Abstract

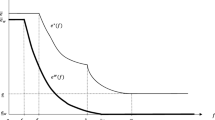

We develop a vertical differentiation model to analyze welfare implications of environmental policies in a competitive market with production and consumption heterogeneity. Consumers with heterogeneous preferences choose between non-green and certified green products, while producers with heterogeneous production costs decide whether to engage in green production. In order for green products to be recognized by consumers, producers must join a green club. Key findings are summarized as follows. (i) The number of green producers, environmental standard, and overall welfare under the market solution are all socially sub-optimal. (ii) The introduction of a subsidy policy for greener production and standards is shown to increase social welfare, but is not Pareto optimal. (iii) A dual policy, which combines abatement subsidizes for a greener production standard and a tax charge for green certification, is shown to be the Pareto-optimal outcome.

Similar content being viewed by others

Notes

In their paper, Hamilton and Zilberman (2006) refer to ProductScan Online, Marketing Intelligence Service Ltd. 1999.

This is in reference to ISO 14001, a green club with over 1500 members in the United States. See Potoski and Prakash (2005).

Since participation in a green club is purely voluntary, club admittance by a firm is essentially subjection to a “voluntary agreement.”

Another stage of policy implementation is added when we evaluate regulatory implications.

We assume a full covered market where each consumer purchases either a green or non-green product, which is considered as a “necessity” to all consumers, but our results are unaffected by the coverage of the market. For studies of a full covered market using a vertical product differentiation setting see, for example, Cremer and Thisse (1994), Crampes and Hollander (1995), Wauthy (1996), Ecchia and Lambertini (1997), Maxwell (1998), and Andaluz (2000).

Here we assume that \(\theta \) and \(\tau \) are not correlated. However, Teisl et al. (2002) suggest that one aim of green labels is to “educate consumers about the environmental impacts of the product’s manufacture, use, and disposal, thereby leading to a change in purchasing behavior...” Thus, it’s possible that higher standards could actually shift user utility of green products. However, we leave this for a future study. The notion of warm glow is borrowed from Andreoni (2006).

As the number of consumers is normalized to one, we have \(0\le 1-({P_e }/{\theta \tau })\le 1,\) which implies that \(\theta \tau \ge P_e \ge 0\).

Since \(v=P\) consumer surplus is unaffected by the quantity of non-green products purchased.

Since \(P=c\) producer surplus is unaffected by the quantity of non-green products sold, and the coverage of the non-green market is no impact on our results.

Note that the marginal green firm, y, has the property: \(y=\tilde{y}\).

We have the additional restriction that \(0\le {P_e }/{(\varepsilon \theta ^{2}+\gamma })\le 1\), which implies that \(0\le P_e \le \varepsilon \theta ^{2}+\gamma \).

See Bonroy and Constantatos (2008) for further discussions about perfect and imperfect labeling.

For analysis on different clubs and variety of objectives with homogenous firms see van’t Veld and Kotchen (2011). Additional club objectives can be examined in our structure, however, our focus is policy and welfare implication, thus we leave that topic for future study.

In order for a club to operate, i.e., \(n>0\), the value of n should satisfy the following condition: \(0\le {\theta \tau }/{(\varepsilon \theta ^{2}+\tau \theta +\gamma )}\le 1\), which implies that \(-(\gamma /\gamma )\le \theta ^{2}\) or \(\theta >0.\)

The number of green products consumed is \(n=\min \{\tilde{x}, \tilde{y}\}\), where \(\tilde{y}\) is the number of green products produced, therefore in equilibrium \(n=\tilde{x}=\tilde{y}.\)

It will be shown that in order for the club to exist and have members the inequality \(\tau >2\sqrt{\varepsilon \gamma }\) must hold. Detailed expressions for the comparative-static derivatives in (12) can be found in “Appendix A-1”.

Detailed expressions for the comparative-static derivatives in (13) can be found in “Appendix A-2”.

In order for the club to be operating we require that \(\theta >0\) and \(n>0\).

For a detailed derivation of the consumer surplus measure, see “Appendix A-3”.

For a detailed derivation of the producer surplus measure, see “Appendix A-4”.

If we optimize social welfare using the equilibrium condition in Eq. (7), the optimal club size would be trivial, specifically, \(\hbox {n} \rightarrow 0\).

Detailed expressions for the comparative-static derivatives in (18) can be found in “Appendix A-5”.

Instead of using both instruments (club standard and club size), the social planner could use just one. However, by using just one instrument, the social planner will be unable to obtain the same level of social welfare. If the social planner only utilizes the standard, a sub-optimal (or fewer) producers will sign up for the green club. At the same time, if the social planner utilizes the number of producers in the club, a sub-optimal standard will be selected.

Second order condition is: \(\frac{\partial ^{2}{} { SW}}{\partial n^{2}}\frac{\partial ^{2}{} { SW}}{\partial \theta ^{2}}-\frac{\partial ^{2}{} { SW}}{\partial n\partial \theta }\frac{\partial ^{2}{} { SW}}{\partial \theta \partial n}=(\varepsilon \theta ^{2}\,+\,\tau \theta \,+\,\gamma )(n^{2}\varepsilon )-[\beta \,+\,\tau (1\,-\,n)-2n\theta \varepsilon ]^{2}\), which is satisfied if: the club’s member cost is sufficient large or the marginal benefits and cost of higher environment standards are similar in magnitude, specifically: \([\beta +\tau (1-n)-2n\theta \varepsilon ]^{2}<(\varepsilon \theta ^{2}+\tau \theta +\gamma )(n^{2}\varepsilon )\). We assume this condition holds.

Showing that \(SW^{{ GC}}<SW^{{ SP}}\) requires proving that \([(2\beta +\tau )^{2}-4\gamma ](\tau ^{2}-4\gamma \varepsilon )>4\tau (\tau \sqrt{\gamma \varepsilon }-2\gamma )(2\beta +\tau ).\) If we let \(\tau =2\sqrt{\gamma \varepsilon }+a,\) this condition simplifies to: \(a^{3}+4a(\beta ^{2}+a\beta +\gamma \varepsilon -\gamma )+4\sqrt{\gamma \varepsilon }[(a+2\beta )^{2}+4\beta \sqrt{\gamma \varepsilon }-4\gamma ]>0\), which is sufficiently positive whenever \(\beta ^{2}+a\beta +\gamma \varepsilon >\gamma \) and \((a+2\beta )^{2}+4\beta \sqrt{\gamma \varepsilon }>4\gamma .\) We assume these conditions hold.

The number of green firms must satisfy this condition: \(0\le y\le 1\). This implies that \(0\le {(P_e +s\theta )}/{(\gamma +\theta ^{2}\varepsilon )}\le 1\) or to state another way: \(0\le P_e \le \theta ^{2}\varepsilon +\gamma -s\theta .\)

Note the condition that \(0\le {[(s+\tau )\theta ]}/{(\varepsilon \theta ^{2}+\tau \theta +\gamma )}\le 1\) which implies that: \(\theta ^{2}\ge {(s\theta -\gamma )}/\varepsilon .\)

The green product premium is positive, \(P_e >0\), if \((s_A \theta -\gamma )/\varepsilon <\theta ^{2}.\)

Note that \(P_e >0\) if \({(s-\gamma )}/\varepsilon <\theta ^{2}.\)

The associated welfare calculations for the club membership case are provided in the appendix.

In order for \(s_M^*>0,4\gamma \varepsilon <(2\beta +\tau )^{2}\) must hold. If we let \(\tau =2\sqrt{\gamma \varepsilon }+\alpha \), where \(\alpha >0\), then we can rewrite the previous inequality as: \(4\gamma \varepsilon <4\beta (2\sqrt{\gamma \varepsilon }+\alpha +\beta )+4\gamma \varepsilon +\alpha (4\sqrt{\gamma \varepsilon }+\alpha )\), which cannot hold, thus implies that \(s_M^*<0.\)

Note that \(0\le {[(s+\tau ) \theta +\omega ]}/{[\varepsilon \theta ^{2}+\tau \theta +\gamma ]}\le 1,\) which implies that: \(\theta ^{2}\ge {(\omega +s\theta -\gamma )}/\varepsilon \).

Note that \(P_e >0\) if \({(s\theta +\omega -\gamma )}/\varepsilon <\theta ^{2}.\)

This extension section is due completely to an anonymous reviewer’s suggestions to analyze alternative objectives that certifier may have. One is when a private certifier is a profit maximizing monopoly and the other is when an industry certifier maximizes green producers’ surplus. We are graceful to the reviewer’s insightful and constructive suggestions which allow us to have a more complete analysis in terms of comparing alternative equilibrium outcomes.

Increasing production costs for green producers could also occur if inputs costs are constant, but transportation costs increase as more producer adjust to green production.

The segmentation of the market in green and non-green producers due to product differentiation may allow member firms in a club to make greater profits when the objective of the club is to maximize profit of its members.

The contribution by Hamilton and Zilberman (2006) addresses issues on fraud in green markets. In our analysis, we find that even in the absence of credibility or fraud, the free-market equilibrium is socially inefficient in terms of the number of green products available to environmentally conscientious consumers.

References

Amacher, G. S., Koskela, E., & Ollikainen, M. (2004). Environmental quality competition and eco-labeling. Journal of Environmental Economics and Management, 47, 284–306.

Andaluz, J. (2000). On protection and vertical product differentiation. Regional Science and Urban Economics, 30, 77–97.

Andreoni, J. (2006). Philanthropy. In S.-C. Kolm & J. M. Ythier (Eds.), Applications, volume 2 of handbook of the economics of giving, altruism and reciprocity (pp. 1201–1269). Amsterdam: Elsevier.

Baksi, S., & Bose, P. (2007). Credence goods, efficient labelling policies, and regulatory enforcement. Environmental and Resource Economics, 37, 411–430.

Baron, D. (2011). Credence attributes, voluntary organizations, and social pressure. Journal of Public Economics, 95, 1331–1338.

Ben Youssef, A., & Lahmandi-Ayed, R. (2008). Eco-labelling, competition and environment: Endogenization of labelling criteria. Environmental and Resource Economics, 41, 133–154.

Bonroy, O., & Constantatos, C. (2008). On the use of labels in credence goods markets. Journal of Regulatory Economics, 33, 237–252.

Bonroy, O., & Constantatos, C. (2015). On the economics of labels: How their introduction affects the functioning of markets and the welfare of all participants. American Journal of Agricultural Economics, 97, 239–259.

Bonroy, O., & Lemarie, S. (2012). Downstream labeling and upstream price competition. European Economic Review, 56, 347–360.

Bottega, L., & De Freitas, J. (2009). Public, private and nonprofit regulations for environmental quality. Journal of Economics & Management Strategy, 18, 105–123.

Buchanan, J. M. (1965). An economic theory of clubs. Economica, 32, 1–14.

Conrad, K. (2005). Price competition and product differentiation when consumers care for the environment. Environmental and Resource Economics, 31, 1–19.

Crampes, C., & Hollander, A. (1995). Duopoly and quality standard. European Economics Review, 39, 71–82.

Cremer, H., & Thisse, J. F. (1994). Commodity taxation in differentiated oligopoly. International Economic Review, 35, 613–633.

David, M., & Sinclair-Desgagne, B. (2005). Environmental regulation and the eco-industry. Journal of Regulatory Economics, 28, 141–155.

Doni, N., & Ricchiuti, G. (2013). Market equilibrium in the presence of green consumers and responsible producers: A comparative static analysis. Resource and Energy Economics, 35, 380–395.

Dosi, C., & Moretto, M. (2001). Is eco-labeling a reliable environmental policy measure? Environmental and Resource Economics, 18, 113–127.

Dossey, L. (2010). Natural Marketing Institute: LOHAS market size. LOHAS Journal, Spring volume, 28–29.

Ecchia, G., & Lambertini, L. (1997). Minimum quality standards and collusion. Journal of Industrial Economics, 45, 101–113.

EPA. (2014). Partnership programs: List of programs. Retrieved from http://www.epa.gov/partners/programs/index.htm.

Fishcer, C., & Lyon, T. P. (2014). Competing environmental labels. Journal of Economics and Management Strategy, 23, 692–716.

Garcia-Gallego, A., & Georgantzis, N. (2009). Market effects of changes in consumers’ social responsibility. Journal of Economics and Management Strategy, 18, 235–262.

Grolleau, G., Ibanez, L., & Mzoughi, N. (2007). Industrialists hand in hand with environmentalists: How eco-labeling schemes can help producers to raise rivals’ costs. European Journal of Law and Economics, 24, 215–236.

Hamilton, S. F., & Zilberman, D. (2006). Green markets eco-certification and equilibrium fraud. Journal of Environmental Economics & Management, 52, 627–644.

Heyes, A. G., & Maxwell, J. W. (2004). Private vs. public regulation: Political economy of the international environment. Journal of Environmental Economics and Management, 48, 978–996.

Ibanez, L., & Grolleau, G. (2008). Can ecolabeling schemes preserve the environment? Environmental and Resource Economics, 40, 233–249.

Kurtyka, O., & Mahenc, P. (2011). The switching effect of environmental taxation within Bertrand differentiated duopoly. Journal of Environmental Economics and Management, 62, 267–277.

Lehtonen, M. (1997). Criteria in environmental labelling: A comparative analysis of environmental criteria in selected labelling schemes. Environment and Trade (UNEP).

Lombardini-Riipinen, C. (2005). Optimal tax policy under environmental quality competition. Environmental and Resource Economics, 32, 317–336.

Mason, C. F. (2006). An economic model of eco-labeling. Environmental Modeling and Assessment, 11, 131–143.

Mason, C. F. (2011). Eco-labeling and market equilibria with noisy certification tests. Environmental and Resource Economics, 48, 537–560.

Maxwell, J. W. (1998). Minimum quality standards as a barrier to innovation. Economics Letters, 58, 355–360.

Michels, S. (2008). Environmental demand drives eco-friendly products. Retrieved from http://www.pbs.org/newshour/topic/science/.

Moraga-Gonzalez, J., & Padron-Fumero, N. (2002). Environmental policy. Environmental and Resource Economics, 22, 419–447.

Potoski, M., & Prakash, A. (2005). Green clubs and voluntary governance: ISO 14001 and producer’s regulatory compliance. American Journal of Political Science, 49, 235–248.

Rahbar, E., & Wahid, N. (2011). Investigation of green marketing tools’ effect on consumers” purchase behavior. Business Strategy Series, 12, 73–83.

Segerson, K., & Miceli, T. (1998). Voluntary environmental agreements: Good or bad news for environmental protection? Journal of Environmental Economics and Management, 36, 109–130.

Teisl, M., Roe, B., & Hicks, R. (2002). Can eco-labels tune a market? Evidence from dolphin-safe labeling. Journal of Environmental Economics and Management, 43, 339–359.

Timmer, C. P. (1971). Using a probabilistic frontier production function to measure technical efficiency. Journal of Political Economy, 79(4), 776–794.

van’t Veld, K., & Kotchen, M. (2011). Green clubs. Journal of Environmental Economics and Management, 62, 309–322.

Wauthy, X. (1996). Quality choice in models of vertical differentiation. Journal of Industrial Economics, 44, 345–353.

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to the editor Menahem Spiegel and anonymous referees for insightful comments and suggestions, which led to significant improvements in the paper. Any remaining errors are, of course, ours alone.

Appendices

Appendix A-1

Given that the equilibrium number of green producers in the market is: \(n^{{ GC}}=\frac{\tau }{(\tau +2\sqrt{\gamma \varepsilon })}\), we take the derivative of \(n^{{ GC}}\) with respect to \(\tau ,\varepsilon \), and \(\gamma \) to obtain the following:

1.1 Appendix A-2

Given that the equilibrium value of the green product premium is: \(P_e^{{ GC}} =\frac{2\tau \gamma }{\tau +2\sqrt{\gamma \varepsilon }}\), we take the derivative of \(P_e^{{ GC}} \) with respect to \(\tau ,\varepsilon \), and \(\gamma \) to obtain the following:

Appendix A-3

1.1 Consumer surplus

According to the preferences of heterogeneous consumers as specified in (1), we have

Note that \(\beta \psi \) is the external benefit to the society from the green product’s environmental friendliness or abatement, where \(\psi =\theta n\) and n is the equilibrium quantity of the green product sold in the market. We then have

which is re-written as

Competitive market for the non-green product implies that the equilibrium price for the good is equal to its price, that is, \(P=v\). In addition, the equilibrium quantity of the green product sold (n) is equal to the number of green consumers (x). It follows that

where \(\beta \theta n\) is public benefit from the green product, \([{\theta \tau x(2-x)]}/2\) is private benefit to green consumers, and \(P_e x\) is the amount of premium to green producers.

Appendix A-4

1.1 Producer surplus

According to the profit functions of green and non-green producers as specified in (3), we have

which is re-written as

Competitive market for the green product implies that the equilibrium price for the good is equal to the cost of production for the marginal producer, that is, \(P=c\). We thus have

where \(P_e y\) is green price premium, and \({(\varepsilon \theta ^{2}+\gamma )y^{2}}/2\) is green cost.

Appendix A-5

Given that the equilibrium level of social welfare is:

we take the derivative of \(SW^{{ GC}}\) with respect to \(\tau ,\varepsilon \) ,and \(\gamma \) to obtain the following:

Rights and permissions

About this article

Cite this article

Walter, J., Chang, YM. Green certification, heterogeneous producers, and green consumers: a welfare analysis of environmental regulations. J Regul Econ 52, 333–361 (2017). https://doi.org/10.1007/s11149-017-9339-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-017-9339-5