Abstract

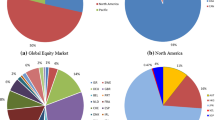

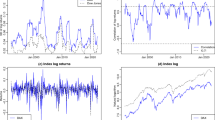

This article empirically investigates the exposure of country-level conditional stock return volatilities to conditional global stock return volatility. It provides evidence that conditional stock market return volatilities have a contemporaneous association with global return volatilities. While all the countries included in the study exhibited a significant and positive relationship to global volatility, emerging market volatility exposures were considerably higher than developed market exposures.

Similar content being viewed by others

References

Bollerslev T, Engle R (1993) Common persistence in conditional variances. Econometrica 61:167–186

Brailsford TJ (1996) Volatility spillovers across the tasman. Australian Journal of Management 21:13–28

Bekaert G, Harvey C (2000) Foreign speculators and emerging equity markets. Journal of Finance 55:565–614

Campbell J (1987) Stock returns and the term structure. Journal of Financial Economics 18:373–399

Chou R (1988) Volatility persistence and stock valuations: Some empirical evidence using GARCH. Journal of Applied Econometrics 3:279–294

Choudhry T (1996) Stock market volatility and the crash of 1987: evidence from six emerging markets. Journal of International Money and Finance 15:969–981

De Santis G, Imrohoroglu S (1997) Stock returns and volatility in emerging financial markets. Journal of International Money and Finance 16:561–579

Degiannkis S, Xekalaki E (2004) Autoregressive conditional heteroscedasticity (ARCH) models: A review. Quality Technology and Quantitative Management 1:271–324.

Detemple J, Osakwe C (2000) The valuation of volatility options. European Finance Review 4:21–50

Dimson E (1979) Risk measurement when shares are subject to infrequent trading. Journal of Financial Economics 7:197–226

Dittmar R (2002) Nonlinear pricing kernels, kurtosis preference, and evidence from the cross-section of equity returns. Journal of Finance 57:369–402

Elyasiani E, Mansur I (1998) Sensitivity of the bank stock returns distribution to changes in the level and volatility of interest rates: A GARCH-M model. Journal of Banking and Finance 22:535–563

Engle R (1987) Multivariate ARCH with factor structures: Cointegration in variance. discussion paper No. 87-27 (Department of Economics, University of California, San Diego, CA)

Engle R, Lilien D, Robins R (1987) Estimating time varying risk premia in the term structure: The ARCH–M model. Econometrica 55:391–407

Engle R, Ng V, Rothschild M (1990) Asset pricing with a factor-ARCH covariance structure. Journal of Econometrics 45:213–237

Engle RF, Susmel R (1993) Common volatility in international equity markets. Journal of Business and Economic Statistics 11:167–176

Erb CB, Harvey CR, Viskanta TE (1996) Expected returns and volatility in 135 countries. Journal of Portfolio Management, Spring pp 46–58

Estrada J (2002) Systematic risk in emerging markets: The D-CAPM. Emerging Markets Review 3:365–379

Faff R, Hodgson A, Kremmer M (2005) An investigation of the impact of interest rates and interest rate volatility on australian financial sector return distributions. Journal of Business Finance and Accounting 32:1001–1031

Fama E, French K (1992) The cross-section of expected returns. Journal of Finance 47:427–465

French K, Schwert G, Stambaugh R (1987) Expected stock returns and volatility. Journal of Financial Economics 19:3–29

Glosten L, Jagannathan R, Runkle D (1993) On the relation between the expected value and the volatility of nominal excess return on stocks. Journal of Finance 48:1779–1801

Hamao Y, Masulis RW, Ng V (1990) Correlations in price changes and volatility across international stock markets. Review of Financial Studies 3:281–307

Harvey C (1989) Time-varying conditional covariances in tests of asset pricing models. Journal of Financial Economices 24:289–317

Haugen R, Talmor E, Torrous W (1991) The effect of volatility changes on the level of stock prices and subsequent expected returns. Journal of Finance 46:985–1007

Hung DC-H, Shackleton M, Xu X (2004) CAPM, higher co-moment and factor models of UK stock returns. Journal of Business Finance & Accounting 31:87–112

Kanas A (1998) Volatility spillovers across equity markets: European evidence. Applied Financial Economics 8:245–256

Kandel S, Stambaugh R (1990) Expectations and volatility of consumption and asset returns. Review of Financial Studies 3:207–232

Karolyi GA (1995) A multivariate GARCH model of international transmissions of stock returns and volatility: The case of the United States and Canada. Journal of Business and Economic Statistics 13:11–25

Kim D (1995) The errors in the variables problem in the cross-section of expected stock returns. Journal of Finance 50:1605–1634

King MA, Wadhwani S (1990) Transmission of volatility between stock markets. Review of Financial Studies 3:5–33

Kraus A, Litzenberger R (1976) Skewness preference and the valuation of risk assets. Journal of Finance 31:1085–1109

Nelson DB (1991) Conditional heteroscedasticity in asset returns: A new approach. Econometrica 59:347–370

Ng V, Engle R Rothschild M (1992) A Multi–dynamic–factor model for stock returns. Journal of Econometrics 52:245–266

Sandeep P, Sarkar A (1998) Stock market crises in developed and emerging markets. Federal Reserve Bank of New York Research Paper (9809)

Whitelaw R (1994) Time variations and covariations in the expectation and volatility of stock market returns. Journal of Finance 49:515–541

Zakoian J-M (1994) Threshold heteroskedastic models. Journal of Economic Dynamics and Control 18:931–995

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification G12

Rights and permissions

About this article

Cite this article

Cai, C.X., Faff, R.W., Hillier, D.J. et al. Modelling return and conditional volatility exposures in global stock markets. Rev Quant Finan Acc 27, 125–142 (2006). https://doi.org/10.1007/s11156-006-8793-4

Issue Date:

DOI: https://doi.org/10.1007/s11156-006-8793-4