Abstract

The European Commission has intensively examined the mandatory separation of natural gas transmission from production and services. However, economic theory is ambiguous on the price effects of vertical separation. In this paper, we empirically analyze the effect of ownership unbundling of gas transmission networks, considered to be the strongest form of vertical separation, on the level of end-user prices. Therefore, we apply different dynamic estimators such as system GMM and the bias-corrected least-squares dummy variable estimator to an unbalanced panel consisting of 18 EU countries over 19 years, allowing us to avoid the endogeneity problem and to estimate the long-run effects of regulation. We introduce a set of regulatory indicators as market entry regulation, ownership structure, vertical separation and market structure, as well as account for structural and economic country specifics. Among the different estimators, we consistently find that ownership unbundling has no impact on natural gas end-user prices, while the more modest legal unbundling reduces them significantly. Furthermore, third-party access, market structure and privatization show significant influence, with the latter leading to higher prices.

Similar content being viewed by others

Notes

The weakest form is accounting unbundling, meaning that the utility has to set up separate accounts only for different services. Legal unbundling requires the different services be operated by separate companies, which can still belong to the same owner.

In an earlier version of this paper, we included other OECD countries as well. Via interviews with the designated regulatory authorities, it turned out that none of these countries had introduced ownership unbundling for gas TSOs, despite exhibiting ambiguous regulatory structures.

We use the term “end-user prices” for household customers and retail prices synonymously throughout the text.

The OECD database provides regulatory indicators for seven network industries, i.e., electricity and gas, for 29 OECD countries. The overall structure of the indicators is the same across sectors. Concerning gas, each of the 12 sub-indicators is coded 0, 3 or 6, with the highest score of 6 indicating the most restrictive conditions regarding competition. For aggregation, equal weights are used for all indicators except for the indicator for vertical integration. See Conway and Nicoletti (2006) for further details.

Looking at two earlier studies on the electricity sector by Steiner (2001) and Hattori and Tsutsui (2004) (with the latter being more or less a re-evaluation of the former) gives some indication regarding this line of argument. While Hattori and Tsutsui define the unbundling variable to be 1 if legal unbundling has been established, Steiner already regards accounting unbundling as a form of vertical separation, leading to the detection of reverse effects for unbundling and the introduction of a power exchange.

Regarding electricity, this has been explicitly analyzed by Nagayama (2009). He defines one single indicator, the so-called liberalization model, subsuming information on various areas of regulation such as, e.g., price regulation and consumer protection. Applying an ordered probit model, he shows that a country’s selection of a certain liberalization model is influenced by electricity prices.

Brau et al. (2010), for example, apply system GMM, but only lagged dependent variables are instrumented. The issue of potential endogeneity of regulatory indicators is not tackled.

The analysis has an EU focus and is based on the OECD database for indicators of regulation in energy, transport and communications (ETCR) that provides information for 19 EU Member States (out of a whole sample of 29 OECD countries). With no data on household gas prices available for Sweden, we are left with 18 countries.

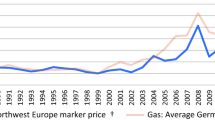

All price data will enter estimations in log form. The absolute values in Fig. 1 are for visualization purposes only. Descriptive statistics can be found in the Annex.

See Footnote 6.

In particular, it is asked if any regulations are in place that restrict the number of competitors allowed to operate a business in at least some upstream markets.

A correlation matrix for the various indicators, including the four main indicators of the ETCR dataset, can be found in the Annex.

The information on both dummy variables has been collected from various benchmarking reports of the European Commission and checked by personal interviews with the designated regulated authorities. Both variables show no problematic correlation. Details on both dummies are provided in the Annex.

The other two ETCR indicators covering the separation of the production and the supply segment are dropped for two reasons. First, correlations with indicators for entry regulation are rather high, facing the risk of multicollinearity. Second, vertical separation is usually discussed in terms of essential facilities with the potential of being a natural monopoly. While this is true for gas pipelines (transmission and distribution), production and supply are clearly competitive parts of the value chain. See, e.g., Gordon et al. (2003).

We thank an anonymous referee for pointing out the need to control for this institutional regime.

The third category of the OECD, the market structure in gas transmission, has been neglected due to the questionable relevance and data inconsistencies.

A preceding correlation analysis shows that gas supply, production as well as exports are highly collinear. Therefore, only the production variable enters the regression. Results for both the correlation analysis as well as the regression are presented in the Annex.

Modeling the indicators as strictly exogenous leads to a rejection of the Sargan test, indicating that regulatory reforms—at least partly—have been driven by high end-user prices for households.

A twice lagged dependent variable is required to obtain valid results of the Arellano–Bond AR(2) test for the system GMM and LSDVC estimators in order to prevent autocorrelation in the error terms.

References

Alesina, A., Ardagna, S., Nicoletti, G., & Schiantarelli, F. (2005). Regulation and Investment. Journal of the European Economic Association, 3(4), 791–825.

Anderson, T. W., & Hsiao, C. (1982). Formulation and estimation of dynamic models using panel data. Journal of Econometrics, 18, 47–82.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58, 277–297.

Ascari, S. (2011). An American Model for the EU Gas Market?. EUI Working Papers No. 2011/39, Robert Schuman Centre for Advanced Studies, Florence School of Regulation, Florence.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143.

Brau, R., Doronzo, R., Fiorio, C. V., & Florio, M. (2010). EU gas industry reforms and consumers’ prices. The Energy Journal, 31(4), 163–178.

Bremberger, F., Cambini, C., Gugler, K., & Rondi, L. (2013). Dividend Policy in Regulated Firms, MPRA Paper 48043. University Library of Munich, Germany.

Brown, S. P. A., & Yücel, M. K. (2007). What Drives Natural Gas Prices?. Working Paper 0703, Federal Reserve Bank of Dallas.

Bruno, G. S. F. (2005). Approximating the bias of the LSDV estimator for dynamic unbalanced panel data models. Economics Letters, 87(3), 361–366.

Buehler, S. (2005). The promise and pitfalls of restructuring network industries. German Economic Review, 6(2), 205–228.

Buehler, S., Schmutzler, A., & Benz, M.-A. (2004). Infrastructure quality in deregulated industries: Is there an underinvestment problem? International Journal of Industrial Organization, 22(2), 253–267.

Buehler, S., Gärtner, D., & Halbheer, D. (2006). Deregulating network industries: Dealing with price-quality tradeoffs. Journal of Regulatory Economics, 30(1), 99–115.

Bun, M. J. G., & Kiviet, J. F. (2003). On the diminishing returns of higher Order terms in asymptotic expansions of bias. Economics Letters, 79, 145–152.

Cambini, C., & Rondi, L. (2010). Incentive regulation and investment: Evidence from European energy utilities. Journal of Regulatory Economics, 38(1), 1–26.

Conway, P., & Nicoletti, G. (2006). Product Market Regulation in the Non-Manufacturing Sectors of OECD Countries: Measurement and Highlights. OECD Economics Department Working Paper, No. 530, Paris.

Copenhagen Economics (2005). Market Opening in Network Industries: Part II: Sectoral Analyses. Copenhagen Economics for DG Internal Market.

European Commission. (2007). Inquiry pursuant to Article 17 of Regulation (EC) No 1/2003 into the European gas and electricity sectors (Final Report). Communication from the Commission, COM(2006) 851 final, 10.01.2007, Brussels.

European Commission. (2008). Progress in creating the internal gas and electricity market, Report from the Commission to the Council and the European Parliament. COM(2008) 192 final, 15.04.2008, Brussels.

Froot, K. A. (1989). Consistent covariance matrix estimation with cross-sectional dependence and heteroscedasticity in financial data. Journal of Financial and Quantitative Analysis, 24, 333–355.

Gordon, D. V., Gunsch, K., & Pawluk, C. V. (2003). A Natural monopoly in natural gas transmission. Energy Economics, 25(5), 473–485.

Hattori, T., & Tsutsui, M. (2004). Economic impact of regulatory reforms in the electricity supply industry: A panel data analysis for OECD countries. Energy Policy, 32(6), 823–832.

Höffler, F., & Kranz, S. (2011). Legal unbundling can be a ‘Golden Mean‘ between vertical integration and vertical separation. International Journal of Industrial Organization, 29(5), 576–588.

Hollas, D. R. (1999). Gas utility prices in a restructured industry. Journal of Regulatory Economics, 16(2), 167–185.

Joskow, P. (2008). Lessons learned from electricity market liberalization. The Energy Journal, 29(2), 9–42.

Kiviet, J. F. (1995). On bias, inconsistency and efficiency of various estimators in dynamic panel data models. Journal of Econometrics, 68, 53–78.

Kiviet, J. F. (1999). Expectation of expansions for estimators in a dynamic panel data model: Some results for weakly exogenous regressors. In C. Hsiao, K. Lahiri, L.-F. Lee, & M. H. Pesaran (Eds.), Analysis of panel data and limited dependent variables (pp. 199–225). Cambridge: Cambridge University Press.

Keefer, P. (2012). Database of Political Institutions: Changes and Variable Definitions, DPI 2012. The World Bank.

Laffont, J. J., & Tirole, J. (1993). A theory of incentives in procurement and regulation. Cambridge, MA: MIT Press.

Nagayama, H. (2009). Electric power sector reform liberalization models and electric power prices in developing countries: An empirical analysis using international panel data. Energy Economics, 31(3), 463–472.

Nesta, L., Vona, F., & Nicolli F. (2012). Environmental policies, product market regulation and innovation in renewable energy. Documents de Travail de l’OFCE 2012–25. Observatoire Francais des Conjonctures Economiques (OFCE).

Nickell, S. J. (1981). Biases in dynamic models with fixed effects. Econometrica, 49, 1417–1426.

Nillesen, P. H. L., & Pollitt, M. G. (2011). Ownership unbundling in electricity distribution: Empirical evidence from New Zealand. Review of Industrial Organization, 38(1), 61–93.

Roodman, D. (2006). How to Do xtabond2: An Introduction to “Difference” and “System” GMM in Stata. Working Paper No. 103, Center for Global Development, Washington D.C.

Roodman, D. (2008). A Note on the Theme of Too Many Instruments. Working Paper No. 125, Center for Global Development, Washington D.C.

Sen, A., & Jamasb, T. (2010). The Economic Effects of Electricity Deregulation: An Empirical Analysis of Indian States. EPRG Working Paper 1001, University of Cambridge, January 2010.

Siliverstovs, B., L’Hégaret, G., Neumann, A., & Von Hirschhausen, C. (2005). International market integration for natural gas? A cointegration analysis of prices in Europe, North America and Japan. Energy Economics, 27(4), 605–615.

Steiner, F. (2001). Regulation, industry structure and performance in the electricity supply industry. OECD Economic Studies, 32, 143–182.

Stronzik, M. (2012). The European Natural Gas Sector—Between Regulation and Competition. PhD Thesis, Jacobs University, Bremen, July 2012.

Vickers, J. (1995). Competition and regulation in vertically related markets. The Review of Economic Studies, 62(1), 1–17.

Williams, R. L. (2000). A note on robust variance estimation for cluster-correlated data. Biometrics, 56, 645–646.

Zhang, Y.-F., Parker, D., & Kirkpatrick, C. (2008). Electricity sector reform in developing countries: An econometric assessment of the effects of privatization, competition and regulation. Journal of Regulatory Economics, 33(2), 159–178.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Growitsch, C., Stronzik, M. Ownership unbundling of natural gas transmission networks: empirical evidence. J Regul Econ 46, 207–225 (2014). https://doi.org/10.1007/s11149-014-9252-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-014-9252-0