Abstract

We analyze the design of policies to promote efficient distributed generation (DG) of electricity. The optimal policy varies with the set of instruments available to the regulator and with the prevailing DG production technology. DG capacity charges often play a valuable role in inducing optimal investment in DG capacity, allowing payments for DG production to induce the optimal production of electricity using non-intermittent DG technologies. Net metering can be optimal in certain settings, but often is not optimal, especially for non-intermittent DG technologies.

Similar content being viewed by others

Notes

See DNV GL (2014), the World Alliance for Decentralized Energy (2014) and Solar Energy Industries Association (2015), for example. The distributed generation of electricity entails the “generation of electricity from sources that are near the point of consumption, as opposed to centralized generation sources such as large utility-owned power plants” (American Council for an Energy-Efficient Economy 2015).

See Weissman and Johnson (2012), for example.

NCCETC (2015d) reviews recent and ongoing DG policy initiatives throughout the U.S.

Such rate restructuring can be viewed as a form of decoupling the utility’s revenue from the amount of electricity it supplies. In addition to promoting efficient investment in DG capacity, decoupling can encourage a utility to promote energy conservation (Brennan 2010a).

The largest utility in Arizona imposes a fee of $0.70/kW on solar DG capacity, and has suggested that this fee be raised to $3.00/kW (NCCETC 2015d). In 2014, the Wisconsin Public Service Commission approved a capacity charge of $3.79/kW on wind and solar DG. See NCCETC (2015d) and filings in the Arizona Corporation Commission’s Docket No. 13-0248 (http://edocket.azcc.gov) and in the Wisconsin Public Service Commission Docket No. 5-UR-107 (http://psc.wi.gov).

Industry experts have provided useful recommendations regarding various elements of DG compensation. Couture and Gagnon (2010), Kind (2013) and Raskin (2013), among others, review and discuss these recommendations. However, these recommendations typically do not reflect the explicit predictions of comprehensive, formal economic models. Darghouth et al. (2011, 2014) and Poullikkas (2013) simulate the effects of selected forms of DG compensation. Yamamoto (2012) models some considerations in the design of DG compensation policies, but abstracts from such elements as the full impact of DG investment on a consumer’s energy costs. Brown and Sappington (2017a) examine whether common net metering policies are ever optimal in a setting where the regulator’s retail pricing instruments are limited, DG capacity payments are not feasible, and only one (fully intermittent) DG production technology is available.

Solar panels account for the majority of DG capacity in most U.S. states, due in part to the rapid decline in the cost of solar panels in recent years (Barbose et al. 2014). However, natural gas-based DG configured in combined heat and power (CHP) mode account for the majority of DG capacity in Connecticut and New York (DNV GL 2014). CHP units can be of particular value as a reliable alternative source of electricity when primary sources fail (U.S. Department of Energy 2013).

Smart meters permit precise measurement of the amount of electricity that is consumed at each moment in time, thereby admitting (real-time) prices that can vary from one instant to the next.

Our qualitative conclusions are unchanged if there are multiple identical D consumers and multiple identical N consumers.

Formally, in hot climates, \(\frac{\partial V_{t}^{j}(x,\theta _{s})}{\partial \theta _{s}}\ge \,0\,\) and \(\frac{\partial ^{2}V_{t}^{j}(x,\theta _{s})}{\partial \theta _{s}\partial x}\ge \,0\,\) for all \(x\ge 0\) and \(\theta _{s}\in [\,\underline{\theta }_{t},\,\overline{\theta }_{t}\,]\), for \(j\in \{D,N\}\). These inequalities need not hold more generally. The findings reported below hold even if these inequalities do not hold.

In settings where the regulator cannot set state-specific prices, \( r_{jt}(\theta _{s})=r_{jt}(\theta _{s^{\prime }})\) for all \(\theta _{s},\theta _{s^{\prime }}\in [\,\underline{\theta }_{t},\overline{ \theta }_{t}\,]\).

This formulation admits different retail prices for different consumers. The ensuing discussion also will consider settings in which such price discrimination is not feasible.

\( X_{t}^{j}(r_{jt}(\theta _{s}),\mathbf {r}_{\mathbf {jt}^{\prime }}(\theta _{\mathbf {t}^{\prime }}),\theta _{s})\) is a strictly decreasing function of \(r_{jt}(\theta _{s})\) and a non-decreasing function of each element of \(\mathbf {r}_{\mathbf {jt}^{\prime }}(\theta _{\mathbf {t}^{\prime }})\). Here and throughout the ensuing analysis, we abstract from income effects in assuming that the fixed charge does not affect a consumer’s demand for electricity.

The precise placement of solar panels and the surrounding foliage or the adjacent structures at a specific location can cause electricity production to vary at different times of the day, holding constant the amount of sunshine that prevails in a geographic region.

The presumed linear relationship between output and capacity is adopted for expositional simplicity and does not affect the qualitative conclusions drawn below.

Formally, \(\frac{\partial C_{t}^{D}(Q_{t}^{n},K_{Dn})}{\partial Q_{t}^{n}} >\,0\) and \(\frac{\partial ^{2}C_{t}^{D}(Q_{t}^{n},K_{Dn})}{\partial Q_{t}^{n \, 2}}>\,0\) for all \(Q_{t}^{n}\ge \,0\).

Consumer D will optimally do so in equilibrium if, for instance, \(limit_{K_{Dy}\,\rightarrow \,0}\,\frac{\partial C_{D}^{K}(\cdot )}{\partial K_{Dy}}=\,0\) for \(y\in \{i,n\}\) and \(limit_{ K_{Dn}\,\rightarrow \,0}\,\left| \,\frac{\partial C_{t}^{D}(\cdot )}{\partial K_{Dn}}\,\right| \,=\,\infty \) for \(t\in \{L,H\}\).

Capacity is measured in MWs.

S must deliver this payment to consumer D regardless of whether he produces more or less electricity than he consumes.

Consumer D is fully compensated in each period for all of the electricity he produces in the period.

Formally, \(\frac{\partial C_{t}^{G}(Q_{t}^{v},K_{G})}{\partial K_{G}}<\,0\), \( \frac{\partial ^{2}C_{t}^{G}(Q_{t}^{v},K_{G})}{\partial Q_{t}^{v}\partial K_{G}}<\,0\), and \(\frac{\partial ^{3}C_{t}^{G}(Q_{t}^{v},K_{G})}{\partial Q_{t}^{v}\partial ^{2}K_{G}}>\,\,0\,\) for all \(\,Q_{t}^{v}>\,0\).

Formally, \(C^{K\prime }(K_{G})>0\,\) and \(\,C^{K\prime \prime }(K_{G})>0\). We also assume a strictly positive level of generating capacity is optimal. This will be the case if, for example, \(limit_{ K_{G}\,\rightarrow \,0}\) \(\left| \frac{\partial C_{t}^{G}(Q_{t}^{v},K_{G})}{\partial K_{G}}\right| =\,\infty \) and \( limit_{K_{G}\,\rightarrow \,0}\,C^{K\prime }(K^{G})=\,0\). The electricity supplier’s choice of generating capacity is relevant only in settings where the electricity market has not been restructured, so S is a vertically-integrated supplier. All elements of the ensuing analysis other than the choice of capacity are relevant in both restructured and non-restructured electricity markets.

For expositional ease, the ensuing discussion focuses on settings where \( T(\cdot )\) is increasing in each of its arguments. Section 7 explicitly considers settings where DG capacity investments reduce S’s TDM costs.

Although local distribution networks can experience substantial line losses on occasion, system-wide line losses typically are relatively small in practice (Parsons and Brinckerhoff 2012; U.S. Energy Information Administration 2014b). Explicit accounting for these variable costs would not affect the key qualitative conclusions reported below.

The sequencing of the two demand periods does not affect our findings.

The fixed retail charges (\(R_{j}\)) are set to ensure that S earns zero expected profit.

The values of \(w_{it}(\theta _{s})\) and \(k_{i}\) identified in Proposition 1 are not unique because the values of \(w_{it}(\theta _{s})\) do not affect the amount of electricity produced by the installed intermittent capacity. If the \(w_{it}(\theta _{s})\) payments are increased above \(\frac{\partial C_{t}^{G}}{\partial Q_{t}^{v}}\), then \(k_{i}\) can be reduced accordingly to ensure consumer D installs the efficient level of intermittent DG capacity.

Retail charges that differ across consumers can be optimal if the regulator values the welfare of consumer N differently from the welfare of consumer D.

For simplicity, we assume the social loss from externalities in one period does not vary with outputs produced in the other period. We also assume the total social loss from externalities is the sum of the corresponding losses in each period.

If prevailing policies (e.g., carbon taxes) compel electricity producers to fully internalize the social losses from environmental externalities, then the utility’s marginal cost of supplying electricity will reflect both the physical marginal cost of production and the associated marginal social losses from externalities. Fabra and Reguant (2014) find that, in practice, taxes on emissions are passed on to consumers in the form of higher retail prices for electricity.

Again, the values of \(w_{it}(\theta _{s})\) and \(k_{i}\) identified in Proposition 2 are not unique because the \(w_{it}(\theta _{s})\) payments do not affect consumer D’s production of electricity using the intermittent DG technology, given installed capacity \(K_{Di}\).

In principle, more than two demand periods might be established, thereby allowing the regulator to better approximate the solution to [RP-\(\theta \)]. To illustrate, a regulator might be able to set prices that can differ in time periods where the prevailing temperature is expected to be low, moderate, high, or very high.

Proposition 6 in Brown and Sappington (2017b) identifies how social losses from externalities affect the optimal regulatory policy in the present setting.

Conclusion (ii) in Proposition 3 identifies the particular gains from consumer-specific prices that arise when the price sensitivity of demand (as opposed to, say, the level of demand) varies considerably across consumers.

Because S generates the difference between the quantity of electricity demanded and the quantity supplied by consumer D, \(\frac{\partial Q_{t}^{v}}{\partial Q_{t}^{i}}\,=-\,1\) and so \(\frac{\partial Q_{t}^{v}}{ \partial Q_{t}^{i}}\,\frac{\partial Q_{t}^{i}(\cdot ,\theta _{s})}{\partial K_{Di}}\,=\,-\,\mu _{t}\,\theta _{s}\).

This conclusion does not hold if: (i) there are multiple distinct non-intermittent DG technologies; or (ii) the network value of investment in a single non-intermittent DG technology varies with the geographic location of the DG capacity.

Conclusion (i) in Proposition 3 also holds and S earns zero expected profit at the solution to [RP].

DG capacity charges have been proposed in Arizona, Hawaii, Kansas, Maine, New Mexico, Oklahoma, Utah, and Wisconsin (NCCETC 2015d).

Conclusion (i) in Proposition 1 also holds and S earns zero expected profit at the solution to [RP-\(\theta k\)].

The numerator of the last term in conclusion (ii) in Proposition 5 for \(y=n\) is the rate at which S’s TDM costs increases as \( w_{nt}(\theta _{s})\) increases due to the induced increase in \(K_{Di}\). The denominator of this term reflects the rate at which output produced using the non-intermittent DG technology (\(Q_{t}^{n}(\cdot )\)) increases as \( w_{nt}(\theta _{s})\) increases. The increase in \(Q_{t}^{n}(\cdot )\) arises from two sources. First, the increase in \(w_{nt}(\theta _{s})\) induces consumer D to increase \(K_{Dn}\), which reduces the consumer’s marginal cost of producing electricity, which in turn induces increased production. Second, the increase in \(w_{nt}(\theta _{s})\) increases the prevailing rate of compensation for electricity production, which induces increased production. The corresponding interpretation when \(y=i\) is analogous except that an increase in \(w_{it}(\theta _{s})\) only affects the amount of electricity produced using the intermittent DG technology by inducing consumer D to increase \(K_{Di}\) (i.e., \(\frac{\partial Q_{t}^{i}(\cdot ,\theta _{s})}{\partial w_{it}(\theta _{s})}=0\)).

The central considerations that underlie the findings in Proposition 5 persist in other settings where the regulator’s instruments are more limited (e.g., where she can only set TOU retail prices and TOP DG payments).

Estimates of the short-run price elasticity of demand for electricity for residential consumers range from \(-0.13\) to \(-0.35\). Corresponding long-run estimates range from \(-0.40\) to \(-0.85\) (Espey and Espey 2004; Paul et al. 2009). Commercial and industrial customers typically exhibit less elastic demands for electricity (e.g., Wade 2003; Taylor et al. 2005; Paul et al. 2009).

Profit is the difference between: (i) the sum of payments for DG output and any relevant payments for installing DG capacity; and (ii) the sum of DG capacity costs and any relevant variable costs of DG production.

Formally, \(E\,\{c^{S}\}=[\,E\,\{C_{L}^{G}(\cdot )+C_{H}^{G}(\cdot )\}+C^{K}(\cdot )+T(\cdot )\,]\,/\,E\{Q_{L}^{v}(\cdot )+Q_{H}^{v}(\cdot )\}\).

Aggregate welfare, W, is the difference between consumer welfare and losses from environmental externalities.

For expositional ease, the values reported in Table 1 are rounded either to the nearest tenth or the nearest whole number.

Consumer N’s expected utility increases because the reduction in S’s expected unit operating cost admits a reduction in the fixed retail charge that more than offsets the impact of the higher unit retail price of electricity.

The limited impact of DG capacity charges on aggregate expected welfare reflects in part the limited sensitivity of consumer demand to the price of electricity and the regulator’s unrestricted use of a fixed retail charge that never induces any customer to cease all electricity purchases.

Brown and Sappington (2017b) also demonstrate how expanded pricing flexibility affects the optimal regulatory policy and industry outcomes in the baseline setting. When TOU and state-specific pricing become feasible, the regulator sets (expected) retail prices and DG output payments that are higher in the peak period than in the off-peak period. The optimal level of centralized capacity declines modestly and the regulator reduces \(k_{i}\) in order to (substantially) reduce investment in DG-i capacity. Expected losses from environmental externalities increase modestly, as does the expected utility of both consumers. Expected aggregate welfare increases slightly.

Fixed DG capacity charges (\(k_{0i}\) and \(k_{0n}\)) also can serve this function if they do not induce consumers to forego efficient DG capacity investment.

Future research might compare the performance of the four-part tariff that we have analyzed with some of the three-part tariffs that have been proposed (e.g., Faruqui and Hledik 2015). Our four-part tariff includes a fixed charge (R), a variable retail charge (r), variable compensation for DG production (w), and DG capacity charges (k). Three-part tariffs that have been proposed often include (along with net metering) a fixed retail charge, a variable retail charge, and a demand charge that varies with the consumer’s maximum purchase of electricity.

It can be shown that the key qualitative conclusions drawn above continue to hold when the regulator seeks to maximize a weighted average of the welfare of consumer D and the welfare of consumer N, while ensuring a reservation level of expected welfare for both consumers. In this setting, fixed retail charges are set to deliver a higher level of welfare to the favored consumer while ensuring the less-favored consumer secures his reservation welfare level. Binding limits on feasible fixed retail charges would introduce additional changes to the optimal unit retail prices of electricity.

In addition to accounting explicitly for relevant network congestion costs, future research should account for the large, non-divisible investments that are common in the electricity sector and for the fact that regulators often have limited knowledge of consumer preferences and industry production technologies.

Brown and Sappington (2017c) provide more detailed proofs.

\( \overline{X}_{t}\) is the sum of: (i) \(\widehat{X}_{t}\), the average observed hourly electricity demand during period t in California in 2014 (which does not include behind-the-meter generation); and (ii) \(\overline{Q}_{ts}\), the estimated average amount of electricity generated hourly by solar DG during period t in California in 2014. Average peak demand in California in 2014 was 29,415 MWh (CAISO 2015a), and the ratio of average peak consumption to average off-peak consumption in the CAISO region was approxiately 1.867 (EIA 2014c). Reflecting these statistics, we assume \( \widehat{X}_{H}=\) 29,415 and \(\widehat{X}_{L}=\) 15,755 (\(=\frac{29{,}415}{1.867}\) ). \(\overline{Q}_{Ls}\) is \(12.1\%\) of \(\overline{K}_{D}\) and \(\overline{Q} _{Hs}\) is \(58.8\%\) of \(\overline{K}_{D}\), where \(\overline{K}_{D}\) is the 3254 MW of PV capacity installed in California at year end 2014 (California Solar Statistics 2015). 0.121 and 0.588 reflect the utilization rates of solar DG capacity during period the off-peak and peak periods in California in 2014 (i.e., the relevant expected values of \(\theta \) in our sample, as described further below).

The data on PV output are derived from CAISO (2015b).

Employing a cost function of the form \(C(Q^{v})=a\,Q^{v}+\frac{1}{ 2}\,\,b(Q^{v})^{2}\), Bushnell (2007) estimates \(\,a=\,28.53\) and \( b=0.003\).

\(\overline{Q}^{v}=\) 24,577 is the average MWh’s of electricity sold daily by California utilities in 2014 and \(\overline{K}_{G}=\) 72,926 is the MW of centralized non-renewable generation capacity in California at year-end 2014. Thus, the initial value for \(c_{v}\) (and hence \(a_{v}\)) reflects the assumption that the welfare-maximizing level of capacity in the model is \(\overline{K}_{G}\).

EIA (2014a) estimates that 2.16 (1.22) pounds of carbon dioxide are emitted when a KWh of electricity is produced using a coal (natural gas) generating unit. These estimates are multiplied by 1000 to convert KWhs to MWhs, and divided by 2204.62 to convert pounds to metric tons. Thus, \( \,e_{c}\,=\,38\left[ \,2.16\,\right] \frac{1000}{2204.62}\,=\,37.231\) and \( e_{g}\,=\,38\left[ \,1.22\,\right] \frac{1000}{2204.62}\,=\,21.029\).

For simplicity, we abstract from the non-linearities that arise in practice as different technologies are employed to meet baseload, systematic non-baseload, and peak-load demand for electricity.

In practice, other units primarily reflect hydro and nuclear production. \( \,\phi _{o}=1-\phi _{c}-\phi _{g}\).

References

American Council for an Energy-Efficient Economy. (2015). Distributed generation. http://www.aceee.org/topics/distributed-generation (visited June 24).

Antweiler, W. (2015). A two-part feed-in-tariff for intermittent electricity generation. SSRN Working Paper 2649205. doi:10.2139/ssrn.2649205.

Barbose, G., Weaver, S., & Darghouth, N. (2014). Tracking the sun VII: An historical summary of the installed price of photovoltaics in the United States from 1998 to 2013. Berkeley: Lawrence Berkeley National Laboratory.

Baumol, W., & Bradford, D. (1970). Optimal departures from marginal cost pricing. American Economic Review, 60, 265–283.

Borenstein, S. (2015). The private net benefits of residential solar PV: And who gets them. Energy Institute at Haas, Working Paper 259. http://ei.haas.berkeley.edu/research/papers/WP259.pdf.

Branker, K., Pathak, M., & Pearce, J. (2011). A review of solar photovoltaic levelized cost of electricity. Renewable and Sustainable Energy Reviews, 15, 4470–4482.

Brennan, T. (2010a). Decoupling in electric utilities. Journal of Regulatory Economics, 38, 49–69.

Brennan, T. (2010b). Optimal energy efficiency policies and regulatory demand-side management tests: How well do they match? Energy Policy, 38, 3874–3885.

Brown, D., & Sappington, D. (2016a). On the optimal design of demand response policies. Journal of Regulatory Economics, 49, 265–291.

Brown, D., & Sappington, D. (2016b). On the role of maximum demand charges in the presence of distributed generation resources. University of Alberta discussion paper. http://uofa.ualberta.ca/arts/about/people-collection/david-brown.

Brown, D., & Sappington, D. (2017a). On the design of distributed generation policies: Are common net metering policies optimal? The Energy Journal, 38, 1–32.

Brown, D., & Sappington, D. (2017b). Technical appendix to accompany ‘Optimal policies to promote efficient distributed generation of electricity’. http://uofa.ualberta.ca/arts/about/people-collection/david-brown.

Brown, D., & Sappington, D. (2017c). Promoting the efficient distributed generation of electricity. University of Alberta discussion paper. http://uofa.ualberta.ca/arts/about/people-collection/david-brown.

Brown, T., & Faruqui, A. (2014). Structure of electricity distribution network tariffs: Recovery of residual costs. The Brattle Group Report Prepared for Australian Energy Market Commission. http://www.ksg.harvard.edu/hepg/Papers/2014/Brattle%20report%20on%20structure%20of%20DNSP%20tariffs%20and%20residual%20cost.pdf.

Bushnell, J. (2007). Oligopoly equilibria in electricity contract markets. Journal of Regulatory Economics, 32, 225–245.

California Energy Commission. (2015). Electricity generation capacity and energy. California Energy Almanac. http://energyalmanac.ca.gov/electricity/electric_generation_capacity.html (visited Sept 10).

California Independent System Operator (CAISO). (2015a). Open access same-time information system. http://oasis.caiso.com (visited Sept 15).

CAISO. (2015b). Renewables watch: Reports and data. http://www.caiso.com/market/Pages/ReportsBulletins/DailyRenewablesWatch.aspx.

California Public Utilities Commission (PUC). (2015). Utility tariff information. http://www.cpuc.ca.gov/PUC/energy/Electric+Rates/utiltariffs/index.htm (visited Oct 12).

California Solar Statistics. (2015). Geographical statistics. http://www.californiasolarstatistics.ca.gov/reports/locale_stats (visited Sept 10).

Chao, H. (2011). Demand response in wholesale electricity markets: The choice of the consumer baseline. Journal of Regulatory Economics, 39, 68–88.

Chu, L., & Sappington, D. (2013). Motivating energy suppliers to promote energy conservation. Journal of Regulatory Economics, 43, 229–247.

Clean Power Research. (2014). Minnesota value of solar: Methodology. Prepared for Minnesota Department of Commerce, Division of Energy Resources. http://www.cleanpower.com/wp-content/uploads/MN-VOS-Methodology-2014-01-30-FINAL.pdf.

Cohen, M., Kauzmann, P., & Callaway, D. (2015). Economic effects of distributed PV generation on California’s distribution system. Energy Institute at Haas Working Paper 260. http://ei.haas.berkeley.edu/research/papers/WP260.pdf.

Costello, K. (2015). Major challenges of distributed generation for state utility regulators. The Electricity Journal, 28, 8–25.

Couture, T., & Gagnon, Y. (2010). An analysis of feed-in tariff remuneration models: Implications for renewable energy investment. Energy Policy, 38, 955–965.

Darghouth, N., Barbose, G., & Wiser, R. (2011). The impact of rate design and net metering on the bill savings from distributed PV for residential customers in California. Energy Policy, 39, 5243–5253.

Darghouth, N., Barbose, G., & Wiser, R. (2014). Customer-economics of residential photovoltaic systems (Part 1): The impact of high renewable energy penetrations on electricity bill savings with net metering. Energy Policy, 67, 290–300.

DNV GL Energy. (2014). A review of distributed energy resources. Prepared by DNV GL Energy for the New York Independent System Operator. http://www.nyiso.com/public/webdocs/media_room/publications_presentations/Other_Reports/Other_Reports/A_Review_of_Distributed_Energy_Resources_September_2014.pdf.

Espey, J., & Espey, M. (2004). Turning on the lights: A meta-analysis of residential electricity demand elasticities. Journal of Agricultural and Applied Economics, 36, 65–81.

Fabra, N., & Reguant, M. (2014). Pass-through of emissions costs in electricity markets. American Economic Review, 104, 2872–2899.

Farrell, J. (2014a). Could Minnesota’s “value of solar” make everyone a winner? Renewable Energy World.Com. http://www.renewableenergyworld.com/rea/blog/post/2014/03/could-minnesotas-value-of-solar-make-everyone-a-winner.

Farrell, J. (2014b). Minnesota’s value of solar: Can a northern state’s new solar policy defuse distributed generation battles? Institute for Local Self-Reliance Report. http://www.ilsr.org/wp-content/uploads/2014/04/MN-Value-of-Solar-from-ILSR.pdf.

Faruqui, A., & Hledik, R. (2015). An evaluation of SRP’s electric rate proposal for residential customers with distributed generation. The Brattle Group Report Prepared for Salt River Project. http://www.srpnet.com/prices/priceprocess/pdfx/DGRateReview.pdf.

Hledik, R. (2014). Rediscovering residential demand charges. The Electricity Journal, 27, 82–96.

ICF International. (2012). Combined heat and power policy analysis and 2011–2030 market assessment. Prepared for the California Energy Commission. http://www.energy.ca.gov/2012publications/CEC-200-2012-002/CEC-200-2012-002.pdf.

Kind, P. (2013). Disruptive challenges: Financial implications and strategic responses to a changing retail electric business. Report prepared for the Edison Electric Institute. http://www.eei.org/ourissues/finance/Documents/disruptivechallenges.pdf.

Linvill, C., Shenot, J., & Lazar, J. (2013). Designing distributed generation tariffs well: Fair compensation in a time of transition. The Regulatory Assistance Project. http://idahocleanenergy.org/wp-content/uploads/2013/01/2013-12-rap-carl-dg-tariffs-6898.pdf.

Lively, M., & Cifuentes, L. (2014). Curing the death spiral: Seeking a rate design that recovers cost fairly from customers with rooftop solar. Public Utilities Fortnightly, 152, 14–17.

Maine Public Utilities Commission. (2013). Central Maine Power Company request for new alternative rate plan: Revenue allocation and rate design. Docket No. 2013 – 00168.

MIT Energy Initiative. (2016). Utility of the future. http://energy.mit.edu/wp-content/uploads/2016/12/Utility-of-the-Future-Full-Report.pdf.

North Carolina Clean Energy Technology Center (NCCETC). (2015a). Personal tax credit by state. http://programs.dsireusa.org/system/program?type=31&technology=7&.

NCCETC. (2015b). Solar rebate program by state. http://programs.dsireusa.org/system/program?type=88&technology=7&.

NCCETC. (2015c). Solar renewable energy credit program by state. http://programs.dsireusa.org/system/program?type=85&.

NCCETC. (2015d). The 50 states of solar: A quarterly look at America’s fast-evolving distributed solar policy and regulatory conversation. http://nccleantech.ncsu.edu/wp-content/uploads/50-States-of-Solar-Issue2-Q2-2015-FINAL3.pdf.

PacifiCorp. (2013). Integrated resource plan (Vol. 1). http://www.pacificorp.com/content/dam/pacificorp/doc/Energy_Sources/Integrated_Resource_Plan/2013IRP/PacifiCorp-2013IRP_Vol1-Main_4-30-13.pdf.

Parsons and Brinckerhoff. (2012). Electricity transmission costing study. An Independent Report Endorsed by the Institution of Engineering and Technology. http://renewables-grid.eu/uploads/media/Electricity_Transmission_Costing_Study_Parsons_Brinckerhoff.pdf.

Paul, A., Myers, E., & Palmer, K. (2009). A partial adjustment model of U.S. electricity demand by region, season, and sector. Resources for the Future Discussion Paper RFF DP 08-50. http://www.rff.org/files/sharepoint/WorkImages/Download/RFF-DP-08-50.pdf.

Perez-Arriaga, I., & Bharatkumar, A. (2014). A framework for redesigning distribution network use of system charges under high penetration of distributed energy resources: New principles for new problems. MIT Center for Energy and Environmental Policy Research Working Paper 2014-006.

Poullikkas, A. (2013). A comparative assessment of net metering and feed in tariff schemes for residential PV systems. Sustainable Energy Technologies and Assessments, 3, 1–8.

Ramsey, F. (1927). A contribution to the theory of taxation. Economic Journal, 37, 47–61.

Raskin, D. (2013). The regulatory challenge of distributed generation. Harvard Business Law Review Online, 4, 38–51.

Schneider, J., & Sargent, R. (2014). Lighting the way: The top ten states that helped drive America’s solar energy boom in 2013. PennEnvironment Research and Policy Center Report. http://environmentamericacenter.org/sites/environment/files/reports/EA_Lightingtheway_scrn.pdf.

Shlatz, E., Buch, N., & Chan, M. (2013). Distributed generation integration cost study: Analytical framework. California Energy Commission Report, CEC-200-2013-007, Prepared by Navigant Consulting Inc. http://www.energy.ca.gov/2013publications/CEC-200-2013-007/CEC-200-2013-007.pdf.

Solar Energy Industries Association. (2015). Solar state by state. http://www.seia.org/policy/state-solar-policy (visited June 17).

Taylor, T., Schwarz, P., & Cochell, J. (2005). 24/7 hourly response to electricity real-time pricing with up to eight summers of experience. Journal of Regulatory Economics, 27, 235–262.

U.S. Department of Energy. (2013). Guide to using combined heat and power for enhancing reliability and resiliency in buildings. Report Developed by the U.S. Department of Energy, the U.S. Environmental Protection Agency, and the U.S. Department of Housing and Urban Development. http://www1.eere.energy.gov/manufacturing/distributedenergy/pdfs/chp_critical_facilities.pdf.

U.S. Energy Information Administration (EIA). (2014a). Reporting of greenhouse gases program. Table of Fuel and Energy Source: Codes and Emissions Coefficients. EIA Office of Integrated Analysis and Forecasting. http://www.eia.gov/oiaf/1605/coefficients.html.

U.S. Energy Information Administration. (2014b). State electricity profiles. Table 10: Supply and disposition of electricity. http://www.eia.gov/electricity/state/.

U.S. Energy Information Administration. (2014c). Peak-to-average electricity demand ratio rising in New England and many other U.S. regions. Energy Information Administration. http://www.eia.gov/todayinenergy/detail.php?id=15051#tabs_SpotPriceSlider-7.

U.S. Energy Information Administration. (2015a). Levelized cost and levelized avoided cost of new generation resources. Annual energy outlook. http://www.eia.gov/forecasts/aeo/pdf/electricity_generation.pdf.

U.S. Energy Information Administration. (2015b). Form 826. http://www.eia.gov/electricity/data/eia826.

U.S. Energy Information Administration. (2015c). Detailed state data. http://www.eia.gov/electricity/data/state.

U.S. Environmental Protection Agency (EPA). (2013). Regulatory impact analysis for the proposed standards of performance for greenhouse gas emissions for new stationary sources: Electric utility generating units. EPA-452/R-13-003. http://www2.epa.gov/sites/production/files/2013-09/documents/20130920proposalria.pdf.

Virginia State Corporation Commission (VSCC). (2011). Application of Virginia Electric and Power Company for approval of a standby charge and methodology and revisions to its tariff and terms and conditions of service. Case No. PUE-2011-00088. http://www.scc.virginia.gov/docketsearch/DOCS/2hm201!.PDF.

Wade, S. (2003). Price responsiveness in the AEO2003 NEMS residential and commercial buildings sector models. Report Prepared for the U.S. Energy Information Administration. http://www.eia.gov/oiaf/analysispaper/elasticity/pdf/buildings.pdf.

Weissman, S., & Johnson, N. (2012). The statewide benefits of net-metering in California & the consequences of changes to the program . Center for Law, Energy & the Environment, University of California. http://www.law.berkeley.edu/files/The_Statewide_Benefits_of_Net-Metering_in_CA_Weissman_and_Johnson.pdf.

Wiser, R., Mills, A., Barbose, G., & Golove, W. (2007). The impact of retail rate structures on the economics of commercial photovoltaic systems in California. Lawrence Berkeley National Laboratory LBNL—63019 Report. http://emp.lbl.gov/sites/all/files/REPORT%20lbnl%20-%2063019_0.pdf.

World Alliance for Decentralized Energy. (2014). Where can DE be used? http://www.localpower.org/deb_where.html (visited September 21, 2014).

Yamamoto, Y. (2012). Pricing electricity from residential photovoltaic systems: A comparison of feed-in tariffs, net metering, and net purchase and sale. Solar Energy, 86, 2678–2685.

Acknowledgements

Support from the Government of Canada’s Canada First Research Excellence Fund under the Future Energy Systems Research Initiative is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Part A of this Appendix outlines the proofs of key propositions in the text.Footnote 58 Part B provides the details of the numerical analysis presented in Sect. 7.

1.1 A. Proofs of the propositions in the text

The proof of Proposition 1 follows immediately from the proof of Proposition 2. The proof of Proposition 3 follows immediately from the proof of Proposition 6 in Brown and Sappington (2017b).

Proof of Proposition 2

Let \(\lambda \ge 0\) denote the Lagrange multiplier associated with constraint (5). Using (1), (2), (3), and the Envelope Theorem, the necessary conditions for a solution to [RP-\(\theta e\)] with respect to \(R_{j}\) and \(K_{G}\) reveal that \(\lambda \,=\,1\) and conclusion (i) in Proposition 1 holds. Furthermore, because \(\,\frac{\partial Q_{t}^{v}}{\partial X_{t}^{j}} \,=\,1\, \) and \(\,\frac{\partial V_{t}^{j}(X_{t}^{j}(\cdot ,\theta _{t}),\theta _{t})}{\partial X_{t}^{j}}\,=\,r_{jt}(\theta _{t})\) for \(\,j\in \{D,N\}\) and \(t\in \{L,H\}\), the corresponding necessary condition with respect to \(\,r_{jt}(\theta _{t})\) provides:

Because \(\lambda =1\), \(\frac{\partial Q_{t}^{v}}{\partial Q_{t}^{n}}\,=\,-\,1\,\), \(\,\frac{\partial K_{Dy} }{\partial k_{yt}}\) is not a function of \(\,\theta _{s}\), \(\,k_{y}\) only affects \(Q_{t}^{v}\) through \(K_{Dy}\), \(\,\frac{dQ_{t}^{v}(\cdot ,\theta _{s}) }{dK_{Di}}\,=\,-\,\mu _{t}\,\theta _{s}\,\), and \(\frac{\partial Q_{t}^{i}(\cdot ,\theta _{s})}{\partial K_{Di}}\,=\,\mu _{t}\,\theta _{s}\), the necessary conditions with respect to \(k_{i}\) and \( k_{n}\) reveal:

Because \(\lambda =1\), \(\frac{\partial Q_{t}^{i}(\cdot ,\theta _{s})}{\partial K_{Di}} \,=\,\,\mu _{t}\,\theta _{s}\), \(\,\frac{\partial Q_{t}^{i}(\cdot ,\theta _{s})}{\partial w_{it}(\theta _{s})}\,=\,0\), and \(\,\frac{\partial Q_{t}^{v}(\cdot ,\theta _{s})}{\partial K_{Di}}\,=\,-\,\mu _{t}\,\theta _{s}\) , the necessary condition with respect to \(w_{it}(\cdot )\) implies that for all \(\theta _{s}\,\in \,[\,\underline{\theta }_{t}, \overline{\theta }_{t}\,]\):

(12) implies that \(k_{i}\,\) \(=\) \(-\,\frac{\partial T(\cdot )}{\partial K_{Di}}\) when (13) holds.

Because \(\lambda =1\) and \(\frac{\partial Q_{t}^{v}}{\partial Q_{t}^{n}}\,=\,-\,1\), the necessary condition with respect to \(w_{nt}(\cdot )\) implies that for each \(\theta _{s}\,\in \,[\,\underline{\theta }_{t},\,\overline{\theta }_{t}\,]\):

Since \(\frac{\partial Q_{t}^{n}(\cdot ,\theta _{s})}{\partial K_{Dn}} \,>\,0\), \(\frac{\partial Q_{t}^{n}(\cdot ,\theta _{s})}{\partial w_{n}(\theta _{s})}\,>\,0\), and \(\frac{\partial K_{Dn}}{\partial w_{nt}(\theta _{s})}\,>\,0\,\) for all \(\theta _{s}\,\in \,[\, \underline{\theta }_{t},\,\overline{\theta }_{t}\,]\), (14) implies that if \(\,w_{nt}(\theta _{s})\,>\,\frac{\partial C_{t}^{G}(\cdot )}{\partial Q_{t}^{v}}+\psi _{tn}(\cdot )-\psi _{tv}(\cdot )\) , then \(\,k_{n}+\frac{\partial T(\cdot )}{\partial K_{Dn}} \,<\,0\). (14) also implies that if \(\,w_{nt}(\theta _{s})\,<\,\frac{\partial C_{t}^{G}(\cdot )}{\partial Q_{t}^{v}}+\psi _{tn}(\cdot )-\psi _{tv}(\cdot )\), then \(\,k_{n}+\frac{\partial T(\cdot )}{ \partial K_{Dn}}\,>\,0\). Therefore, because \(\,k_{n}+\frac{ \partial T(\cdot )}{\partial K_{Dn}}\) does not vary with \(\theta _{s}\), it must be the case that:

(11) and (15) imply \(k_{n}\) \(=\,\,-\,\frac{ \partial T(\cdot )}{\partial K_{Dn}}\,\). \(\square \)

Proof of Proposition 4

Let \(\lambda \) denote the Lagrange multiplier associated with constraint (5). As in the proof of Proposition 2, it is readily shown that \(\lambda =1\) at the solution to [RP]. Furthermore, because \(\,\frac{\partial Q_{t}^{v}}{\partial X_{t}^{j}} \,=\,1\), \(\frac{dQ_{t}^{v}}{dK_{G}}\,=\,0\,\), and \(\frac{\partial V_{t}^{j}(X_{t}^{j}(r,\theta _{s}),\theta _{s})}{\partial X_{t}^{j}}=r\) for \(j\in \{D,N\}\) and \(t\in \{L,H\}\), the necessary conditions for \(K_{G}\) and r reveal that conclusion (i) of the proposition and conclusion (i) in Proposition 3 hold.

Because \(\lambda =1\), \(\,\frac{\partial K_{Dn} }{\partial k_{n}}\) is not a function of \(\,\theta _{s}\), and \( k_{n}\) only affects \(Q_{t}^{v}\) through \(K_{Dn}\) and the corresponding impact on \(Q_{t}^{n}\), the necessary condition with respect to \(k_{n}\) reveals:

Therefore, since \(\frac{\partial Q_{t}^{v}}{\partial Q_{t}^{n}}\,=\,-\,1\), conclusion (iii) in the proposition holds for \(y=n\). The proof of conclusion (iii) for \(y=i\) is analogous.

Because \(\lambda =1\), \(\frac{\partial K_{Dn}}{\partial w_{n}}\,\) is not a function of \(\theta _{t}\) , and \(\,\frac{\partial Q_{t}^{v}}{\partial Q_{t}^{n}}\,=\,-\,1\), the necessary condition with respect to \(w_{n}\) provides:

(16) reflects conclusion (iii) in the proposition for \(y=n\). Since \(\, \frac{\partial Q_{t}^{n}}{\partial w_{n}}\) is not a function of \(\theta _{s}\), (16) implies that conclusion (ii) of the proposition holds. \(\square \)

Proof of Proposition 5

Let \(\lambda \ge 0\) denote the Lagrange multiplier associated with constraint (5). As in the proof of Proposition 2, it is readily shown that \(\lambda =1\) at the solution to [RP-\(\theta k\)]. Furthermore, because \(\,\frac{ \partial Q_{t}^{v}}{\partial Q_{t}^{n}}\,=\,-\,1\,\), the necessary condition with respect to \(w_{nt}(\cdot )\) can be written as:

Therefore, conclusion (ii) of the proposition for \(y=n\) holds for each \(\theta _{s}\,\in \,[\,\underline{\theta }_{t},\,\overline{ \theta }_{t}\,]\). The corresponding proof for \(y=i\) is analogous.

\(\frac{\partial V_{t}^{j}(X_{t}^{j}(r,\theta _{s}),\theta _{s})}{\partial X_{t}^{j}}=r_{jt}(\theta _{s})\) for each \(j\in \{D,N\}\) and \(t\in \{L,H\}\). Also \(\,\frac{\partial Q_{t}^{v} }{\partial X_{t}^{j}}=1\). Therefore, because \(\lambda \,=\,1\) , the necessary condition with respect to \(r_{jt}(\cdot )\) implies that for each \(\theta _{s}\,\in \,[\,\underline{\theta } _{t},\,\overline{\theta }_{t}\,]\,\) and for \(t,\,t^{\prime }\in \{L,H\}\) (\(t^{\prime }\ne t\)):

(17) is satisfied if conclusion (i) in the proposition holds. \(\square \)

1.2 B. Details of the numerical analysis in Sect. 7

The baseline setting is designed to reflect settings where S primarily employs non-coal resources to serve a relatively large number of customers. Consumer \(j\in \left\{ D,N\right\} \)’s demand for electricity in period \(t\in \{L,H\}\) given state \(\theta _{t}\) and unit price r is assumed to be:

Period H is the period of peak demand between 11:00 am and 6:00 pm. Period L consists of the other (off-peak) hours of the day.

The \(\beta _{jt}\) parameters in (18) are set to ensure that the elasticity of demand with respect to solar intensity (\(\theta _{t}\)) is 0.1 in each period at the relevant expected values of demand and \(\theta \). The \(\alpha _{jt}\) parameters in (18) are set to ensure the price elasticity of demand is \(-0.25\) at \(\overline{r} =143.8165\) ($/MWh), the average unit retail price of electricity in California in 2014 (California PUC 2015), and at \(\overline{X}_{t}^{j}\), the average baseline level of demand for consumer j in period t. This average baseline demand is the product of: (i) \(\overline{X}_{t}\), the average hourly total electricity consumption in period t in California in 2014 (\(\overline{X}_{H}\,=31,328\) and \(\overline{X}_{L}=16,149\));Footnote 59 and (ii) \(\eta _{j}\), the fraction of total consumption accounted for by consumers of type j. We assume \(\eta _{D}=0.1\) (and \(\eta _{N}=0.9\)) to reflect the potential deployment of PV panels in the U.S. in the near future.Footnote 60

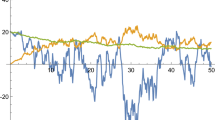

Recall that the distribution of the solar intensity variable (\(\theta \)) reflects variation in the production of electricity from installed DG capacity. To specify this distribution, we first plot the ratio of the MW’s of electricity produced by photo-voltaic (PV) panels to the year-end installed generating capacity (\(\overline{K}_{D}=3254\) MW) of PV panels in California for each of the 8760 h in 2014.Footnote 61 We then employ maximum likelihood estimation to fit a density function to the observations that are strictly positive in each of the relevant periods. Standard tests reveal that the beta density with parameters (2.834641, 1.712483) fits the data well in period H and the beta density with parameters (0.8267931, 1.434153) fits the data well in period L. These functions are used as the densities for \(\theta \) in the two periods.

S’s capacity costs are taken to be \(C^{K}(K_{G})=a_{K}\,K_{G}+b_{K}\left( K_{G}\right) ^{2}\). Estimates of the cost of the generation capacity required to produce a MWh of electricity range from \(\$16.1\)/MWh for a conventional combined cycle natural gas unit to \(\$81.9\)/MWh for a nuclear facility (EIA 2015a). We set \(a_{K}\) at the lower bound of this range (16.1). We also set \(b_{K}=0.00045\) to ensure that the marginal cost of capacity required to generate a MWh of electricity is \(\$81.9\) at the observed level of centralized non-renewable generation capacity in California in 2014 (\(\,\overline{K}_{G}=\) 72,926 MW) (California Energy Commission 2015).

S’s TDM costs are assumed to be \(T(K_{G},K_{Di},K_{Dn})= a_{T}^{G}\,K_{G}+a_{T}^{Di}\,K_{Di}+a_{T}^{Dn}\,K_{Dn}\). Estimates of these costs vary widely. EIA (2015a) estimates utility transmission capacity costs associated with generating a MWh of electricity are between \(\$1.2\) and \(\$3.5\) for centralized, non-renewable generation, and between \(\$4.1\) and \(\$6.0\) for PV generation. Reflecting the midpoints of these cost estimates, we initially assume \(a_{T}^{G} =a_{T}^{Dn}=2.35\) and \(a_{T}^{Di}=5.05\).

We assume that S’s cost of generating \(Q^{v}\) units of electricity when it has \(K_{G}\) units of capacity is \(C^{G}(Q^{v},K_{G})=\left[ \,a_{v}+\frac{c_{v}}{K_{G}}\,\right] Q^{v}+b_{v}\left( Q^{v}\right) ^{2}\), where \(a_{v}\), \(b_{v}\), and \(c_{v}\) are positive constants. We set \( b_{v}=0.0015\) and \(a_{v}+\frac{c_{v}}{K_{G}}=28.53\), reflecting Bushnell (2007)’s estimates.Footnote 62 \(c_{v}\) is chosen to equate the observed marginal benefit (\(\frac{c_{v}\,\overline{Q}^{v}}{\left( \overline{K} _{G}\right) ^{2}}\)) and marginal cost (\(a_{K}+2\,b_{K}\,\overline{K} _{G}+a_{T}^{G}\,\)) of S’s capacity.Footnote 63

The cost of installing \(K_{Di}\) units of intermittent DG capacity and \( K_{Dn} \) units of non-intermittent DG capacity is assumed to be \( \,C_{D}^{K}(K_{Di},K_{Dn})=a_{Di} \,K_{Di}+b_{Di}\left( K_{Di}\right) ^{2}+a_{Dn}\,K_{Dn}+b_{Dn}\left( K_{Dn}\right) ^{2}\). Estimates of the unsubsidized cost of residential PV capacity vary between \(\$100\) and \(\$400\)/MWh (Branker et al. 2011; EIA 2015a). When the 30 percent federal income tax credit (ITC) is applied, these estimates decline to between \(\$70\) and \(\$280\)/MWh. State subsidies further reduce these estimates to between \(\$45\) and \(\$255\)/MWh (NCCETC 2015a, b, c). We initially set \(a_{Di}=150\), the midpoint of this lattermost range. We also set \(\,b_{D}=0.0038\) to ensure ensure that the marginal cost of DG capacity when \(K_{Di}=\overline{K}_{D}=3254\) (i.e., \(a_{D}+2\,b_{D}\, \overline{K}_{D}\)) is 175, the midpoint of the range of estimated costs after applying the ITC.

Estimates of the cost of DG capacity using natural gas reciprocating engine and gas turbines range from \(\$34.09\) to \(\$87.44\)/MWh (PacifiCorp 2013, Table 6.8). We set \(a_{Dn}\) equal to the lower bound of this range (34.09) and select \(b_{Dn}\) to ensure the marginal cost of capacity at the level of combined heat and power (CHP) DG in California, \(\overline{K}_{Dn}=8518\) MW (ICF 2012), reflects the upper bound of this range, so \(a_{Dn}+2b_{Dn}\overline{K}_{Dn}= 87.44\).

To capture the social losses from environmental externalities (\(\psi (\cdot ) \)), we introduce the parameters \(e_{c}=37.231\), \(e_{g}=21.029\), and \( e_{o}=0\), where \(\,e_{j}\) is the estimated unit loss from environmental externalities for production technology \(j\in \{c,g,o\}\), where c denotes coal, g denotes natural gas, and o denotes other. The \(e_{j}\) estimate is the product of \(\$38\), the estimated social cost of a metric ton of CO\( _{2}\) emissions (EPA 2013), and the metric tons of \(\hbox {CO}_{2}\) emissions that arise when technology j is employed to produce a MWh of electricity.Footnote 64

We assume \(\,\psi _{t}(Q_{t}^{v},\,Q_{t}^{i},\,Q_{t}^{n})\,=e_{v}\,Q_{t}^{v}+e_{o} \,Q_{t}^{i}+e_{g}\,Q_{t}^{n}\) where \(e_{v}=\phi _{c}\,e_{c}+\phi _{g}\,e_{g}+\phi _{o}\,e_{o}\).Footnote 65 \(\,\phi _{c}\), \(\phi _{g}\), and \(\phi _{o}\) denote the fraction of S’s electricity production that is generated by coal, natural gas, and other units, respectively.Footnote 66 In the baseline setting, we assume \(\phi _{c}=0.064\) and \(\phi _{g}=0.445\), reflecting the fraction of electricity generated by California utilities in 2014 using coal and natural gas generating units, respectively (California Energy Commission 2015). Consequently, \(e_{v}=11.746\).

Rights and permissions

About this article

Cite this article

Brown, D.P., Sappington, D.E.M. Optimal policies to promote efficient distributed generation of electricity. J Regul Econ 52, 159–188 (2017). https://doi.org/10.1007/s11149-017-9335-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-017-9335-9