Abstract

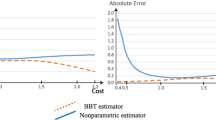

This study examined the relationship between disclosure and the cost of capital. Prior studies empirically testing this relationship provided mixed findings, and also raised several concerns, such as the endogeneity of disclosure, the information disclosure environment, and the sample size. This study investigated this relationship based on data from the Chinese capital market where a unique institutional arrangement makes the disclosure exogenous. This unique characteristic, in conjunction with a less stringent information environment and a big sample size, helped address these concerns. Our findings confirmed the negative relationship between disclosure and cost of capital.

Similar content being viewed by others

References

Admati A, Pfleiderer P (1988) A theory of intraday patterns: Volume and price variability. The Review of Financial Studies (1986–1998) 1:3–40

Bessembinder H, Chan K, Seguin P (1996) An empirical examination of information, differences of opinion, and trading activity. Journal of Financial Economics 40:105–34

Bloomfield R, Wilks T (2000) Disclosure effects in the laboratory: Liquidity, depth, and the cost of capital. The Accounting Review 75:13–41

Botosan C (1997) Disclosure level and the cost of equity capital. The Accounting Review 72:323–349

Botosan C, Plumlee M (2002) A re-examination of disclosure level and the expected cost of equity capital. Journal of Accounting Research 40:21–40

Bushee B, Noe C (2000) Corporate disclosure practices, institutional investors, and stock return volatility. Journal of Accounting Research 38:171–202

Chen C, Gul F, Su X (1999) A comparison of reported earnings under Chinese GAAP vs. IAS: Evidence from the Shanghai stock exchange. Accounting Horizons 13:91–111

Chen S, Sun Z, Wang Y (2002) Evidence from China on whether harmonized accounting standards harmonize accounting practices. Accounting Horizons 16:183–197

Clarkson P, Guedes J, Thompson R (1996) On the diversification, observability, and measurement of estimation risk. Journal of Financial and Quantitative Analysis 31:69–84

Clement M, Frankel R, Miller J (2003) Confirming management earnings forecasts, earnings uncertainty, and stock returns. Journal of Accounting Research 41:653–679

Diamond D, Verrecchia R (1991) Disclosure, liquidity and the cost of capital. Journal of Finance 46:1325–60

Easley D, Kiefer N, O’Hara M, Paperman J (1996) Liquidity, information, and infrequently traded stocks. Journal of Finance 51:1405–1436

Frech K, Roll R (1986) Stock return variances: The arrival of information and the reaction of traders. Journal of Financial Economics 17:5–26

Gietzmann M, Ireland J (2005) Cost of capital, strategic disclosures and accounting choice. Journal of Business Finance & Accounting 32:599–634

Glosten L, Milgrom P (1985) Bid, ask, and transaction prices in a specialist market with heterogeneously informed traders. Journal of Financial Economics 14:71–100

Glosten L, Harris L (1988) Estimating the components of bid/ask spread. Journal of Financial Economics 21:123–4

Hail L (2002)The impact of voluntary corporate disclosures on the ex-ante cost of capital for swiss firms. The European Accounting Review 11:741–773

Hair J, Anderson R, Thatham R, Black W (1998) Multivariate data analysis, fifth edition. Prentice-Hall

He J (2004) The reason and the administration advice for the over-speculation of Chinese stock market. JinRongXueYuan (Chinese) 2:43–48

Healy P, Hutton A, Palepu K (1999) Stock performance and intermediation changes surrounding sustained increases in disclosure. Contemporary Accounting Research 16:485–520

Healy P, Palepu K (2001) Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics 31:405–440

Joos P (2000) Discussion of the economic consequences of increased disclosure. Journal of Accounting Research 38:125–136

Leuz C, Verrecchia R (2000) The economic consequences of increased disclosure. Journal of Accounting Research 38:91–124

Leuz C (2003) Discussion of ADRS, analysts, and accuracy: Does cross-listing in the united states improve a firm’s information environment and increase market value?. Journal of Accounting Research 41:347–362

Nikolaev V, Lent L. The endogeneity bias in the relation between cost-of-debt capital and corporate disclosure policy. European Accounting Review, Forthcoming

Richardson A, Welker M (2001) Social disclosure, financial disclosure and the cost of equity capital. Accounting, Organizations and Society 26:597–616

Stoll H (1978) The pricing of security dealer services: An empirical study of NASDAQ stocks. Journal of Finance 33:1153–1172

Tkac P (1999) A trading volume benchmark: Theory and evidence. Journal of Financial and Quantitative Analysis 34:89–114

Welker M (1995). Disclosure policy, information asymmetry and liquidity in equity markets. Contemporary Accounting Research 11:801–828

Yang J, Yang J (1998) The handbook of Chinese accounting (Chinese). Oxford University Press (China) Ltd.

Zhang G (2001) Private information production, public disclosure, and the cost of capital: Theory and implications. Contemporary Accounting Research 18:363–384

Z Jun lin, Wang L (2001) Financial disclosure and accounting harmonization: Cases of three listed companies in China. Managerial Auditing Journal 16:263–273

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhang, L., Ding, S. The effect of increased disclosure on cost of capital: Evidence from China. Rev Quant Finan Acc 27, 383–401 (2006). https://doi.org/10.1007/s11156-006-0044-1

Issue Date:

DOI: https://doi.org/10.1007/s11156-006-0044-1