Supplement 1968): 67–92

Bhushan R (1989a) Collection of information about publicly traded firms: theory and evidence. J Account Econ 11(2–3):183–206

Bhushan R (1989b) Firm charecteristics and analyst following. J Account Econ 11(2–3): 255–274

Bikhchandani S, Sharma S (2000) Herd Behavior in Financial Markets: A Review. Working Paper, International Monetary Fund

Brown LD, Griffin P, Hagerman R, Zmijewski M (1987) An evaluation of alternative proxies for market expectations of earnings. J Account Econ 9:159–194

Brusa J, Liu P (2004) The day-of-the-week and the week-of-the-month effects: an analysis of investors’ trading activities. Rev Quant Finance Account 23:19–30

Chiao C, Cheng DC, Hung W (2005) Overreaction after controlling for size and book-to-market effects and its mimicking portfolio in Japan. Rev Quant Finance Account 24:65–91

Chordia T, Richard R, Avanidhar S (2001) Market liquidity and trading activity. J Finance 56:501–530

Covrig V, Ng L (2004) Volume autocorrelation, information and investor trading. J Bank Finance 28:2155–2174

DeLong JB, Shleifer A, Summers L, Waldman R (1990) Noise trader risk in financial markets. J Political Econ 98(4):703–738

Dow J, Gorton G (1994) Arbitrage chains. J Finance 49(3):819–849

Fama E, MacBeth J (1973) Risk, return and equilibrium: empirical tests. J Political Econ 81:607–636

Frazzini A, Lamont OA (2005) Dumb money: Mutual fund flows and the cross-section of stock returns, Mimeo, Yale; http://www.nber.org/∼confer/2005/URCs05/lamont.pdf

Freeman R, Tse SY (1992) A nonlinear model of security price responses to unexpected earnings. J Account Res 30(2):185–210

Grinblatt M, Titman S, Wermers R (1995) Momentum investment strategies, portfolio performance and herding: a study of mutual fund behavior. Am Econ Rev 85(5):1088–1105

Hellwig MF (1980) On the aggregation of information in competitive markets. J Econ Theory 22:477–498

Hong H, Lim T, Stein JC (2001) Bad news travels slowly: size, analyst coverage and the profitability of momentum strategies. J Finance 55:265–295

Jain PC (1988) Response of hourly stock prices and trading volume to economic news. J Bus 61(2):219–31 (April)

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for market efficiency. J Finance 48:65–91

Jegadeesh N, Titman S (2001) Profitability of momentum strategies: an evaluation of alternative explanations. J Finance 56(2):699–720

Kyle AS (1985) Continuous auctions and insider trading. Econometrica 53(6):1315–1335

Li DD, Yung K (2004) Institutional herding in the ADR market. Rev Quant Finance Account 23:5–17

Llorente G, Michaely R, Saar G, Wang J (2002) Dynamic volume-return relation of individual stocks. Rev Financial Studies 15(4):1005–1047

Sharma V, Easterwood JC, Kumar R (2004) Did Institutional Investors Herd into New Economy Stocks? http://www.papers.ssrn.com/sol3/papers.cfm?abstract_id=501423

Shiller RJ (1999) Measuring Bubble Expectations and Investor Confidence. Working Paper, NBER

Shroff PK, Venkatraman R, Xin B (2003) Leaders and followers among security analysts: analysis of impact and accuracy. University of Minnesota, Mimeo

Sias RW (2004) Institutional Herding. Rev Financial Studies 17(1):165–206

Acknowledgments

We have benefited from comments and suggestions by seminar participants at CUNY-Baruch, Georgetown, Maryland, Rutgers, Waterloo, the Conference on Financial Economics and Accounting, and the Washington Area Finance Association Conference. The paper benefited substantially from help received from Srini Sankaraguruswamy. We also thank Bruce Lehmann, Bikki Jaggi, Prem Jain, Russell Lundholm, Sandeep Patel, Sundaresh Ramnath and Rohan Williamson. Special thanks are due to our discussants at the FEA Conference, Sudhakar Balachandran, and the WAFA Conference, Chris Jones, for very detailed comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Data Availability: The data used in this study is available from public sources cited in the text.

Rights and permissions

About this article

Cite this article

Hoitash, R., Krishnan, M. Herding, momentum and investor over-reaction. Rev Quant Finan Acc 30, 25–47 (2008). https://doi.org/10.1007/s11156-007-0042-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-007-0042-y

Keywords

- Noise in prices

- Measuring speculation

- Herding not due to information

- Momentum trading

- Investor over-reaction