Abstract

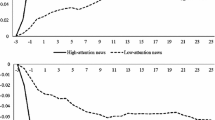

I investigate the effects of R&D progress on the dynamics of stock price volatility and the post announcement drift to provide insights into whether or not and how capital markets react to corporate R&D progress in the context of the biotech industry. I find both stock price volatility and the post announcement drift decrease in R&D progress. More importantly, the decrease is proportional to the increase in the drug development success rate driven by R&D progress. Findings suggest that R&D progress conveys useful risk-relevant information, and plays an important role in explaining stock price volatility change and market anomalies.

Similar content being viewed by others

References

Ball R, Brown P (1968) An empirical evaluation of accounting income numbers. Journal of Accounting Research 6:159–178

Bartov E (1992) Patterns in unexpected earnings as an explanation for post-announcement drift. The Accounting Review 67:610–622

Bartov E, Radhakrishnan S, Krinsky I (2000) Investor sophistication and patterns in stock returns after earnings announcements. The Accounting Review 75:43–63

Bernard V, Thomas J (1989) Post-earnings announcement drift: Delayed price response or risk premium?. Journal of Accounting Research 27:1–36

Bloomfield R, Libby R, Nelson M (2000) Under-reactions and over-reactions: The influence of information reliability and portfolio formation rules. Journal of Financial Markets 3:113–137

Brockman P, Chung D (2000) An empirical investigation of trading on asymmetric information and heterogeneous prior beliefs. Journal of Empirical Finance 7:417–454

Bhushan R (1994) An information efficiency perspective on the post-earnings-announcement drift. Journal of Accounting and Economics 18:45–65

Chambers D, Jennings R, Thomson II R (2002) Excess returns to R&D-intensive firms. Review of Accounting Studies 7:133–158

Chan L, Lakonishok J, Sougiannis T (2001) The stock market valuation of research and development expenditures. The Journal of Finance LVI:2431–2456

Chae J (2005) Trading volume, information asymmetry, and timing information. The Journal of Finance LX:413–442

DiMasi JA (1995) Success rate for new drug entering clinical testing in the United States. Clinical Pharmacology & Therapeutics 58:1–14

Dasgupta P, Stiglitz J (1980) Uncertainty, industrial structure, and the speed of R&D. Bell Journal of Economics 11:1–28

Ely K, Simko PJ, Thomas LG (2003) The usefulness of biotechnology firms’ drug development status in the development of research and development costs. Journal of Accounting, Auditing and Finance 18:163–196

Fama E, French K (1993) Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33:3–56

Francis J, LaFond R, Olsson P, Schipper K (2003) Accounting anomalies and information uncertainty, Working paper, Duke University, University of Wisconsin, Duke University, and Financial Accounting Standards Board in the U.S.

Foster G, Olsen C, Shevlin T (1984) Earnings releases, anomalies, and the behaviour of securities returns. The Accounting Review 59:574–603

Kellogg D, Charnes JM (2000) Real-option valuation for a biotechnology company. Financial Analysts Journal May/June 76–84

Kim D, Kim M (2003) A multifactor explanation of post earnings announcement drift. Journal of Financial and Quantitative Analysis 38:383–398

Lev B, Sougiannis T (1999) Penetrating the book-to-market black box: the R&D effect. Journal of Business Finance and Accounting 26:419–449

Liang L (2003) Post-earnings announcement drift and market participants’ information processing biases. Review of Accounting Studies 8:321–345

Mikhail B, Walter R, Willis H (2000) The effects of experience on security analyst underreaction and post-earnings announcement drift, Working paper, Duck University

Riahi-Belkaoui A (2002) Level of multinationality as an explanation for post announcement drift. The International Journal of Accounting 37:413–419

Robbins-Roth C (2000) From Alchemy to IPO: The Business of biotechnology. Perseus Publishing

Soffer L, Lys T (1999) Post-earnings-announcements drift and the discussions of predictable information. Contemporary Accounting Research Summer 305–274

Shi C (2003) On the trade-off between the future benefits and riskiness of R&D: a bondholders’ perspective. Journal of Accounting and Economics 35:227–254

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Xu, B. R&D Progress, stock price volatility, and post-announcement drift: An empirical investigation into biotech firms. Rev Quant Finan Acc 26, 391–408 (2006). https://doi.org/10.1007/s11156-006-7439-x

Issue Date:

DOI: https://doi.org/10.1007/s11156-006-7439-x