Abstract

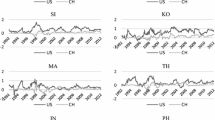

The stock indices of five ASEAN countries, namely, Singapore, Malaysia, Indonesia, Thailand and the Philippines have experienced a structural change after mid-1997 due to the Asian financial crisis, and another shift slightly more than a year later when the markets rebounded. Contemporaneous correlation in stock returns is the strongest and Indonesia leads the movements of the other indices during the crisis. The relative influence of foreign shocks is much more felt during the crisis, as seen in the stronger and longer horizon of responses of all the markets. The stock indices are cointegrated before, but not during the crisis. Price feedbacks between the larger markets of Singapore, Malaysia and Indonesia that existed before the crisis disappear once the crisis is over. Short-run linkages of Malaysia with the other markets have weakened after the crisis. With an increase in the degree of exogeneity of its stock market, contemporaneous co-movements with the other markets have reduced and the causal relationships no longer exist.

Similar content being viewed by others

References

Cheung, Y. L., Y. W. Cheung and K.C. Ng, “East Asian Equity Markets, Financial Crises, and the Japanese Currency”, Working Paper Presented at the International Conference on Asian Crisis, IV: The Recovery and the Rest of the World, National Taiwan University, Taiwan, 24–25 July 2002.

Dickey, D. A. and W.A. Fuller, “Distribution of the Estimators for Autoregressive Time Series with a Unit Root.” Journal of the American Statistical Association 74, 427–437 (1979).

Doraisami, A., “From Crisis to Recovery: The Motivations for and Effects of Malaysian Capital Controls.” Journal of International Development 16, 241–254 (2004).

Fernandez-Serrano, J. L. and S. Sosvilla-Rivero, “Modeling Evolving Long-run Relationships: The Linkages between Stock Markets in Asia”. Japan and the World Economy 13(2), 145–160 (2001).

International Finance Corporation, Emerging Stock Markets Factbook. Washington: World Bank, 2000.

Jang, H. Y. and W. S. Sul, “The Asian Financial Crisis and the Co-movement of Asian Stock Markets.” Journal of Asian Economics 13, 94–104 (2001).

Johansen, S., “Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models.” Econometrica 59, 1551–1580 (1991).

MacKinnon, J. G., “Critical Values for Cointegration Tests.” In R.F. Engle and C.W.J. Granger (eds.), Long-run Economic Relationships, Oxford: Oxford University Press, 1991, pp. 267–276.

Mansor, H.I., “Financial Integration and Diversification among ASEAN Equity Markets: A Malaysian Perspective”. Capital Markets Review 8, 25–40 (2000).

Moon, W. S., “Currency Crisis and Stock Market Integration: A Comparison of East Asian and European Experiences.” Journal of International and Area Studies 8(1), 41–56 (2001).

Newey, W. and K. West, “Automatic Lag Selection in Covariance Matrix Estimation.” Review of Economic Studies 61, 631–653 (1994).

Osterwald-Lenum, M., “A Note with Quantiles of the Asymptotic Distribution of the Maximum Likelihood Cointegration Rank Test Statistics.” Oxford Bulletin of Economics and Statistics 54, 461–472 (1992).

Palac-McMiken, E. D., “An Examination of ASEAN Stock Markets—A Cointegration Approach.” ASEAN Economic Bulletin 13(3), 299–311 (1997).

Pesaran, H. and Y. Shin, “Generalized Impulse Response Analysis in Linear Multivariate Modes.” Economics Letters 58, 17–29 (1998).

Phillips, P.C.B. and P. Perron, “Testing for a Unit Root in Time Series Regression.” Biometrika 75, 335–346 (1988).

Roca, E. D., “Do Birds of the Same Feather Flock Together? The Case of the Chinese States Equity Markets”. Working Paper Presented at The First SSAAPS Asia-Pacific Annual Conference, Gothenburg University, Sweden, 26–28 September 2002.

Roca, E. D., E. A. Selvanayhan and W.A. Shepherd, “Are the ASEAN Equity Markets Interdependent?” ASEAN Economic Bulletin 15(2), 109–120 (1998).

Sheng, H. C. and A. H. Tu, “A Study of Cointegration and Variance Decomposition among National Equity Indices Before and During the Period of the Asian Financial Crisis.” Journal of Multinational Financial Management 10, 345–365 (2000).

Tan, K. B. and Y. K. Tse, “Equity-Market Linkages in the East and South-East Asian Region.” Working Paper of the International Centre for the Study of East Asian Development, 2002.

Vogelsang, T. J., “Wald-Type Tests for Detecting Breaks in the Trend Function of a Dynamic Time Series.” Econometric Theory 13, 818–849 (1997).

Yang, T. and J. J. Lim, “Crisis, Contagion, and East Asian Stock Markets.” Working Paper on Economics and Finance No 1, Institute of South East Asian Studies, Singapore, 2002.

Author information

Authors and Affiliations

Corresponding author

Additional information

JEL Classification: G15, F30

Rights and permissions

About this article

Cite this article

Goh, KL., Wong, YC. & Kok, KL. Financial Crisis and Intertemporal Linkages Across the ASEAN-5 Stock Markets. Rev Quant Finan Acc 24, 359–377 (2005). https://doi.org/10.1007/s11156-005-7018-6

Issue Date:

DOI: https://doi.org/10.1007/s11156-005-7018-6