Abstract

According to the World Health Organization, obesity is one of the greatest public-health challenges of the 21st century. Body weight is also known to affect individuals’ self-esteem and interpersonal relationships, including romantic ones. We estimate the “utility-maximizing” Body Mass Index (BMI) and calculate the implied monetary value of changes in both individual and spousal BMI, using the compensating income variation method and data from the Swiss Household Panel. We employ the Oster’s method (Oster, 2019) to estimate the degree of omitted variable bias in the effect of BMI on life satisfaction. Results suggest that the optimal own BMI is 27.1 and 20.1 for men and women, respectively. The annual value of reaching optimal weight ranges from $7069 for women with underweight to $88,709 for women with obesity and between $95,165 for men with underweight to $32,644 for men with obesity. On average, women value reduction in their own BMI about four times higher than reduction in their spouse’s BMI. Men, on the other hand, value a reduction in their spouse’s BMI almost twice as much compared to a reduction in their own BMI. This highlights important gender differences and relative effects based on spousal BMI.

Similar content being viewed by others

1 Introduction

Obesity is one of the greatest public-health challenges of the 21st century according to the World Health Organization. Worldwide obesity has nearly tripled since 1975 (World Health Organization, 2021) and in Europe one in three school-aged children, and almost 60% of the adult population, are now living with overweight or obesity (WHO European Regional Obesity Report, 2022). In addition to increasing a person’s risk of various physical ailments, including cardiovascular disease, cancer, diabetes, and COVID 19 (WHO European Regional Obesity Report, 2022), body weight is also known to affect individuals psychologically based on factors such as social norms that are formed through interactions with society at large and interpersonal relationships (Carr & Friedman, 2005).

Efficient resource allocation is a challenge within any health-care system. An important part of tackling this challenge is knowledge of the value of health itself together with the more easily measured costs and benefits of health interventions, such as medical expenses and changes in productivity. A wide range of polices relating to body weight are justified as a means of fixing market failures such as imperfect information, negative externalities including higher medical cost, irrational behavior, and unanticipated variation in social norms regarding body shape (Philipson, 2001). Policies that affect individuals’ body weight alter individual well-being, which is likely to weigh heavily in many cost-benefit or cost-utility analyses, leaving studies that exclude or miscalculate benefits of health interventions severely biased. Furthermore, allocation of resources requires efficiency comparisons not only within health-care systems but also between health care and other uses of resources.

One way to determine individuals’ value of improvements in non-market goods like body mass index (BMI) is to calculate the willingness to pay (WTP) for such improvements or the willingness to accept (WTA) compensation for losses. That is, to estimate how much money individuals would be willing to give up (or receive) in exchange for such improvements (losses). Studies determining the monetary value that individuals place on intangible goods are scarce because the methods traditionally used have limitations. These limitations have led researchers to focus largely on non-monetary measures such as health-related quality of life (HRQoL). The limitations further restrict efficiency evaluations to cost-effectiveness analyses that focus on prioritization within health-care systems rather than cost-benefit analyses that compare health care and other uses of resources.

A promising method to calculate the monetary value of health and other goods that do not have a revealed market price, and thus facilitate efficiency comparisons between health care and other uses of resources, is the compensating income variation (CIV) method. The method is firmly rooted in economic theory (Hicks, 1939) and has been used to estimate the monetary value of various non-market goods, although economists have only recently started using it for health-related conditions. Applications to health include some studies examining specific conditions, such as migraines (Groot & Maassen van den Brink, 2004) cardiovascular disease (Groot & Maassen van den Brink, 2006), and pain (Ferrer-i-Carbonell & van Praag, 2002; McNamee & Mendolia, 2014; Ólafsdóttir, Ásgeirsdóttir, & Norton, 2020), body weight (Asgeirsdóttir et al., 2020), depression and anxiety (Buason et al., 2021; McNamee, Mendolia & Yerokhin, 2021), and studies examining a set of different health problems and diseases (Asgeirsdottir, Birgisdottir, Ólafsdóttir, & Olafsson, 2017; Asgeirsdottir, Birgisdottir, Henrysdottir & Ólafsdóttir, 2020, Powdthavee & van den Berg, 2011; Howley, 2017). In addition, the method has been used to estimate the dollar value of a quality-adjusted life-year (QALY) (Huang, Frijters, Dalziel & Clarke, 2018) and changes in HRQoL (McNamee & Mendolia; 2019).

Applications of the method to estimate the monetary compensation needed to offset the welfare loss associated with a sub-optimal Body Mass Index (BMI) is limited. Kuroki (2016) calculated the CIV for having overweight and obesity. He concluded that life satisfaction of people who are affected by overweight or obesity is statistically significantly lower than people who have normal weight, even after controlling for socioeconomic factors and obesity-related health variables. He also found the relationship to be greater for women with overweight than men. Asgeirsdottir et al., (2020) also found gender differences using the method, but more importantly highlighted the importance of income measurement when using the method. Although Kuroki (2016) and Asgeirsdottir et al., (2020) mark important first attempts at estimating the CIV for body weight, we substantially improve upon their results in several important ways. First, we calculate the CIV for being below, as well as above the optimal BMI, defined as the BMI that optimizes life satisfaction, which was not done by Kuroki and analyzed in a limited manner by Asgeirsdottir et al., (2020), due to a small overall sample size, and with only under 1% of their sample being with underweight. We furthermore estimate the CIV for the continuous measure of BMI for the first time. Second, and maybe more interestingly, the study sheds light on the interplay between own and spouse’s BMI and the corresponding CIVs, which to our knowledge has not been done before. This spousal analysis underscores the gender differences in own and spousal CIV for BMI changes. We calculate CIVs for the individual’s own and spouse’s optimal BMI directly from the data and assess the concordance in couple’s BMI preferences. Meylera, Stimpson and Peek (2007) performed a systematic review of 103 studies of health-concordance in mental health, physical health, and health behavior among couples. The review suggests evidence for concordant mental and physical health, as well as health behaviors among couples. Studies have furthermore found BMI to be highly correlated between spouses (Jeffery and Rick, 2002, The & Gordon-Larsen, 2009). Clark and Etilé (2011) found that the negative well-being effect of own BMI is lower when the individual’s partner is heavier, which is consistent with social contagion effects in weight. This paper extends the analysis made by Clark and Etilé (2011) by producing CIV estimates and by including a separate underweight category for BMI. Furthermore, this paper calculates values for optimal own BMI conditional on spouse’s BMI and optimal spouse’s BMI conditional on own BMI.

A benefit of the CIV method is that it can be applied to existing data, contrary to most valuation methods. Individual responses to questions about life-satisfaction, as well as BMI and income, are used for the direct estimation of a life-satisfaction equation. The estimation results are then used to calculate the income-BMI trade-off that keeps life satisfaction constant. The CIV thus represents the monetary compensation needed by an individual with a sub-optimal BMI to have the same level of well-being as with optimal BMI, ceteris paribus. Our definition of sub-optimal is any deviation from optimal BMI, where optimal BMI is defined as the BMI that maximizes life satisfaction.

We choose Switzerland for the context of our study due to the availability of exceptional data. The Swiss Household Panel is a rich dataset, which includes 21 waves and is well suited for estimation of CIVs. Calculating CIVs for sub-optimal BMI using data from Switzerland adds to the existing CIV literature, as well as the literature on sub-optimal BMI that has been analyzed in different contexts. However, it should be kept in mind that results could be context specific, especially as Switzerland has a relatively low rate of obesity (OECD, 2017). It is therefore possible that there is a greater penalty in Switzerland for being above optimal BMI than in other countries.

The results suggest that both women and men would be willing to pay an increasing amount to reach the optimal BMI the further away from the optimal BMI they become, both when below and above the optimal BMI. Similarly, there is a positive value for changing the BMI of a spouse whose BMI is sub-optimal, which is conditional on one’s own BMI. This spousal analysis highlights the gender differences in own and spousal CIV for BMI changes and shows how limited the individual analyses can be. Importantly, women’s values are on average about four times as high for reductions in their own BMI compared to reduction in their spouse’s BMI. Values for men, on the other hand, are almost twice as high for a reduction in their spouse’s BMI towards the optimal level compared to a reduction in their own BMI when above their optimal BMI.

The main implications for policy are the systematic gender differences in weight preferences, with females being more sensitive to being over their optimal BMI than under, while men would be willing to forego considerable consumption possibilities to not be with underweight. Our results suggest that health promotion policies aimed at obesity prevention may be more effective if they are tailored to gender and designed with an understanding of gender difference in issues relating to causes and consequences of body weight.

The paper is organized as follows. The next section presents the data and variables, and the third section discusses the methodological approach. The results are presented in Section 4 and discussed in Section 5. The final section includes our conclusions.

2 Data and variables

2.1 Data

The Swiss Household Panel (SHP) data is a nationally representative annual survey conducted since 1999 with information on living conditions in Switzerland. All individuals aged 14 or older who live in the household are eligible to answer the individual questionnaire. We use waves 6 (2004) to 21 (2019) because they include the variables needed to calculate CIV for sub-optimal BMI. The original sample of the sixteen waves consisted of 124,700 observations on 19,031 individuals. Our final sample, after dropping observations with missing values, consisted of 112,710 observations on 18,012 individuals. The size of the sample is lower in the spousal analysis, or 49,784 observations on 8,099 individuals, because it includes only those who have spouses.

2.2 Variables

Well-being is measured with a question about satisfaction with life in general. The question is on an 11-point scale and the respondents are asked the following question: In general, how satisfied are you with your life if 0 means “not at all satisfied” and 10 means “completely satisfied”? As expected, the distribution of life satisfaction over the sample is highly skewed with an average of 8.0 and the interquartile range (IQR) is 2. Despite some criticism, measures of subjective well-being such as questions on life satisfaction have been widely used in social sciences and psychology, as well as in some economic studies. For a reference to discussion on the vast testing of the robustness of these subjective measures, we refer the reader to Clark, Frijters, and Shields (2006). To ease interpretation of the estimated coefficients and comparisons to previous results in the literature, the life satisfaction variable is standardized to having a mean of zero and a standard deviation of one.

BMI is calculated using respondents self-reported height and weight and is the ratio of weight, in kilograms, over height, in meters, squared. For the most part BMI is used in continuous form, although for certain purposes it is categorized into the traditional four categories using criteria from the WHO. Individuals are defined to have underweight if their BMI is under 18.5, normal weight if their BMI is between 18.5 and 25, overweight if their BMI is over 25 and up to 30, and obesity if their BMI exceeds 30 (World Health Organization, 2021). As the survey is a household survey, the spouses BMI is also available based on self-reported weight and height.

Income is yearly household income equivalized according to a modified OECD scale (Voorpostel et al., 2020). We use the log of income in our estimations to account for diminishing marginal utility of income (Layard, Nickell, & Mayraz, 2008). To prevent inflation from affecting the results, the income variable was CPI-adjusted to the 2019 price level (Federal Statistical Office of Switzerland, 2021), and we convert the results to US dollars to facilitate comparison with other studies, using the average exchange rate from 2019 of one CHF equaling 0.9937 US dollar (Board of Governors of the Federal Reserve System U.S., 2021).

Other control variables are years of education based on the International Standard Classification of Education (ISCED classification scheme), age, marital status, labor-force status, wave dummy, degree of urbanization, and number of children. We include age in 5-year brackets, as previous research suggests that it is important to include age in the model in a flexible form (Blanchflower & Oswald, 2008). Table 1 shows means, and standard deviations of continuous variables and percentage distributions of dummy variables used in the study.

3 Methods

We follow Groot and van den Brink (2004), Asgeirsdottir et al., (2017 & 2020), and Olafsdottir et al., (2020) and define an indirect well-being function W which is determined by household income Y, BMI status B, and other individual characteristics X as

Comparison of well-being with a sub-optimal BMI status B to that of optimal BMI status B* can be expressed as follows:

The CIV is the additional amount of income that leaves the individual with the same level of well-being with the sub-optimal BMI status as without it so that:

Three different empirical estimations of Eq. (1) are considered. The first model represents B as dummy variables indicating a person’s BMI category, i.e., whether a person has underweight, normal weight, overweight or obesity. The model is empirically estimated using the following equation:

where Wit is life satisfaction of individual i at time t, and the α′s and β′s are coefficients measuring the relationship between the independent variables and life satisfaction. ε is the error term, and Xk,it represents other individual characteristics. The benchmark BMI category in this model is normal weight. We can then use point estimates from Eq. (4) to calculate the CIV from Eq. (3) as follows:

where \(\bar Y\) is mean income and β2,j represents the coefficient of sub-optimal BMI category j.

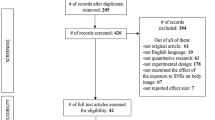

Using BMI categories has two notable disadvantages. First, the categorization of this continuous variable inevitably discards some within-category information. Second, this categorization is based on the medical literature and does not have to be in accordance with people’s preferred weight. In the second model, the B in Eq. (1) is modeled as the continuous form of BMI and includes a square term of BMI as well. The motivation for including the square term in BMI comes from the hump-shape shown in Figure A1, where life satisfaction increases up to a peak level and then decreases again with increasing BMI after accounting for outliers. The following model is empirically estimated:

where Wit, the α′s, β′s, and the Xk,it are the same as in Eq. (4). In this model, BMI is related to life satisfaction in a parabolic way, and the vertex of the parabola represents a well-being optimizing BMI, provided that β2 > 0 and β3 < 0. The optimal BMI is then found using the standard formula for the vertex of a parabola:

Employing the point estimates from Eq. (6), one can calculate the CIV for moving to the optimal BMI from Eq. (3) as follows:

where \(\bar Y\) is average income and B* is found from Eq. (7). Note that the CIV is now a function of B so that for each value of B we get a specific CIV value.

In the third approach, we follow Clark & Etilé (2011) and define a model in terms of both individual’s and spouse’s BMI together with the square of both BMI levels and their interaction. The questions are then what BMI level for the spouse would maximize the individual’s life satisfaction, given the BMI of the individual, and what the optimal BMI for the individual would be, given the BMI of the spouse. Representing the BMI of the individual as Bi and the BMI of the spouse as Bs, the third model is empirically estimated using the following equation:

where Wit, the α′s, β′s, and the Xk,it have the same meaning as in Eq. (4). Both individual BMI and spouse’s BMI have a squared term in the model, and the model also includes their interaction. Fixing all variables except Bi in Eq. (9), there is an optimal BMI for the individual that maximizes life satisfaction. As for Eq. (7), the optimal BMI is found using the standard formula for the vertex of a parabola:

provided that β2 + β6Bs > 0 and β3 < 0. The optimal BMI for the individual depends on the BMI of the spouse. If β6 > 0 the optimal BMI for the individual increases with increasing BMI of the spouse. Employing the point estimates from Eq. (9), one can calculate the CIV for the individuals own BMI changing to its optimal, given the BMI of the spouse as follows:

where \(\bar Y\) is average income and \(B_i^ \ast\) is found from Eq. (10). Note that the CIV is now a function of both Bi and Bs so that for each pair of values Bi and Bs we get a CIV value. Similarly, holding all variables except Bs in Eq. (9) constant, there is an optimal BMI for the spouse in the sense that the life satisfaction of the individual is maximized. The optimal BMI for the spouse is then

provided that β4 + β6Bi > 0 and β5 < 0. Note that the optimal BMI for the spouse depends on the BMI of the individual, allowing for exploration of potential social interaction in BMI between spouses (Clark & Etilé, 2011). If β6 > 0 the optimal BMI for the spouse increases with increasing BMI of the individual. Employing the point estimates from Eq. (9), one can calculate the CIV for changing the spouse’s BMI to its optimal from Eq. (3) as follows:

Several endogeneity biases in the body-weight coefficients can be hypothesized. However, neither the direction of the body-weight bias nor its magnitude is as established in the literature as the well-known income-endogeneity bias. In an earlier version (Clark & Etilé, 2010) of their paper, Clark and Etilé (2011) applied past changes in BMI as an instrument on the BMI variable. Their results were inconclusive, and they observed that finding a good instrument for BMI is very challenging (Clark & Etilé, 2011). Katsaiti (2012) tried to account for the endogeneity of BMI by using height as an instrument. That instrument is, however, unlikely to fulfill the exclusion restriction since height has been shown to have a significant effect on well-being (Deaton & Arora, 2009). Kuroki (2016) and Asgeirsdottir et al., (2020), the only two papers in the literature to calculate the CIV of BMI, were also unable to account for endogeneity due to similar data limitations. Asgeirsdottir et al., (2020) however, point out that although the endogeneity of body weight in subjective well-being regressions could hypothetically cause biases either way, some clues can be found in studies using polygenic risk scores as instruments for BMI when regressed on depression (Huang et al., 2014; Jokela et al., 2012; Lawlor et al., 2011; Tyrell et al., 2019; Walter et al., 2015; Willage, 2018). In all six studies the non-instrumented results showed a positive relationship between BMI and depression, while the BMI coefficient either increased with instrumentation or decreased. This suggests therefore that it is difficult to assess the direction of any endogeneity bias in the BMI coefficient, if such a bias exists. However, the mixed results on the direction of the bias in depression equations indicate that an extreme bias is unlikely to affect our results.

We employ the Oster’s method (Oster, 2019) to estimate the degree of omitted variable bias in the effect of BMI on life satisfaction under the assumption that the selection on the observed controls is proportional to the selection on the unobserved controls. The Oster method assumes that if a coefficient is stable after the inclusion of the observed controls, considering R2 or the proportion of the variance explained by the inclusion of the controls, then the omitted variable bias must be limited. Oster applies further assumptions on the relationship between observable and unobservable variables and derives bounds on the unbiased OLS coefficients. We apply the method on model 1 and compare an uncontrolled regression, only including the key variable of interest, with the controlled regression where the key variable of interest is included together with all other relevant observable control variates. The method requires parameters that are set following Oster’s suggestions (e.g., Rmax = 1.3\(\tilde R\) where \(\tilde R\) is the R2 of the controlled regression). Table 2 reports the bounds of the BMI effects on life satisfaction estimated using the Stata package psacalc (Oster, 2013).

The first column contains the baseline uncontrolled effect, the second column contains the controlled effect, taking into consideration the observable controls, and the third column shows the estimated unbiased treatment effect. If the range between the controlled effect and estimated unbiased treatment effect does not include zero, i.e., the sign of the two estimates is the same, omitted variable bias is considered to be of little concern. The findings in Table 2 suggest that the bias adjusted BMI effects on life satisfaction have the same sign as the estimated controlled effects, and that these effects are close in magnitude. Thus, the omitted variable bias is of limited concern in the effect of BMI on life satisfaction expect perhaps for men with overweight, but the controlled estimate is insignificant in this case.

We also explored the impact of lagging both income and BMI in model 1. Results from those estimations are reported in Table 7 in the Appendix and indicate that the results are robust to this change, with similar implications and comparable CIV’s as in the original model without lagging. We did not lag the spousal model since lagging significantly reduces the sample size as each individual and their spouse needs to participate in the survey in consecutive years.

Evidence suggests that endogeneity likely causes the effect of income on life satisfaction to be significantly understated without instrumentation and the derived CIVs might consequently be biased upwards (Groot & Massen van den Brink 2004, 2006; Powdthavee, 2010, Powdthavee & van den Berg, 2011). For completeness, we followed Howley (2017) and Ólafsdóttir et al., (2020) and estimated two-stage least squares (IV-2SLS) models, with mother’s education as an instrument to account for the potential endogeneity in income. The availability in the dataset of suitable instruments for income is limited and the chosen instrument may not act on life satisfaction only through income. Comparing the income coefficients from the IV-2SLS and OLS models (see IV-2SLS results in the Appendix Tables 8–10), shows an increase by approximately two to threefold with instrumentation, which is in line with previous results (Howley, 2017; Ólafsdóttir et al., 2020; Powdthavee, 2010). Table 11 contains the comparison of IV-2SLS, OLS and adjustments according to Lindqvist et al., (2020) who used lottery winnings in Sweden to estimate the treatment effect of one unit of log household income on standardized life-satisfaction, which is only about 30% higher than our OLS coefficient.

Due to the nature of the data, we explored panel regressions. However, the main variation in BMI is between individuals (see Table 12). Approximately 75% of participants were always in the same BMI category throughout the survey and 25% even had the exact same BMI every year they participated. Although panel regression methods did not produce robust results they are reported in the Appendix for completeness (see Table 13).

4 Results

Table 3 shows point estimates for the key variables of interest, BMI categories, and household income, along with the corresponding CIVs. Point estimates are statistically significant except for the overweight coefficient for men. The results for women suggest that higher income is associated with greater life satisfaction and that sub-optimal BMI categories affect life satisfaction in a negative way. The CIVs for women with underweight is higher than for women with overweight but the highest CIV is for women with obesity.

Gender differences in CIVs are substantial. For men, being with underweight produces the highest CIV, but the CIV for men affected by obesity is much lower, and the point estimate for the overweight category is statistically insignificant, suggesting that there is no gain or loss relative to the normal weight category.

Table 4 includes point estimates for the continuous form of BMI, BMI squared, and household income, along with the corresponding CIVs. All point estimates are highly significant both for men and women.

Optimal BMI for women is 20.1 and 27.1 for men. This means that the optimal level for women is within the normal weight category but for men it is optimal to be with a slight overweight. Table 4 and Fig. 1 show CIVs for selected BMI levels for men and women, showing that both women and men have higher CIVs the further away from the optimal BMI they are, both when below and above the optimal BMI.

As seen in Table 4, men have a higher CIV than women when they are with underweight, but women have higher CIVs than men when they are with overweight or obesity. It can also be seen from Table 4 that men whose BMI is 15 have a CIV value of $95,615 per year to achieve the well-being associated optimal BMI or 120% of their average yearly income, but on the other hand women’s CIV in the same situation is only $7069 or 10% of their average annual income. Table 4 shows that women with a BMI of 35 have a higher CIV than women with BMI 15 to reach optimal BMI, with values of $88,709 (around 125% of their average annual salary) and $7069, respectively. Men with BMI of 35 would have a CIV value of $32,644 to reach the optimal BMI of 27.1 (around 41% of average yearly salary). Appendix Table 14 contains the CIV for 1-10 BMI units away from the optimal BMI and CIV per unit BMI.

Table 5 includes point estimates for individual’s own BMI and spouse’s BMI, as well as the squared BMI levels and their interactions, for both men and women.

Table 5 and Fig. 2 furthermore include individual’s own optimal BMI and CIV given the spouse’s BMI, and then spouse’s optimal BMI and CIV given the individual’s own BMI (Table 15 in the Appendix shows standard errors in CIVs).

For example, Table 5, section A for women shows that when the spouse’s BMI is fixed at 22 or 28 the corresponding optimal own BMI levels are 20.7 and 22.8. If a woman’s BMI is for example 15 and her spouse has a BMI of 28, then she has a CIV of $34,199 to reach the optimal BMI of 22.8. However, she has a CIV of $116,197 to reach the optimal BMI of 22.8 if her actual BMI is 35 and her spouse has a BMI of 28. The results for section A can also be seen in the upper half Fig. 2.

Table 5, section B for men shows that when their own BMI is fixed at 28 or 35, the corresponding spouse’s optimal BMI levels are 28.5 and 38.1. If a man’s own BMI is for example at 28 and his spouse has a BMI of 15, the man has a CIV of $79,612 for his spouse to achieve the optimal BMI of 28.5. However, the same man has a CIV of $14,052 for his spouse to achieve the optimal BMI of 28.5 if his spouse has an actual BMI of 35. The results for section B can also be seen in the lower half of Fig. 2.

Comparing sections, A and B for women in Table 5 shows that women are generally affected more severely by their own BMI being above their optimal level than by their spouses BMI being above the optimal as indicated by the shaded area in Table 5. The CIV values for men, on the other hand, show them to be affected by their spouse’s BMI being above the optimal point for a spouse. In other words, they are more concerned (from the perspective of negative impact on their own life satisfaction) about reducing their spouse’s BMI towards the optimal than reducing their own BMI to the optimal level. The opposite is true when men are below their optimal BMI as underlined by the symmetry in the shaded areas in Table 5.

Table 16 contains the findings of categorical spouse analysis for robustness and Table 17 contains the CIV for 1-10 BMI units away from own optimal BMI and spouse optimal BMI and CIV per unit BMI.

5 Discussion

We find that the life satisfaction of people who are with underweight or obesity is lower than for people with normal weight. Women have a higher value for not being in the obese category than men, while men have a stronger preference than women to avoid being with underweight. This is in line with the findings of a Swiss Health Survey (Forrester-Knauss & Zemp Stutz, 2012) which reported that men with underweight were two times more likely to be dissatisfied with their weight compared to women with underweight. They also found that while more men than women were with overweight or obesity, more women reported weight dissatisfaction. When accounting for spouse’s BMI, men are more sensitive to their spouse’s BMI being above its optimal than to their own BMI. Women on the other hand have a higher WTP for reduction in their own BMI than their spouse’s BMI. This could be a manifestation of pressure on women, both from themselves and their husbands, to be in the normal weight category. Swiss women have the lowest average BMI (23.7) in Europe, while men’s average BMI (26.7) lies close to the average BMI for European men (WHO, 2021), suggesting that the norm in Switzerland is for women being within the normal weight category while it is more acceptable for men to be above. BMI has been shown to be related to the number of work hours through marriage and labor market mechanisms (Cawley, 2015, Grossbard & Mukhopadhyay, 2017). Some studies have shown that hours of work are positively associated with body weight for women, i.e., that high-BMI women work more hours (Cawley, 2015, Caliendo, & Gehrsitz, 2016, Grossbard & Mukhopadhyay, 2017). In the light of traditional gender values, married women have shown to be more likely than married men to receive in-marriage income transfers as women are rewarded for thinness while higher body weight reduces their bargaining power in marriage, leading to lower access to their spouse’s income (Oreffice & Quintana-Domeque, 2012). However, BMI has been shown to be unrelated to work hours for married men (Caliendo, & Gehrsitz, 2016, Grossbard & Mukhopadhyay, 2017). These findings are consistent with traditional gender roles, and although we find evidence of positive sorting in spouses’ BMI, both men and women place greater value on women not being above their optimal BMI and men not under their optimal BMI. In terms of gender equality, Switzerland still lags behind many European countries (Boeglin, 2021). While the gap between women and men in labor force participation has narrowed in recent years, traditional values are still somewhat ingrained in the Swiss culture (Boeglin, 2021, Lalive, & Lehmann, 2020). Our results, coupled with the traditional gender values in Switzerland, are thus in tune with the results described above on the impact of gender differences in BMI on the marriage and labor markets. Furthermore, our results underline the traditional gender roles in household decisions where the man has the status of the strong breadwinner and the status on the woman focuses more on physical appearance as both spouses are willing to use significant resources to avoid BMI above the optimal for women and below optimal for men.

Kuroki (2016) calculated the CIV for being with overweight and obesity using separate OLS models. According to our results, including individuals with underweight is crucial to get the full picture of BMI preferences, especially in the case of males. Using the point estimates in Kuroki (2016), the CIV for women with overweight was $39,434 and $54,401 for women with obesity compared to our finding of $17,748 (overweight) and $72,399 (obese) (see Table 3). Similarly, Kuroki (2016) estimates the CIV for men with overweight to be $13,730 and men with obesity to be $37,128 while our findings suggest that men do not require a CIV for being with overweight, and our CIV for men with obesity is $14,216. The findings of Asgeirsdottir et al., (2020) are in accordance with our results, showing males not to be affected (from a life satisfaction perspective) from being with overweight, whilst they are affected if they are living with obesity. In addition to including the underweight category in the analyses, this study extends the work of Kuroki (2016) and Asgeirsdóttir et al., (2020) exploring both the individual’s own and spouse’s optimal BMI taking into consideration their interactions.

Clark and Etilé (2011) explored the association of sub-optimal BMI levels and life satisfaction controlling for spouse’s BMI but did not produce CIV estimates. In their semi-parametric approach, they find that the optimal BMI for women is in the range of 22–23, and 24–25 for men (both unconditional on spouse’s BMI). Our unconditional optimal BMI for women is 20.1 and 27.1 for men as seen in Table 4.

Clark and Etilé (2011) also explored the impact of own and spousal BMI levels on life satisfaction. They estimated categorical models considering all combinations of BMI categories between husbands and wives where the reference category was neither the husband or wife being with overweight or obesity. While our model is continuous, we can align the results from Clark and Etile in a comparable way by looking at the effect on life satisfaction in various complimentary situations where one person has a different BMI category than his or her spouse (see Table 18). The table shows that in 2 out of 3 situations, the impact on men’s life satisfaction is higher when their wives have a higher BMI compared to the situation when they have a higher BMI themselves. In other words, women are more concerned about reducing their own BMI than their husbands. This trend is the same as we observed in our results. Our findings also show that optimal BMI increases with spouse’s BMI.

Clark and Etilé (2010) remarked that BMI instrumentation is remarkably difficult to carry out in this context. This paper does not include an instrumental variable for BMI and conclusions on causality can thus not be made although our estimated omitted variable bias of BMI on life satisfaction is not a concern. Instrumentation might impact the results in a similar manner as in Clark and Etilé (2011), and this could be explored further in future studies. Although depression and life satisfaction are clearly measuring different aspects of an individual’s well-being, it is reassuring that instrumentation of BMI in depression regressions does not consistently create biases in one direction rather than the other (Huang et al., 2014; Jokela et al., 2012; Lawlor et al., 2011; Sabia & Rees, 2015; Tyrell et al., 2019; Walter et al., 2015; Willage, 2018). However, the literature on the causal effect of body weight on well-being measures is not large and a future improvement of our study with an inclusion of an instrument for body weight would be of value given availability of data.

When comparing results from different studies on valuation of relief from sub-optimal health conditions, a few things should be kept in mind. The specific type of model used has a significant impact on the CIV estimates. Other factors include size of the data sets and the number of waves collected, as well as the inclusion or exclusion of specific control variables.

Our research has some limitations. The results are based on self-reported key variables such as life satisfaction, income, height, and weight which may be biased. The SHP dataset does not include any objective measurements for height and weight so for the BMI calculations we rely on self-reported height and weight. The use of BMI, based on self-reported weight and height, may result in biases (Rothman, 2008, Cawley, 2015). Individuals tend to underreport their weight and heavier individuals underreport to a greater extent. In addition to this bias, BMI may not reflect changes in body fat and muscle mass (Rothman, 2008, Cawley, 2015). This bias may underestimate the number of individuals affected by overweight or obesity in our study. Physical activity could be used as a proxy indicator for muscle mass (An et al., 2020), and Table 19 reports the results when the physical activity variable is added to Model 1, and the conclusions remain largely the same. We assume that individuals of the same gender generally have the same optimal BMI, apart from the dependence on spousal BMI which is a special focus of this paper. However, other characteristics such as education and work status might be related to optimal BMI as well. For simplicity, we assume that the utility function does not, e.g., involve interaction between income and BMI although Finkelstein, Luttmer and Notowidigdo (2013) found evidence that the marginal utility of income declines as health deteriorates, which would cause heterogeneity in CIV across health-income combinations. Similarly, Sato (2021) report an increase in BMI for both men and women after marriage, which would make future studies including heterogeneous results by marriage duration interesting. Just as we examine own-spousal combinations, other such state dependencies would be worth further exploration in future research. Future studies could also explore other intra-household relationships in this context, such as between parents and children. However, a strength of this study is the rich dataset, which made for opportunities to estimate different models, as well as to explore both the individual’s own and spouse’s optimal BMI accounting for their interactions.

6 Conclusion

In conclusion, we add to the expanding literature applying the CIV method and shed light on aspects of the method, opportunities, and challenges. The main contributions are fourfold. First, we estimate CIV´s for all BMI categories, not only the overweight and obese categories as in Kuroki (2016) or Asgeirsdottir et al., (2020) who only do so in underpowered estimations. This has proved important to shed light on gender differences and is especially important for males. Second, the study estimates the CIV for the continuous form of own BMI, allowing for optimal BMI to differ from the health-maximizing BMI on which WHO results are based. Third, the study calculates the CIV for BMI conditional on spouse’s BMI, which to our knowledge has not been done before, and highlights important gender differences and relative effects based on spousal BMI. Fourth, the study makes several methodological improvements to the previously published results.

The main implications for policy are the systematic gender differences in weight preferences. Health promotion policies aimed at obesity prevention may be more effective if they are tailored to gender and designed with an understanding of gender difference in issues relating to causes and consequences of body weight (Östlin et al., 2006, Kanter & Caballero, 2012). Policies that take the difference in gender roles into account are more likely to be successful compared to policies that do not (Östlin et al., 2006, Kanter & Caballero, 2012). Our results suggest material gender differences where females are more sensitive to being over their optimal BMI than under, while men would be willing to forego considerable consumption possibilities to avoid being with underweight. Traditional gender roles are still prevalent in Switzerland where men are often assigned the gender role of a ‘breadwinner’ that can lead to increased pressure and stress. Some men may try to cope with stresses through unhealthy behaviors that may cause weight gain. Swiss women, in general, pay more attention to their diet but are also more dissatisfied with their weight than men (Turuban, 2021). This can be explained in part by social norms and traditional gender roles that pressures women to be thin. On the one hand, it could protect them from being overweight or obese, but on the other it could have negative impact on wellbeing and, in severe situations, can increase the probability of eating disorders which are a much more prevalent in women (Turuban, 2021). With these gender differences in mind, policies that promote gender equality can add health benefits if implemented thoughtfully.

References

An, H. Y., Chen, W., Wang, C. W., Yang, H. F., Huang, W. T., & Fan, S. Y. (2020). The relationships between physical activity and life satisfaction and happiness among young, middle-aged, and older adults. International Journal of Environmental Research and Public Health, 17(13), 4817 https://doi.org/10.3390/ijerph17134817.

Asgeirsdottir, T. L., Birgisdottir, K. H., Ólafsdóttir, T., & Olafsson, S. P. (2017). A compensating income variation approach to valuing 34 health conditions in Iceland. Economics & Human Biology, 27, 167–183. https://doi.org/10.1016/j.ehb.2017.06.001.

Asgeirsdottir, T. L., Birgisdottir, K. H., Henrysdottir, H. B., & Ólafsdóttir, T. H. (2020). Health-related quality of life and compensating income variation for 18 health conditions in Iceland. Applied Economics, 52(15), 1656–1670. https://doi.org/10.1080/00036846.2019.1677849.

Asgeirsdóttir, T. L., Buason,A., Jonbjarnardottir, B.,& Ólafsdóttir, T. (2020). The value of normal body weight: evidence from Iceland. Applied Economics. https://doi.org/10.1080/00036846.2020.1859450.

Blanchflower, D. G., & Oswald, A. J. (2008). Is well-being U-shaped over the life cycle. Social Science & Medicine, 66, 1733–1749. https://doi.org/10.1016/j.socscimed.2008.01.030.

Board of Governors of the Federal Reserve System (U.S.). (2021, March). Foreign Exchange Rates- G.5A Annual. https://www.federalreserve.gov/releases/g5a/current/ (accessed March, 2021).

Boeglin, T., (2021, March). A misrepresentation: Switzerland as an economically advanced country but lacking in terms of Gender Equality. EUROPEAN STUDENT THINK TANK. (accessed November 18. 2022) https://esthinktank.com/2021/03/08/a-misrepresentation-switzerland-as-an-economically-advanced-country-but-lacking-in-terms-of-gender-equality/.

Buason, A., Norton, E., C., McNamee, P., Thordardottir, E., B., & Asgeirsdottir, T. L. (2021). The Causal Effect of Depression and Anxiety on Life Satisfaction: An Instrumental Variable Approach. (NBER Working Paper No. 28575). National Bureau of Economic Research. https://doi.org/10.3386/w28575.

Caliendo, M., & Gehrsitz, M. (2016). Obesity and the labor market: A fresh look at the weight penalty. Economics & Human Biology, 23, 209–225. https://doi.org/10.1016/j.ehb.2016.09.004.

Carr, D., & Friedman, M. (2005). Is obesity stigmatizing? Body weight, perceived discrimination and psychological wellbeing in the United States. Journal of Health and Social Behavior, 46, 244–259. https://doi.org/10.1177/002214650504600303.

Cawley, J. (2015). An economy of scales: A selective review of obesity’s economic causes, consequences, and solutions. Journal of Health Economics, 43(2015), 244–268. https://doi.org/10.1016/j.jhealeco.2015.03.001.

Clark, A. E., & Etilé, F. (2011). Happy house: Spouse weight and individual well-being. Journal of Health Economics, 30(5), 1124–1136. https://doi.org/10.1016/j.jhealeco.2011.07.010.

Clark, A. E., Etilé, F. (2010). Happy house: spousal weight and individual well-being. PSE Discussion Paper 2010-07.

Clark, A., Frijters, P., & Shields, M. A. (2006). Income and happiness: evidence, explanations and economic implications. Paris-Jourdan Sciences Economiques. Working Paper no. 2006–2024.

Deaton, A., & Arora, R. (2009). Life at the top: The benefits of height. Economics & Human Biology, 7, 133–136. https://doi.org/10.1016/j.ehb.2009.06.001.

Federal Statistical Office of Switzerland. (2021, March). Swiss Consumer Price Index. https://www.bfs.admin.ch/bfs/en/home/statistics/prices/consumer-price-index.assetdetail.16224179.html (Accessed March, 2021).

Ferrer-i-Carbonell, A., & van Praag, B. M. S. (2002). The subjective costs of health losses due to chronic diseases. An alternative model for monetary appraisal. Health Economics, 11, 709–722. https://doi.org/10.1002/hec.696.

Finkelstein, A., Luttmer, E. F., & Notowidigdo, M. J. (2013). What good is wealth without health? The effect of health on the marginal utility of consumption. Journal of the European Economic Association, 11(1), 221–258. https://doi.org/10.1111/j.1542-4774.2012.01101.x.

Forrester-Knauss, C., & Zemp Stutz, E. (2012). Gender differences in disordered eating and weight dissatisfaction in Swiss adults: which factors matter. BMC Public Health, 12, 809 https://doi.org/10.1186/1471-2458-12-809.

Groot, W., & Maassen van den Brink, H. (2004). A direct method for estimating the compensating income variation for severe headache and migraine. Social Science & Medicine, 58, 305–314. https://doi.org/10.1016/S0277-9536(03)00208-9.

Groot, W., & Maassen van den Brink, H. (2006). The compensating income variation of cardiovascular disease. Health Economics, 15, 1143–1148. https://doi.org/10.1002/hec.1116.

Grossbard, S., & Mukhopadhyay, S. (2017). Marriage markets as explanation for why heavier people work more hours. IZA Journal of Labor Economics, 6, 9 https://doi.org/10.1186/s40172-017-0059-y.

Hicks, J. R. (1939). Value and Capital: An Inquiry Into Some Fundamental Principles of Economic Theory. Oxford: Clarendon Press.

Howley, P. (2017). Less money or better health? Evaluating individual’s willingness to make trade-offs using life satisfaction data. Journal of Economic Behavior & Organization, 135, 53–65. https://doi.org/10.1016/j.jebo.2017.01.010.

Huang, C. F., Rivera, M., Craddock, N., Owen, M. J., Gill, M., Korszun, A., & McGuffin, P. (2014). Relationship between obesity and the risk of clinically significant depression: Mendelian randomisation study. The British Journal of Psychiatry, 205, 24–28. https://doi.org/10.1192/bjp.bp.113.130419.

Huang, L., Frijters, P., Dalziel, K., & Clarke, P. (2018). Life satisfaction, QALYs, and the monetary value of health. Social Science & Medicine, 211, 131–136. https://doi.org/10.1016/j.socscimed.2018.06.009.

Jeffery, R. W., & Rick, A. M. (2002). Cross‐sectional and longitudinal associations between body mass index and marriage‐related factors. Obesity Research, Aug, 10(8), 809–815. https://doi.org/10.1038/oby.2002.109.

Jokela, M., Elovainio, M., Keltikangas-Järvinen, L., Batty, G. D., Hintsanen, M., Seppälä, I., & Kivimäki, M. (2012). Body mass index and depressive symptoms: instrumental-variables regression with genetic risk score. Genes, Brain and Behavior, 11, 942–948. https://doi.org/10.1111/j.1601-183X.2012.00846.x.

Kanter, R., & Caballero, B. (2012). Global gender disparities in obesity: a review. Advances in Nutrition, 3, 491–498. https://doi.org/10.3945/an.112.002063.

Katsaiti, M. S. (2012). Obesity and happiness. Applied Economics, 44, 4101–4114. https://doi.org/10.1080/00036846.2011.587779.

Kuroki, M. (2016). Life satisfaction, overweightness and obesity. International Journal of Wellbeing, 6(2), 93–110. https://doi.org/10.5502/ijw.v6i2.519.

Lalive, R., & Lehmann, T. (2020). The labor market in Switzerland, 2000–2018. IZA World of Labor. 402 https://doi.org/10.15185/izawol.402.v2.

Lawlor, D., Harbord, R., Tybjaerg-Hansen, A., Palmer, T., Zacho, J., Benn, M., & Nordestgaard, B. (2011). Using genetic loci to understand the relationship between adiposity and psychological distress: a Mendelian randomization study in the copenhagen general population study of 53221 adults. Journal of Internal Medicine, 269, 525–537. https://doi.org/10.1111/j.1365-2796.2011.02343.x.

Layard, R., Nickell, S., & Mayraz, G. (2008). The marginal utility of income. Journal of Public Economy, 90, 1846–1857. https://doi.org/10.1016/j.jpubeco.2008.01.007.

Lindqvist, E., Östling, R., & Cesarini, D. (2020). Long-run effects of lottery wealth on psychological well-being. The Review of Economic Studies, 87(6), 2703–2726. https://doi.org/10.1093/restud/rdaa006.

McNamee, P., & Mendolia, S. (2014). The effect of chronic pain on life satisfaction: evidence from Australian data. Social. Science & Medicine, 121, 65–73. https://doi.org/10.1016/j.socscimed.2014.09.019.

McNamee, P., & Mendolia, S. (2019). Changes in health-related quality of life: a compensating income variation approach. Applied Economics, 51(6), 639–650. https://doi.org/10.1080/00036846.2018.1504160.

McNamee, P., Mendolia, S., & Yerokhin, O. (2021). The transmission of partner mental health to individual life satisfaction: Estimates from a longitudinal household survey. Scottish Journal of Political Economy, 68, 494–516. https://doi.org/10.1111/sjpe.12296.

Meylera, D., Stimpson, J. P., & Peek, M. K. (2007). Health concordance within couples: A systematic review. Social Science & Medicine, 64, 2297–2310. https://doi.org/10.1016/j.socscimed.2007.02.007.

OECD (2017). Obesity Update 2017. The Organization for Economic Cooperation and Development. Retrieved from https://www.oecd.org/els/health-systems/Obesity-Update-2017.pdf.

Ólafsdóttir, T., Ásgeirsdóttir, T. L., & Norton, E. C. (2020). Valuing pain using the subjective well-being method. Economics and Human Biology, 37, 100827 https://doi.org/10.1016/j.ehb.2019.100827.

Oreffice, S., & Quintana-Domeque, C. (2012). Fat spouses and hours of work: are body and Pareto weights correlated? IZA. Journal of Labor Economics, 1, 1–21. https://doi.org/10.1186/2193-8997-1-6.

Oster, E. (2019). ‘Unobservable selection and coefficient stability: theory and evidence’. Journal of Business & Economic Statistics, 37, 187–204. https://doi.org/10.1080/07350015.2016.1227711.

Oster, E. (2013). PSACALC: Stata Module to Calculate Treatment Effects and Relative Degree of Selection Under Proportional Selection of Observables and Unobservables. Revised 18 November 2022 ed, Boston Collage Department of Economics, Technical Report S457677.

Östlin, P., Eckermann, E., Mishra, U., Nkowane, S., & M., Wallstam, E. (2006). Gender and health promotion: A multisectoral policy approach. Health Promotion International, 21, 25–35. https://doi.org/10.1093/heapro/dal048.

Philipson, T. (2001). The world-wide growth in obesity: an economic research agenda. Health Economics, 10(1), 1–7. 10.1002/1099-1050(200101)10:1<1::aid-hec586>3.0.co;2-1. PMID: 11180565.

Powdthavee, N. (2010). How much does money really matter? Estimating the causal effect of income on happiness. Empirical Economics, 39, 77–92. https://doi.org/10.1007/s00181-009-0295-5.

Powdthavee, N., & van den Berg, B. (2011). Putting different price tags on the same health condition: Re-evaluating the well-being valuation approach. Journal of Health Economics, 30, 1032–1043. https://doi.org/10.1016/j.jhealeco.2011.06.001.

Rothman, K. J. (2008). BMI-related errors in the measurement of obesity. International Journal of Obesity (2005), 32(Suppl 3), S56–S59. https://doi.org/10.1038/ijo.2008.87.

Sabia, J. J., & Rees, D. I. (2015). Body weight, mental health capital, and academic achievement. Review of the Economics of the Household, 13, 653–684. https://doi.org/10.1007/s11150-014-9272-7.

Sato, K. (2021). Relationship between marital status and body mass index in Japan. Review of the Economics of the Household, 19, 813–841. https://doi.org/10.1007/s11150-020-09503-0.

The, N. S., & Gordon-Larsen, P. (2009). Entry into romantic partnerships associated with obesity. Obesity, 17, 1441–1447. https://doi.org/10.1038/oby.2009.97.

Turuban, P., (2021, February) How gender disparities impact health. Swissinfo.ch. (accessed November 20. 2022). https://www.swissinfo.ch/eng/society/how-gender-disparities-impact-health/46353974.

Tyrell, J., Mulugeta, A., Wood, A. R., Beaumont, R. N., Tuke, M. A., Jones, S. E., & Hyppönen, E. (2019). Using genetics to understand the causal influence of higher BMI on depression. International Journal of Epidemiology, 48, 834–848. https://doi.org/10.1093/ije/dyy223.

Voorpostel, M., Tillmann, R., Lebert, F., Kuhn, U., Lipps, O., Ryser, ……. & Wernli, B. (2020). Swiss Household Panel Userguide (1999-2018), Wave 20, February 2020. Lausanne: FORS. Retrived from https://forscenter.ch/wp-content/uploads/2020/05/shp_user-guide-w20.pdf.

Walter, S., Kubzansky, L. D., Koenen, K. C., Liang, L., Tchetgen, E. J., Cornelis, M. C., & Glymour, M. M. (2015). Revisiting mendelian randomization studies of the effect of body mass index on depression. American Journal of Medical Genetics Part B: Neuropsychiatric Genetics, 168, 108–115. https://doi.org/10.1002/ajmg.b.32286.

WHO European Regional Obesity Report (2022). Copenhagen: WHO Regional Office for Europe; 2022. Licence: CC BY-NC-SA 3.0 IGO.

Willage, B. (2018). The effect of weight on mental health: New evidence using genetic IVs. Journal of Health Economics, 57, 113–130. https://doi.org/10.1016/j.jhealeco.2017.11.003.

World Health Organization (2021). Obesity and overweight. Retrieved from https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight.

Acknowledgements

We gratefully acknowledge financial support from The Icelandic Research Fund (grant no. 184975-052) and the University of Iceland Research Fund. This study has been realized using the data collected by the Swiss Household Panel (SHP), which is based at the Swiss Center of Expertise in the Social Sciences FORS. The SHP project is supported by the Swiss National Science Foundation.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by K.B. and T.L.Á. The first draft of the manuscript was written by K.B., and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Baldursdottir, K., McNamee, P., Norton, E.C. et al. Life satisfaction and body mass index: estimating the monetary value of achieving optimal body weight. Rev Econ Household 21, 1215–1246 (2023). https://doi.org/10.1007/s11150-022-09644-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-022-09644-4