Abstract

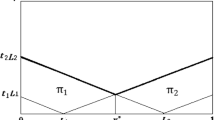

This paper examines the welfare effects of physically interconnecting two (network) markets that were previously separated. In each market a different set of capacity-constrained firms operate. Firms engage in a supergame and collude whenever it is rational for them to do so.We find that, under certain parametric restrictions, interconnection of the two markets reduces total welfare. The collusive horizon may extend from a single market to the overall integrated market. In such case, interconnection can be viewed as “exporting” collusion, rather than competition.

Similar content being viewed by others

References

Barla P. (2000) Firm size inequality and market power. International Journal of Industrial Organization 18: 693–722

Bernheim D., Whinston M. (1990) Multimarket contacts and collusive behavior. Rand Journal of Economics 21: 1–26

Boffa, F. (2006). Essays on optimal capacity and optimal regulation of interconnection infrastructures. Unpublished Ph. D. Thesis, Northwestern University.

Brock W., Scheinkman J. (1985) Price setting supergames with capacity constraints. Review of Economic Studies 52: 371–82

Compte O., Jenny F., Rey P. (2002) Capacity constraints, mergers and collusion. European Economic Review 46: 1–29

Davidson C., Deneckere R. (1990) Excess capacity and collusion. International Economic Review 31: 521–41

DTI. (2007). The potential economic gains from full market opening in network industries. A study by Copenhagen Economics for the UK Department of Trade and Industry. DTI, London. Downloadable at www.copenhageneconomics.com.

Emerson M., Anjean M., Catinet M., Goybet P., Jacquemin A. (1988) The Economics of 1992. Oxford University Press, Oxford

Fabra N. (2006) Collusion with capacity constraints over the business cycle. International Journal of Industrial Organization 24: 69–81

Ivaldi, M., Jullien, B., Rey, P., Seabright P., & Tirole, J. (2003). The economics of tacit collusion. Final Report for DG Competition, European Commission.

Kreps D., Scheinkman J. (1983) Quantity precommitment and bertrand competition yield cournot outcomes. Bell Journal of Economics 14: 326–337

Krugman P., Obstfeld M. (2004) International economics: Theory and policy. Pearson-Addison-Wesley, London

Lambson V. (1987) Optimal penal codes in price-setting supergames with capacity constraints. Review of Economic Studies 54: 385–397

Levitan R., Shubik M. (1972) Price duopoly and capacity constraints. International Economic Review 13: 111–122

Markusen J. (1981) Trade and the gains from trade with imperfect competition. Journal of International Economics 11: 531–551

Penard T. (1997) Choix de Capacités et Comportement Stratégique: une Approche par la Théorie des Jeux Répetés. Annales d’Economie et de Statistique, 46: 203–224

Shih J., Mai C., Liu J. (1988) A general analysis of the output effect under third degree price discrimination. The Economic Journal 98: 149–158

Staiger R., Wolak F. (1992) Collusive pricing with capacity constraints in the presence of demand uncertainty. Rand Journal of Economics 23: 203–220

Varian H. (1989) Price discrimination. In: Schmalensee R., Willig R.D. (eds) The Handbook of Industrial Organization. North-Holland, Amsterdam

Van Wegberg M., Van Witteloostuijn A., Roscam Abbing M. (1994) Multimarket and multiproject collusion: Why European integration may reduce intra-community competition. De Economist 142: 253–285

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Boffa, F., Scarpa, C. An Anticompetitive Effect of Eliminating Transport Barriers in Network Markets. Rev Ind Organ 34, 115–133 (2009). https://doi.org/10.1007/s11151-008-9198-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-008-9198-4