Abstract

This study presents a structural model of the Korean airline industry and examines the effects of Korea’s Airline Deregulation Act of May 2008. We investigate the route-level impact of low-cost carrier (LCC) entries on air travel demand and incumbents’ strategic responses. We use a panel of airline-level data for each of the three Jeju Island routes, covering the 2006–2010 period, and find evidence for a common sensitivity to price across routes, but a route-specific response to flight characteristics. Air passengers favor frequent flights and larger aircraft. Moreover, departure flight schedules that are more spread out throughout the day provide higher utility for air passengers on high-volume routes. In the post-deregulation period, both legacy carriers lost sales on high-volume routes to emerging independent LCCs, but partly recouped those losses through their own subsidiary LCCs (dependent LCCs), by either replacing their previous services with their own LCCs or flying under a two-brand strategy. We empirically divide the price-cost markups into an own product-specific effect and a multiproduct firm-specific effect. This expansion of independent LCCs accounts for a substantial proportion of the two legacy carriers’ profit reductions, whereas the magnitude of the estimated profit losses varies widely depending on their strategic responses. In summary, the legacy carriers’ post-deregulation competitive behavior is far from collusive.

Similar content being viewed by others

Notes

The longest flight among Korea’s domestic routes requires only about 65 min of travel time for jet airplanes and about 90 min for turboprop airplanes.

Airline industry business strategies are necessarily tied to network choices: the full-service business model utilizes a hub-and-spoke network, while the LCC business model operates within a point-to-point network.

A detailed description of the airline carriers in Korea is presented in the "Appendix".

Source: Centre for Asia Pacific Aviation and OAG Facts.

The National Assembly passed a bill to amend the Labor Standard Act (LSA) in August 2003. This amended LSA introduced a 5-day work week by reducing the maximum legal working hours from 44 to 40 per week. A law that imposed a shorter workweek on public sector workers, financial institutions, and private companies with more than 1000 employees was passed by the Korean parliament in 2004. For firms with between 300 and 1000 employees, this amended LSA was effective from July 2005; for firms with between 100 and 299 employees, it was effective from July 2006. In 2011, Korean companies of all sizes were required to switch to the 5-day work week.

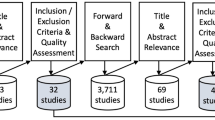

We limit the sample to routes where a substantial number of passengers fly. In addition, some domestic city-pair routes are excluded if data such as fares or aircraft size were missing, or if the number of flights in a given route were less than three. Within the five Jeju Island routes, the entry of LCCs is limited to four routes, of which three faced significant competition (e.g., for over half a year) from independent LCCs.

The editor raises a concern for endogeneity among the three Jeju Island routes. If someone is flying from elsewhere in Korea to one of the three cities in order to connect to a flight to Jeju, then his/her choice of which city to use as the connection may depend on the relative attraction of the fares and/or frequencies of the flights to Jeju from the three cities. However, since there are flights to Jeju from other airports in Korea in addition to the flights from the three cities on which this study focuses, the bulk of the traffic between each of these three cities and Jeju is likely to come from within each of these metropolitan areas, respectively. Consequently, competition for such out-of-area passengers is likely to be modest, at best; and thus the potential endogeneity among the three Jeju Island routes is unlikely to be serious problem.

The nested logit model is derived from the assumption that the random terms \(\varepsilon _{ijt}\) have a generalized extreme-value distribution; thereby, a general pattern of dependence among the choices is allowed only within the same nest, avoiding the Independence of Irrelevant Alternatives (IIA) property.

The nesting parameter \(\sigma _{r}\) lies between 0 and 1 and measures the correlation of air passengers’ utilities across flights compared with those of potential fliers who did not choose air travel at time t. As \(\sigma _{r}\) approaches 1, flights operated by different carriers are perceived as perfect substitutes.

If product j is in group g, the well-known formula for the market share of product j as a fraction of the total group share is \(s_{{jt}/{gt}}=e{}^{{\delta _{jt}^{r}}/{(1-\sigma _{r})}}/D_{g}\), where the denominator of this expression for a product in group g is \(s_{gt}=D_{g}^{(1-\sigma _{r})}/\left[ \sum _{g}D_{g}^{(1-\sigma _{r})}\right] \), which gives a market share of \(s_{jt}=s_{{jt}/{gt}}\cdot s_{gt}=e^{{\delta _{jt}^{r}}/{(1-\sigma _{r})}}/D_{g}^{\sigma _{r}}\left[ \sum _{g}D_{g}^{(1-\sigma _{r})}\right] \).

So the outside good share is \(s_{ot}= {1}/{\left[ \sum _{g}D_{g}^{(1-\sigma _{r})}\right] }\).

We take the logs of \(s_{jt}\) and \(s_{ot}\), \(ln\left( s_{jt}\right) -ln\left( s_{ot}\right) ={\delta _{jt}^{r}}\big /{(1-\sigma _{r})}-\sigma _{r}ln(D_{g})\). We take the log of \(s_{gt}\): \(ln\left( D_{g}\right) ={[ln(s_{gt})-ln(s_{ot})]}\big / {(1-\sigma _{r})}\). Combining terms gives the analytic expression of the implied mean utility level of product j: \(\delta _{jt}^{r}=ln\left( s_{jt}\right) -\sigma _{r}ln\left( s_{{jt}/{gt}}\right) -ln\left( s_{ot}\right) \).

DIFF is calculated using the departure times of all non-stop flights. There are n non-stop flights on a route, which depart at \(d_{1}, \ldots \,,\, d_{n}\) min. For DIFF, each departing time, \(d_{1}, \ldots \,,\, d_{n}\), is expressed as minutes after midnight.

The average distance between flights on a route is measured as:

$$\begin{aligned} AVGDIFF=\frac{2}{n\left( n-1\right) }\sum _{i=1}^{n-1}\sum _{j>1}^{n}\left[ min\left\{ \left| d_{i}-d_{j}\right| ,\,1440-\left| d_{i}-d_{j}\right| \right\} \right] ^{\alpha },\;0<\alpha <1\,, \end{aligned}$$where 1440 denotes the number of minutes in a day. AVGDIFF is minimized at zero when all flights depart at the same time. AVGDIFF is maximized when flights on a route are evenly distributed over a day. The power of \(\alpha \) denotes the marginal effect of changes in time differences between flights on a route. We arbitrarily choose \(\alpha =0.5\), as the results do not qualitatively change across alternative values of \(\alpha\).

For comparisons across routes with different numbers of flights, AVGDIFF is normalized by the maximum possible departure schedule differentiation, MAXDIFF, which is the value when the flights are equally spaced around the 24-h clock.

$$\begin{aligned} MAXDIFF={\left\{ \begin{array}{ll} \frac{2}{n\left( n-1\right) }\sum _{k=1}^{{n}/{2}-1}n\left( k\frac{1440}{n}\right) ^{\alpha }+\frac{n}{2}\left( 720^{\alpha }\right), &\quad \forall n=even\\ \frac{2}{n\left( n-1\right) }\sum _{k=1}^{{\left( n-1\right) }/{2}}n\left( k\frac{1440}{n}\right) ^{\alpha }, &\quad \forall n=odd. \end{array}\right. } \end{aligned}$$Thus, \(DIFF=\frac{AVGDIFF}{MAXDIFF}\) takes a value in the interval [0,1]. The closer the index value is to 1, the more evenly distributed the flights are over a 24-h clock, thus maximizing the departure time differentiation. When this index value is equal to 0, all flights depart at the same time, indicating no departure time differentiation.

We assume the existence of a pure-strategy interior equilibrium. A unique pure-strategy equilibrium for the Bertrand game exists (Caplin and Nalebuff 1991).

Further details with respect to the definition of market size are given in Sect. 4. The method of defining route-specific outside goods also applies to the rest of the supply models.

As mentioned, a unique pure-strategy equilibrium for the Bertrand game exists (Caplin and Nalebuff 1991).

Specifically, in a discrete choice demand model specification, a diversion ratio can be directly calculated from own- and cross-price elasticities of demand for each product. For example, the diversion from KAL flights (m) to JNA flights (l) is measured by the ratio of the cross-price elasticity of demand for JNA flights (l) (with respect to KAL flights’ price change) to the own-price elasticity of demand for KAL flights (m), multiplied by the ratio of the market share for JNA flights (l) to the market share for KAL flights (m):

$$\begin{aligned} diversion\; ratio_{ml}=\frac{\eta _{ml}}{\eta _{mm}}\cdot \frac{s_{l}}{s_{m}} \end{aligned}$$December 2009 is excluded, as no data on the total monthly flight frequency of domestic city-pair nonstop flights are captured by the KAC for that period.

Prior to July 2008, fuel surcharges were imposed only on international routes. Airline-specific fuel surcharges are directly linked to the Mean of Platts Singapore, a measure of fuel oil pricing in Singapore. Airline-specific fuel surcharges are reassessed every 2 months and updated on the each carrier’s website.

January and October are holiday seasons. July and August are the summer vacation/tourist season. Elementary, middle, and high schools schedule educational field trips in April and May. Scatter plots of monthly passenger volumes indicate seasonality.

Based on the yearly reports of the Jeju Special Self-Governing Provincial Tourism Association, the average number of visitor arrivals by vessel on the three Jeju Island routes from 2006 to 2010 equals approximately 10% of the total passenger volume for each route.

The outside good market shares calculated from 0.5 to 2% of the populations of origin cities and flying to Jeju Island range from 7.758 to 25.056% for the Jeju–Seoul (\(r=1\)) route, 10.454–31.646% for the Jeju–Busan (\(r=2\)) route, and 3.093–11.301% for the Jeju–Cheongju (\(r=3\)) route. The choice of time- and route-specific outside goods affects the size and significance level of the airline carrier-specific fixed effects, and the relative size of the carrier-specific fixed effects does not change over the chosen percentages (i.e., 0.5–2%) of the populations for origin cities. Thus, we proceed with these chosen percentages of the population of the origin city: 0.75% for Seoul, 0.5% for Busan, and 2% for Cheongju. The average for outside good shares in our dataset is 10% for each given route.

The existence of extreme pairwise correlations may be sufficient for detecting multicollinearity, but it is not necessary (Mansfield and Helms 1982).

The key assumption of the BLP-type instruments is that all product attributes are exogenous with respect to the unobservable. However, in recent discrete choice applications in the demand estimation in airline literature, flight attributes can be assumed endogenous. Berry and Jia (2010) have both fare and flight frequency endogenous in the airline demand equation. Flight frequency is there because any instrument for fare would also be potentially correlated with flight frequency. Berry and Jia (2010) therefore try to fix this violation of the exclusion restriction by treating flight frequency as endogenous as well.

The ideal instrumental variables are ones that shift costs but do not directly enter the demand Eq. (3). An obvious underlying cost variable would be fuel costs. However, no data are available at the route-carrier-month level; thus, the jet fuel prices as instruments would probably be weak in this context. For robustness purposes, jet fuel prices are used as instruments, generating undesirable biases in point estimation results for Fare, an endogenous variable with a strong rejection of the null hypothesis of the Sargan–Hansen over-identification test. So, this rules out jet fuel prices as an instrument for Fare. The demand estimation results using jet fuel prices as instruments are available upon request.

Alternative functions of the observed characteristics have been used as instruments with no qualitative change to the results.

No data for the number of passengers on each flight are available. In line with Berry and Jia (2010), in the absence of sufficient data, we instrument flight frequencies without explicitly modeling how carriers schedule departure times. The dataset is supplemented with monthly meteorological data for Jeju Island, including data that pertain to precipitation (mm), average temperatures, and number of snow days; in this way, we control for seasonality in Jeju air travel demand. The fitted departures are obtained from the regressions of flight frequencies on the following exogenous variables: carrier dummy variables; route-level characteristics (e.g., distance and difference in January temperatures between the destination cities); market size (measured by population); and number of competitors.

A test that \(Aircraft\, Size\) is actually an exogenous variable is performed using the STATA estat endogenous command and is interpreted using the Durbin and Wu-Hausman test. The Durbin and Wu-Hausman test statistics are not statistically significant at the 5% level, so we fail to reject the null of exogeneity. Thus, \(Aircraft\, Size\) is assumed to be exogenous in each model specification.

For robustness purposes, the demand estimation results from Ackerberg and Rysman (2005) congestion model specification are used for each of the three routes, and we conclude that there is no congestion effect as new LCCs enter the three Jeju Island routes. Ackerberg and Rysman (2005) relax the no-crowding-out assumption of standard logit errors (wherein all products are equidistant from each other in unobserved characteristic space and the dimensionality of this space expands by 1 with the addition of the new product) when new brands are introduced.

We include carrier dummy variables for Korean Air (the default group, KAL), Asiana Airlines (AAR), and Jeju Air (JJA) as well as a dummy variable for all other carriers, Others; this is in line with Berry and Jia (2010) method. Yeongnam Air (ONA), an independent LCC, launched its flight services in July 2008, 2 months after the Deregulation Act of May 2008. The two independent LCCs ceased their operations in 2008: November (HAN) and December (ONA). Others includes these independent LCCs and the two dependent LCCs [i.e., JNA flew only a few months on the Jeju–Busan route (April 2009 to Nov 2009)].

We also interacted year dummy variables with carrier dummy variables to see if there are differing annual trends by carrier. A test of joint significance for these interacted variables failed to reject the hypothesis that these independent variables have no collective influence on the dependent variable at the 5% significance level. Thus, these year dummy variables that are interacted with carrier dummy variables are dropped from our estimation.

The test rejects the null of first-order serial correlation with a p value of 0.0335 for the Jeju–Seoul route (\(r=1\)) at the 5% significance level. The test fails to reject the null of first-order serial correlation with a p value of 0.090 for the Jeju–Busan route (\(r=2\)), and that of 0.1631 for the Jeju–Cheongju route (\(r=3\)). A significance test statistic for the Jeju–Seoul route (\(r=1\)) indicates the presence of serial correlation. If there is serial correlation in the idiosyncratic error term, clustering at the panel level will produce consistent estimates of the standard errors; and as is discussed by Baltagi (2005) and Wooldridge (2002), other estimators will produce more efficient estimates.

Based on the average load factor, which is the percentage of seats occupied, August seems to face a capacity constraint problem in which demand is high relative to the number of flights or seats offered.

Cragg and Donald (1993) propose a test statistic that can be used to test for weak instruments. A test for weak identification (which means that the instruments correlate with endogenous regressors, but not to a high degree) is performed using STATA 11 and is interpreted as per Stock and Yogo (2005). The Cragg–Donald F test for multiple endogenous variables does not specify the source of failure to reject the null hypothesis. A detailed description of Stock and Yogo is presented in the "Appendix".

The editor points out that there may be some anticipation behavior before May 2008 and/or after May 2008. In order to address this issue, we estimate the demand model for all months excluding 2008, with no qualitative change in the results. The results of a Chow test indicate that there is no statistical evidence to reject the null hypothesis for equality of coefficients when the sample is divided into two groups (i.e., pre- and post- deregulation periods). In order to address a potential problem that could arise in aggregate-level data, we compare relative fares during the early months of the entry and the relative fares during the well-established period and test whether these differences are statistically significant. There is no statistical evidence to reject the null hypothesis of the same coefficients. Thus, we proceed with the time-invariant coefficients for Fare in Eq. (3).

On high-demand routes (\(r=1,2\)) that have one of the two largest metropolitan areas (i.e., Seoul or Busan) as a destination, air passengers’ benefits from evenly distributed flight departures would be larger than those along the other routes.

The own- and cross-price elasticities for the nested logit model specification for air travel demand are:

\(\eta _{jj,t}^{r}=|{\frac{p_{jt}^{r}}{s_{jt}}\frac{\partial s_{jt}}{\partial p_{jt}^{r}}}|=|{\frac{\alpha }{1-\sigma }p_{jt}^{r}\left( 1-\sigma s_{{jt}/{gt}}-\left( 1-\sigma \right) s_{jt}\right) }\)|

\(\eta _{jk,t}^{r}=\frac{p_{jt}^{r}}{s_{kt}}\frac{\partial s_{kt}}{\partial p_{jt}^{r}}=\frac{\alpha }{1-\sigma }p_{kt}^{r}\left( -\sigma s_{{kt}/{gt}}-\left( 1-\sigma \right) s_{kt}\right) \)

\(\eta _{jq,t}^{r}=\frac{p_{jt}^{r}}{s_{qt}}\frac{\partial s_{qt}}{\partial p_{jt}^{r}}=-\alpha p_{qt}^{r}s_{qt}\,,\) where \(s_{{jt}/{gt}} \left( s_{{kt}/{gt}}\right) \) is the within-group market share for carrier j \(\left( k\right) \). Carriers j and k belong to the same segment while q belongs to another segment (q means outside good option in our context).

For independent LCCs, the time-varying market share weighted average values across different carriers within the same type are presented at route level.

JNA fliers were charged the same low price that the independent LCCs offered. On the other hand, KAL fliers were charged almost the same price that AAR fliers paid.

A potential problem in interpreting the results from MBNE may arise from the way in which the diversion ratio, which is a critical component of the firm-specific term in Eqs. (7) and (8), is constructed (i.e., a diversion ratio is designed to place more weight on a carrier that has a larger market share, and KAL recorded the largest market share during the full sample period).

ABL scheduled a total of 8.3 daily flights, which exceeded its pre-deregulation flight frequency under AAR operation by 78.1%. From December 2008 to June 2010 ABL reached a 29.8% market share. This number exceeded its market share of 21.2% under AAR operation in the regulated period. Extending its reputation through the code-share operation with ABL created customer loyalty, while sharing the online reservation system for airline tickets.

Profit changes are commonly known to be a welfare measure of producer surplus. The changes in producers’ surplus due to the entry of LCCs for both the entrant and pre-existing competitors are computed under two equilibrium concepts: the SBNE and the MBNE.

Korean Air (http://kr.koreanair.com/), Asiana Airlines (http://flyasiana.com/), Hansung Airlines (Hansung Airlines ceased operation), Jeju Air (http://www.jejuair.net/), Yeongnam Air (Yeongnam Air ceased operation), Jin Air (http://www.jinair.com/), Air Busan (http://www.airbusan.com/), Eastar Jet (http://www.eastarjet.co.kr/).

References

Ackerberg, D., & Rysman, M. (2005). Unobserved product differentiation in discrete choice models: Estimating price elasticities and welfare effects. The Rand Journal of Economics, 36, 771–788.

Baltagi, B. H. (2005). Econometric analysis of panel data (Vol. 3). Hoboken: Wiley.

Berry, S. (1994). Estimating discrete choice models of product differentiation. Rand Journal of Economics, 24(2), 242–262.

Berry, S., & Jia, P. (2010). Tracing the woes: An empirical analysis of the airline industry. American Economic Journal: Microeconomics, 2, 1–43.

Berry, S., Levinsohn, J., & Pakes, A. (1995). Automobile prices in market equilibrium. Econometrica, 63(4), 841–890.

Borenstein, S., & Netz, J. (1999). Why do all the flights leave at 8 am? Competition and departure-time differentiation in airline markets. International Journal of Industrial Organization, 17, 611–640.

Bresnahan, T. F., Stern, S., & Trajtenberg, M. (1997). Market segmentation and the source of rents from innovation: Personal computers in the late 1980s. The Rand Journal of Economics, 28, S17–S44.

Caplin, A., & Nalebuff, B. (1991). Aggregation and imperfect competition: On the existence of equilibrium. Econometrica, 59(1), 25–59.

Cardell, N. S. (1997). Variance components structures for the extreme-value and logistic distributions with application to models of heterogeneity. Econometric Theory, 13(2), 185–213.

Cragg, J. G., & Donald, S. G. (1993). Testing identifiability and specification in instrumental variable models. Econometric Theory, 9(2), 222–240.

Drukker, D. M. (2003). Testing for serial correlation in linear panel-data models. The Stata Journal, 3(2), 168–177.

Garcia-Gallego, A., & Georgantzis, N. (2001). Multiproduct activity in an experimental differentiated oligopoly. International Journal of Industrial Organization, 19, 493–518.

Gillen, D., & Morrison, W. (2005). Regulation, competition and network evolution in aviation. Journal of Air Transport Management, 11, 161–175.

Hausman, J. (1996). Valuation of new goods under perfect and imperfect competition. In T. Bresnahan & R. Gordon (Eds.), The economics of new goods, studies in income and wealth (Vol. 58). Chicago: National Bureau of Economic.

Mansfield, E., & Helms, B. (1982). Detecting multicollinearity. The American Statistician, 36(3), 158–160.

Morrison, S., & Winston, C. (1986). The economic effects of airline deregulation. Washington: Brookings Institution.

Nevo, A. (2000). Practitioner’s guide to estimation of random coefficients logit models of demand. Journal of Economics & Management Strategy, 9(4), 513–548.

Panzar, J. C. (1979). Equilibrium and welfare in unregulated airline markets. American Economic Review, 69(2), 92–95.

Petrin, A. (2002). Quantifying the benefits of new products: The case of the minivan. Journal of Political Economy, 110(4), 705–729.

Sun, J. Y. (2015). Clustered airline flight scheduling: Evidence from airline deregulation in korea. Journal of Air Transport Management, 42, 85–94.

Stock, J., Wright, J., & Yogo, M. (2002). A survey of weak instruments and weak identification in generalized method of moments. Journal of Business and Economic Statistics, 20(4), 518–529.

Stock, J., & Yogo, M. (2005). Testing for weak instruments in linear IV regression, Chapter 5. In J. H. Stock & D. W. K. Andrews (Eds.), Identification and inference for econometric models: Essays in honor of Thomas Rothenberg (pp. 80–108). Cambridge: Cambridge University Press.

Verboven, F. (1996). International price discrimination in the European car market. The Rand Journal of Economics, 27(2), 240–268.

Winston, C. (1998). U.S. industry adjustment to economic deregulation. Journal of Economic Perspectives, 12(3), 89–110.

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data (Vol. 1). Cambridge: MIT Press.

Acknowledgements

This paper is based on my Ph.D. dissertation at Cornell University. I am especially grateful to Robert Masson, Jeffrey Prince, and George Jakubson. I thank the editor, Lawrence White, for his constructive suggestions on an earlier draft. I also thank two anonymous referees whose comments have greatly improved this paper. Any remaining errors are my own.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Description of the Airline Carriers Footnote 43

-

Korean Air (KAL) is the largest airline of South Korea, with global headquarters that are located in Seoul, Korea. KAL is among the top 20 airlines in the world in terms of passengers carried and is also the top-ranked international cargo airline. KAL is a founding partner airline of SkyTeam, the world’s second-largest airline alliance. Its main rival is Asiana Airlines, the second-largest South Korean carrier.

-

Asiana Airlines (AAR) is one of South Korea’s two major airlines, along with KAL. AAR is one of the seven airlines to be ranked as a 5-star airline by the independent research consultancy firm Skytax.

-

Hansung Airlines (HAN), an independent LCC, arose out of a collaboration between the city of government of Cheongju and the University of Chungcheong in 2004. In 2005, HAN received its Air Operator Certificate (AOC), thus formally approved with the delivery of ATR-72, turboprop aircraft which has less than 100 seats per plane. On 19 December 2005, HAN suspended all services due to budgetary constraints. On 15 February 2006, flights could be resumed, but financial difficulties remained, resulting in its shut-down in November 2008.

-

Jeju Air (JJA), an independent LCC, is an airline that is based in Jeju, South Korea and offers scheduled domestic services between Jeju and the South Korean mainland. JJA was established in January 2005 and began operations on June 2006. It is owned by the Aekyung Group (75%) and the Jeju Provincial Government (25%).

-

Yeongnam Air (ONA), an independent LCC, was a small regional airline of South Korea that launched in July 2008. Its main base was Busan airport and Daegu airport. It flew to Jeju and Seoul with a single aircraft: Fokker100. ONA stopped its operations in December 2008.

-

Jin Air (JNA) is a dependent LCC. It is a full subsidiary of KAL. JNA began operations in July 2008 with Boeing 737s.

-

Air Busan (ABL) is a dependent LCC with its headquarters in Busan, the second largest metropolis after Seoul in Korea. ABL is a subsidiary of AAR, and it launched service on October 2008. It has code-share operations with its parent company AAR.

-

Eastar Jet (ESR), an independent LCC, is a scheduled low-cost airline that is based in Seoul, South Korea. ESR started operations in October 2008. The main share holder of ESR is the Eastar group in South Korea. ESR is a regional airline, being organized to take advantage of a specific gap—low-cost services out of hub airports, i.e., Seoul and Jeju—in the short-haul domestic travel market.

1.2 Testing for Weak Instruments

The linear IV regression model with multiple endogenous regressor \((n>1)\) is

and

where Y are \(T\times n\) vectors of observations on endogenous variables; X is a \(T\times K_{1}\) matrix of included exogenous variables; Z is a \(T\times K_{2}\) matrix of instruments; and u and \(\nu \) are \(T\times n\) vectors of disturbance terms. It is assumed throughout that \(K_{2}\ge n\). The errors \([u_{t}\,\nu _{t}]'\) are assumed to be iid \(N(0,\sum )\), where the elements of \(\sum \) are \(\sigma _{u}^{2}\), \(\sigma _{uv}\), and \(\sigma _{v}^{2}\).

In Stock et al. (2002), the concentration parameter \(\mu ^{2}\)—a \(K_{2}\times K_{2}\) matrix—is defined to measure the strength of the instruments, \(\mu ^{2}=\) \(\sum _{VV}^{{1}/{2'}}\Pi 'Z'Z\Pi \sum _{VV}^{{1}/{2}}\), where \(\sum _{VV}\) is a covariance matrix of the vector of errors \(\nu \). \(\mu ^{2}\) is relevant to the F statistic in Eq. (10), the first-stage F statistic. Let \(\widetilde{F}\) be the computed value of F using the true \(\sigma _{v}^{2}\), such as \(K_{2}\widetilde{F}\sim Chi^{2}(df=K_{2})\) and \(E(\widetilde{F})={\mu ^{2}}/{K_{2}}+1\). If the sample size is large, then F and \(\widetilde{F}\) are close, so \(E(F)\tilde{=}{\mu ^{2}}/{K_{2}}+1\), the first-stage F statistic. In order to have a set of instruments that are strong enough, the matrix \({\mu ^{2}}/{K_{2}}\) must be sufficiently large in the sense that its smallest eigenvalue is large. Inference about \(\mu ^{2}\) can be based on the \(n\times n\) matrix analog of the first-stage F statistic, \(G_{T}=\hat{\sum }_{VV}^{{-1}/{2'}}Y'P_{Z}Y\hat{\sum }_{VV}^{-{1}/{2}}/K_{2}\), where \(\hat{\sum }_{VV}=Y'M_{Z}Y/(T-K_{2});\) \(M_{Z}=I-P_{Z}\); and I is a conformable identity matrix. Under weak-instruments asymptotic, \(E(G_{T})\rightarrow {\mu ^{2}}/{K_{2}}+I\). Cragg and Donald (1993) proposed using \(G_{T}\) to test for identification. Accordingly, Stock, Wright, and Yogo provided tables of critical values based on the minimum eigenvalue of \(G_{T}\).

In Stock and Yogo (2005), the definition of size of test refers to the researcher’s tolerance for departures from the usual standards of inference. The standard normal 5% hypothesis test is thrown off by the weak first-stage estimates when the instruments are relevant but weak, \(\Pi \ne 0\) in Eq. (10). The tails are flatter than one would expect if one took a parameter in the second-stage and tested it as if one would test a parameter in an OLS. Then, one may think (say) 15% is good enough to reject the null and this may correspond with an OLS calculation of 5% given some number of first-stage regressors. The size of test refers to the maximum of the willingness rejection rate, \(r(\%)\).

Rights and permissions

About this article

Cite this article

Sun, J.Y. Airline Deregulation and Its Impacts on Air Travel Demand and Airline Competition: Evidence from Korea. Rev Ind Organ 51, 343–380 (2017). https://doi.org/10.1007/s11151-017-9565-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-017-9565-0