Abstract

I examine price dispersion in retail gasoline and focus on differentiation along the service dimension: full service versus self service. Consistent with more intensive search by self-service customers, I find that price dispersion always decreases with the number of nearby self-service stations, but does not decrease with the number of nearby full-service stations. When I segment the market by brand, I observe that the estimates are sensitive to how brands are separated into different types. These findings show that the market is more clearly segmented by service level than by brand type and also highlight the importance of product differentiation when modeling price dispersion.

Similar content being viewed by others

Notes

Korean full-service customers are reluctant to engage in costly behavior. Kim et al. (2010) conduct a survey of 1000 consumers who buy gasoline in 3 months, and document that 22.5% of the consumers report “I am not willing to use self-service stations.” About 40% of those unwilling to buy self-serve gasoline report “inconvenience of getting in and out of the car” as the reason.

If stations choose a manual update, they must report their price within 24 h of a change in price.

There are 79 instances of stations that do not report prices for over a week without a change in station characteristics. In my dataset, when stations drop out of the sample for longer than 7 days, observed station characteristics typically change, in which case I assume that the stations temporally closed to make that change. See Fig. 7 in “Appendix 3”.

My estimation results are qualitatively similar using one, one-and-a-half, and two-mile radii. I report results using a 1.5-mile radius to be consistent with previous studies.

When using a five-mile radius, no stations are dropped. I re-estimate the main regressions of this paper, and the results are shown in Table 12 in “Appendix 1”. In addition, using a logistic regression with odds ratios, I find that the dropped stations are about twice as likely to be full service and to have a convenience store, but are about a third less likely to have other station amenities such as a carwash or repair facility. They are also less likely to be located at an intersection. These results are shown in Table 13 in “Appendix 1”.

Korean residents are required to report relocations as well as births and deaths to a local administrative office.

The total number of gasoline stations decreases from 628 to 583 over the sample period. This phenomenon is called “station rationalization” and often observed in the retail gasoline industry. See Eckert and West (2005).

Lewis (2008) measures localized dispersion by estimating a regression of citywide residuals on local average residuals. Both specifications produce qualitatively similar results in my setting.

Unlike a model of price level in Eq. (1), I do not include station fixed effects when modeling price dispersion due to insufficient within-station variation in the number of nearby stations. Station fixed effects would absorb most of the variation in the log squared residuals across individual stations and result in lack of estimation power of the number of stations nearby on price dispersion in my data. Also, I separate the number of stations by service level in a modified specification in the result section.

This specification explains the heteroskedastic variance of the squared residuals. Note that the residuals that are estimated by OLS are produced under the assumption that the variance of log price of stations is homogenous. However, this assumption does not change the residuals in the first-stage regression, although it changes the standard errors of the coefficient estimates. This paper focuses on the residuals rather than the coefficient estimates.

The coefficient estimates in this specification are recovered in three stages. First, I obtain the residuals \(\hat{w}\) from the specification without an AR process. Second, I obtain an estimated vector of coefficients \(\rho\) in the AR process (on the assumption that \(\upmu\) is stationary). Finally, having \(\hat{\rho }\) and \(\hat{w}\) enables me to construct the estimated variance–covariance matrix \({\mathbf{M}}\).

The average number of missing weeks is 17; the median is 12; the minimum is zero; the maximum is 125 weeks.

In addition to this pooled-sample regression, I also estimate separate-sample regressions for full-service and self-service subsamples, starting from a price-level regression in Eq. (1). Chow-like F tests show no significant structural breaks between the subsamples, which may indicate that the market has been not clearly segmented by service level during my study period. The market conversion had just started at the beginning of my sample, and many low-price full-service stations charged prices similar to self-service stations during this period, so it seems that some full-service stations still competed with self-service stations on gasoline price in this market. Accordingly, I keep the pooled-sample regressions in this study. See Table 9 in “Appendix 1” for detailed results of the Chow-like tests.

I specify the empirical models of brand classifications (low-brand vs. high-brand, follower-brand vs. leader-brand, and unbranded vs. branded) similarly.

Models of search generally predict a non-monotonic relationship between search intensity and dispersion, but my main specification estimates a monotonic and linear relationship between them. To test for non-monotonicity, I divide my sample into stations with above-average numbers of self-service stations and those with below-average numbers of self-service stations. Using Chow tests, I confirm that the elasticities are statistically indistinguishable across the two samples. This result is also qualitatively similar when I divide the sample based on the average number of full-service stations. I do not show the results in this paper.

In the unbranded/branded setting in Column (3), the results are generally insignificant; the sample size is much smaller because many stations have no unbranded stations within 1.5 miles. I re-estimate the same specification using a five-mile radius in which most stations have both branded and unbranded stations nearby, and I continue to find insignificant coefficients. The results are omitted in this paper.

Search-based models differ with respect to assumptions such as the information acquisition channel and firm and consumer heterogeneity. As a result, model predictions about the sign of the relationship between price dispersion and information costs vary—predicting, variously, a positive relationship (Reinganum 1979), a negative relationship (MacMinn 1980), or a non-monotonic relationship (Varian 1980). Empirical counterparts of the relationship are also not uniform: Studies have found a positive relationship (Borenstein and Rose 1994), a negative relationship (Gerardi and Shapiro 2009), or a non-monotonic relationship (Chandra and Lederman forthcoming). See Baye et al. (2006) for a review of a wide range of search models from both theoretic and empirical perspectives.

Wildenbeest (2011) provides a model-based framework for studying price dispersion in markets with product differentiation and search frictions with simplification assumptions on consumer preference and firm’s quality input factors.

I present results only from local variation in Table 15 since results from citywide variation and those from local variation are qualitatively similar.

References

Barron, J. M., Taylor, B. A., & Umbeck, J. R. (2004). Number of sellers, average prices, and price dispersion. International Journal of Industrial Organization, 22(8), 1041–1066.

Basker, E., Foster, L., & Klimek, S. D. (2017). Customer-labor substitution: Evidence from gasoline stations. Journal of Economics and Management Strategy, 26(4), 876–896.

Baye, M. R., Morgan, J., & Scholten, P. (2006). Information, search, and price dispersion. In T. Hendershott (Ed.), Handbook of economics and information systems (pp. 323–371). Amsterdam: Elsevier.

Borenstein, S., & Rose, N. L. (1994). Competition and price dispersion in the US airline industry. Journal of Political Economy, 102(4), 653–683.

Chandra, A., & Lederman, M. (forthcoming) Revisiting the relationship between competition and price discrimination. American Economic Journal: Microeconomics.

Chandra, A., & Tappata, M. (2011). Consumer search and dynamic price dispersion: An application to gasoline markets. RAND Journal of Economics, 42(4), 681–704.

Eckert, A., & West, D. S. (2005). Rationalization of retail gasoline station networks in Canada. Review of Industrial Organization, 26(1), 1–25.

Genesove, D. (1995). Search at wholesale auto auctions. Quarterly Journal of Economics, 110(1), 23–49.

Gerardi, K. S., & Shapiro, A. H. (2009). Does competition reduce price dispersion? New evidence from the airline industry. Journal of Political Economy, 117(1), 1–37.

Harvey, A. C. (1976). Estimating regression models with multiplicative heteroscedasticity. Econometrica, 44(3), 461–465.

Hastings, J. S. (2004). Vertical relationships and competition in retail gasoline markets: Empirical evidence from contract changes in Southern California. American Economic Review, 94(1), 317–328.

Houde, J.-F. (2012). Spatial differentiation and vertical mergers in retail markets for gasoline. American Economic Review, 102(5), 2147–2182.

Kim, D.-W., & Kim, J.-H. (2011). The impact of the entry of self-service stations in the Korean retail gasoline market: Evidence from the difference-in-differences methods. Korean Journal of Economic Studies, 59(2), 77–99.

Kim, H. G., Won, D. H., Hankook Research, & Koo, H. M (2010). 소비자의 주유소 구매행태 설문조사 (Survey on Consumers’ Shopping Pattern for Gasoline), Korea Energy Economics Institute. Available at http://www.keei.re.kr/main.nsf/index.html. Accessed 23 Dec 2017.

Lach, S. (2002). Existence and persistence of price dispersion: An empirical analysis. Review of Economics and Statistics, 84(3), 433–444.

Lach, S., & Moraga-González, J. L. (2015). Asymmetric price effects of competition. Centre for Economic Policy Research (CEPR) Discussion Papers 10456.

Lewis, M. (2008). Price dispersion and competition with differentiated sellers. Journal of Industrial Economics, 56(3), 654–678.

Lewis, M. S., & Marvel, H. P. (2011). When do consumers search? Journal of Industrial Economics, 59(3), 457–483.

MacMinn, R. D. (1980). Search and market equilibrium. Journal of Political Economy, 88(2), 308–327.

Marvel, H. P. (1976). The economics of information and retail gasoline price behavior: An empirical analysis. Journal of Political Economy, 84(5), 1033–1060.

Noel, M. D. (2016). Retail gasoline markets. In E. Basker (Ed.), Handbook on the economics of retailing and distribution (pp. 392–412). Cheltenham: Edward Elgar.

Reinganum, J. F. (1979). A simple model of equilibrium price dispersion. Journal of Political Economy, 87(4), 851–858.

Salop, S., & Stiglitz, J. (1977). Bargains and Ripoffs: A model of monopolistically competitive price dispersion. Review of Economic Studies, 44(3), 493–510.

Saxonhouse, G. R. (1976). Estimated parameters as dependent variables. American Economic Review, 66(1), 178–183.

Shepard, A. (1991). Price discrimination and retail configuration. Journal of Political Economy, 99(1), 30–53.

Sorensen, A. T. (2000). Equilibrium price dispersion in retail markets for prescription drugs. Journal of Political Economy, 108(4), 833–850.

Stahl, D. O. (1989). Oligopolistic pricing with sequential consumer search. American Economic Review, 79(4), 700–712.

Varian, H. R. (1980). A model of sales. American Economic Review, 70(4), 651–659.

Wildenbeest, M. R. (2011). An empirical model of search with vertically differentiated products. RAND Journal of Economics, 42(4), 729–757.

Acknowledgements

This paper was written while I am a Ph.D. student at the University of Missouri, and it is expected to be one chapter of my dissertation. I am extremely grateful to Emek Basker for her guidance and encouragement. I thank Lawrence White (the Editor) and two anonymous referees for meticulous reviews and constructive comments that greatly improved this paper. I also thank Ingul Baek, Wesley Burnett, Ambarish Chandra, Bruce Hansen, Katherine Harris, David Kaplan, Cory Koedel, Oksana Loginova, David Mandy, Zack Miller, Peter Mueser, Kyungsik Nam, Shawn Ni, Michael Sykuta, and seminar participants at the 2016 MU Research and Creative Activities Forum (Columbia, MO), the 2016 IIOC (Philadelphia, PA), the 2016 MVEA (St. Louis, MO), the 2016 SEA (Washington, DC), and the 2017 KEA-APEA (Seoul) for helpful comments and conversations. All remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Supplementary Results

See Figs. 4, 5 and Tables 7, 8, 9, 10, 11, 12, 13.

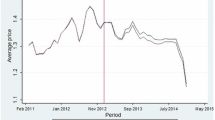

Price dispersion of stations that enter or exit during the sample period. I plot the distribution of squared residuals (and squared adjusted residuals) for entrants in their first week and for exiters in the last week in the sample. The market dispersion uses all observations except entrants, exiters, and switchers (full to self service). Note: Market dispersion excludes stations that enter, exit, or switch

Appendix 2: Robustness Checks

Appendix 3: Price Information

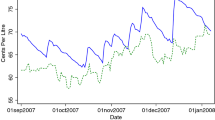

Price changes: timing and frequency. This figure shows how often stations change prices and which day their prices change in the full dataset, respectively. The left-hand figure shows that stations change price once every 12 days on average (median = 12; SD = 7.03; min = 2.53; max = 44.2). The right-hand figure shows that price changes are most common on Tuesdays and least common on Sundays

Missing observations at a daily frequency. The left-hand figure shows the frequency of missing observations in the full dataset. The right-hand figure describes my compromise for instances that do not report price for up to 30 days, but report no changes of station characteristics. Of about 120,000 observations, these 79 instances are assumed to remain open over the period during which they did not report prices. Note: The right figures include stations’ missing with no changes reported when they are back

Rights and permissions

About this article

Cite this article

Kim, T. Price Competition and Market Segmentation in Retail Gasoline: New Evidence from South Korea. Rev Ind Organ 53, 507–534 (2018). https://doi.org/10.1007/s11151-018-9626-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-018-9626-z