Abstract

This paper discusses three alternative assumptions concerning household preferences (altruism, self-interest, and a desire for dynasty building) and shows that these assumptions have very different implications for bequest motives and bequest division. After reviewing some of the literature on actual bequests, bequest motives, and bequest division, the paper presents data on the strength of bequest motives, stated bequest motives, and bequest division plans from a new international survey conducted in China, India, Japan, and the United States. It finds striking inter-country differences in bequest plans, with the bequest plans of Americans and Indians appearing to be much more consistent with altruistic preferences than those of the Japanese and Chinese and the bequest plans of the Japanese and Chinese appearing to be much more consistent with selfish preferences than those of Americans and Indians. These findings have important implications for the efficacy and desirability of stimulative fiscal policies, public pensions, and inheritance taxes.

Similar content being viewed by others

Notes

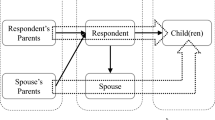

Two additional assumptions concerning household preferences are (1) that the household derives utility not only from its own consumption but also from its wealth [as assumed in the “capitalist spirit” or “wealth-in-the-utility function” model of Carroll (2000)], and (2) that the household derives utility not only from its own consumption but also from the size of its bequest [as assumed in the “joy of giving,” “warm glow,” or “bequest-as-consumption” model of Abel and Warshawsky (1988)]. These assumptions are not discussed in detail here because they do not have clear implications for bequest motives and bequest division (except that assumption (2) implies that households will leave bequests to their children even without any quid pro quo, as in the case of altruistic preferences).

The term “dynasty model” is often used to refer to what we call the “altruism model” but we use the term in a different sense. What we call the dynasty model is also called the “primogeniture model” if it is the eldest son who carries on the family line and/or the family business (Chu 1991).

Another possibility is that selfish parents who want their children to take care of them in old age will set an example by taking care of their own elderly parents in front of their children [the so-called “demonstration effect” of Stark (1995) and Cox and Stark (1996)]. In this case, the quid pro quo for care given to one’s elderly parents will not be bequests received from one’s elderly parents but rather care received from one’s children.

Note, however, that altruistic parents will leave more bequests to less affluent children, meaning that inter-sibling inequalities will be alleviated to a greater extent in the case of altruistic parents. I am indebted to an anonymous referee for this point.

References

Abel, A. B., & Warshawsky, M. (1988). Specification of the joy of giving: Insights from altruism. Review of Economics and Statistics, 70(1), 145–149.

Altonji, J. G., Hayashi, F., & Kotlikoff, L. J. (1997). Parental altruism and inter vivos transfers: Theory and evidence. Journal of Political Economy, 105(6), 1121–1166.

Altonji, J. G., Hayashi, F., & Kotlikoff, L. J. (2000). The effects of income and wealth on time and money transfers between parents and children. In A. Mason & G. Tapinos (Eds.), Sharing the wealth: Demographic change and economic transfers between generations (pp. 306–357). Oxford: Oxford University Press.

Arrondel, L., & Masson, A. (2006). Altruism, exchange or indirect reciprocity: What do the data on family transfers show? In S.-C. Kolm, J. M. Ythier (Eds.), Handbook of the economics of giving, altruism and reciprocity, Vol. 2 (pp. 971–1053). Amsterdam: Elsevier B.V.

Barro, R. (1974). Are government bonds net wealth? Journal of Political Economy, 82(6), 1095–1117.

Barthold, T. A., & Ito, T. (1992). Bequest taxes and accumulation of household wealth: U.S.–Japan comparison. In T. Ito, A. O. Krueger (Eds.), Political economy of tax reform. NBER East Asian Seminar on Economics, Vol. 1 (pp. 235–292). Chicago, IL: University of Chicago Press.

Becker, G. S. (1974). A theory of social interactions. Journal of Political Economy, 82(6), 1063–1093.

Becker, G. S. (1981). A treatise on the family. Cambridge, MA: Harvard University Press).

Becker, G. S. (1991). A treatise on the family: Enlarged edition. Cambridge, MA: Harvard University Press).

Bernheim, B. D., & Severinov, S. (2003). Bequests as signals: An explanation for the equal division puzzle. Journal of Political Economy, 111(4), 733–764.

Bernheim, B. D., Shleifer, A., & Summers, L. H. (1985). The strategic bequest motive. Journal of Political Economy, 93(6), 1045–1076.

Campbell, D. W. (1997). Transfer and life-cycle wealth in Japan, 1974–1984. Japanese Economic Review, 48(4), 410–423.

Carroll, C. D. (2000). Why do the rich save so much? In J. B. Slemrod (Ed.), Does atlas shrug? The economic consequences of taxing the rich. Cambridge, MA: Harvard University Press.

Chu, C. Y. C. (1991). Primogeniture. Journal of Political Economy, 99(1), 78–99.

Cox, D. (1987). Motives for private income transfers. Journal of Political Economy, 95(3), 508–546.

Cox, D., & Rank, M. R. (1992). Inter-vivos transfers and intergenerational exchange. Review of Economics and Statistics, 74(2), 305–314.

Cox, D., & Stark, O. (1996). Intergenerational transfers and the demonstration effect. Boston College Working Papers in Economics no. 329, Department of Economics, Boston College, Chestnut Hill, MA, U.S.A.

Cremer, H., Kessler, D., & Pestieau, P. (1992). Intergenerational transfers within the family. European Economic Review, 36(1), 1–16.

Davies, J. B. (1981). Uncertain lifetime, consumption, and dissaving in retirement. Journal of Political Economy, 89(3), 561–577.

Dekle, R. (1989). The unimportance of intergenerational transfers in Japan. Japan and the World Economy, 1(4), 403–413.

Dunn, T. A., & Phillips, J. W. (1997). The timing and division of parental transfers to children. Economics Letters, 54(2), 135–137.

Esping-Andersen, G. (1990). The three worlds of welfare capitalism. Princeton, NJ: Princeton University Press.

Esping-Andersen, G. (1999). Social foundations of postindustrial economics. Oxford: Oxford University Press).

Gans, D., Silverstein, M., & Lowenstein, A. (2009). Do religious children care more and provide more care for older parents? A study of filial norms and behaviors across five nations. Journal of Comparative Family Studies, 40(2), 187–201.

Hayashi, F. (1986). Why Is Japan’s saving rate so apparently high? In Stanley F. (Ed.), NBER macroeconomics annual 1986, vol. 1 (pp. 147–210). Cambridge, MA: MIT Press.

Horioka, C. Y. (1993). Saving in Japan. In A. Heertje (Ed.), World savings: An international survey (pp. 238–278). Oxford: Blackwell Publishers.

Horioka, C. Y. (2002). Are the Japanese selfish, altruistic, or dynastic? Japanese Economic Review, 53(1), 26–54.

Horioka, C. Y. (2008). Nihon ni okeru Isan to Oyako-kankei: Nihonjin ha Rikoteki ka, Ritateki kia, Ouchouteki ka? In Charles Yuji Horioka and Institute for Research on Household Economics (Eds.), Setai-nai Bunpai/Sedai-kan Iten no Keizai Bunseki (An Economic Analysis of Intra-Household Distribution and Inter-generational Transfers) (pp. 118–135). Tokyo: Minerva Shobou (in Japanese).

Horioka, C. Y. (2009). Do bequests increase or decrease wealth inequalities? Economics Letters, 103(1), 23–25.

Horioka, C. Y., Fujisaki, H., Watanabe, W., & Kouno, T. (2000). Are Americans more altruistic than the Japanese? A U.S.–Japan comparison of saving and bequest motives. International Economic Journal, 14(1), 1–31.

Horioka, C. Y., Gahramanov, E., Hayat M., Abdul A., & Tang, X. (2014). The determinants of parent-child co-residence in Japan: A test of altruism, Mimeo. Melbourne, Australia: School of Accounting, Economics and Finance, Deakin University.

Horioka, C. Y., Yamashita, K., Nishikawa, M., Iwamoto, S. (2002). Nihonjin no Isan Douki no Juuyoudo, Seishitsu, Eikyou ni tsuite (On the Importance, Nature, and Impact of the Bequest Motives of the Japanese). Yuusei Kenkyuusho Geppou (The Monthly Review of the Institute of Posts and Telecommunications Policy), 163, 4–31 (in Japanese).

Ioannides, Y. M., & Kan, K. (2000). The Nature of two-directional intergenerational transfers of money and time: An empirical analysis. In J. M. Ythier, S.-C. Kolm, L.-A. Gerard-Varet (Eds.), The economics of reciprocity, giving and altruism (pp. 314–331). Houndmills: Palgrave Macmillan.

Komamura, K. (1994). Koureisha Kakei ni okeru Isan Koudou no Keizai Bunseki (Economic Analysis of the Bequest Behavior of Aged Households). Kikan Shakai Hoshou Kenkyuu (Quarterly of Social Security Research), 30(1), 62–74 (in Japanese).

Kotlikoff, L. J. (1988). Intergenerational transfers and savings. Journal of Economic Perspectives, 2(2), 41–58.

Kotlikoff, L. J., & Spivak, A. (1981). The family as an incomplete annuities market. Journal of Political Economy, 89(2), 372–391.

Kotlikoff, L. J., & Summers, L. H. (1981). The role of intergenerational transfers in aggregate capital accumulation. Journal of Political Economy, 89(4), 706–732.

Laferrere, A., & Wolff, F.-C. (2006). Microeconomic models of family transfers. In S.-C. Kolm & J. M. Ythier (Eds.), Handbook of the economics of giving, altruism and reciprocity (Vol. 2, pp. 889–969). Amsterdam: Elsevier B.V.

Laitner, J. (1997). Intergenerational and interhousehold economic links. In M. R. Rosenzweig & O. Stark (Eds.), Handbook of population and family economics (Vol. 1A, pp. 189–238). Amsterdam: North-Holland.

Lehrer, E. L. (2004). Religiosity as a determinant of educational attainment: The case of conservative protestant women in the United States. Review of Economics of the Household, 2(2), 203–219.

Light, A., & McGarry, K. (2004). Why parents play favorites: Explanations for unequal bequests. American Economic Review, 94(5), 1669–1681.

Lundholm, M., & Ohlsson, H. (2000). Post mortem reputation, compensatory gifts and equal bequests. Economics Letters, 68(2), 165–171.

Masson, A., & Pestieau, P. (1996). Bequest motives and models of inheritance: A survey of the literature. In G. Erreygers & T. Vandevelde (Eds.), Is inheritance legitimate? Ethical and economic aspects of wealth transfers. Berlin: Springer.

McGarry, K. (1999). Inter vivos transfers and intended bequests. Journal of Public Economics, 73(3), 321–351.

Menchik, P. L. (1980). Primogeniture: Equal sharing, and the U.S. Distribution of Wealth. Quarterly Journal of Economics, 94(2), 299–316.

Menchik, P. L. (1988). Unequal estate division: Is it altruism, reverse bequests, or simply noise. In D. Kessler & A. Masson (Eds.), Modelling the accumulation and distribution of wealth (pp. 105–116). Oxford: Clarendon Press.

Menchik, P. L., Irvine, O, & Jianakoplos, N. (1988). Determinants of intended bequests. Discussion Paper Series A, no. 197, University of Bonn, Germany.

Modigliani, F. (1988). The role of intergenerational transfers and life cycle saving in the accumulation of wealth. Journal of Economic Perspectives, 2(2), 15–40.

Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-section data. In K. K. Kurihara (Ed.), Post-keynesian economics (pp. 388–436). New Brunswick, NJ: Rutgers University Press.

Molina, J. A. (2013). Altruism in the household: In-kind transfers in the context of kin selection. Review of Economics of the Household, 11(3), 309–312.

Mukhopadhyay, S. (2011). Religion, religiosity and educational attainment of immigrants to the USA. Review of Economics of the Household, 9(4), 539–553.

Noguchi, Y., Uemura, K., & Kitou, Y. (1989). Souzoku ni yoru Sedai-kan Iten no Kouzou: Shutoken ni okeru Jittai Chousa Kekka (The structure of intergenerational transfers via bequests: Results of a survey in the Tokyo Metropolitan Area). Kikan Shakai Hoshou Kenkyuu (Quarterly of Social Security Research), 25(2), 136–144 (in Japanese).

Ohtake, F. (1991). Bequest motives of aged households in Japan. Ricerche Economiche, 45(2–3), 283–306.

Ohtake, F., & Horioka, C. Y. (1994). Chochiku Douki (Saving Motives). In T. Ishikawa (Ed.), Nihon no Shotoku to Tomi no Bunpai (The Distribution of Income and Wealth in Japan) (pp. 211–244). Tokyo: University of Tokyo Press (in Japanese).

Perozek, M. G. (1998). A reexamination of the strategic bequest motive. Journal of Political Economy, 106(2), 423–445.

Slavik, C., & Wiseman, K. (2013). Tough love for lazy kids: Dynamic insurance and equal bequests,” mimeo. Goethe University Frankfurt, Frankfurt, Germany (December).

Stark, O. (1995). Altruism and beyond: An economic analysis of transfers and exchanges within families and groups. Cambridge: Cambridge University Press).

Stark, O. (1998). Equal bequests and parental altruism: Compatibility or orthogonality. Economics Letters, 60(2), 167–171.

Tomes, N. (1981). The family, inheritance and the intergenerational transmission of inequality. Journal of Political Economy, 89(5), 928–958.

Wilhelm, M. O. (1996). Bequest behavior and the effect of heirs’ earnings: Testing the altruistic model of bequests. American Economic Review, 86(4), 874–892.

World Bank. (2013). World development indicators. Washington, DC: World Bank.

Yamada, K. (2006). Intra-family transfers in Japan: Intergenerational co-residence, distance, and contact. Applied Economics, 38(16), 1839–1861.

Zuckerman, P. (2005). Atheism: Contemporary rates and patterns. In M. Martin (Ed.), The Cambridge companion to atheism. Cambridge: Cambridge University Press.

Acknowledgments

This author is indebted to Krishnendu Dastidar, Emin Gahramanov, Shoshana Grossbard, Jose Albert Molina, Abdul Aziz Hayat Muhammad, Wataru Kureishi, Shizuka Sekita, Xueli Tang, Midori Wakabayashi, Yoko Niimi, Oded Stark, Tien Manh Vu, Ken Yamada, three anonymous referees, and the participants of the International Conference on Econometrics and the World Economy, Fukuoka University, Fukuoka, Japan; the Eighth Biennial Conference of the Asian Consumer and Family Economics Association (ACFEA), Yamaguchi University, Yamaguchi, Japan; the International Workshop on “Social Inequality in Transferring Resources across Generations,” University of Tokyo, Tokyo, Japan; the Fifteenth Annual Conference on “Dynamics, Economic Growth and International Trade (DEGIT),” Goethe University, Frankfurt, Germany: the Annual Meeting of the Japan Society of Family Sociology, Konan University, Kobe, Japan; ESAM12: The Econometric Society Australasian Meeting, Langham Hotel, Melbourne, Australia; and seminars at the Asian Development Bank, Deakin University, the Federal Reserve Bank of San Francisco, Goethe University, Hong Kong University, Hunter College, Keio University, Melbourne University, Monash University, the National Graduate Research Institute of Policy Studies (GRIPS), the National University of Singapore, the University of Auckland, the University of Michigan, the University of the Philippines, Diliman, the University of Queensland, and the University of Tokyo for their valuable comments, to Tien Manh Vu for his superb research assistance, and to the Philippine Center for Economic Development (PCED), Ministry of Education, Culture, Sports, Science, and Technology of the Japanese Government for Grant-in-Aid for Scientific Research Category B (topic number 22330083) and Category S (topic number 20223004), and to the Osaka University Global Center of Excellence (GCOE) Program “Human Behavior and Socioeconomic Dynamics,” all of which supported this research. This research uses micro data from the Preference Parameters Study of Osaka University’s 21st Century COE Program “Behavioral Macrodynamics Based on Surveys and Experiments” and its Global COE project “Human Behavior and Socioeconomic Dynamics.”

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Horioka, C.Y. Are Americans and Indians more altruistic than the Japanese and Chinese? Evidence from a new international survey of bequest plans. Rev Econ Household 12, 411–437 (2014). https://doi.org/10.1007/s11150-014-9252-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-014-9252-y

Keywords

- Bequests

- Inheritances

- Intergenerational transfers

- Bequest motives

- Bequest division

- Household preferences

- Self-interest

- Selfish life cycle model

- Altruism model

- Dynasty model